TIDMFLTR

RNS Number : 1933K

Flutter Entertainment PLC

04 May 2022

4 May 2022

Q1 2022 Trading Update

Strong US momentum continues, ex-US performance in line with

market expectations

Flutter Entertainment plc (the "Group") announces a trading

update for three months ended 31 March 2022.

Unaudited GBPm Q1 2022 Q1 2021 YoY % YoY % CC(1)

Average monthly players(2)

('000s) 8,855 7,672 +15%

Sports revenue 930 896 +4% +5%

Gaming revenue 636 589 +8% +9%

------- ------- ----- -----------

Total revenue 1,566 1,485 +5% +6%

--------------------------- ------- ------- ----- -----------

All commentary within this trading update refers to constant

currency (1) growth rates. Any differences due to rounding.

-- Group: Revenue growth of 6% driven by continued strong

recreational player momentum with average monthly players ("AMPs")

up 15%

-- US: excellent execution delivering revenue growth of 45% to

$574m with continued strong customer economics

-- Group ex-US: 3% decline in revenue or 2% higher excluding

known safer gambling and regulatory headwinds driven by strong

performance in Australia, Canada, Brazil and India

-- Sustainability: Positive Impact Plan progress in Q1 included

roll out of mandatory deposit limits to under 25s in the UK and

Ireland, and the launch of our Play Well advertising campaign with

US ambassador Craig Carton

Peter Jackson, Chief Executive, commented:

"Flutter delivered a positive Q1 performance with revenue growth

of 6%. The quarter saw us launch our new global sustainability

strategy, the Positive Impact Plan, aligning commercial goals with

our commitment to support our customers, colleagues and the

communities in which we operate.

In the US we had another exciting quarter as FanDuel continued

to deliver unparalleled scale, with the US accounting for over half

of all stakes for the Flutter Group in Q1. We launched our FanDuel

sportsbook in New York and Louisiana in January and also expanded

into Ontario in April. We beat a number of FanDuel records in the

quarter; Super Bowl Sunday was the single biggest day ever for new

customers and we had over 1.5m active customers on the day. March

Madness this year also proved our most popular season yet

attracting 19m wagers across the tournament.

Outside of the US, our business performed well, adapting to the

evolving regulatory and trading environment and reflecting the

benefits of our global diversification. In the UK and Ireland we

launched several new products in the quarter. I look forward to the

imminent release of the UK Government's White Paper on its review

of the Gambling Act. In Australia, Sportsbet delivered good growth

from ongoing customer driven momentum, with excellent retention of

players acquired in 2021. Our International business benefitted

from strong performance in focus markets and we hope to complete

the Sisal acquisition in Q3.

With our enlarged recreational customer base, winning position

in the US and ongoing focus on sustainable growth, our business

remains well placed for the future."

Divisional analysis

Unaudited revenue Total Sports Gaming Average monthly

GBPm players(2)

Q1 2022 Q1 2021 YoY % YoY % YoY % Q1 2022 YoY%

CC CC CC (000s)

------- ------ ------ ----------

US 429 288 +45% +50% +34% 2,359 +43%

UK & Ireland 519 568 -8% -21% +15% 3,627 +15%

- UK & Ireland

Online 453 568 -20% -32% +4% 3,627 +15%

- UK & Ireland

Retail 65 - +100% +100% +100%

Australia 291 279 +8% +8% 915 +10%

International 327 351 -5% -3% -5% 1,954 -4%

------------------ ------- ------- ----- ------ ------ ----------

Group 1,566 1,485 +6% +5% +9% 8,855 +15%

------------------ ------- ------- ----- ------ ------ ----------

US

In the US, FanDuel delivered another excellent performance with

2.4m customers and revenue of GBP429m ($574m). We remained the

number 1 US sportsbook with a 37% online sports betting share. We

acquired over 1.3m new customers in the quarter and similar to the

trends seen in Q1 2021, some of our key promotional mechanics led

to reduced market share particularly around the SuperBowl. Our

iGaming share was 20% in Q1(3) .

Revenue grew by 45% driven by a 43% growth in AMPs, with a

number of factors driving performance:

-- Excellent execution delivered record customer acquisition and engagement with:

Compelling customer economics as cumulative CPAs remain at

c.$290 and average paybacks within 12-18 month range(4)

Strong SuperBowl/March Madness campaigns with FanDuel the most

downloaded sportsbook app across the events

Successful launches in New York and Louisiana, with New York

exceeding expectations representing the fastest penetration of our

daily fantasy sports player base to date

-- This strong player momentum more than doubled stakes to

GBP5.7bn ($7.7bn). Sportsbook revenue was up 89% with net revenue

margin 30 basis points lower at 4.1%. Customer friendly results

cost GBP98m ($132m)(5) or 175 basis points versus expected margin

in Q1, however, structural margin gains delivered by our leading

product proposition drove additional revenue firepower to offset

most of this year-on-year results impact

-- iGaming growth reflects the launch of Connecticut in Q4 and

good cross-sell to SuperBowl and March Madness players. We

continued to improve our customer proposition with FanDuel rated

the number 1 casino app in Q1

UK & Ireland

Online

UK&I online AMPs grew 15% while revenue declined 20% (pro

forma for Tombola AMPs +2%, revenue -26%) due to the expected

impact of:

-- Safer gambling measures introduced over the last 12 months

(incremental year-on-year impact GBP30m in Q1)

-- Favourable sports results in the comparable period with

sportsbook net revenue margin 100 basis points lower year-on-year

at 9.6%

-- Peak in player engagement during Q1 2021 from Covid-related restrictions

We continue to sharpen our sports product with the launch of

'Buildabet' and 'Acca Assist' in SkyBet. On the gaming side, Sky

Vegas launched 'The Vault' and we continue to see good recreational

player growth with gaming AMPs up 9% on a pro forma basis. We

believe that our increased focus on product and efficiency will set

the division up well for the future.

Retail

Our retail estate was fully open during the quarter compared to

completely closed during Q1 2021. Our UK estate has returned to

near pre-Covid levels with revenue just 6% lower than Q1 2019. Our

Irish estate was 24% lower than Q1 2019 reflecting the higher level

of societal caution with respect to Covid and is unlikely to return

to pre-Covid levels in the current year.

Australia

At Sportsbet, revenue grew by 8% despite a more challenging

market environment with Covid restrictions easing. Our strong

performance was driven by player volumes as AMP growth accelerated

to 10%. Structural improvements in margin driven by our in-house

pricing capabilities and product mix funded an increase in

promotional spend. This led to strong player engagement and good

retention of the 2021 Covid-enlarged customer base. Staking was 7%

higher as a result with net revenue margin broadly flat at

11.5%.

International

Revenue in our International division was 5% lower, reflecting

the impact of guided headwinds(6) in the quarter. Excluding these

headwinds revenue grew 6% with strong growth in focus markets of

Canada, Brazil, India, Georgia and Armenia.

We continue to improve the customer proposition by leveraging

expertise within the Group. The Group's global betting platform has

been deployed in Denmark. Junglee is bringing the concepts of

PokerStars 'Spin and Go' poker product to the Indian rummy

market.

(1) Constant currency ("cc") growth is calculated by

retranslating the non-sterling denominated components of Q1 2021 at

Q1 2022 exchange rates. Growth rates in the commentary are in local

or constant currency.

(2) Average Monthly Players represent the average number of

players who have placed and/or wagered a stake and/or contributed

to rake or tournament fees during the month in the reporting

period.

(3) Online sportsbook market share is the GGR market share of

FanDuel and FOX Bet for Q1 2022 in the states in which FanDuel was

live, based on published gaming regulator reports in those states.

During Q1 2022 FanDuel was live in 15 states; Arizona (AZ),

Colorado (CO), Connecticut (CT), Illinois (IL), Indiana (IN), Iowa

(IA), Louisiana (LA), Michigan (MI), New Jersey (NJ), New York

(NY), Pennsylvania (PA), Tennessee (TN), Virginia (VA), West

Virginia (WV) and Wyoming (WY). During Q1 FOX Bet was live in 4

states; CO, NJ, MI and PA. Market share does not include AZ for

February or AZ, IL, VA, WV and WY for March as the data has yet to

be released. Online gaming market share reflects the combined CT,

MI, NJ, PA and WV market share of our gaming brands.

(4) CPA is cost per acquisition and represents the total media

and digital marketing spend per acquired customer including those

cross-sold from daily fantasy sports. The payback period represents

the average number of months it takes to generate sufficient gross

profit to pay back the average CPA to acquire those customers. It

includes all quarterly cohorts of FanDuel sportsbook acquired

between Q3 2018 through Q1 2021.

(5) Represents the revenue impact of sports results in Q1 before adjusting for recycling.

(6) Guided headwinds in International reflect the impact of the

temporary market exit from the Netherlands, tax changes in Germany

and the effects of the ongoing war in Ukraine on our business in

Russia and the Ukraine.

Analyst briefing:

The Group will host a questions and answers call for institutional

investors and analysts this morning at 9:00am (BST). To dial into

the conference call, participants need to register here where they

will be provided with the dial in details to access the call.

Contacts:

Investor Relations:

Ciara O'Mullane, Investor Relations + 353 87 947 7862

Liam Kealy, Investor Relations + 353 87 665 2014

Press:

Kate Delahunty, Corporate Communications + 44 78 1077 0165

Lindsay Dunford, Corporate Communications + 44 79 3197 2959

Rob Allen, Corporate Communications + 44 75 5444 1363

Billy Murphy, Drury Communications + 353 1 260 5000

James Murgatroyd, Finsbury + 44 20 7251 3801

------------------------------------------------- -------------------

About Flutter Entertainment plc:

Flutter Entertainment plc (the "Group") is a global

sports-betting and gaming company reporting as four divisions:

-- UK & Ireland: includes Sky Betting and Gaming, Paddy

Power, Betfair and Tombola brands offering a diverse range of

sportsbook, exchange and gaming services across the UK and Ireland,

along with over 600 Paddy Power betting shops.

-- Australia: the Sportsbet brand offers online sport betting

and is the Australian market leader.

-- International: includes PokerStars, Adjarabet, Betfair and

Junglee operating in multiple jurisdictions around the world

offering a diverse range of sportsbook, exchange and gaming

services.

-- US: includes FanDuel, TVG, Stardust, FOX Bet and PokerStars

brands, offering regulated real money and free-to-play sports

betting, online gaming, daily fantasy sports and online racing

wagering products to customers across various states in the US.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSSWFADEESEFI

(END) Dow Jones Newswires

May 04, 2022 02:01 ET (06:01 GMT)

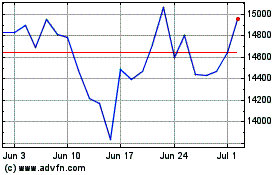

Flutter Entertainment (LSE:FLTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Flutter Entertainment (LSE:FLTR)

Historical Stock Chart

From Apr 2023 to Apr 2024