TIDMGBP

RNS Number : 3733I

Global Petroleum Ltd

12 August 2021

12 August 2021

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR'). Upon the

publication of this announcement via a Regulatory Information

Service ('RIS'), this inside information is now considered to be in

the public domain.

Global Petroleum Limited

("Global" or "the Company")

Placing to raise GBP1 million

Global Petroleum Limited (AIM: GBP) is pleased to announce that

it has successfully raised GBP1,000,000 in aggregate before costs

(the "Placing"), through the Placing of 200,000,000 Ordinary Shares

(the "Placing Shares") at a Placing Price of 0.5 pence per

share.

As a further component of the Placing, 100,000,000 Warrants are

also being issued at an exercise price of 1 pence per share for a

period of 2 years (one Warrant for every two new Ordinary Shares).

In the event the Warrants are exercised in due course in full,

associated proceeds will be GBP1,000,000 with the result that the

Company will have raised gross proceeds of GBP2,000,000 at a

weighted average price of 0.67 pence per share.

Monecor (London) Ltd, trading as ETX Capital ("ETX Capital"),

the Company's Joint Broker, acted as sole broker in respect of the

Placing.

Rationale for the Placing

In January 2021 the Company announced its updated Prospective

Resources on its Namibian licence PEL0094. The inclusion of seven

new leads, in addition to the Marula and Welwitschia Deep

prospects, resulted in a threefold increase to 2,284 million

barrels of Best Estimate (P50) Prospective Resources of oil net to

Global, confirming the Company's view that the acreage is highly

prospective.

The Company completed some time ago its work commitments under

the current licence sub-period, which expires in September 2021.

Having done so, the Company announced on 10 August 2021 that the

Ministry of Mines and Energy ("Ministry") had agreed to Global's

proposal to enter into the next licence sub-period, from September

2021 to September 2022. The work commitment for the next sub-period

is to acquire and process 2,000 square kilometres of 3D seismic

data, a commitment which Global expects to fulfil via a

farmout.

The farmout process is currently underway. The wider context in

offshore Namibia exploration is the drilling programme in Namibia's

Orange Basin to be undertaken by the oil majors, Total (Venus-1 )

and Shell (PEL0039). Both wells are expected to spud in Q4

2021.

The Placing will position the Company to part-fund the new

licence commitments, as well as provide general working capital,

including the possible pursuit of other strategic options, as

previously communicated.

Admission of and Dealings in the Placing and Subscription

Shares

Application has been made to AIM for the Placing Shares, which

will rank pari passu with existing Ordinary Shares, to be admitted

to trading on AIM ("Admission"). Dealings are expected to commence

on or around 18 August 2021 at 8.00 a.m.

Following Admission, the total issued share capital of the

Company will be 811,541,816 Ordinary Shares. Accordingly, the

figure of 811,541,816 may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to,

their interest in the Company under the FCA's Disclosure Guidance

and Transparency Rules.

Peter Hill, Global Petroleum's CEO, commented:

"We are very pleased to have raised further capital, enabling us

to continue progress with our exploration activities on PEL0094,

and also providing the Company with optionality through this

exciting period for Namibian offshore exploration. We are also very

happy to welcome new shareholders to the Company. We look forward

to providing further updates in due course."

For further information please visit: www.globalpetroleum.com.au

or contact:

+44 (0) 20 3875

Global Petroleum Limited 9255

Peter Hill, Managing Director & CEO

Andrew Draffin, Company Secretary

Panmure Gordon (UK) Limited (Nominated Adviser +44 (0) 20 7886

& Joint Broker) 2500

Hugh Rich / Nick Lovering / Ailsa MacMaster

Nominated Adviser: Nicholas Harland

ETX Capital (Joint Broker) +44 (0) 20 7392

Thomas Smith 1568

Tavistock (Financial PR & IR) +44 (0) 20 7920

Simon Hudson / Nick Elwes 3150

The Placing does not constitute a public offer of securities in

accordance with the provisions of Section 85 of the Financial

Services and Markets Act 2000 and accordingly a prospectus will not

be issued in the United Kingdom.

This announcement does not constitute an offer of securities in

the United Kingdom or in any other jurisdiction, including the

United States of America.

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEPBMMTMTIBTPB

(END) Dow Jones Newswires

August 12, 2021 02:00 ET (06:00 GMT)

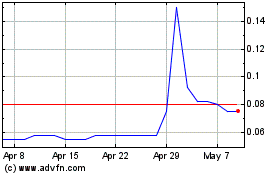

Global Petroleum (LSE:GBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Global Petroleum (LSE:GBP)

Historical Stock Chart

From Apr 2023 to Apr 2024