TIDMFPO

RNS Number : 5451G

First Property Group PLC

26 November 2020

Date: 26 November 2020

On behalf First Property Group plc ("First Property" or

of: "the Group")

Embargoed: 0700hrs

First Property Group plc

Interim Results for the six months to 30 September 2020

First Property Group plc (AIM: FPO), the award-winning property

fund manager and investor with operations in the United Kingdom and

Central Europe, today announces its interim results for the six

months to 30 September 2020.

Highlights:

-- Significant cash reserves at period end: GBP21.21 million (31 March 2020: GBP7.34 million);

-- Substantially reduced net debt: GBP19.83 million (31 March 2020: GBP57.19 million);

-- Well positioned to weather the crisis and make judicious

investments as the UK, Poland and Romania emerge from it;

-- Fund management division AUM: GBP557 million (31 March 2020: GBP567 million);

-- Weighted average unexpired fund management contract term: 4

years, 5 months (31 March 2020: 5 years, 0 months);

-- Interim dividend maintained at 0.45 pence per share.

Financial Summary:

Unaudited Unaudited Percentage Audited

Six months Six months change Year to

to 30 Sept to 30 Sept 31 March

2020 2019 2020

------------------------- ------------ ------------ ----------- --------------

Income Statement:

------------------------- ------------ ------------ ----------- --------------

Statutory profit before GBP2.08m GBP2.98m -30.20% GBP5.52m

tax

Diluted earnings per

share 0.46p 2.07p -77.78% 4.29p

Total dividend per

share 0.45p 0.45p - 1.67p

Average EUR/GBP rate 1.1159 1.1246 - 1.1453

Balance Sheet at period

end:

------------------------- ------------ ------------ ----------- --------------

Investment properties GBP47.48m GBP82.98m -42.78% GBP47.10m

and Inventories at

book value

Investment properties GBP56.82m GBP96.26m -40.97% GBP56.30m

and Inventories at

market value

Cash balances GBP21.21m GBP8.55m +148.07% GBP7.34m

Cash per share 19.21p 7.72p +148.83% 6.65p

Gross debt GBP41.04m GBP67.50m -39.20% GBP64.53m

Net debt GBP19.83m GBP58.95m -66.36% GBP57.19m*

Gearing ratio at book

value** 46.56% 59.24% - 57.32%

Gearing ratio at market

value*** 40.09% 49.93% - 50.94%

Net assets at book GBP47.11m GBP46.45m +1.42% GBP48.05m

value

Net assets at market GBP61.34m GBP67.68m -9.37% GBP62.15m

value

Adjusted net assets

per share (EPRA basis) 54.28p 59.65p -9.00% 55.00p

Period end EUR/GBP

rate 1.1025 1.1303 - 1.1301

* Prior to completion of the sale of CH8 in April 2020.

** Gearing ratio = Gross debt divided by gross debt plus

net assets at book value.

*** Gearing ratio = Gross debt divided by gross debt plus

net assets at market value.

Commenting on the results, Ben Habib, Chief Executive of First

Property Group, said:

"The sale of Cha ubińskiego 8 (CH8) in April released some GBP17

million in cash and put the Group in a strong position from which

to navigate the economic fallout of the COVID pandemic.

"As a consequence of the sale there has been a reduction in

rental income, which is the primary reason for the reduction in

earnings reported today.

"This reduction should be temporary and last only until we

reinvest the cash. We expect to do so in association with clients

of the Group. Our aim is to invest some 10-20% of the equity

required in any acquisition which, when coupled with bank debt,

should enable us to acquire up to some GBP300 million in

property.

"There is a great deal of flux in the market at the moment and

we expect interesting opportunities to emerge next year. "

A briefing for analysts will be held at 11:00hrs today via

Investor Meet Company. To participate it is necessary to register

at

https://www.investormeetcompany.com/first-property-group-plc/register-investor

and select to meet the Company. Those who have already registered

and selected to meet the company will be automatically invited. A

copy of the accompanying investor presentation and a recording of

the call will be posted on the company website.

For further information please contact:

First Property Group plc Tel: +44 (20) 7340

0270

Ben Habib (Chief Executive Officer) www.fprop.com

Laura James (Interim Group Finance investor.relations@fprop.com

Director)

Jeremy Barkes (Director, Business

Development)

Jill Aubrey (Company Secretary)

Arden Partners (NOMAD & Broker) Tel: + 44 (20) 7614

5900

John Llewellyn-Lloyd (Director, Corporate

Finance)

Ben Cryer (Corporate Finance)

Newgate Communications (PR) Tel: + 44 7540106366

Robin Tozer / Tom Carnegie / Isabelle firstproperty@newgatecomms.com

Smurfit

Notes to Investors and Editors :

First Property Group plc is an award-winning property fund

manager and investor with operations in the United Kingdom and

Central Europe. Its focus is on higher yielding commercial property

with sustainable cash flows. The company is flexible and takes an

active approach to asset management. Its earnings are derived

from:

-- Fund Management - via its FCA regulated and AIFMD approved

subsidiary, First Property Asset Management Ltd (FPAM), which earns

fees from investing for third parties in property. FPAM currently

manages twelve funds which are invested across the United Kingdom,

Poland and Romania.

-- Group Properties - principal investments by the Group, to

earn a return on its own capital, usually in partnership with third

parties. Investments include eight directly held properties in

Poland and Romania, and non-controlling interests in ten of the

twelve funds managed by FPAM.

Listed on AIM the Company has offices in London, Warsaw and

Bucharest. Around one third of the shares in the Company are owned

by management and their families. Further information about the

Company and its products can be found at: www.fprop.com .

CHIEF EXECUTIVE'S STATEMENT

Performance:

I am pleased to report interim results for the six months ended

30 September 2020.

Revenue earned by the Group was GBP6.33 million (30 September

2019: GBP8.08 million) yielding a profit before tax of GBP2.08

million (30 September 2019: GBP2.98 million).

The decrease in profit before tax was mainly attributable

to:

-- A loss incurred by Cha ubińskiego 8 (CH8) which reduced

profit before tax by GBP135,000 following completion of its sale on

24 April 2020 (30 September 2019: profit GBP600,000);

-- Reduced contribution from Associates and investments of

GBP796,000 (30 September 2019: GBP1.27 million), a decrease of

GBP475,000 mainly due to:

a) a loss incurred by Fprop Phoenix Ltd of which the Group's

share amounted to GBP219,000 (30 September 2019: profit GBP8,000);

and

b) Foregone rent and service charge in Fprop Opportunities plc

(FOP) and Fprop Galeria Corso (FGC) from rent holidays granted to

tenants by the Polish government during the first lockdown, of

which the Group's share amounted to GBP132,000.

-- No performance fees earned by our fund management division

(FPAM) (30 September 2019: GBP247,000).

Diluted earnings per share decreased to 0.46 pence (30 September

2019: 2.07 pence), more than the decrease in profit before tax, due

to a deferred tax charge of GBP1.14 million (30 September 2019:

GBP27,000) resulting from the write-off of a previously recognised

deferred tax asset following the repayment of the loan secured

against CH8 in April 2020. The subsidiary company which held the

property retains the benefit of the crystallised tax loss to

relieve future taxable profits if earned.

It is the accounting policy of the Group to carry its properties

and interests in associates at the lower of cost or market value.

Market values are independently assessed at least once a year, on

31 March. The Group ended the period with net assets under the cost

basis of accounting of GBP47.11 million (31 March 2020: GBP48.05

million). The net assets of the Group when adjusted to their market

value less any deferred tax liabilities (EPRA basis) at the period

end was GBP61.34 million (31 March 2020: GBP62.15 million).

Gross debt at the period end amounted to GBP41.04 million (31

March 2020: GBP64.53 million), the reduction being due to the

completion of the sale of CH8 and the repayment of the

corresponding bank loan. This in turn reduced the Group's gearing

ratio at book value from 57.32% at 31 March 2020 to 46.56%, and at

market value from 50.94% at 31 March 2020 to 40.09%. Net debt

reduced to GBP19.83 million (31 March 2020: GBP57.19 million).

Group cash balances at the period end stood at GBP21.21 million

(31 March 2020: GBP7.34 million prior to the completion of the sale

of CH8 in April 2020). This represents 19.21 pence per share (31

March 2020: 6.65 pence per share).

Dividend:

The Directors have resolved to maintain the interim dividend at

0.45 pence per share (30 September 2019: 0.45 pence per share)

which will be paid on 8 January 2021 to shareholders on the

register at 4 December 2020, with an ex-dividend date of 3 December

2020.

REVIEW OF OPERATIONS

PROPERTY FUND MANAGEMENT (First Property Asset Management Ltd or

FPAM)

Third party assets under management at period end amounted to

GBP557 million (31 March 2020: GBP567 million). This 1.8% decrease

was primarily attributable to reductions in the value of properties

held by our UK property funds. Some 65% of third-party assets under

management were located in the UK, 33% in Poland, and 2% in

Romania. A further GBP80 million of committed but as yet

un-invested equity remains available to be drawn by funds managed

by FPAM.

Fund management fees are generally levied monthly by FPAM by

reference to the value of properties under management. In the case

of Fprop Offices LP, the Group is entitled to a share of total

profits in lieu of fund management fees and to receive annual

payments on account equivalent to 10% of total cumulative income

profits and realised capital gains. Under its accounting policy the

Group will not recognise unrealised property revaluations above a

given property's original cost. These payments are adjusted

annually, if necessary, for any overpayments made in previous years

up to a maximum of total past cumulative payments received

(totalling GBP1.38 million as at 30 September 2020).

Revenue earned by this division decreased by 18% to GBP1.66

million, resulting in profit before unallocated central overheads

and tax of GBP633,000 (30 September 2019: GBP1.00 million),

representing 22% of Group profit before unallocated central

overheads and tax. The decrease was primarily due to no performance

fees being earned in the period (30 September 2019:

GBP247,000).

At the period end FPAM's fund management fee income, excluding

performance fees and the profit share from Fprop Offices LP, was

being earned at an annualised rate of GBP3.02 million (31 March

2020: GBP3.13 million).

FPAM's weighted average unexpired fund management contract term

at the period end was 4 years, 5 months (31 March 2020: 5 years, 0

months).

The reconciliation of movement in third party funds under

management during the period is shown below:

Funds managed for third parties

(including funds in which the

Group is a minority shareholder)

----------------------- ----------------------------------------

UK CEE Total No. of

GBPm GBPm GBPm prop's

----------------------- --------- -------- -------- ---------

As at 1 April 2020 375.7 191.3 567.0 69

----------------------- --------- -------- -------- ---------

Purchases - - - -

New fund mandates - - - -

Property sales - - - -

Capital expenditure 0.1 - 0.1 -

Property depreciation - - - -

Property revaluation (14.7) (0.6) (15.3) -

FX revaluation - 4.8 4.8 -

As at 30 Sept 2020 361.1 195.5 556.6 69

----------------------- --------- -------- -------- ---------

An overview of the value of assets and maturity of each of the

funds managed by FPAM is set out below:

Fund Country Fund Assets No of % of total Assets

of investment expiry under properties third-party under management

management assets at market

at market under value at

value management 31 March

at 2020

30 Sept

2020

------------ ---------------- ---------- ------------ ------------ ------------- ------------------

Fund management division GBPm. GBPm.

------------------------------ ---------- ------------ ------------ ------------- ------------------

SAM & DHOW UK Rolling * * * *

UK PPP UK Feb 2022 67.1 20 12.0 70.3

5PT Poland Dec 2022 8.2 3 1.5 8.0

OFFICES UK Jun 2024 139.5 5 25.1 143.4

SIPS UK Jan 2025 136.9 24 24.6 143.4

FOP Poland Oct 2025 72.5 5 13.0 71.3

FRS Romania Jan 2026 1.0 1 0.2 1.0

FGC Poland Mar 2026 22.9 1 4.1 22.4

SPEC OPPS UK Jan 2027 17.7 4 3.2 18.6

FKR Poland Mar 2027 23.6 1 4.2 23.0

FCL Romania Jun 2028 8.0 1 1.5 7.8

FPL Poland Jun 2028 59.2 4 10.6 57.8

------------ ---------------- ---------- ------------ ------------ ------------- ------------------

Total Third-Party

AUM 556.6 69 100.0 567.0

------------------------------ ---------- ------------ ------------ ------------- ------------------

* Not subject to recent revaluation;

The sub sector weightings of investments in FPAM funds is set

out in the table below:

UK Poland Romania Total % of Total

-------------------- ------ ------- -------- ------- -----------

GBPm. GBPm. GBPm. GBPm.

-------------------- ------ ------- -------- ------- -----------

Offices 209.3 108.1 8.0 325.4 58.4%

Retail warehousing 92.8 - - 92.8 16.7%

Supermarkets 50.8 20.0 1.0 71.8 12.9%

Shopping centres - 58.4 - 58.4 10.5%

Industrial 8.2 - - 8.2 1.5%

-------------------- ------ ------- -------- ------- -----------

Total 361.1 186.5 9.0 556.6 100.0%

-------------------- ------ ------- -------- ------- -----------

% of Total

Third-Party

AUM 64.9% 33.5% 1.6% 100.0%

-------------------- ------ ------- -------- ------- -----------

Average rent collection rates by funds managed by FPAM in the

six months to 30 September 2020 were as follows:

UK Poland Romania

-----------------

Rent collected as

a percentage of what

would have been invoiced

prior to COVID related

concessions 92.3% 90.1% 98.03%

------------------------------ ----------------- ----------------- -----------------

Offices Retail Offices Retail Offices Retail

95.9% 88.3% 97.2% 75.4% 100.0% 85.9%

------------------------------ -------- ------- -------- ------- -------- -------

Rent collected after 95.1%* 98.1%** 98.03%***

adjustments for concessions

granted due to COVID

------------------------------ ----------------- ----------------- -----------------

Offices Retail Offices Retail Offices Retail

96.3% 93.2% 99.1% 95.7% 100.0% 85.9%

------------------------------ -------- ------- -------- ------- -------- -------

*In the UK no rent discounts were granted, only deferrals of

payment;

**After adjusting for rent waivers statutorily imposed upon

landlords of non-essential retail outlets during the first lockdown

and for cash concessions granted to tenants in return for lease

extensions;

***In Romania no rent discounts were granted, only deferrals of

payment.

GROUP PROPERTIES

At the period end Group Properties comprised eight directly

owned commercial properties in Poland and Romania and interests in

ten of the twelve funds managed by FPAM (which are invested in the

UK, Poland and Romania).

The contribution to Group profit before tax and unallocated

central overheads from the Group Properties division was GBP2.30

million (30 September 2019: GBP3.10 million), representing 78% of

Group profit before unallocated central overheads and tax.

Approximately 65% of this contribution was from the eight directly

owned properties and 35% was from the Group's Associates and other

investments.

1. Directly owned Group Properties (all accounted for under the cost model):

Two of the Group's eight directly owned properties account for

80% of the value (GBP37.8 million). Both are office buildings in

Poland of which one is in Warsaw (11,000 m(2) ) and the other in

Gdynia (15,500 m(2) ). The balance of 20% by value (GBP9.6 million)

is invested in three mini-supermarkets in Poland, a development

site in Warsaw, an office block in Bucharest and a warehouse in

Romania.

Country Sector No. of Book Market *Contribution *Contribution

properties value value to Group to Group

profit profit

before before

tax - period tax - period

to to

30 Sept 30 Sept

2020 2019

--------- ---------------- ------------ ------- ------- -------------- --------------

GBPm. GBPm. GBPm. GBPm.

Poland Offices 2 37.8 43.9 1.9 2.6

Poland Supermarkets 4 5.4 6.1 0.1 0.1

Office

Romania and logistics 2 4.2 6.8 0.2 0.1

Total 8 47.4 56.8 2.2 2.8

--------------------------- ------------ ------- ------- -------------- --------------

*Prior to the deduction of direct overhead and unallocated

central overhead expenses.

The eight directly owned properties generated a profit before

unallocated central overheads and tax of GBP1.50 million (30

September 2019: GBP1.83 million). The decrease was almost entirely

attributable to completion in April 2020 of the sale of Cha

ubińskiego 8 (CH8), an office tower in Warsaw, resulting in no

further rental contributions from this property. The impact from

COVID was minimal, mainly because none of the remaining eight

properties are shopping centres (see next section, "Associates and

Investments" for fuller details).

Free cash generation of the eight directly owned properties for

the six months to 30 September 2020 was EUR973,000 (30 September

2019: EUR829,000).

6 months 6 months 12 months

to 30 Sept to 30 Sept to 31 March

2020 2019* 2020*

---------------------------- ------------ ------------ -------------

EUR'000 EUR'000 EUR'000

---------------------------- ------------ ------------ -------------

Net operating income

(NOI) 3,945 3,979 8,024

Interest expense on

bank loans/ finance

leases (356) (397) (775)

---------------------------- ------------ ------------ -------------

NOI after interest expense 3,589 3,582 7,249

---------------------------- ------------ ------------ -------------

Current tax (430) (600) (1,110)

Debt amortisation (2,174) (2,096) (4,368)

Capital expenditure (12) (57) (566)

---------------------------- ------------ ------------ -------------

Free Cash 973** 829 1,205

---------------------------- ------------ ------------ -------------

*Excluding CH8;

**of which EUR881,000 was from the property in Gdynia.

The average rent collection rates across the eight properties in

the six months to 30 September 2020 are shown in the table below.

The high collection rate is testament both to the quality of our

properties and our asset management capabilities.

Poland Romania

------------------------------------------ ------- --------

Rent collected as a percentage of what

would have been invoiced prior to COVID

related concessions 98.8% 94.2%

------------------------------------------ ------- --------

Rent collected after adjustments for

concessions granted due to COVID 98.8% 94.5%

------------------------------------------ ------- --------

The debt secured against the eight Group Properties reduced to

GBP41.04 million (31 March 2020: GBP64.53 million) following the

sale of CH8. The loans secured against the eight properties are

held in separate non-recourse special purpose vehicles.

30 Sept 2020 30 Sept 2019

GBPm GBPm

Book value 47.4 49.4*

Market value 56.8 60.9*

Gross debt (all non-recourse

to Group) 41.0 44.1*

LTV at book value % 86.5% 89.3%

LTV at market value % 72.2% 72.4%

Weighted average borrowing cost 1.70% 1.84%

Weighted average debt term excluding 4 yrs 7 mths 5 yrs 10 mths

Gdynia

Weighted average debt term including 1 yr 10 mths 2 yrs 11 mths

Gdynia

*Comparable figure has been adjusted to exclude the property CH8

and the associated bank loan.

The Group has been depreciating the value of the Gdynia property

in anticipation of the near simultaneous expiry of both the over

rented lease to its sole tenant and the bank financing (on 21

February 2021). The Group is now in negotiations with the lending

bank about terms on which to renew/ restructure the financing. We

are also in discussions with the tenant.

When the Group sold Cha ubińskiego 8 (CH8) at the end of the

last financial year, it guaranteed the rent and service charge

income on the residual vacant space until March 2025 as a condition

of the sale (amounting to EUR1.34 million per annum), and undertook

to pay fit out costs associated with new lettings of up to circa

EUR1.50 million. An accrual was recognised in the year ended 31

March 2020 for one year's worth of this rent guarantee and the full

fit-out costs, totalling EUR2.85 million (GBP2.52 million).

The weighted average vacancy rate across all eight properties is

10%. The weighted average unexpired lease term (WAULT) of all eight

properties as at 30 September 2020 was 1 year and 3 months.

2. Associates and Investments

These comprise non-controlling interests in ten of the twelve

funds managed by FPAM, of which seven are accounted for as

associates under the cost model, and three are accounted for as

investments in funds and held at fair value.

The contribution to Group profit before tax and unallocated

central overheads from its seven associates and three investments

decreased by 37% to GBP796,000 million (30 September 2019: GBP1.27

million). This contribution represents 27% of Group profit before

unallocated central overheads and tax and 35% of the contribution

by Group Properties. The reduction was largely attributable to the

loss generated by Fprop Phoenix Ltd, of which the Group's 23.4%

share amounted to GBP219,000 (30 September 2019: profit GBP8,000)

and also the impact of COVID on the two funds which own shopping

centres, Fprop Opportunities plc (FOP) and Fprop Galeria Corso

(FGC).

During the first lockdown in Poland, which lasted from 14 March

to 4 May, all shops except for food retailers and pharmacies were

forcibly closed and tenants absolved from paying rent, subject to

those tenants wishing to benefit from the rent holiday extending

their leases on the same terms by the period of the ban plus a

further six months. The two funds affected suffered a total loss of

rent and service charge income of GBP589,000, of which the Group's

share amounted to GBP204,000. In the six months to 30 September the

impact was GBP132,000, with the balance having been already

recognised in the financial year ended 31 March 2020. Further rent

concessions on top of these government-imposed rent holidays were

granted in exchange for lease extensions. These amounted to

GBP465,000 for the six months to 30 September 2020 in terms of cash

flow but their impact on profit before tax is minimal due to the

rent reductions being amortised over the remaining life of the

respective leases.

The rent collection rate amongst the Group's associates and

investments is shown in a table in the fund management section of

this report. With the exception of Fprop Phoenix Ltd (FPL), which

is a turnaround, these funds are invested in well let commercial

property.

An overview of the Group's Associates and Investments is set out

in the table below:

Fund % owned Book value Current Group's Group's

by of First market share share

First Property's value of of post-tax of post-tax

Property share in holdings profits profits

Group fund earned by earned by

fund fund

30 Sept 30 Sept

2020 2019

--------------- ---------- ------------ ---------- ------------- --------------

% GBP'000 GBP'000 GBP'000 GBP'000

--------------- ---------- ------------ ---------- ------------- --------------

a) Associates

5PT 37.8% 1,200 1,299 72 73

FRS 24.1% 179 269 11 11

FOP 40.4% 10,866 10,936 627 751

FGC 28.2% 2,445 2,784 99 156

FKR 18.1% 1,543 1,986 92 97

FPL 23.4% 1,690 6,900 (219) 8

FCL 17.4% 560 558 41 43

--------------- ---------- ------------ ---------- ------------- --------------

Sub Total 18,483 24,732 723 1,139

--------------------------- ------------ ---------- ------------- --------------

b) Investments

UK PPP 0.9% 656 656 14 33

SPEC OPPS 4.8% 502 502 17 32

OFFICES 1.6% 2,002 2,002 42 67

----------- ----- ------ ------ --- ----

Sub Total 3,160 3,160 73 132

------------------ ------ ------ --- ----

Total 21,643 27,892 796 1,271

------- ------- ------- ---- ------

Commercial Property Markets Outlook

Poland:

Poland is likely to be one of the least affected in the EU by

the pandemic with GDP forecast to have returned to pre-pandemic

levels by early 2022. Government debt as a percentage of GDP

remains low by western European standards (at around 55%), making

its COVID-19 stimulus package affordable. Like elsewhere, the

retail and hospitality sectors have suffered more than others from

COVID. But our own experience of rent collection has been good, as

evidenced in the divisional reports above. Capital value reductions

have been limited and transaction volumes are only down by around

10% year to date, although the percentage of transactions in

industrial and logistics property has increased.

Romania:

Similar to Poland, Romania is expected to return to pre-pandemic

levels of economic growth early in 2022. Like Poland, Romania

benefits from low government debt as a ratio of GDP (at around

41%), giving it fiscal headroom to help speed its recovery.

Commercial property turnover in 2020 is likely to be less than the

EUR1 billion of recent years.

United Kingdom:

According to Bank of England analysis of independent forecasts,

GDP will have shrunk by around 10% in 2020 but will grow by 7% next

year. In the meantime, the occupier market for commercial property

is suffering. Notwithstanding this, office tenants are generally

continuing to pay rent (unless their business has been directly

impacted) but rent collection rates amongst retail and hospitality

tenants is lower. Overall, this is bound to exert downward pressure

on rent levels, more so in some sub-sectors than others. It should

also exert downward pressure on capital values, but renewed

quantitative easing and zero percent interest rates have reduced

the impact, and in some cases served to boost capital values. The

market is in a state of flux.

Current Trading and Prospects

The sale of Cha ubińskiego 8 (CH8) in April released some GBP17

million in cash and put the Group in a strong position from which

to navigate the economic fallout of the COVID pandemic.

As a consequence of the sale there has been a reduction in

rental income, which is the primary reason for the reduction in

earnings reported today.

This reduction should be temporary and last only until we

reinvest the cash. We expect to do so in association with clients

of the Group. Our aim is to invest some 10-20% of the equity

required in any acquisition which, when coupled with bank debt,

should enable us to acquire up to some GBP300 million in

property.

There is a great deal of flux in the market at the moment and we

expect interesting opportunities to emerge next year.

Ben Habib

Chief Executive

CONSOLIDATED INCOME STATEMENT

for the six months to 30 September 2020

Notes Six months Six months Year to

to 30 Sept to

2020

(unaudited) 30 Sept 31 Mar 2020

2019

(unaudited) (audited)

--------------------------------- ------ -------------- -------------- --------------

Total results Total results Total results

--------------------------------- ------ -------------- -------------- --------------

GBP'000 GBP'000 GBP'000

Revenue 6,330 8,077 16,287

--------------------------------- ------ -------------- -------------- --------------

Cost of sales (1,194) (1,705) (3,969)

Gross profit 5,136 6,372 12,318

Profit on sale of an investment

property - - 1,527

Operating expenses (3,492) (4,006) (8,612)

Operating profit 1,644 2,366 5,233

Share of results in associates 7 723 1,139 1,220

Investment income 73 132 324

Interest income 3 45 42 80

Interest expense 3 (403) (696) (1,338)

Profit before tax 2,082 2,983 5,519

Corporation tax 4 (404) (586) (974)

Deferred tax 4 (1,140) (27) 360

--------------------------------- ------ -------------- -------------- --------------

Profit for the period 538 2,370 4,905

Attributable to:

Owners of the parent 515 2,350 4,859

Non-controlling interests 23 20 46

538 2,370 4,905

Earnings per share

Basic 5 0.47p 2.11p 4.38p

Diluted 5 0.46p 2.07p 4.29p

--------------------------------- ------ -------------- -------------- --------------

All operations are continuing.

CONDENSED CONSOLIDATED STATEMENT OF

COMPREHENSIVE INCOME

for the six months to 30 September 2020

Six months Six months Year to

to 30 Sept to 31 Mar

2020 30 Sept 2020

2019

(unaudited) (unaudited) (audited)

--------------------------------------- -------------- -------------- ----------

Total results Total results Total

results

--------------------------------------- -------------- -------------- ----------

GBP'000 GBP'000 GBP'000

--------------------------------------- -------------- -------------- ----------

Profit for the period 538 2,370 4,905

--------------------------------------- -------------- -------------- ----------

Other comprehensive income

--------------------------------------- -------------- -------------- ----------

Items that may subsequently

be reclassified to profit

or loss

Exchange differences on retranslation

of foreign subsidiaries (53) (451) (502)

Net gain/(loss) on financial

assets at fair value through

Other Comprehensive Income (52) (52) (195)

Taxation - - -

--------------------------------------- -------------- -------------- ----------

Total comprehensive income

for the period 433 1,867 4,208

--------------------------------------- -------------- -------------- ----------

Total comprehensive income

for the period attributable

to:

Owners of the parent 412 1,847 4,135

--------------------------------------- -------------- -------------- ----------

Non-controlling interests 21 20 73

--------------------------------------- -------------- -------------- ----------

433 1,867 4,208

--------------------------------------- -------------- -------------- ----------

All operations are continuing.

CONDENSED CONSOLIDATED BALANCE SHEET

as at 30 September 2020

Notes As at As at As at

30 Sept 31 Mar 30 Sept

2020 (unaudited) 2020 (audited) 2019 (unaudited)

------------------------------- ------ ------------------ ---------------- ------------------

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 153 153 153

Investment properties 6 32,544 32,537 67,956

Property, plant and equipment 56 64 61

Investment in associates 7a 18,483 17,698 17,937

Other financial assets

at fair value through OCI 7b 3,128 3,174 3,306

Other receivables 8 730 922 1,133

Right of use assets 584 584 -

Deferred tax assets 2,307 2,659 2,828

------------------------------- ------ ------------------ ---------------- ------------------

Total non-current assets 57,985 57,791 93,374

Current assets

Inventories - land and

buildings 14,940 14,558 15,025

Current tax assets 133 122 29

Trade and other receivables 8 3,216 44,845 4,890

Cash and cash equivalents 21,207 7,337 8,553

------------------------------- ------ ------------------ ---------------- ------------------

Total current assets 39,496 66,862 28,497

Current liabilities

Trade and other payables 9 (5,464) (9,158) (4,923)

Financial liabilities 10a (25,803) (49,073) (6,749)

Current tax liabilities (78) (71) (193)

------------------------------- ------ ------------------ ---------------- ------------------

Total current liabilities (31,345) (58,302) (11,865)

------------------------------- ------ ------------------ ---------------- ------------------

Net current assets 8,151 8,560 16,632

------------------------------- ------ ------------------ ---------------- ------------------

Total assets less current

liabilities 66,136 66,351 110,006

------------------------------- ------ ------------------ ---------------- ------------------

Non-current liabilities

Financial liabilities 10b (15,241) (15,461) (60,745)

Lease liabilities (584) (584) -

Deferred tax liabilities (3,049) (2,102) (2,712)

Net assets 47,262 48,204 46,549

------------------------------- ------ ------------------ ---------------- ------------------

Equity

Called up share capital 1,166 1,166 1,166

Share premium 5,791 5,791 5,791

Share-based payment reserve 179 179 179

Foreign exchange translation

reserve (1,311) (1,260) (1,180)

Purchase of own shares

reserve (2,653) (2,653) (2,462)

Investment revaluation

reserve (288) (236) (93)

Retained earnings 44,228 45,060 43,046

------------------------------- ------ ------------------ ---------------- ------------------

Equity attributable to

the owners of the parent 47,112 48,047 46,447

Non-controlling interests 150 157 102

------------------------------- ------ ------------------ ---------------- ------------------

Total equity 47,262 48,204 46,549

------------------------------- ------ ------------------ ---------------- ------------------

Net assets per share 5 42.68p 43.53p 41.90p

------------------------------- ------ ------------------ ---------------- ------------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months to 30 September 2020

Share Share Share- Foreign Purchase Investment Retained Non-controlling Total

Capital Premium Based Exchange of own Revaluation Earnings Interests

Payment Translation Shares Reserve

Reserve Reserve

----------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

At 1 April 2019 1,166 5,791 179 (731) (2,248) (41) 42,056 114 46,286

----------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

Profit for the

period - - - - - - 2,370 - 2,370

Net gain/ (loss)

on financial

assets at fair

value through

other

comprehensive

income - - - - - (52) - - (52)

Movement on

foreign

exchange - - - (449) - - - (2) (451)

Total

Comprehensive

Income - - - (449) - (52) 2,370 (2) 1,867

Purchase of

treasury shares - - - - (214) - - - (214)

Non-controlling

interests - - - - - - (20) 20 -

Dividends paid - - - - - - (1,360) (30) (1,390)

At 30 Sept 2019 1,166 5,791 179 (1,180) (2,462) (93) 43,046 102 46,549

----------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

Profit for the

period - - - - - - 2,535 - 2,535

Net gain/ (loss)

on financial

assets at fair

value through

other

comprehensive

income - - - - - (143) - - (143)

Movement on

foreign

exchange - - - (80) - - - 29 (51)

----------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

Total

Comprehensive

Income - - - (80) - (143) 2,535 29 2,341

Sale of treasury

shares - - - - 12 - - - 12

Purchase of

treasury shares - - - - (203) - - - (203)

Non-controlling

interests - - - - - - (26) 26 -

Dividends paid - - - - - - (495) - (495)

----------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

At 1 April 2020 1,166 5,791 179 (1,260) (2,653) (236) 45,060 157 48,204

----------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

Profit for the

period - - - - - - 538 - 538

Net gain/ (loss)

on financial

assets at fair

value through

other

comprehensive

income - - - - - (52) - - (52)

Movement on

foreign

exchange - - - (51) - - - (2) (53)

Total

Comprehensive

Income - - - (51) - (52) 538 (2) 433

Purchase of - - - - - - - - -

treasury shares

Non-controlling

interests - - - - - - (23) 23 -

Dividends paid - - - - - - (1,347) (28) (1,375)

----------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

At 30 Sept 2020 1,166 5,791 179 (1,311) (2,653) (288) 44,228 150 47,262

----------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

for the six months to 30 September 2020

Notes Six months Six months Year to

to to 30 Sept

2019 (unaudited)

30 Sept 31 Mar

2020 (unaudited) 2020

(audited)

----------------------------------------- ------ ------------------- ------------------ ------------

GBP'000 GBP'000 GBP'000

----------------------------------------- ------ ------------------- ------------------ ------------

Cash flows from operating activities

Operating profit 1,644 2,366 5,233

Adjustments for:

Depreciation of investment

property, and property, plant

& equipment 949 1,057 2,178

Profit on the sale of investment

property - - (1,527)

(Increase)/decrease in inventories 21 (48) (258)

(Increase)/decrease in trade

and other receivables 41,999 1,301 1,040

(Decrease)/increase in trade

and other payables (4,242) (2,193) (483)

Other non-cash adjustments 23 153 168

Cash generated from operations 40,394 2,636 6,351

Income taxes paid (407) (473) (1,013)

----------------------------------------- ------ ------------------- ------------------ ------------

Net cash flow from operating

activities 39,987 2,163 5,338

----------------------------------------- ------ ------------------- ------------------ ------------

Cash flow (used in)/from investing

activities

Capital expenditure on investment

properties 6 (12) (777) (1,258)

Proceeds from partial disposal

of financial assets held at

fair value through Other Comprehensive

Income 7a - 256 576

Purchase of property, plant

and equipment - (6) (42)

Investment in funds 7b (6) - (48)

Proceeds from funds 7b - 218 218

Investment in shares of associates 7a (62) - -

Interest received 3 45 42 80

Dividends from associates 7a - - -

Distributions received 73 95 276

Net cash flow (used in)/from

investing activities 38 (172) (198)

----------------------------------------- ------ ------------------- ------------------ ------------

Cash flow (used in)/from financing

activities

Proceeds from bank loan - 1,769 1,769

Repayment of bank loans (23,126) (1,458) (3,054)

Repayment of finance lease (1,358) (1,291) (2,562)

Purchase of new treasury shares - (214) (417)

Sale of shares held in Treasury - - 12

Exercise of share options - - -

Interest paid 3 (403) (656) (1,338)

Dividends paid (1,347) (1,360) (1,855)

Dividends paid to non-controlling

interests (28) (30) (30)

----------------------------------------- ------ ------------------- ------------------ ------------

Net cash flow (used in)/from

financing activities (26,262) (3,240) (7,475)

Net (decrease)/increase in

cash and cash equivalents 13,763 (1,249) (2,335)

----------------------------------------- ------ ------------------- ------------------ ------------

Cash and cash equivalents at

the beginning of period 7,337 9,738 9,738

----------------------------------------- ------ ------------------- ------------------ ------------

Currency translation gains/(losses)

on cash and cash equivalents 107 64 (66)

----------------------------------------- ------ ------------------- ------------------ ------------

Cash and cash equivalents at

the end of the period 21,207 8,553 7,337

----------------------------------------- ------ ------------------- ------------------ ------------

NOTES TO THE ACCOUNTS

for the six months ended 30 September 2020

1. Basis of Preparation

-- These interim consolidated financial statements for the six

months ended 30 September 2020 have not been audited or reviewed

and do not constitute statutory accounts within the meaning of

section 435 of the Companies Act 2006. They have been prepared in

accordance with the Group's accounting policies as set out in the

Group's latest annual financial statements for the year ended 31

March 2020 and are in compliance with IAS 34 "Interim Financial

Reporting". These accounting policies are drawn up in accordance

with International Accounting Standards (IAS) and International

Financial Reporting Standards (IFRS) as issued by the International

Accounting Standards Board and as adopted by the European Union

(EU).

-- The comparative figures for the financial year ended 31 March

2020 are not the full statutory accounts for the financial year but

are abridged from those accounts prepared under IFRS which have

been reported on by the Group's auditors and delivered to the

Registrar of Companies. The report of the auditors was unqualified,

did not include references to any matter to which the auditors drew

attention by way of emphasis without qualifying their report and

did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006.

-- These interim financial statements were approved by a

committee of the Board on 18 November 2020.

2. Segmental Analysis

Segment reporting for the six months to 30 September 2020

Direct costs incurred by First Property Group plc relating to

the cost of the Board and the related share listing costs are shown

separately under unallocated central costs. The staff incentive

accrual is included under unallocated central costs but will be

reallocated across all segments at the year end.

Fund Management Group Properties

Division Division

-------------------------- ----------------- ------------------------------- ------------ --------

Property Group Associates Unallocated TOTAL

fund management properties and investments central

overheads

-------------------------- ----------------- ------------ ----------------- ------------ --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ----------------- ------------ ----------------- ------------ --------

Rental income - 4,006 - - 4,006

Service charge

income - 663 - - 663

Asset management

fees 1,661 - - - 1,661

Performance related - - - - -

fee income

-------------------------- ----------------- ------------ ----------------- ------------ --------

Total revenue 1,661 4,669 - - 6,330

-------------------------- ----------------- ------------ ----------------- ------------ --------

Depreciation and

amortisation (10) (976) - - (986)

-------------------------- ----------------- ------------ ----------------- ------------ --------

Operating profit 633 1,884 - (873) 1,644

Share of results

in associates - - 723 - 723

Investment income - - 73 - 73

Interest income - 21 - 24 45

Interest expense - (403) - - (403)

Profit/(loss) before

tax 633 1,502 796 (849) 2,082

-------------------------- ----------------- ------------ ----------------- ------------ --------

Analysed as:

Underlying profit/loss

before tax before

adjusting for the

following items: 644 2,572 796 (680) 3,332

Write down, impairment - - - - -

loss/reversals

Profit on the sale - - - - -

of 'FOP' shares

Goodwill write - - - - -

off on acquisition

of associates

Group's share of - - - - -

revaluation losses

on associates

Performance related - - - - -

fee income

Depreciation on

investment property - (884) - - (884)

Staff incentives - - - (397) (397)

Realised foreign

currency (losses)/gains (11) (186) - 228 31

Profit/(loss) before

tax 633 1,502 796 (849) 2,082

-------------------------- ----------------- ------------ ----------------- ------------ --------

Revenue for the six months to 30 September 2020 from continuing

operations consists of revenue arising in the United Kingdom 14%

(30 September 2019: 12%) and Central and Eastern Europe 86% (30

September 2019: 88%) and all relates solely to the Group's

principal activities.

Segment reporting for the six months to 30 September 2019

Fund Management Group Properties

Division Division

-------------------------- ----------------- ------------------------------- ------------ --------

Property Group Associates Unallocated TOTAL

fund management properties and investments central

overheads

-------------------------- ----------------- ------------ ----------------- ------------ --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ----------------- ------------ ----------------- ------------ --------

Rental income - 5,484 - - 5,484

Service charge

income - 567 - - 567

Asset management

fees 1,779 - - - 1,779

Performance related

fee income 247 - - - 247

-------------------------- ----------------- ------------ ----------------- ------------ --------

Total revenue 2,026 6,051 - - 8,077

-------------------------- ----------------- ------------ ----------------- ------------ --------

Depreciation and

amortisation (15) (899) - - (914)

-------------------------- ----------------- ------------ ----------------- ------------ --------

Operating profit 1,003 2,492 - (1,129) 2,366

Share of results

in associates - - 1,139 - 1,139

Investment income - - 132 - 132

Interest income - 36 - 6 42

Interest expense - (696) - - (696)

Profit/(loss) before

tax 1,003 1,832 1,271 (1,123) 2,983

-------------------------- ----------------- ------------ ----------------- ------------ --------

Analysed as:

Underlying profit/loss

before tax before

adjusting for the

following items: 748 2,853 1,271 (476) 4,396

Write down, impairment - - - - -

loss/reversals

Profit on the sale - - - - -

of 'FOP' shares

Goodwill write - - - - -

off on acquisition

of associates

Group's share of - - - - -

revaluation losses

on associates

Performance related

fee income 247 - - - 247

Depreciation on

investment property - (879) - - (879)

Staff incentives - - - (656) (656)

Realised foreign

currency (losses)/gains 8 (142) - 9 (125)

Profit/(loss) before

tax 1,003 1,832 1,271 (1,123) 2,983

-------------------------- ----------------- ------------ ----------------- ------------ --------

Segment reporting year to 31 March 2020

Fund Management Group Properties

Division Division

-------------------------- ----------------- ------------------------------- ------------ ---------

Property Group Associates Unallocated TOTAL

fund management properties and investments central

overheads

-------------------------- ----------------- ------------ ----------------- ------------ ---------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ----------------- ------------ ----------------- ------------ ---------

Rental income - 10,403 - - 10,403

Service charge

income - 1,986 - - 1,986

Asset management

fees 3,483 - - - 3,483

Performance related

fee income 415 - - - 415

-------------------------- ----------------- ------------ ----------------- ------------ ---------

Total revenue 3,898 12,389 - - 16,287

-------------------------- ----------------- ------------ ----------------- ------------ ---------

Depreciation and

amortisation (35) (2,443) - - (2,478)

-------------------------- ----------------- ------------ ----------------- ------------ ---------

Operating profit 1,335 5,962 - (2,064) 5,233

Share of results

in associates - - 1,879 - 1,879

Fair value adjustment

on associates - - (659) - (659)

Investment income - - 324 - 324

Interest income - 74 - 6 80

Interest expense - (1,338) - - (1,338)

Profit/(loss) before

tax 1,335 4,698 1,544 (2,058) 5,519

-------------------------- ----------------- ------------ ----------------- ------------ ---------

Analysed as:

Underlying profit/(loss)

before tax before

adjusting for the

following items: 1,344 6,549 2,203 (1,023) 9,073

Profit on the sale

of investment property - 1,527 - - 1,527

Fair value adjustment

on associates - - (659) - (659)

Depreciation (35) (2,443) - - (2,478)

Performance related

fee income 415 - - - 415

Staff incentives (383) (325) - (1,101) (1,809)

Realised foreign

currency (losses)/gains (6) (610) - 66 (550)

Total 1,335 4,698 1,544 (2,058) 5,519

-------------------------- ----------------- ------------ ----------------- ------------ ---------

Assets - Group 1,078 98,591 3,174 4,032 106,875

Share of net assets

of associates - - 18,006 (308) 17,698

Liabilities (338) (74,793) - (1,238) (76,369)

-------------------------- ----------------- ------------ ----------------- ------------ ---------

Net assets 740 23,798 21,180 2,486 48,204

-------------------------- ----------------- ------------ ----------------- ------------ ---------

3. Interest Income/(Expense)

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 Mar 2020

2020 2019

---------------------------------- ---------------------- ---------------------- ------------------------

GBP'000 GBP'000 GBP'000

Interest income -

bank deposits 24 11 26

Interest income -

other 21 31 54

Total interest income 45 42 80

---------------------------------- ---------------------- ---------------------- ------------------------

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 Mar 2020

2020 2019

----------------------------------- ---------------------- ---------------------- ------------------------

GBP'000 GBP'000 GBP'000

Interest expense

- property loans (257) (519) (1,009)

Interest expense

- bank and other (22) (29) (53)

Finance charges on

finance leases (124) (148) (276)

----------------------------------- ---------------------- ---------------------- ------------------------

Total interest expense (403) (696) (1,338)

----------------------------------- ---------------------- ---------------------- ------------------------

4. Tax Expense

The tax charge is based on a combination of actual current and

deferred tax charged at an effective rate that is expected to apply

to the profits for the full year.

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 Mar 2020

2020 2019

------------------------- ---------------------- ---------------------- ------------------------

GBP'000 GBP'000 GBP'000

Current tax (404) (586) (974)

Deferred tax (1,140) (27) 360

------------------------- ---------------------- ---------------------- ------------------------

Total (1,544) (613) (614)

------------------------- ---------------------- ---------------------- ------------------------

The deferred tax charge relates to the reversal of a previously

recognised deferred tax asset following the repayment of the bank

loan secured against the property CH8 in April 2020 .

5. Earnings/NAV Per Share

The basic earnings per ordinary share is calculated on the

profit on ordinary activities after taxation and after

non-controlling interests on the weighted average number of

ordinary shares in issue, during the period.

Figures in the table below have been used in the

calculations.

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 Mar 2020

2020 2019

-------------------------------------- ----------------------- --------------------------- ------------------------

Basic earnings per share 0.47p 2.11p 4.38p

Diluted earnings per share 0.46p 2.07p 4.29p

-------------------------------------- ----------------------- --------------------------- ------------------------

Number Number Number

-------------------------------------- ----------------------- --------------------------- ------------------------

Weighted average number of

Ordinary shares in issue

(used for basic earnings

per share calculation) 110,953,578 111,318,482 110,953,578

Number of share options 2,610,000 2,610,000 2,610,000

-------------------------------------- ----------------------- --------------------------- ------------------------

Total number of Ordinary

shares used in the

diluted

earnings per share

calculation 113,563,578 113,928,482 113,563,578

-------------------------------------- ----------------------- --------------------------- ------------------------

GBP'000 GBP'000 GBP'000

-------------------------------------- ----------------------- --------------------------- ------------------------

Basic earnings 516 2,350 4,859

Notional interest on share

options assumed to be

exercised 4 8 8

-------------------------------------- ----------------------- --------------------------- ------------------------

Diluted earnings 520 2,358 4,867

-------------------------------------- ----------------------- --------------------------- ------------------------

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 Mar 2020

2020 2019

------------------------------------------ ---------------------- ---------------------- ------------------------

Net assets per share 42.68p 41.90p 43.53p

Adjusted net assets per share 54.28p 59.65p 55.00p

------------------------------------------ ---------------------- ---------------------- ------------------------

Adjusted net assets per share are calculated using the fair

value of all investments.

The following numbers have been used to calculate both the net

assets and adjusted net assets per share:

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 Mar 2020

2020 2019

------------------------------------------ ----------------------- ----------------------- ------------------------

Number Number Number

------------------------------------------ ----------------------- ----------------------- ------------------------

Number of shares in issue

at period end 110,383,332 110,854,001 110,382,332

------------------------------------------ ----------------------- ----------------------- ------------------------

GBP'000 GBP'000 GBP'000

------------------------------------------ ----------------------- ----------------------- ------------------------

Net assets excluding

Non-controlling

interest 47,112 46,447 48,047

For adjusted net assets per Number Number Number

share

------------------------------------------ ----------------------- ----------------------- ------------------------

Number of shares in issue

at period end 110,382,332 110,854,001 110,382,332

Number of share options

assumed

to be exercised 2,610,000 2,610,000 2,610,000

------------------------------------------ ----------------------- ----------------------- ------------------------

Total 112,992,332 113,464,001 112,992,332

------------------------------------------ ----------------------- ----------------------- ------------------------

For adjusted net assets per GBP'000 GBP'000 GBP'000

share

------------------------------------------ ----------------------- ----------------------- ------------------------

Net assets excluding

Non-controlling

interests 47,112 46,447 48,047

Investment properties at

fair value net of deferred

taxes 4,564 5,925 4,520

Inventories at fair value

net of deferred taxes 3,034 5,837 2,939

Investments in associates

and other financial

investments 6,246 9,088 6,260

Other items 381 381 381

------------------------------------------ ----------------------- ----------------------- ------------------------

Total 61,337 67,678 62,147

------------------------------------------ ----------------------- ----------------------- ------------------------

6. Investment Properties

Six months Year Six months

ended ended ended

30 Sept 31 Mar 2020 30 Sept

2020 2019

--------------------------------------------- ---------------------- -------------------- ----------------------

GBP'000 GBP'000 GBP'000

--------------------------------------------- ---------------------- -------------------- ----------------------

1 April 32,537 67,348 67,348

Capital expenditure 12 1,258 777

Disposals - (33,192) -

Additions through acquisitions - - -

Depreciation (939) (2,055) (1,021)

Impairment loss to an investment - - -

property

Foreign exchange translation 934 (822) 852

Total at end of period 32,544 32,537 67,956

--------------------------------------------- ---------------------- -------------------- ----------------------

Investment properties owned by the Group are stated at cost less

depreciation and accumulated impairment losses.

7. Investments in associates and other financial investments

Six months Year Six months

ended ended ended

30 Sept 31 Mar 2020 30 Sept

2020 2019

--------------------------------- ----------- ------------- -----------

a) Associates GBP'000 GBP'000 GBP'000

Cost of investment at beginning

of period 17,698 17,054 17,054

Additions 62 - -

Disposals - - -

Repayment of shareholder

loan - (576) (256)

Share of associates profit

after tax 723 1,879 1,139

Share of associates revaluation - (659) -

losses

Dividends received - - -

Cost of investment at end

of period 18,483 17,698 17,937

--------------------------------- ----------- ------------- -----------

Six months Year Six months

ended ended ended

30 Sept 31 Mar 2020 30 Sept

2020 2019

------------------------------- ----------- ------------- -----------

GBP'000 GBP'000 GBP'000

------------------------------- ----------- ------------- -----------

Investments in associates

------------------------------- ----------- ------------- -----------

5th Property Trading Ltd 1,508 1,436 1,361

Fprop Romanian Supermarkets

Ltd 179 168 161

Fprop Galeria Corso Ltd 2,445 2,346 2,214

Fprop Krakow Ltd 1,543 1,451 1,379

Fprop Cluj Ltd 560 519 501

Fprop Phoenix Ltd 1,690 1,908 2,057

Fprop Opportunities plc (FOP) 10,866 10,178 10,572

------------------------------- ----------- ------------- -----------

18,791 18,006 18,245

------------------------------- ----------- ------------- -----------

Less: Group share of profit

after tax withheld on sale

of property to an associate

in 2007 (308) (308) (308)

------------------------------- ----------- ------------- -----------

Cost of investment at end

of period 18,483 17,698 17,937

------------------------------- ----------- ------------- -----------

The withheld profit figure of GBP308,000 represents the removal

of the percentage of intercompany profit resulting from the sale of

the property in 2007 to 5th Property Trading Ltd (an associate).

The figure will reduce when there is a reduction in First Property

Group's stake in 5th Property Trading Ltd.

Six months Year Six months

ended ended ended

30 Sept 31 Mar 2020 30 Sept

2020 2019

-------------------------------- ----------- ------------- -----------

GBP'000 GBP'000 GBP'000

-------------------------------- ----------- ------------- -----------

b) Other financial investments

-------------------------------- ----------- ------------- -----------

Cost of investment at 1 April 3,174 3,539 3,539

Additions 6 48 37

Repayments - (218) (218)

Disposal - - -

(Decrease)/increase in fair

value during the period (52) (195) (52)

-------------------------------- ----------- ------------- -----------

Cost of investment at end

of period 3,128 3,174 3,306

-------------------------------- ----------- ------------- -----------

8. Trade and Other Receivables

Six months Year Six months

ended ended ended

30 Sept 31 Mar 2020 30 Sept

2020 2019

-------------------------------- ----------- ------------- -----------

GBP'000 GBP'000 GBP'000

Current assets

Trade receivables 1,222 1,423 1,128

Less provision for impairment

of receivables (356) (330) (320)

-------------------------------- ----------- ------------- -----------

Trade receivables net 866 1,093 808

Other receivables 1,757 42,343 2,910

Prepayments and accrued income 593 1,409 1,172

3,216 44,845 4,890

-------------------------------- ----------- ------------- -----------

Non-current assets

-------------------------------- ----------- ------------- -----------

Other receivables 730 922 1,133

-------------------------------- ----------- ------------- -----------

Other receivables, under current assets, as at 31 March 2020

included GBP38.93 million relating to the sale proceeds following

the sale of CH8, which were received in full on 24 April 2020.

Other receivables receivable after one year include a balance of

GBP730,000 (31 March 2020: GBP922,000) relating to the deferred

consideration from the sale of an investment property located in

Romania. This has been discounted to reflect its current value.

9. Trade and Other Payables

Six months Year Six months

ended ended ended

30 Sept 31 Mar 2020 30 Sept

2020 2019

----------------------------- ----------- ------------- -----------

GBP'000 GBP'000 GBP'000

Current liabilities

Trade payables 1,841 2,591 2,296

Other taxation and social

security 621 1,030 938

Other payables and accruals 2,819 5,354 1,343

Deferred income 183 183 346

5,464 9,158 4,923

----------------------------- ----------- ------------- -----------

10. Financial Liabilities

Six months Year Six months

ended ended ended

30 Sept 31 Mar 2020 30 Sept

2020 2019

---------------------------- ----------- ------------- -----------

GBP'000 GBP'000 GBP'000

a) Current liabilities

Bank loans 1,302 23,829 4,079

Finance leases 24,501 25,244 2,670

25,803 49,073 6,749

---------------------------- ----------- ------------- -----------

b) Non-current liabilities

---------------------------- ----------- ------------- -----------

Bank loans 15,241 15,461 36,864

Finance leases - - 23,881

---------------------------- ----------- ------------- -----------

15,241 15,461 60,745

---------------------------- ----------- ------------- -----------

c) Total obligations under

financial liabilities

Repayable within one year 25,803 49,073 6,749

Repayable within one and

five years 8,833 8,770 53,247

Repayable after five years 6,408 6,691 7,498

---------------------------- ----------- ------------- -----------

41,044 64,534 67,494

---------------------------- ----------- ------------- -----------

Five bank loans and one finance lease (all denominated in Euros)

totalling GBP41.04 million (31 March 2020: GBP64.53 million which

includes the bank loan relating to CH8 which was not repaid until

April 2020) included within financial liabilities are secured

against investment properties owned by the Group and one property

owned by the Group shown under inventories. These bank loans and

this finance lease are otherwise non-recourse to the Group's

assets.

The interim results are being circulated to all shareholders and

can be downloaded from the company's web site. Further copies can

be obtained from the registered office at 32 St James's Street,

London SW1A 1HD.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BELLLBFLLFBE

(END) Dow Jones Newswires

November 26, 2020 02:00 ET (07:00 GMT)

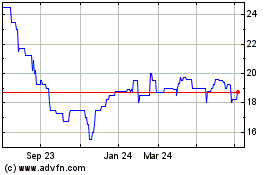

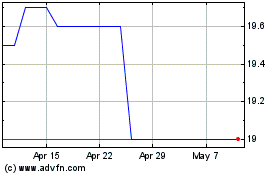

First Property (LSE:FPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

First Property (LSE:FPO)

Historical Stock Chart

From Apr 2023 to Apr 2024