TIDMFGP

FIRSTGROUP PLC

PROPOSED SALE OF FIRST STUDENT AND FIRST TRANSIT

FirstGroup plc ("FirstGroup" or the "Group") is pleased to announce that it has

entered into an agreement for the sale of First Student and First Transit to

EQT Infrastructure (the "Transaction").

Summary

* c.£3.3bn ($4.6bn) headline enterprise value, including First Transit

earnout of up to c.£170m

* Transaction fully recognises the long-term, strategic value of First

Student and First Transit - headline multiple of 8.9x combined FY20 EBITDA

(on a pre-IFRS 16 basis)

* c.£2,190m initial net proceeds (after deducting First Student and First

Transit self-insurance liabilities valued at c.£390m and c.£505m in debt

and debt-like items, net working capital and other adjustments) to be used

in addressing longstanding liabilities, ensuring the Group has sufficient

means for the future development of its retained businesses, and enabling a

return of value to shareholders:

* c.£1,345m to be used to reduce indebtedness (including £300m CCFF repayment

to UK Government) and to derisk other liabilities (including for North

American legacy pensions and self-insurance)

* £336m contribution to the UK Bus and Group pension schemes (of which £116m

to be held in escrow), enabling move to low dependency funding position

* c.£100m initial pro forma Retained Group net debt to ensure adequate

financial resources are available

* c.£365m proposed return of value (30 pence per share) to shareholders

during current calendar year

* Potential for further distributions to shareholders in due course,

including following resolution of Greyhound, crystallisation of the First

Transit earnout, and as UK end markets recover

* Ongoing FirstGroup will be a leader in public transportation focused on the

UK, with a strong platform on which to create sustainable value:

* Well-capitalised and de-risked balance sheet

* Cash generative operating model that will support an attractive dividend

* Critical enabler of economic, social and environmental goals at key

inflection point for public transport

* Transaction subject to FirstGroup shareholder approval; circular to be

published as soon as practicable

* Sale completion expected in calendar H2 2021 following North American

regulatory approval timetable

* Recent trading: Group expects adjusted operating profit for the 2021

financial year to be ahead of management's previous expectations; current

liquidity in excess of £900m

David Martin, FirstGroup Chairman said:

"We are delighted to announce the sale of our North American contract divisions

First Student and First Transit to EQT Infrastructure for $4.6bn. This

transaction, which follows a strategic review by the Board of all options to

unlock value, enables FirstGroup to address its long-standing liabilities, make

a substantial contribution to its UK Bus and Group pension schemes and return

value to shareholders, while ensuring the ongoing business has the appropriate

financial strength and flexibility to deliver on its goals.

"On behalf of the Board, I would like to thank all of our employees for their

hard work and commitment in dealing with the immense challenges of the past

year, and commend the team for delivering on the Board's strategic objective to

rationalise the portfolio."

Matthew Gregory, FirstGroup Chief Executive said:

"We are pleased to have agreed the sale of First Student and First Transit in a

transaction which recognises their full strategic value. Both are resilient,

high quality businesses with strong prospects for returning to normal levels of

service following the pandemic. Our colleagues at First Student and First

Transit have built excellent relationships with their customers over many

years, and we are proud of their commitment and expertise. I would like to pay

tribute to everyone in these businesses and acknowledge the vital role they

play in their communities, both now and for many years to come.

"As economies begin to emerge from the pandemic restrictions and society begins

the process of building back better, the vital role of public transport is

clear. The services we provide are critical to economic activity and social

objectives including 'levelling up', and play an important role in combating

climate change and helping local communities flourish. Going forward,

FirstGroup will be a more focused, resilient business that is in a strong

position to deliver for bus and rail passengers in the UK, continue investing

in its zero-emissions fleet strategy and play a key role in meeting society's

broader ESG goals."

Investor and analyst briefing

A conference call for investors and analysts will be held at 9:00am today -

attendance is by invitation. Please email corporate.comms@firstgroup.com in

advance of the call to receive joining details. The presentation to be

discussed on the conference call, together with a pdf copy of this

announcement, will be available before the call at go to www.firstgroupplc.com/

investors/reports-and-presentations.aspx. A playback facility will also be

available there in due course.

Contacts at FirstGroup:

Faisal Tabbah, Head of Investor Relations

Stuart Butchers, Group Head of Communications

corporate.comms@firstgroup.com

+44 (0) 20 7725 3354

Contacts at Brunswick PR:

Andrew Porter / Simone Selzer, Tel: +44 (0) 20 7404 5959

Advisers:

Rothschild & Co

Joint Financial Adviser and Joint Sponsor

Avi Goldberg, Jessica Dale, Alice Squires - London

Lee LeBrun, Markus Pressdee, Jamie Anderson - New York

J.P. Morgan Cazenove

Joint Financial Advisor, Joint Corporate Broker and Joint Sponsor

Charles Harman, Richard Perelman, James Robinson, Ram Anand

Goldman Sachs International

Joint Financial Advisor and Joint Corporate Broker

Eduard van Wyk, Bertie Whitehead, Govind Shanbogue

Notes

Classification as per DTR 6 Annex 1R: 2.2. This announcement contains inside

information. The person responsible for arranging the release of this

announcement on behalf of FirstGroup is David Isenegger, Group General Counsel

and Company Secretary. Legal Entity Identifier (LEI): 549300DEJZCPWA4HKM93.

FirstGroup plc (LSE: FGP.L) is a leading provider of transport services in the

UK and North America. With £7.8bn in revenue in the year to 31 March 2020 and

around 100,000 employees, we transported 2.1bn passengers. Whether for

business, education, health, social or recreation - we get our customers where

they want to be, when they want to be there. We create solutions that reduce

complexity, making travel smoother and life easier. We provide easy and

convenient mobility, improving quality of life by connecting people and

communities. Visit our website at www.firstgroupplc.com and follow us

@firstgroupplc on Twitter.

Background to and reasons for the Transaction

Following the appointment of David Martin as Chairman in 2019 the Board

conducted a strategic review to consider all options to realise value for

shareholders. The Board formally announced the commencement of a sale process

for the Group's North American contract businesses First Student and First

Transit in March 2020 in order to unlock value and focus on its bus and rail

divisions in the UK.

Having conducted a comprehensive and competitive process, the Board believes

that the best value for shareholders is achieved by the combined sale of both

First Student and First Transit. The Board unanimously believes that the

Transaction is in the best interests of shareholders for the following reasons:

* the Transaction recognises the long-term strategic value of each of First

Student and First Transit. These businesses have leading market positions,

meaningful revenue and earnings growth potential and benefit from resilient

contract-based business models as demonstrated by their robust performance

through the COVID-19 pandemic;

* the Transaction implies a headline multiple of 8.9x the combined FY20

EBITDA of First Student and First Transit (on a pre-IFRS 16 basis);

* the Transaction value appropriately recognises the prospects for a recovery

to normal levels of business activity which are currently being suppressed

by the effects of the COVID-19 pandemic;

* the Transaction allows the Group to make a £336m contribution to UK defined

benefit pension schemes and address other longstanding liabilities

(including those relating to the Greyhound business) while ensuring the

ongoing business is appropriately capitalised to continue investing for the

future;

* the Transaction results in c.£365m being available to be returned to

shareholders through a proposed return of value by the end of the calendar

year, following realisation of the inherent value of First Student and

First Transit and the financial consequences of their sale noted above; and

* the Transaction is in line with the Group's portfolio rationalisation

strategy to exit its North American businesses and focus on the growth and

value creation opportunities available to the Retained Group's leading bus

and rail divisions in the UK. Greyhound remains non-core and the Group

continues to pursue all exit options for it while de-risking its

liabilities and actively managing its substantial property portfolio for

value.

Information on First Student and First Transit

First Student is the largest provider of student transportation in North

America, operating in 435 locations across 40 US states and seven Canadian

provinces. First Student provides safe, reliable and cost-effective

transportation services that help school districts focus on providing students

with the best possible education. It also has a strong charter business for

student and non-school trips. The business has a wholly-owned fleet of c.39,500

revenue-producing vehicles and operates a further c.2,500 leased or

customer-owned vehicles.

First Transit is one of the largest private sector providers of public transit

management and contracting services in North America, managing fixed route and

shuttle bus services, paratransit operations, call centres for accessible

transportation and other light transit activities. The business conducted over

300m passenger journeys in FY20 and owns or operates 12,500 vehicles. The

business has a well-established platform with the ability to capture long-term

growth in evolving transit management markets.

For the last full financial year to 31 March 2020, First Student and First

Transit together recorded revenue of $3,959.8m (£3,109.1m) and EBITDA of

$576.2m (£450.1m). For that period, adjusted operating profit was $241.6m (£

186.7m) and operating profit was $92.7m (£67.1m). The value of the total assets

the subject of the Transaction as at 30 September 2020 was $4,744.1m (£

3,722.0m).

Principal terms of the Transaction

FirstGroup will, on the terms and subject to the conditions in the purchase

agreement entered into with Recess Holdco Inc., a newly incorporated affiliate

of EQT Infrastructure V Collect EUR SCSp and EQT Infrastructure V Collect USD

SCSp (the "Purchaser") (the "Purchase Agreement"), sell to the Purchaser the

entities comprising First Student and First Transit (the "Target Businesses").

The consideration payable by the Purchaser in cash at Completion is c.$3,065m

(excluding the locked box adjustments and net of transaction costs). The

Purchaser has also agreed to a deferred, contingent payment of up to $240m (c.£

170m) which will allow FirstGroup to share in the future value of First

Transit, calculated and payable on the third anniversary of closing the

Transaction or a sale of First Transit by the Purchaser, if earlier. The full

$240m would be received by FirstGroup on achievement of a First Transit

enterprise value of c.$765m, with FirstGroup sharing in any upside above an

enterprise value of $380m.

As part of the Transaction, First Student and First Transit self-insurance

liabilities valued at c.$545m are transferred to the Purchaser, as well as

c.$305m in long term debt relating to First Student and First Transit and

debt-like items and other enterprise value adjustments of c.$400m (including

pension and environmental liabilities relating to First Student and First

Transit and working capital and other deductions). In summary, the net cash

proceeds from the Transaction before the First Transit earnout are expected to

be c.$3,065m (the "Net Disposal Proceeds"), equivalent to c.£2,190m, as shown

below:

$m £m

Headline enterprise value 4,555 3,255

First Student and First Transit self-insurance provisions (545) (390)

First Transit earnout (240) (170)

Debt transferred to the Purchaser (305) (220)

Other EV adjustments including net working capital, pension,

environmental liabilities, transaction costs (400) (285)

Net Disposal Proceeds 3,065 2,190

The Transaction constitutes a Class 1 transaction for FirstGroup under the

Listing Rules and is, therefore, conditional on FirstGroup shareholders passing

a resolution approving the Transaction (the "Resolution"). The Transaction is

also conditional on among other things regulatory clearances from the US

Surface Transportation Board, the Canadian Minister of Transport, provincial

regulators in Ontario and Quebec and approval from the Vermont Department of

Financial Regulation, as well as antitrust clearances in the United States and

Canada (the "Closing Approvals"). The Purchaser has agreed to use its best

efforts to obtain the Closing Approvals as soon as practicable and, in any

event, on or before 22 January 2022. Completion of the Transaction is expected

to occur in the second half of the 2021 calendar year.

The Purchase Agreement contains obligations on both sides to obtain the

required approvals, as well as customary warranties, indemnities, termination

fees and cost reimbursements.

The Purchaser has agreed to pay FirstGroup a termination fee of $250m if the

Transaction fails to complete in certain specified circumstances, including

where all conditions to Completion are fulfilled in accordance with the terms

of the Purchase Agreement but the Purchaser fails to comply with its completion

obligations under it.

FirstGroup has agreed to pay the Purchaser a termination fee of c.$14m if the

Transaction fails to complete as a result of the Board modifying or withdrawing

its recommendation that FirstGroup shareholders approve the Transaction and the

Purchase Agreement is terminated by the Purchaser following such withdrawal or

modification or if the Resolution fails to be approved.

In addition, for a limited time following completion of the Transaction, the

Purchaser has agreed that the Target Businesses will provide certain

transitional services to Greyhound.

Use of Net Disposal Proceeds and proposed return of value to shareholders

The Board will use the Net Disposal Proceeds to reduce the Group's financial

indebtedness, discharge legacy liabilities and move its UK pension schemes to a

low dependency funding position. The Board believes these measures will ensure

the Group following completion of the Transaction (the "Retained Group") is in

a strong position to create value for shareholders going forward. As a result,

the Net Disposal Proceeds will be applied as follows:

Reducing the Group's financial indebtedness

The Group's net debt as at 31 March 2021 is expected to be c.£1.4bn, excluding

the impact of Rail ring-fenced cash and IFRS 16 lease liabilities. As part of

the Transaction, c.£220m of financial indebtedness will be transferred to the

Purchaser along with the Target Businesses. The Board believes that

substantially reducing the remaining financial indebtedness of c.£1.2bn will

provide the Retained Group with significant balance sheet strength and

flexibility to navigate the current period of uncertainty and pursue its

strategy going forward. As a result, the Retained Group will retain the £200m

2024 bond along with c.£45m in First Bus finance leases, while repaying the

remaining c.£935m of debt instruments and facilities including the £300m in

commercial paper issued through the UK Government's Covid Corporate Financing

Facility (CCFF) scheme. Make-whole costs of c.£65m in total will be incurred in

relation to these repayments.

Discharge of certain significant liabilities

The Board believes the Transaction provides an opportunity for the Group to

address certain significant legacy liabilities relating to the Greyhound

business, fund short term capital requirements of the Retained Group as well as

the payments in relation to the rail franchise termination agreements. Hence,

the Board intends to retain c.£345m for the anticipated discharge of these

liabilities over the near term. This will allow the Retained Group to focus on

growth opportunities in its core addressable markets instead of having to

allocate further capital towards these liabilities.

Making contributions to UK Pension schemes

The Board has entered into memoranda of understanding with the First UK Bus

Pension Scheme trustee and the FirstGroup Pension Scheme trustee (together the

"Pension Trustees") to contribute in aggregate £336m of the Net Disposal

Proceeds to improve funding and accelerate de-risking of these schemes. Of the

aggregate amount, £220m in cash will be contributed into the First UK Bus

Pension Scheme, and a further £95m held in escrow. It is expected that this

contribution to the First UK Bus Pension Scheme (which had an accounting

deficit of £171m as at 30 September 2020) will enable the Scheme to move to a

low dependency funding position. The remaining £21m will be held in escrow by

the FirstGroup Pension Scheme. Both amounts in escrow may be released back to

the Group following the conclusion of subsequent triennial valuations and

subject to scheme performance. The Transaction has no impact on the Railway

Pension Scheme or the Local Government Pension Scheme in First Bus.

Proposed return of value to shareholders and Retained Group capital structure

Given the near-term uncertainty in the Retained Group's end markets, the Board

believes it is prudent for the Group initially to maintain significant

liquidity. Hence, of the remaining net proceeds of c.£510m, the Board intends

to return c.£365m of cash (equivalent to 30 pence per share) to shareholders

through the proposed return of value which will be executed during the current

calendar year. The Board intends to consult with major shareholders as to the

most appropriate distribution mechanism for the return of value in due course.

The Board will keep the balance sheet position of the Retained Group under

review and will consider the potential for making further additional

distributions to shareholders in due course, subject to end market outlook and

business performance, as well as further clarity on the crystallisation of the

First Transit earnout and resolution of legacy liabilities related to

Greyhound.

The expected use of proceeds is therefore summarised as follows:

£m

Net Disposal Proceeds 2,190

Repayment of Government CCFF scheme funding (300)

Reduction of the Group's other financial indebtedness (635)

Make-whole costs towards repayment of Group debt instruments (65)

Cash retained for Greyhound liabilities, rail termination sums and short (345)

term capital requirements

Sub-total before contribution to UK defined benefit pension schemes 845

Contribution to UK defined benefit schemes (336)

Net proceeds available to the Retained Group 509

Cash in Retained Group (144)

Of which, proposed return of value to shareholders in current calendar 365

year

The Retained Group's pro forma capital structure will therefore comprise a cash

balance of c.£145m, offsetting the £200m 2024 bond and c.£45m in First Bus

finance leases described above. Accordingly, the Retained Group will have an

initial pro forma net debt position as at 31 March 2021 of c.£100m (on a

pre-IFRS 16 basis and excluding ring-fenced First Rail cash). As set out in the

financial policy framework section below, the Board believes that the Retained

Group will in due course support greater leverage as pandemic restrictions ease

and UK end markets recover.

The future of FirstGroup - a leader in public transportation in the UK

FirstGroup is a leader in public transportation in the UK through its First Bus

and First Rail divisions. Going forward, the Retained Group has a strong

platform on which to create sustainable value, and is well-positioned to help

deliver wider economic, social and environmental goals at a key inflection

point for public transport in the UK. Following Completion and the proposed

return of value, the Directors believe that the Retained Group will be a

sustainable and cash generative business with a well-capitalised balance sheet

and an operating model that will support an attractive dividend for

shareholders.

Investment case of the Retained Group

On Completion, the Board expects FirstGroup to be a strong platform for further

value creation based on the following considerations:

* Leading positions in bus and rail transportation in the UK: First Bus is a

leader in regional bus operations outside London with a c.20 per cent.

market share and strong positions in most of its local areas of operation.

First Rail is the largest passenger rail operator in the UK by revenue with

c.27 per cent. of the national passenger rail sector through four wholly or

majority-owned operations, namely the West Coast Partnership (in which

Trenitalia is a 30 per cent. minority shareholder and which comprises

operation of Avanti West Coast and the role of 'shadow operator' to the HS2

project), Great Western Railway ("GWR"; 100 per cent. owned), South Western

Railway ("SWR"; in which MTR is a 30 per cent. minority shareholder) and

TransPennine Express ("TPE"; 100 per cent. owned) as well as one open

access rail service, Hull Trains, and a second, East Coast Trains,

launching later in 2021. It also operates the Tramlink network on behalf of

Transport for London.

* Inflection point for growth, underpinned by supportive government and

social policies: public transport operators play a vital role in meeting

local and national objectives, including net zero carbon, green jobs,

reduced congestion, improved air quality, and the "levelling up" agenda,

particularly in "left behind" towns and regions, as well as the recovery in

economic and social activity following the COVID-19 pandemic. The

importance of all of these agendas to the UK was clearly indicated in the

National Bus Strategy published in March 2021, which recommits the UK

government to £3bn in investment to improve bus services and support 4,000

new zero-emission buses across the country over the current Parliament. The

Retained Group's services are key to supporting modal shift particularly

from cars to sustainable, zero-carbon public transport, a key strand in

meeting the UK's climate change goals.

* Digital innovation to attract more customers, enhance business efficiency

and flexibility: enhancements seek to stimulate passenger growth by

delivering FirstGroup's vision to provide easy and convenient mobility,

improving quality of life by connecting people and communities.

FirstGroup's public transport services offer efficient, cost effective and

convenient travel options, both within and between the UK's congested towns

and cities. Public transport is an attractive travel choice for customers,

with increasingly sophisticated and easy-to-use journey planning tools

(principally delivered via smartphone apps), simple and value-for-money

ticket products catering to a wide range of needs, and reduced complexity

and cost compared to other travel options.

* First Bus: ready to complete trajectory to delivering a 10% margin in the

first full financial year after pandemic-related social distancing

restrictions on public transport end: Although near-term passenger volume

and revenue levels following the COVID-19 pandemic are difficult to

forecast with any certainty at present, management are readying detailed

plans to realign networks in several potential passenger volume scenarios.

The Group's current expectation is that bus passenger volumes will recover

to between 80 and 90% of pre-pandemic levels during first year after social

distancing restrictions on public transport end (noting passenger volumes

recovered to c.60 per cent. of pre-pandemic levels in some of First Bus'

local areas when travel restrictions were partially eased during 2020).

These plans will be adapted to align with demand and growth potential,

significantly aided by the digital transformation of First Bus'

capabilities in real-time passenger volume data capture. In the

post-pandemic environment, it is possible that passenger demand on some

routes may no longer support previous levels of commercial operations. The

recently launched National Bus Strategy in England provides a clear

framework and funding for bus operators and local government to promote bus

use, and First Bus will work with local transport authorities to develop

Bus Service Improvement Plans and future statutory partnerships. These will

align services to the needs of local bus customers and enable access to the

funding available to help deliver them in the coming years. Management

expect that the revenue effect of any volume reductions will be mitigated

over time by the targeted network changes, together with a new data-driven

pricing strategy which is underway and other ticketing innovations. Margin

performance will also benefit from operational and engineering efficiency

actions already in place as well as £3m in divisional overhead and other

cost improvements made since 2019, which will enhance the level of

operational gearing to increased passenger activity.

* First Rail: well-placed for lower risk, long term and cash generative rail

operations: As the largest incumbent operator with four UK passenger rail

contracts expected to at least 2023, First Rail will benefit from the

government's transition of the passenger rail industry's commercial

structure to a lower-risk and more predictable National Rail Contract

model. Under the proposed new model, it is expected that operators will be

paid a fixed management fee with performance incentives for delivery

against specific punctuality and other operational targets, and it is

expected that there will be no passenger revenue risk and limited cost risk

for operators, as well as no significant contingent capital requirements.

Overall, the new model is expected to deliver a successful railway system

that works better for passengers while generating more resilient and

consistent returns for shareholders.

* Opportunities from adjacent markets in UK bus and rail, and in new

geographies over time, leveraging the Group's considerable industry

knowledge, skills and experience. For example, the Retained Group's rail

division has set up open access operations (both with Hull Trains and with

the East Coast Trains open access operation which is due to start services

from London to Edinburgh later in 2021), developed and deployed new rail

technology such as next generation on-board WiFi, on-train entertainment as

well as integrated passenger information and analytics systems. First Rail

also delivers high levels of customer satisfaction and efficiency through

its integrated passenger contact centre which was built based on

scalability and the latest technology. The bespoke customer service centre

operates at a lower cost than First Rail's previous outsourcing

arrangements and provides a single service for all customer queries across

several First Rail operations. First Rail will also seek to build on its

consultancy experience as 'shadow operator' to the HS2 infrastructure

project since last year. First Bus is also building on its existing

platform of contracted fleet services for commercial customers in order to

deliver revenue growth and capital efficiency.

* Critical enabler of society's ESG goals, accelerating the transition to a

zero-carbon world: principally through facilitating modal shift from cars

and through FirstGroup's commitments to transition its bus fleet to

zero-carbon by 2035, to cease to purchase any new diesel buses after

December 2022 and to support the UK Government's goal to remove all

diesel-only trains from service by 2040. These commitments form part of the

Group's Mobility Beyond Today sustainability framework and will increase

its EU Green Taxonomy eligibility year by year. The Group has also

committed to implementing the Task Force on Climate-Related Financial

Disclosures ("TCFD") recommendations in its 2021 reporting, a year ahead of

the regulatory mandate. FirstGroup is also the first UK road and rail

operator to formally commit to setting a science-based target ("SBT") for

reaching net zero emissions by 2050 or earlier, in accordance with the SBT

initiative. Alongside top decile ratings in our sector globally from

multiple ESG ratings providers, FirstGroup is a longstanding constituent of

the FTSE4Good index and was recently recognised with a place in the 2021

Clean200 report, which ranks the world's largest publicly listed companies

by their total clean energy revenues from products and services that

provide solutions for the planet and define a clean energy future - the

only passenger transport operator based in Europe to be listed in this

year's report.

Financial policy framework of the Retained Group

The targeted financial policy framework for the Retained Group can be

summarised as follows:

Metric Objective

Revenue * First Bus: Planning for a range of post-pandemic scenarios;

central case envisages passenger volumes recover to between c.80

and 90% of pre-pandemic levels during first year after social

distancing restrictions on public transport end, with further

growth thereafter.

* First Rail: opportunities to build on base business of four

contracted operations with no revenue risk.

Profitability * First Bus: targeting 10 per cent. margin in first full financial

year after social distancing restrictions on public transport end.

* First Rail: profitability driven by delivering against performance

targets under the National Rail Contracts while adding earnings in

adjacent rail opportunities.

* Reduction in central costs of at least £10m per annum from FY23.

Investment * First Bus: c.£90m per annum from FY23, mainly driven by the

commitment to operating a zero-emission bus fleet by 2035.

* First Rail: expected to continue to be cash capital-light under

the National Rail Contracts.

Leverage * Target leverage ratio of less than 2.0x net debt (pre-IFRS 16) /

Bus and non-contracted Rail EBITDA, plus contracted Rail

dividends, minus central costs.

Dividend * Intention to pay regular dividends to shareholders commencing in

FY23.

* Subject to a normalisation of trading conditions post-pandemic,

targeting annual dividend around 3x covered by new Adjusted Profit

After Tax measure.

* Adjusted Profit After Tax defined as Bus and non-contracted Rail

adjusted operating profit, plus contracted Rail dividends, minus

central costs, minus treasury interest, minus tax.

In summary, the Retained Group is expected to be a sustainable and cash

generative business with a well-capitalised balance sheet, and an operating

model that will support an attractive dividend for shareholders.

Greyhound

Greyhound remains non-core and FirstGroup continues to pursue all exit options

for the business in order to conclude the Group's portfolio rationalisation

strategy. Sale discussions are ongoing but the process has been affected by the

pandemic's impact on this passenger volume-based business. The impact on

Greyhound's financial performance and cash generation continues to be mitigated

by tight cost control and recoveries of 5311(f) grants for operating key coach

services under the US CARES Act. As noted above, c.$250m of the Net Disposal

Proceeds will be utilised to buy out the legacy pension and substantially

de-risk the self-insurance liabilities associated with Greyhound. The liability

de-risking will result in Greyhound having a better capitalised balance sheet,

which also includes its substantial property portfolio which the Group will

continue to actively manage for value as part of Greyhound's network

transformation plans. For the purposes of the Retained Group pro forma net debt

position, c.£15m of finance leases attributable to Greyhound have been

excluded.

FirstGroup Board

As a natural consequence of the Transaction and as the Group enters a new

strategic phase, the composition and background of the Board will evolve.

FirstGroup has separately announced today that Jane Lodge and Peter Lynas will

be joining the Board as non-executive directors on 30 June 2021. David Robbie

has also notified the Group that he will not seek re-election at the 2021 AGM

and will stand down from the Board on 30 June 2021. The Nomination Committee,

led by Chairman David Martin, will continue to oversee an orderly and

appropriate evolution of the Board in order to ensure it has the right balance

of skills, experience and diversity for the Retained Group's future needs.

Current trading and liquidity position

Whilst some uncertainty remains due to the COVID-19 pandemic, the Board's

visibility over the Group's performance has continued to improve since the

half-yearly results announced on 10 December 2020. Due to strong cost control

and other actions to manage the consequences of the pandemic, FirstGroup now

expects adjusted operating profit for the 2021 financial year to be ahead of

management's previous expectations.

Since the Group's last update in December 2020, the proportion of First

Student's bus fleet operating either full service or on a hybrid basis has

increased, to 95% in the second week of April, and First Transit's service

levels have remained broadly stable. Greyhound volumes have improved modestly

and the division is now operating just over half of its pre-pandemic mileage.

Passenger volumes in First Bus and First Rail have also increased as UK

lockdown restrictions have started to ease.

The Group has continued to take all prudent and appropriate action to maintain

a robust financial position and strong liquidity. The Group's free cash (before

rail ring-fenced cash) and committed undrawn banking facilities was c.£905m as

at 22 April 2021. Since the last liquidity update in December 2020, the Group

has repaid the £350m April 2021 bond mainly funded from drawdown of the £250m

bridge facility entered into in March 2020, secured £102m in cash proceeds from

the sale of Greyhound properties announced at the end of December 2020, while

operating cash flow in the second half of the financial year was positive and

ahead of our expectations. In March the Group renewed the £300m in commercial

paper issued through the CCFF scheme for a further year and secured a further £

300m committed bridge facility from the CCFF maturity in March 2022, thereby

providing adequate financial resources for the short to medium term.

Important information regarding forward-looking statements

This document includes statements that are, or may be deemed to be,

forward-looking statements. These forward-looking statements can be identified

by the use of forward-looking terminology, including the terms anticipates,

believes, could, estimates, expects, intends, may, plans, projects, should or

will, or, in each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives, goals, future

events or intentions.

These forward-looking statements include all matters that are not historical

facts. They appear in a number of places throughout this document and include,

but are not limited to, statements regarding FirstGroup and its intentions,

beliefs or current expectations concerning, among other things, the business,

results of operations, prospects, growth and strategies of the Group, the

Target Businesses and the Retained Group.

By their nature, forward-looking statements involve risk and uncertainty

because they relate to future events and circumstances. Forward-looking

statements are not guarantees of future performance and the actual results of

operations of the Group, the Target Businesses and the Retained Group, and the

developments in the industries in which they operate, may differ materially

from those described in, or suggested by, the forward-looking statements

contained in this document. In addition, even if the results of operations of

the Group, the Target Businesses and the Retained Group and the developments in

the industries in which they operate are consistent with the forward-looking

statements contained in this document, those results or developments may not be

indicative of results or developments in subsequent periods. A number of

factors could cause results and developments to differ materially from those

expressed or implied by the forward-looking statements including, without

limitation, general economic and business conditions, industry trends,

competition, changes in law and regulation, currency fluctuations, changes in

business strategy and political and economic uncertainty.

Forward-looking statements may, and often do, differ materially from actual

results. Any forward-looking statements in this document reflect the Group's

current view with respect to future events and are subject to risks relating to

future events and other risks, uncertainties and assumptions relating to the

Group and its operations, results of operations and growth strategy.

Shareholders should specifically consider the factors identified in this

document which could cause actual results to differ before making a decision on

the Transaction.

The unaudited pro forma financial information is shown for illustrative

purposes only and because of its nature addresses a hypothetical situation. It

does not represent the actual financial position of the Retained Group.

Furthermore, it does not purport to represent what the Retained Group's

financial position would actually have been if the Transaction had been

completed on the indicated date and is not indicative of the results that may

or may not be expected to be achieved in the future

No statement in this announcement is intended as a profit forecast or estimate

for any period and no statement in this announcement should be interpreted to

mean that earnings, earnings per share or income, cash flow from operations or

free cash flow for the Group and the Target Businesses, as appropriate, for the

current or future financial years would necessarily match or exceed the

historical published earnings, earnings per share or income, cash flow from

operations or free cash flow for the Group and the Target Businesses, as

appropriate.

Other than in accordance with its legal or regulatory obligations (including

under the Listing Rules, the Disclosure Guidance and Transparency Rules and the

Prospectus Rules), the Group is not under any obligation and the Group

expressly disclaims any intention or obligation (to the maximum extent

permitted by law) to update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise.

Cautionary statement

This announcement is not intended to, and does not constitute, or form part of,

any offer to sell or an invitation to purchase or subscribe for any securities

or a solicitation of any vote or approval in any jurisdiction. FirstGroup

shareholders are advised to read carefully the formal documentation in relation

to the Transaction once it has been despatched. Any response to the Transaction

should be made only on the basis of the information in the formal documentation

to follow.

Important information relating to financial advisers

N.M. Rothschild & Sons Limited ("Rothschild & Co") is authorised and regulated

in the United Kingdom by the FCA and is acting exclusively for FirstGroup and

no one else in connection with the contents of this document and any other

matters referred to in this document and will not regard any other person

(whether or not a recipient of this document) as a client in relation to any

other matters referred to in this document and will not be responsible to

anyone other than FirstGroup for providing the protections afforded to its

clients, or for providing advice, in relation to the contents of this document

or any other matter or arrangement referred to in this document,

Rothschild & Co does not accept any responsibility whatsoever for the contents

of this document, including its accuracy, completeness or verification, or for

any other statement made or purported to be made by it, or on its behalf, in

connection with FirstGroup and/or any other transaction or arrangement referred

to herein. Rothschild & Co accordingly disclaims, to the fullest extent

permitted by applicable law, all and any duty, liability, or responsibility

whatsoever whether arising in tort, contract or otherwise, which it might

otherwise have in respect of this document or any such statement. No

representation or warranty, express or implied, is made by Rothschild & Co or

any of its affiliates as to the accuracy, completeness, verification or

sufficiency of the information set out in this document, and nothing in this

document will be relied upon as a promise or representation in this respect,

whether or not to the past or future, provided that nothing in this paragraph

shall seek to exclude or limit any responsibilities or liabilities which may

arise under the FSMA or the regulatory regime established thereunder.

Goldman Sachs International is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct Authority and the Prudential

Regulation Authority. Goldman Sachs International is acting exclusively for

FirstGroup and no one else in connection with the Transaction and will not

regard any other person (whether or not a recipient of this announcement) as a

client in relation to the Transaction and will not be responsible to anyone

other than FirstGroup for providing the protections afforded to Goldman Sachs

International's clients nor for giving advice in relation to the Transaction or

any other arrangement referred to in this announcement.

J.P. Morgan Securities plc, which conducts its UK investment banking business

as J.P. Morgan Cazenove ("J.P. Morgan Cazenove"), and which is authorised in

the United Kingdom by the Prudential Regulation Authority (the "PRA") and

regulated by the PRA and the Financial Conduct Authority, is acting as

financial adviser exclusively for FirstGroup and no one else in connection with

the Transaction and will not regard any other person as its client in relation

to the Transaction and will not be responsible to anyone other than FirstGroup

for providing the protections afforded to clients of J.P. Morgan Cazenove or

its affiliates, nor for providing advice in relation to the Transaction or any

other matter or arrangement referred to herein.

Exchange rates

Throughout this announcement, unless otherwise stated, the USD to GBP exchange

rate used in this document is as derived from FactSet on the latest practicable

date prior to this announcement, being $1.40 to £1.00.

Rounding

Percentages in this document have been rounded and accordingly may not add up

to 100 per cent. Certain financial data have also been rounded. As a result of

this rounding, the totals of data presented in this document may vary slightly

from the actual arithmetic totals of such data.

END

(END) Dow Jones Newswires

April 23, 2021 02:00 ET (06:00 GMT)

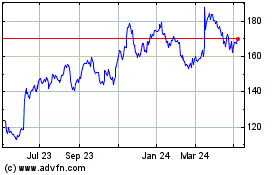

Firstgroup (LSE:FGP)

Historical Stock Chart

From Mar 2024 to Apr 2024

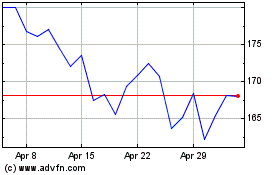

Firstgroup (LSE:FGP)

Historical Stock Chart

From Apr 2023 to Apr 2024