TIDMFSJ

RNS Number : 0872U

Fisher (James) & Sons plc

24 March 2023

This announcement contains inside information

24 March 2023

James Fisher and Sons plc

Corporate, Financing and Trading Update

James Fisher and Sons plc (FSJ.L) ("James Fisher", the "Group"

or the "Company"), the leading provider of marine services is today

providing a corporate, financing and trading update, the highlights

of which are as follows:

-- Publication of FY 2022 financial results to be delayed from 28 March 2023 to 28 April 2023

-- This additional time provides an opportunity for the Group to

complete the previously announced discussions in relation to its

existing debt facilities

-- The Group is also required to resolve certain technical

restrictions, relating to the JFN Disposal, which have been waived

through to 28 April 2023

-- Audit process ongoing for FY 2022 - as a result, u nderlying

operating profit from continuing operations now expected to be

broadly in line with FY 2021

-- Trading in first two months of 2023 was in line with the

Group's expectations and ahead of the same period in the prior

year

Corporate and Financing Update

As previously announced, the Group commenced discussions with

its lending banks earlier this year regarding its existing debt

facilities, which have maturity dates ranging from October 2023 to

September 2024.

On 6 March 2023, the Group announced the sale of James Fisher

Nuclear Holdings Limited ("JFN") and related properties (the "JFN

Disposal"). As per the 6 March 2023 announcement, under the terms

of the JFN Disposal agreement, several legacy parent company

guarantees supporting the obligations of JFN were retained by James

Fisher (the "PCGs"). The retention of the PCGs required consent

under the Group's debt facilities prior to the sale of JFN, which

was not obtained at the time. Following discussions, all lenders

under the debt facilities have agreed waivers in respect of the

PCGs until 28 April 2023.

The Group is grateful for the lenders' constructive approach and

has accelerated engagement with them to seek a permanent solution

in relation to the PCGs and to address its debt facilities by end

of April 2023.

The Group intends to publish its financial results for FY 2022

on 28 April 2023.

FY 2022 results

The audit process for FY 2022 is well-advanced, but ongoing, and

remains subject to finalisation. At this stage, for the year ended

31 December 2022, the Group is expecting to report revenue from

continuing operations of c.GBP475m (2021: GBP442.4m). Underlying

operating profit from continuing operations is expected to be

broadly in line with FY 2021.

James Fisher made good strategic progress over the second half

of 2022 and in early 2023, divesting non-core businesses, as well

as selling a significant fixed asset. The three business sales

completed in December 2022 generated gross proceeds of c.GBP18.4m

and net bank borrowings at 31 December 2022 were c.GBP135m. The

sale of the Swordfish Dive Support Vessel, which was announced in

December 2022, completed in January 2023, with cash proceeds of

c.GBP20m now received.

Important changes have been made at the senior management level

across several of our businesses. This will improve financial and

performance accountability, as well as promote energetic and

disciplined leaders from inside the organisation who have a

demonstrable track record in achieving operational targets.

Additionally, in order to simplify the Group further, from 1

January 2023 the Company has been reorganised into three new

divisions which reflect our customer verticals, namely Energy,

Defence and Maritime Transport .

Current trading update

The Group has made an encouraging start to 2023, with

performance across January and February (the "Period")

demonstrating continued progress, in line with the Board's

expectations.

Group revenue in the Period saw strong year-on-year growth, with

divisional trends similar to those seen towards the end of 2022. On

both a continuing operations and total Group basis (including

discontinued operations), James Fisher generated a small underlying

operating profit in the Period, compared with a loss in the prior

year.

The Group's net debt position is in line with management's

expectations, benefiting from the receipt of Swordfish proceeds,

and the Board expects the Group to continue to de-lever.

Whilst the economic climate more generally remains challenging,

the Group has made clear strategic and financial progress over the

last few months. With the benefit of a more focused portfolio and

reinvigorated strategy, the Board is confident that the Group can

carry forward this momentum through 2023, driving further financial

and operational improvement.

For further information:

Chief Executive

Officer

James Fisher and Jean Vernet Chief Financial

Sons plc Duncan Kennedy Officer 01229 615400

Richard Mountain 0203 727

FTI Consulting Susanne Yule 1340

-------------------------------------- -------------

The person responsible for making this announcement on behalf of

the Company is Jean-François Bauer, Group General Counsel

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSELEDDEDSEFD

(END) Dow Jones Newswires

March 24, 2023 03:00 ET (07:00 GMT)

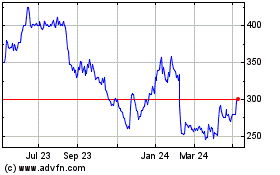

Fisher (james) & Sons (LSE:FSJ)

Historical Stock Chart

From Jan 2025 to Feb 2025

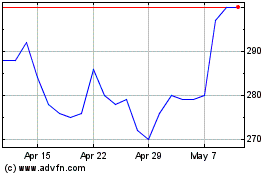

Fisher (james) & Sons (LSE:FSJ)

Historical Stock Chart

From Feb 2024 to Feb 2025