Falcon Oil & Gas Ltd. Falcon Oil & Gas Ltd - Filing Of Interim Financial Statements

August 25 2022 - 1:00AM

UK Regulatory

TIDMFOG

FALCON OIL & GAS LTD.

("Falcon")

Filing of Interim Financial Statements

25 August 2022 - Falcon Oil & Gas Ltd. (TSXV: FO, AIM: FOG)

announces that it has filed its Interim Financial Statements for

the three and six months ended 30 June 2022 and 2021 and the

accompanying Management's Discussion and Analysis ("MD&A").

The following should be read in conjunction with the complete

unaudited unreviewed Interim Financial Statements and the

accompanying MD&A for the three and six months ended 30 June

2022, which are available on the Canadian System for Electronic

Document Analysis and Retrieval ("SEDAR") at www.sedar.com and on

Falcon's website at www.falconoilandgas.com.

2022 financial highlights and other financial updates

-- Strong financial position, debt free with cash of US$17.4 million at 30

June 2022 (31 December 2021: US$8.9 million).

-- Continued focus on cost management and the efficient operation of the

portfolio.

CONTACT DETAILS:

Falcon Oil & Gas Ltd. +353 1 676 8702

Philip O'Quigley, CEO +353 87 814 7042

Anne Flynn, CFO +353 1 676 9162

Cenkos Securities plc (NOMAD &

Broker)

Neil McDonald / Derrick Lee +44 131 220 9771

Interim Condensed Consolidated

Statement of Operations and

Comprehensive Loss

(Unaudited)

Three months Three months Six months Six months

ended 30 ended 30 ended 30 ended 30

June 2022 June 2021 June 2022 June 2021

$'000 $'000 $'000 $'000

Revenue

Oil and natural gas revenue - - - 2

- - - 2

Expenses

Exploration and evaluation

expenses (37) (42) (77) (82)

General and administrative

expenses (1,076) (631) (1,684) (1,662)

Foreign exchange (loss) /

gain (129) 37 (174) (118)

(1,242) (636) (1,935) (1,862)

----------------------------------- ------------ ------------ ---------- ------------

Results from operating activities (1,242) (636) (1,935) (1,860)

Finance income 2 2 5 3

Finance expense (83) (59) (143) (126)

Net finance expense (81) (57) (138) (123)

Loss and comprehensive loss

for the period (1,323) (693) (2,073) (1,983)

Loss and comprehensive loss

attributable to:

Equity holders of the company (1,323) (693) (2,072) (1,982)

Non-controlling interests (1) - (1) (1)

Loss and comprehensive loss

for the period (1,323) (693) (2,073) (1,983)

----------------------------------- ------------ ------------ ---------- ------------

Loss per share attributable

to equity holders of the company:

Basic and diluted (0.001 cent) (0.001 cent) (0.002 (0.002 cent)

cent)

----------------------------------- ------------ ------------ ---------- ------------

Interim Condensed Consolidated

Statement of Financial Position

(Unaudited)

At 30 June At 31 December

2022 2021

$'000 $'000

Assets

Non-current assets

Exploration and evaluation assets 40,244 40,197

Property, plant and equipment 10 13

Trade and other receivables 21 22

Restricted cash 2,050 2,239

42,325 42,471

---------------------------------- ---------- --------------

Current assets

Cash and cash equivalents 17,395 8,894

Trade and other receivables 110 74

17,505 8,968

---------------------------------- ---------- --------------

Total assets 59,830 51,439

----------------------------------- ---------- --------------

Equity and liabilities

Equity attributable to owners

of the parent

Share capital 402,120 392,170

Contributed surplus 46,737 46,254

Retained deficit (401,938) (399,866)

46,919 38,558

Non-controlling interests 697 698

Total equity 47,616 39,256

----------------------------------- ---------- --------------

Liabilities

Non-current liabilities

Decommissioning provision 11,893 11,775

11,893 11,775

---------------------------------- ---------- --------------

Current liabilities

Accounts payable and accrued

expenses 321 408

321 408

Total liabilities 12,214 12,183

----------------------------------- ---------- --------------

Total equity and liabilities 59,830 51,439

----------------------------------- ---------- --------------

Interim Condensed Consolidated Statement

of Cash Flows

(Unaudited)

Six months ended 30 June

2022 2021

$'000 $'000

Cash flows from operating activities

Net loss for the period (2,073) (1,983)

Adjustments for:

Share based compensation 483 747

Depreciation 3 1

Net finance expense 138 123

Effect of exchange rates on operating

activities 174 118

Transfer of Canadian working interests - (28)

Change in non-cash working capital:

(Increase) / decrease in trade and other

receivables (35) 5

Decrease in accounts payable and accrued

expenses (63) (43)

Net cash used in operating activities (1,373) (1,060)

Cash flows from investing activities

Interest received 5 3

Exploration and evaluation assets (44) (2)

Net cash (used in) / generated from

investing activities (39) 1

Cash flows from financing activities

Net proceeds from private placement 9,950 -

Net cash generated from financing activities 9,950 -

Change in cash and cash equivalents 8,538 (1,059)

Effect of exchange rates on cash & cash

equivalents (37) (3)

Cash and cash equivalents at beginning

of period 8,894 11,036

Cash and cash equivalents at end of

period 17,395 9,974

---------------------------------------------- ------------ ------------

All dollar amounts in this document are in United States dollars

"$", except as otherwise indicated.

About Falcon Oil & Gas Ltd.

Falcon Oil & Gas Ltd is an international oil & gas

company engaged in the exploration and development of

unconventional oil and gas assets, with the current portfolio

focused in Australia, South Africa and Hungary. Falcon Oil &

Gas Ltd is incorporated in British Columbia, Canada and

headquartered in Dublin, Ireland with a technical team based in

Budapest, Hungary.

For further information on Falcon Oil & Gas Ltd. please

visit www.falconoilandgas.com

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Certain information in this press release may constitute

forward-looking information. This information is based on current

expectations that are subject to significant risks and

uncertainties that are difficult to predict. Actual results might

differ materially from results suggested in any forward-looking

statements. Falcon assumes no obligation to update the

forward-looking statements, or to update the reasons why actual

results could differ from those reflected in the forward

looking-statements unless and until required by securities laws

applicable to Falcon. Additional information identifying risks and

uncertainties is contained in Falcon's filings with the Canadian

securities regulators, which filings are available at

www.sedar.com.

(END) Dow Jones Newswires

August 25, 2022 02:00 ET (06:00 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

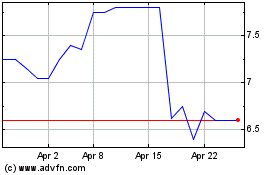

Falcon Oil & Gas (LSE:FOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Falcon Oil & Gas (LSE:FOG)

Historical Stock Chart

From Apr 2023 to Apr 2024