TIDMGDWN

RNS Number : 9852V

Goodwin PLC

13 August 2020

PRELIMINARY ANNOUNCEMENT

Goodwin PLC today announces its preliminary results for the year

ended 30th April 2020.

CHAIRMAN'S STATEMENT

The pre-tax profit for the Group for the twelve month period

ending 30th April 2020, was GBP12.1 million (2019: GBP16.4

million), a decrease of 26% on a revenue of GBP145 million (2019:

GBP127 million) which is 14% up on the figures reported for the

same period last financial year. The Directors propose a reduced

dividend of 81.71p (2019: 96.21p). As with the majority of

companies around the world, Covid-19 has stalled our progress in

the last quarter of the financial year, and we have seen a slower

start to the new financial year than we would have expected without

the pandemic. Despite this and the disruption due to trade

frictions between the USA and China, the underlying progression of

the business remains robust and resilient.

At the time of writing, the Group's current workload stands at

GBP183 million which is 11% ahead of last year's Group record

figure of GBP165 million (2019: GBP165 million, 2018: GBP82

million, 2017: GBP76 million). Whilst the current workload figure

contains the first element of the supply agreement announced to the

Stock Exchange on 22nd June 2020, this supply agreement for the

manufacture and machining of storage boxes to assist with nuclear

waste clean-up accounts for less than 2% of the GBP183 million and

excludes the amount of orders that are expected to be placed in the

future once the mobilisation phase is complete. Armed with this

workload, the Group retains a high degree of confidence in the

future versus the looming uncertainty for many businesses this

coming year.

Within the Mechanical Engineering Division, margins continue to

be squeezed on our petrochemical work and this is likely to persist

during the current financial year given the low oil price. In order

to counteract this I am able to give the assurance that our

diligently fostered and growing workload contains substantial

amounts of non-petrochemical work commanding respectable margins in

areas such as national defence capability and projects of national

importance. The critical nature of this ongoing work was

highlighted by 'key worker' notices being issued to certain of the

Group's operations immediately upon the onset of the pandemic.

Whilst these projects are in their infancy, they will start to ramp

up over the next 6 to 12 months.

Goodwin Steel Castings has had another difficult year. This is

largely attributable to the performance of two contracts where we

are currently in dispute with our customers. Any favourable

resolution will be booked in the current financial year once

resolved. Going forward the casting of nuclear waste containment

boxes in relation to Goodwin International's supply agreement will

provide a significant base load for our foundry. However, with

projects of this nature they take time to get mobilised, so in this

current financial year it is unlikely this contract alone will be

transformational, but it will be beneficial in future years. This

with their other work for shipbuilding components in specialist

alloys for the USA, that only a few alloy steel foundries in the

world are qualified to produce, along with specialist nuclear power

generation application castings means that our foundry has

transitioned away from what used to be business reliant on the

petrochemical industries. The business key market re-alignment is

still transitional, but the Directors can see that with the markets

it is addressing and the projects it is working on that there is a

long term, bright and profitable future for Goodwin Steel

Castings.

Similarly Easat Radar Systems is now focusing on complete radar

system supply contracts, with a product suite and offering that is

competitive internationally. Two complete systems will be sent to

Thailand during this year, and there is a requirement for

significant airport infrastructure in developing countries over the

coming years, which our competitive product offering is tailored to

meet. Over the past twelve months, Easat completed a substantial

amount of business, such that it reduced its unacceptable working

capital investment by some GBP4 million which has helped with the

Group cash flow.

The Refractory Engineering Division achieved operating profits

of GBP7 million in the year, (2019: GBP8 million), representing 47%

of the Group's operating profit despite its customers' consumer

products being affected most by Covid-19 in the last quarter.

Moving forward, although the construction and industrial customers'

activity is returning, uncertainty remains with regard to the

medium term outlook especially for our customers' luxury products,

for which they use our investment powders, waxes and silicone

rubbers.

During the financial year, the Group successfully acquired the

globally recognised Castaldo silicone rubber and wax division,

including the trade name and associated trademarks. For the past 75

years Castaldo has been at the centre of the worldwide jewellery

casting industry and this acquisition will further increase the

Group's global market share within the moulding rubber and

injection wax business by aligning higher value complementary sales

activities with the existing business activities. By utilising the

distribution network and global presence within our Refractory

Engineering Division it is forecast that significant revenue growth

can be achieved over and above the Castaldo division sales levels

seen pre-acquisition. The manufacturing of the product lines is

being relocated to Thailand which will also increase the gross

margin of the acquired product lines.

Post year end the Group has also seized the opportunity to

purchase a 2.5 acre manufacturing site and mineral processing

assets for GBP770,000 that is complementary to our existing

minerals processing business that is running at near full capacity.

The purchase was concluded within seven days, and the Directors

believe that the site was acquired at substantially less than its

true market value. In addition, we believe that within a few months

we will be able to start to generate profits by utilising the

assets acquired.

Across both Divisions, our intangibles have grown in recent

years due to multiple product development activities and

acquisitions. A number of these major activities will be completed

and taken to market within the current financial year leaving us

with products that can be sold for many years to come; many of

these new products are covered by international patent protection.

This is not to say that there will be no new product development

programmes as activities here have just been scaled back, focusing

as always on areas that we anticipate may yield good future

prospects.

In line with the Group's strategy the Board has worked hard to

control its working capital and ensure a safe level of gearing.

This is transparently seen at an operational level delivering

strong cash generation in the year of GBP22.5 million, up GBP7.6

million from the previous year. As a result of a reduced level of

investment in the year, I am pleased to report the Group's net debt

stands at a modest GBP19 million, equating to a gearing percentage

of 18% versus 20% last year.

Following a productive ten year relationship with Lloyds Bank

PLC, and with our five year facility set to mature in December

2020, we put the facilities out for competitive tender. On a

like-for-like basis in terms of available facility and once all

costs in relation to the facility had been evaluated Lloyds were no

longer as competitive in relation to other offers we received. I

can confirm that the Board has now signed a new facility agreement

with Santander UK plc for the same quantum but on improved terms,

including a higher proportion that will be committed for a five

year period. In addition, a GBP10 million revolving credit facility

(RCF) set to expire in October 2020 is also in the final stages of

being renegotiated ultimately providing the Group with long term

facilities totalling over GBP50 million, in addition to the GBP30

million secured as an additional committed credit line through the

Bank of England Covid Corporate Financing Facility (CCFF), which

was taken out as an insurance policy should any possible extreme

Covid-19 event occur and is repayable in April 2021.

Auditor rotation is now mandated by regulation meaning that the

year ended 30th April, 2020 will be KPMG's last year performing the

Group audit having worked with us for the prior 56 years (Peat,

Marwick, Mitchell & Co. in the earlier years). The Board would

like to express its gratitude for the work performed over this

period. Following a competitive tender process, the Audit Committee

and the Board propose that RSM UK Group LLP be appointed as the new

Group auditor, commencing responsibility for auditing the Group for

the financial year beginning 1st May 2020.

Despite my optimism, at the time of writing, it is necessary

that we remain acutely aware of the external environment with

Covid-19, as until an effective vaccination programme is rolled

out, the likelihood of more flare-ups and lockdowns across the

globe seems inevitable. However, with the Group's underpinnings, in

terms of its order book, its cash flow and excellent workforce,

from a business point of view Covid-19 will likely be nothing more

than a bump in the road of the Group's progression when we look

back at it in a few years' time.

Since the start of the pandemic our workforce has been

outstanding. The Group immediately set out a policy to protect its

employees, and they in turn have responded and looked after the

Group's interests. This has involved working in many cases even

harder in order to achieve the same outcomes due to the restrictive

and new working practices that were necessarily imposed for

everyone's wellbeing.

The Board is once again indebted to our Directors, managers and

employees around the world for their efforts in keeping the Group

operational during this difficult Covid-19 period and for their

devotion to the Group's long-term performance. Had the Group not

kept on manufacturing over the four month period between March and

the end of June, the Group's profitability and cash flow would have

deteriorated substantially. We have all been working in uncharted

territory because of this, and I am immensely proud of how every

single employee within the Group has adapted and worked within this

challenging new environment.

13th August, 2020 T.J.W. Goodwin

Chairman

Alternative performance measures mentioned above are defined in

Note 7.

OBJECTIVES, STRATEGY AND BUSINESS MODEL

The Group's main OBJECTIVE is to have a sustainable long-term

engineering based business with good potential for profitable

growth while providing a fair return to our shareholders.

The Board's STRATEGY to achieve this is:

-- to supply a range of technically advanced products to growth

markets in the mechanical engineering and refractory engineering

segments in which we have built up a global reputation for

engineering excellence, quality, efficiency, reliability, price and

delivery;

-- to manufacture advanced technical products profitably, efficiently and economically;

-- to maintain an ongoing programme of investment in plant,

facilities, sales and marketing, research and development with a

view to increasing efficiency, reducing costs, increasing

performance, delivering better products for our customers,

expanding our global customer base and keeping us at the forefront

of technology within our markets, whilst at all times taking

appropriate steps to ensure the health and safety of our employees

and customers;

-- to control our working capital and investment programme to ensure a safe level of gearing;

-- to maintain a strong capital base to retain investor,

customer, creditor and market confidence and so help sustain future

development of the business;

-- to support a local presence and a local workforce in order to stay close to our customers;

-- to invest in training and development of skills for the Group's future.

-- to manage the environmental and social impacts of our

business to support its long-term sustainability.

BUSINESS MODEL

The Group's focus is on manufacturing within two sectors,

mechanical engineering and refractory engineering, and through this

division of our manufacturing activities, our overseas business

facilities and our global sales and marketing activities, the Group

benefits from market diversity. Further details of our business and

products are shown on our website www.goodwin.co.uk

Mechanical Engineering

The Group specialises in supplying industrial goods, generally

on a project basis, more often than not involving the complementary

skillset of other group companies to deliver the requirement. The

projects normally involve international procurement, high integrity

castings, forgings or wrought high alloy steels, precision CNC

machining, complex welding and fabrication, and other operations as

are required. In addition to specialist projects the group,

manufactures and sells a wide range of dual plate check valves,

axial nozzle check valves and axial piston control and isolation

valves to serve the oil, petrochemical, gas, liquefied natural gas

(LNG), mining, nuclear power generation, nuclear waste treatment

and water markets.

We generate value by creating leading edge technology designs,

globally sourcing the best quality raw material at good prices,

manufacturing in highly efficient facilities using up to date

technology to provide very reliable products to the required

specification, at competitive prices and with timely

deliveries.

Our mechanical engineering markets also include high alloy

castings, machining and general engineering products which

typically form part of large construction projects such as power

generation plants, oil refineries, chemical plants, nuclear waste

treatment plants, high integrity offshore structural components and

bridges. The Group through its foundry, Goodwin Steel Castings, has

the capability to pour high performance alloy castings up to 35

tonnes, radiograph and also finish CNC machine and fabricate them

at the foundry's sister company, Goodwin International. This

capability is targeting the defence industry and nuclear

decommissioning, the oil and gas industry, as well as large, global

projects requiring high integrity machined castings.

Goodwin International, the largest company in the mechanical

engineering division, not only designs and manufactures dual plate

check valves, axial nozzle check valves and axial piston control

and isolation valves but also undertakes specialised CNC machining

and fabrication work for nuclear decommissioning projects. Goodwin

International also has a division that is focussed on manufacturing

/ machining high precision, high integrity components for naval

marine vessels. Noreva GmbH also designs, manufactures and sells

axial nozzle check valves. Both Goodwin International and Noreva

purchase the majority of the value of their sand mould castings

from Goodwin Steel Castings for their ranges of check valves and

this vertical integration gives rise to competitive benefits,

increased efficiencies and timely deliveries.

At Goodwin Pumps India we manufacture a superior range of

submersible slurry pumps for end users in India, Brazil, Australia

and Africa. Easat Radar Systems (Easat) and its subsidiary, NRPL,

design and build bespoke high-performance radar antenna systems for

the global market of major defence contractors, civil aviation

authorities and border security agencies. Easat has a sister

company, Easat Radar Systems India, that also manufactures, sells

and maintains radar systems for air traffic control. We create

value on these by innovative design, assembly and testing in our

own facilities using bought in or engineered in-house

components.

Refractory Engineering

Within the Refractory Engineering Division, Goodwin Refractory

Services (GRS) primarily generates value from designing,

manufacturing and selling investment casting powders and waxes to

the jewellery casting industry. GRS also manufactures and sells

investment casting powders to the tyre mould and aerospace

industries. The Refractory Engineering Division has five other

investment powder manufacturing companies located in China, India

and Thailand which sell the casting powders directly and through

distributors to the jewellery casting industry and also directly to

tyre mould and aerospace industries.

These companies are vertically integrated with another of our UK

companies, Hoben International, which manufactures cristobalite,

which it sells to the six casting powder manufacturing companies as

well as producing ground silica that also goes into casting powders

and other UK uses of silica such as wind turbine blade manufacture.

Hoben International now also manufactures different grades of

perlite.

The other UK refractory company is Dupré Minerals which focuses

on producing exfoliated vermiculite that is used in insulation,

brake linings and fire protection products, including technical

textiles that can withstand exposure to high temperatures and for

lithium battery fire extinguishers. Dupré also sells consumable

refractories to the shell moulding precision casting industry.

Dupre has designed, patented and is now selling a range of fire

extinguishers and an extinguishing agent for lithium battery fires

that utilises a vermiculite dispersion as the fire extinguishing

agent.

GOODWIN PLC

CONSOLIDATED STATEMENT OF PROFIT OR LOSS

for the year ended 30th April, 2020

2020 2019

GBP'000 GBP'000

CONTINUING OPERATIONS

Revenue 144,512 127,046

Cost of sales (109,743) (86,414)

GROSS PROFIT 34,769 40,632

Other income 690 -

Distribution expenses (2,792) (3,016)

Administrative expenses (19,809) (21,205)

OPERATING PROFIT 12,858 16,411

Financial expenses (809) (234)

Share of profit of associate companies 66 233

PROFIT BEFORE TAXATION 12,115 16,410

Tax on profit (3,775) (3,963)

PROFIT AFTER TAXATION 8,340 12,447

ATTRIBUTABLE TO:

Equity holders of the parent 7,866 11,505

Non-controlling interests 474 942

PROFIT FOR THE YEAR 8,340 12,447

BASIC EARNINGS PER ORDINARY SHARE 107.93p 159.79p

DILUTED EARNINGS PER ORDINARY SHARE 103.31p 149.65p

GOODWIN PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 30th April, 2020

2020 2019

GBP'000 GBP'000

PROFIT FOR THE YEAR 8,340 12,447

OTHER COMPREHENSIVE EXPENSE

ITEMS THAT MAY BE RECLASSIFIED SUBSEQUENTLY TO

PROFIT OR LOSS:

Foreign exchange translation differences (1,007) (383)

Goodwill arising from purchase of non-controlling

interest in subsidiaries (72) (772)

Effective portion of changes in fair value of

cash flow hedges (355) (644)

Change in fair value of cash flow hedges transferred

to profit or loss 522 180

Effective portion of changes in fair value of

cost of hedging (843) (489)

Change in fair value of cost of hedging transferred

to profit or loss 395 49

Tax credit on items that may be reclassified subsequently

to profit or loss 77 154

OTHER COMPREHENSIVE EXPENSE FOR THE YEAR, NET

OF INCOME TAX (1,283) (1,905)

TOTAL COMPREHENSIVE INCOME FOR THE YEAR 7,057 10,542

ATTRIBUTABLE TO:

Equity holders of the parent 6,587 9,528

Non-controlling interests 470 1,014

7,057 10,542

GOODWIN PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 30th April, 2020

Total

attributable

Cash to equity

Share-based flow Cost holders

Share Translation payments hedge of hedging Retained of the Non-controlling Total

capital reserve reserve reserve reserve earnings parent interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

YEARED

30TH APRIL,

2020

Balance at

1st May, 2019 720 1,044 4,991 (573) (426) 99,409 105,165 4,126 109,291

Total

comprehensive

income:

Profit - - - - - 7,866 7,866 474 8,340

Other

comprehensive

income:

Foreign exchange

translation

differences - (964) - - - - (964) (43) (1,007)

Goodwill arising

from purchase

of NCI interest

in subsidiaries - - - - - (72) (72) - (72)

Net movements

on cash flow

hedges - - - 74 (317) - (243) 39 (204)

TOTAL

COMPREHENSIVE

INCOME FOR

THE YEAR - (964) - 74 (317) 7,794 6,587 470 7,057

Issue of shares 16 - - - - - 16 - 16

Tax on

equity-settled

share-based

payment

transactions - - 253 - - - 253 - 253

Dividends paid - - - - - (6,927) (6,927) - (6,927)

Acquisition

of NCI without

a change in

control - - - - - - - (11) (11)

Disposal of

subsidiary - (77) - - - - (77) - (77)

Reclassification 358 - - - (358) - - -

BALANCE AT

30TH APRIL,

2020 736 361 5,244 (499) (743) 99,918 105,017 4,585 109,602

GOODWIN PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (continued)

for the year ended 30th April, 2020

Total

attributable

Cash to equity

Share-based flow Cost holders

Share Translation payments hedge of hedging Retained of the Non-controlling Total

capital reserve reserve reserve reserve earnings parent interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

YEARED

30TH APRIL,

2019

Balance at

1st May, 2018 720 1,879 1,625 (224) - 95,568 99,568 5,259 104,827

Adjustment

on initial

application

of IFRS 9 (net

of tax) - - - 52 (52) - - - -

Adjustment

on initial

application

of IFRS 15

(net of tax) (684) (684) (350) (1,034)

ADJUSTED

BALANCE

AT 1ST MAY,

2018 720 1,879 1,625 (172) (52) 94,884 98,884 4,909 103,793

Total

comprehensive

income:

Profit - - - - - 11,505 11,505 942 12,447

Other

comprehensive

income:

Foreign

exchange

translation

differences - (430) - - - - (430) 47 (383)

Goodwill

arising

from purchase

of NCI

interest

in

subsidiaries - (180) - - - (592) (772) - (772)

Net movements

on cash flow

hedges - - - (401) (374) - (775) 25 (750)

TOTAL

COMPREHENSIVE

INCOME FOR

THE YEAR - (610) - (401) (374) 10,913 9,528 1,014 10,542

Equity-settled

share-based

payment

transactions - - 1,220 - - - 1,220 - 1,220

Tax on

equity-settled

share-based

payment

transactions - - 2,146 - - - 2,146 - 2,146

Dividends paid - - - - - (6,126) (6,126) (451) (6,577)

Acquisition

of NCI without

a change in

control - - - - - - - (1,750) (1,750)

Disposal of

equity

investments - (225) - - - - (225) - (225)

Acquisition

of subsidiary

with NCI - - - - - - 142 142

Capital

contribution - - - - - (262) (262) 262 -

BALANCE AT

30TH APRIL,

2019 720 1,044 4,991 (573) (426) 99,409 105,165 4,126 109,291

GOODWIN PLC

CONSOLIDATED BALANCE SHEET

at 30th April, 2020

2020 2019

GBP'000 GBP'000

NON-CURRENT ASSETS

Property, plant and equipment 69,626 74,106

Right-of-use assets 5,343 -

Investment in associates 816 739

Intangible assets 24,695 22,354

Derivative financial assets 749 -

Other financial assets at amortised cost 252 505

101,481 97,704

CURRENT ASSETS

Inventories 44,887 50,524

Contract assets 6,558 3,698

Trade receivables and other financial assets 24,486 24,964

Other receivables 4,566 2,715

Derivative financial assets 456 195

Cash and cash equivalents 9,840 9,640

90,793 91,736

TOTAL ASSETS 192,274 189,440

CURRENT LIABILITIES

Bank overdrafts and interest-bearing loans 13,141 9,259

Lease liabilities 1,483 939

Contract liabilities 18,965 18,002

Trade payables and other financial liabilities 23,485 20,570

Other payables 3,298 4,771

Deferred consideration - 204

Derivative financial liabilities 1,071 1,693

Liabilities for current tax 1,873 2,356

Warranty provision 160 261

63,476 58,055

NON-CURRENT LIABILITIES

Interest-bearing loans 14,260 19,322

Lease liabilities 1,339 1,164

Derivative financial liabilities 202 -

Warranty provision 324 232

Deferred tax liabilities 3,071 1,376

19,196 22,094

TOTAL LIABILITIES 82,672 80,149

NET ASSETS 109,602 109,291

EQUITY ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT

Share capital 736 720

Translation reserve 361 1,044

Share-based payments reserve 5,244 4,991

Cash flow hedge reserve (499) (573)

Cost of hedging reserve (743) (426)

Retained earnings 99,918 99,409

TOTAL EQUITY ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT 105,017 105,165

NON-CONTROLLING INTERESTS 4,585 4,126

TOTAL EQUITY 109,602 109,291

GOODWIN PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 30th April, 2020

2020 2020 2019 2019

GBP'000 GBP'000 GBP'000 GBP'000

CASH FLOW FROM OPERATING ACTIVTIES

Profit from continuing operations

after tax 8,340 12,447

Adjustments for:

Depreciation of property, plant

and equipment 5,874 5,571

Depreciation of right of use assets 827 248

Amortisation and impairment of intangible

assets 1,328 1,312

Financial expenses 809 234

Foreign exchange losses 203 66

Loss on sale of property, plant

and equipment 52 13

Profit on disposal of subsidiary (172) -

Share of profit of associate companies (66) (233)

Equity-settled share-based provision - 1,220

Tax expense 3,775 3,963

OPERATING PROFIT BEFORE CHANGES

IN WORKING CAPITAL AND PROVISIONS 20,970 24,841

Decrease / (increase) in inventories 4,748 (11,816)

(Increase) / decrease in contract

assets (2,863) 1,361

Decrease / (increase) in trade and

other receivables (2,549) (4,288)

Increase in contract liabilities 874 3,401

Increase in trade and other payables 2,310 1,965

Increase in unhedged derivative

balances (980) (579)

CASH GENERATED FROM OPERATIONS 22,510 14,885

Interest paid (747) (524)

Interest element of finance lease

obligations (41) (64)

Interest element of operating lease

obligations (56) -

Corporation tax paid (2,493) (3,093)

NET CASH FROM OPERATING ACTIVITIES 19,173 11,204

CASH FLOW FROM INVESTING ACTIVITIES

Proceeds from sale of property,

plant and equipment 139 142

Acquisition of property, plant and

equipment (6,062) (11,451)

Additional investment in existing

subsidiaries (83) (2,668)

Acquisition of controlling interest

in associates net of cash acquired - (425)

Acquisition of intangible assets (1,855) (315)

Development expenditure capitalised (1,105) (1,500)

Dividends received from associate

companies - 1,254

NET CASH OUTFLOW FROM INVESTING

ACTIVITIES (8,966) (14,963)

CASH FLOWS FROM FINANCING ACTIVITIES

Payment of capital element of finance

lease liabilities (954) (911)

Payment of capital element of operating

lease liabilities (509) -

Issue of shares 16 -

Proceeds from new finance leases 102 424

Dividends paid (6,927) (6,126)

Dividends paid to non-controlling

interests - (451)

Net proceeds from loans and committed

facilities 7,556 8,337

NET CASH (OUTFLOW) / INFLOW FROM

FINANCING ACTIVITIES (716) 1,273

NET INCREASE / (DECREASE) IN CASH

AND CASH EQUIVALENTS 9,491 (2,486)

Cash and cash equivalents at beginning

of year 493 2,900

Effect of exchange rate fluctuations

on cash held (535) 79

CASH AND CASH EQUIVALENTS AT OF YEAR 9,449 493

PRINCIPAL RISKS AND UNCERTAINTIES

The Group's operations expose it to a variety of risks and

uncertainties. The Directors confirm that they have carried out a

robust assessment of the principal risks facing the Company,

including those that would threaten its business model, future

performance, solvency or liquidity. And whilst the risk of a health

crisis and black swan events are not new risks, Covid-19 has been

identified as a new principal risk to the Group, as discussed

below.

Covid-19 risk: The Covid-19 pandemic has already had an

unprecedented bearing on businesses and economic activity across

the world. The Group very early on (1st March, 2020), in advance of

any UK government guidelines coming out, developed a policy of

paying any employee or one whose household member exhibiting

Covid-19 symptoms to isolate at home for 14 days and at the same

time set up all manufacturing and office working activities such

that 2 metre social distancing was maintained. Hand sanitisers and

warning labels were positioned by all opening doors and many had,

where possible, self-disinfecting handles fitted. Daily reporting

by location was introduced with any persons, who came into contact

with a symptomatic person, being mandated to take two weeks paid

isolation. Amongst our UK work force of 775 people we had 7

confirmed cases of Covid-19 two of whom were hospitalised but both

have recovered and are now back at work.

In the UK all factories have continuously run since the 6th

January, 2020 and, as has been seen, dispatch and revenue levels

increased for the year ending 30th April, 2020. Three overseas

factories in China and India were subject to mandatory lockdown for

6 to 8 weeks, but these factories are all now back up and

running.

The enduring principal risk of Covid-19 is that consumption of

jewellery in the retail shops has been very much affected world-

wide with our sales volumes of our investment jewellery casting

powders being down in all parts of the world. With retail shops and

airports now starting to reopen there is evidence that the drop in

luxury goods being purchased from our customers is starting to

recover, but it is difficult to predict the 12 month effect to 30th

April, 2021.

The workload in our Mechanical Engineering companies is good and

we expect them to remain busy through to the end of April 2021, as

mentioned in the Chairman's Statement, much of this work is for

naval vessels, and for nuclear waste reprocessing along with

delivering four radar systems and large valves for the potable

water industry.

Market risk: The Group provides a range of products and

services, and there is a risk that the demand for these products

and services will vary from time to time because of competitor

action or economic cycles or international trade friction or even

wars. As shown in note 1 to the financial statements to be

published shortly, the Group operates across a range of

geographical regions, and its turnover is split across the UK,

Europe, USA, the Pacific Basin and the Rest of the World.

This spread reduces risk in any one territory. Similarly, the

Group operates in both mechanical engineering and refractory

engineering sectors, mitigating the risk of a downturn in any one

product area as was seen over the past three financial years.

The potential risk of the loss of any key customer is limited

as, typically, no single customer accounts for more than 10% of

turnover.

As described in the Business Model, the Group generates

significant sales not only from the worldwide energy markets but

also from naval marine applications, military ship building,

vermiculite and perlite to the insulating and fire prevention

industry and the jewellery consumer market that our investment

casting powder companies indirectly supply through the supply of

investment casting moulding powders, waxes, silicone rubber and air

traffic control systems.

Technical risk: The Group develops and launches new products as

part of its strategy to enhance the long-term value of the Group.

Such development projects carry business risks, including

reputational risk, abortive expenditure and potential customer

claims which may have a material impact on the Group. The potential

risk here is seen as manageable given the Group is developing

products in areas in which it is knowledgeable and new products are

tested prior to their release into the market.

Product failure/Contractual risk: The risks that the Group

supplies products that fail or are not manufactured to

specification are risks that all manufacturing companies are

exposed to but we try to minimise these risks through the use of

highly skilled personnel operating within robust quality control

system environments, using third party accreditations where

appropriate. With regard to the risk of failure in relation to new

products coming on line, the additional risks here are minimised at

the research and development stage, where prototype testing and the

deployment of a robust closed loop product performance quality

control system provides feed back to the design department for the

products we manufacture and sell. The risk of not meeting safety

expectations, or causing significant adverse impacts to customers

or the environment, is countered by the combination of the controls

mentioned within this section and the purchase of product liability

insurance. The risk of product obsolescence is countered by

research and development investment.

Supply chain and equipment risk: Failure of a major supplier or

essential item of equipment presents a constant risk of disruption

to the manufacturing in progress. Where reasonably possible,

management mitigates and controls the risk with the use of dual

sourcing, continual maintenance programmes, and by carrying

adequate levels of stocks and spares to reduce any disruption.

Health and safety: The Group's operations involve the typical

health and safety hazards inherent in manufacturing and business

operations. The Group is subject to numerous laws and regulations

relating to health and safety around the world. Hazards are managed

by carrying out risk assessments and introducing appropriate

controls, as well as attending safety training courses.

Acquisitions: The Group's growth plan over recent years has

included a number of acquisitions. There is the risk that these, or

future acquisitions, fail to provide the planned value. This risk

is mitigated through financial and technical due diligence during

the acquisition process and the Group's inherent knowledge of the

markets they operate in.

Financial risk: The principal financial risks faced by the Group

are changes in market prices (interest rates, foreign exchange

rates and commodity prices). Detailed information on the financial

risk management objectives and policies is set out in note 28 to

the financial statements to be published shortly. The Group has in

place risk management policies that seek to limit the adverse

effects on the financial performance of the Group by using various

instruments and techniques, including credit insurance, stage

payments, forward foreign exchange contracts, secured and unsecured

credit lines.

Regulatory compliance: The Group's operations are subject to a

wide range of laws and regulations. Both within Goodwin PLC and its

subsidiaries, the Directors and Senior Managers within the

companies make best endeavours to ensure we comply with the

relevant laws and regulations.

Assessment of principal risks: Changes and likely impact: As

part of the Board's risk management and control of principal risks,

areas of monitoring and expert advice undertaken are reported upon

by the Audit Committee on pages 25 to 27.

The Board's assessment of the impact of Brexit on the Group

Brexit is not seen as a significant issue to the Group. We

envisage minimal overall effect in the long-term within our trading

companies, as the majority of our trade has little direct

interaction within Europe. A significant proportion of our reported

revenue to Europe, as set out within note 4 to the financial

statements to be published shortly, relates to bespoke capital

contracts that typically are installed into projects not within the

EU, despite the customer being resident in the EU. Our UK imports

are not required on a just in time basis nor are they reliant on EU

suppliers. Raw materials are primarily sourced from vendors outside

of the EU due to cost-effectiveness, with EU suppliers being a dual

source for the supply of critical items.

The Brexit related sensitivity or scenario testing has not

indicated that there are any impairment, viability or going concern

issues.

Furthermore, the Group remains focused on and has a growing

proportion of its workload consisting of the supply of niche

UK-based capabilities into long-term, strategically critical

programmes located in the UK and the US where both countries remain

committed to playing a key role in domestic and global

security.

Nonetheless, the Board continually monitors and assesses the

potential risks of Brexit, by regularly consulting on the matter

with the Group's management, suppliers, customers and reviewing and

considering the diverse opinions, written by many commentators.

FORWARD-LOOKING STATEMENTS

The Group Strategic Report contains forward-looking type

statements and information based on current expectations, and

assumptions and forecasts made by the Group. These expectations and

assumptions are subject to various known and unknown risks,

uncertainties and other factors, which could lead to substantial

differences between the actual future results, financial

performance and the estimates and historical results given in this

report. Many of these factors are outside the Group's control. The

Group accepts no liability to publicly revise or update these

forward-looking statements or adjust them for future events or

developments, whether as a result of new information, future events

or otherwise, except to the extent legally required.

Responsibility statement of the Directors in respect of the

Directors Report and Accounts

We confirm that to the best of our knowledge:

-- the financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

taken as a whole; and

-- the Group Strategic Report includes a fair review of the

development and performance of the business and the position of the

Issuer and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face.

We consider the Directors' Report and Accounts, taken as a

whole, is fair, balanced and understandable and provides the

information necessary for shareholders to assess the Group's

position and performance, business model and strategy.

Board of Directors:

T. J. W. Goodwin, Chairman

M. S. Goodwin, Managing Director, Mechanical Engineering

Division

S. R. Goodwin, Managing Director, Refractory Engineering

Division

J. Connolly, Director

S. C. Birks, Director

B. R. E. Goodwin, Director

J. E. Kelly, Non-Executive Director

Accounting policies

Goodwin PLC (the "Company") is incorporated in England and

Wales.

The Group financial statements consolidate those of the Company

and its subsidiaries (together referred to as the "Group") and

equity account the Group's interest in associates.

The Group's financial statements have been approved by the

Directors and prepared in accordance with International Financial

Reporting Standards as adopted by the European Union (EU).

The Accounting Policies are included in Note 1 of the Accounts

to be published shortly.

New IFRS standards and interpretations adopted during 2020

In 2020 the following amendments had been endorsed by the EU,

became effective and were, therefore, mandated to be adopted by the

Group:

-- IFRS 16 - Leases (effective for annual periods beginning on or after 1st January, 2019)

-- Amendments to IFRS 9 - Prepayment Features with Negative

Compensation (effective for annual periods beginning on or after

1st January, 2019)

-- IFRIC Interpretation 23 - Uncertainty over Income Tax

Treatments (effective for annual periods beginning on or after 1st

January, 2019)

-- Amendments to IAS 28 - Long-term Interests in Associates and

Joint Ventures (effective for annual periods beginning on or after

1st January, 2019)

-- Annual Improvements to IFRSs - 2015-2017 Cycle - minor

amendments to IFRS 3, IFRS 11, IAS 12 and IAS 23 (effective for

annual periods beginning on or after 1st January, 2019)

The adoption of IFRS 16 is discussed in Note 3 of the Accounts

to be published shortly. The implementation of all the other

standards and amendments has not had a material impact on the

Group's financial statements.

The financial information previously set out does not constitute

the Company's statutory accounts for the years ended 30th April,

2012 or 2019 but is derived from those accounts. Statutory accounts

for 2019 have been delivered to the Registrar of Companies, and

those for 2020 will be delivered in due course. The auditors have

reported on those accounts; their report was:

i. unqualified;

ii. did not include references to any matters to which the

auditors drew attention by way of emphasis without qualifying their

report; and

iii. did not contain a statement under Section 498(2) or (3) of the Companies Act 2006.

Copies of the 2020 accounts are expected to be posted to

shareholders within the next 10 days and will also be available on

the Company's website: www.goodwin.co.uk and from the Company's

Registered Office: Ivy House Foundry, Hanley, Stoke-on-Trent ST1

3NR.

Note 1

Segmental Information

Products and services from which reportable segments derive

their revenues

For the purposes of management reporting to the chief operating

decision maker, the Board of Directors, the Group is organised into

two reportable operating divisions: mechanical engineering and

refractory engineering. Segment assets and liabilities include

items directly attributable to segments as well as those that can

be allocated on a reasonable basis. In accordance with the

requirements of IFRS 8 the Group's reportable segments, based on

information reported to the Group's Board of Directors for the

purposes of resource allocation and assessment of segment

performance are as follows:

-- Mechanical Engineering - casting, valve, antenna and pump

manufacture and general engineering

-- Refractory Engineering - powder manufacture and mineral processing

Information regarding the Group's operating segments is reported

below. Associates are included in Refractory Engineering.

Revenue

Mechanical Refractory

Engineering Engineering Sub Total

Year ended 30th April 2020 2019 2020 2019 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External sales 100,078 82,375 44,434 44,671 144,512 127,046

Inter-segment sales 25,821 21,714 8,361 8,726 34,182 30,440

Total revenue 125,899 104,089 52,795 53,397 178,694 157,486

Reconciliation to consolidated

revenue:

Inter-segment sales (34,182) (30,440)

Consolidated revenue

for the year 144,512 127,406

Mechanical Refractory

Engineering Engineering Sub Total

Year ended 30th April 2020 2019 2020 2019 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Profits

Operating profit including

share of associates 8,065 11,932 7,034 8,070 15,099 20,002

% of total operating

profit including share

of associates 53% 60% 47% 40% 100% 100%

Group centre (2,175) (2,138)

LTIP - non cash provision - (1,220)

Group finance expenses (809) (234)

Consolidated profit

before tax for the

year 12,115 16,410

Tax (3,775) (3,963)

Consolidated profit after tax for the

year 8,340 12,447

Segmental total Segmental total Segmental net

assets liabilities assets

Year ended 30th April 2020 2019 2020 2019 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segmental net assets

Mechanical Engineering 95,193 97,862 72,207 72,520 22,986 25,342

Refractory Engineering 41,962 43,950 22,850 25,541 19,112 18,409

Sub total reportable

segment 137,155 141,812 95,057 98,061 42,098 43,751

Goodwin PLC net assets 83,415 81,249

Elimination of Goodwin PLC

investments (25,801) (25,374)

Goodwill 9,890 9,665

Consolidated total net assets 109,602 109,291

Segmental property, plant and equipment (PPE) capital

expenditure

2020 2019

GBP'000 GBP'000

Goodwin PLC 2,824 3,602

Mechanical Engineering 2,511 6,461

Refractory Engineering 633 616

5,968 10,679

Segmental depreciation, amortisation and impairment

2020 2019

GBP'000 GBP'000

Goodwin PLC 3,642 2,367

Mechanical Engineering 2,466 3,175

Refractory Engineering 1,921 1,589

8,029 7,131

For the purposes of monitoring segment performance and

allocating resources between segments, the Group's Board of

Directors monitors the tangible and financial assets attributable

to each segment. All assets and liabilities are allocated to

reportable segments with the exception of those held by the parent

Company, Goodwin PLC, and those held as consolidation

adjustments.

Geographical segments

The Group operates in the following principal locations.

In presenting the information on geographical segments, revenue

is based on the location of its customers and assets on the

location of the assets.

Year ended 30th April, Year ended 30th April, 2019

2020

Operational Non-current PPE Capital Operational Non-current PPE Capital

Revenue net assets assets expenditure Revenue net assets assets expenditure

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

UK 39,609 76,467 84,198 5,148 27,934 74,780 80,300 6,044

Rest of

Europe 20,004 8,346 3,439 173 24,205 7,035 3,605 2,300

USA 12,749 - - - 8,100 - - -

Pacific

Basin 34,844 13,513 7,132 81 28,956 14,779 6,855 84

Rest of

World 37,306 11,276 6,712 566 37,851 12,697 6,944 2,251

Total 144,512 109,602 101,481 5,968 127,046 109,291 97,704 10,679

Of the GBP20,004,000 (April 2019: GBP24,205,000) sales to the

rest of Europe, GBP5,975,000 (April 2019: GBP6,721,000), relate to

the German-domiciled subsidiary, Noreva GmbH.

The following tables provide an analysis of revenue by

geographical market and by product line.

Geographical market

Year ended 30th April, Year ended 30th April, 2019

2020

Mechanical Refractory Mechanical Refractory

Engineering Engineering Total Engineering Engineering Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

UK 29,187 10,422 39,609 16,877 11,057 27,934

Rest of Europe 13,088 6,916 20,004 16,282 7,923 24,205

USA 12,664 85 12,749 8,017 83 8,100

Pacific Basin 16,361 18,483 34,844 12,848 16,108 28,956

Rest of World 28,778 8,528 37,306 28,351 9,500 37,851

Total 100,078 44,434 144,512 82,375 44,671 127,046

Product lines

Year ended 30th April, Year ended 30th April, 2019

2020

Mechanical Refractory Mechanical Refractory

Engineering Engineering Total Engineering Engineering Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Standard products

and consumables 9,545 44,434 53,979 7,785 44,671 52,456

Minimum period

contracts 4,143 - 4,143 4,996 - 4,996

Bespoke products

- over time 60,963 - 60,963 34,538 - 34,538

Bespoke products

- point in time 25,427 - 25,427 35,056 - 35,056

Total 100,078 44,434 144,512 82,375 44,671 127,046

Note 2

Intangible Assets

During the year, the Group added to its portfolio of intangible

assets.

On 23rd December, 2019, Goodwin PLC successfully acquired the

globally recognised Castaldo silicone rubber and wax division,

including the intellectual property, trade name and associated

trademarks. For the past 75 years Castaldo has been at the centre

of the worldwide jewellery casting industry and the recent

acquisition will further increase the Group's global market share

within the moulding rubber and injection wax business.

Note 3

Dividends

The Directors propose the payment of an ordinary dividend of

81.71p per share (2019: ordinary dividend of 96.21p ). If approved

by shareholders, the ordinary dividend will be paid on 9th October,

2020 to shareholders on the register at the close of business on

11th September, 2020.

Note 4

Earnings per share

The calculation of the basic earnings per ordinary share is

based on the number of ordinary shares in issue. For all periods up

to and including 30th April, 2019 this amounted to 7,200,000 shares

and with effect from the 16th October 2019 this has increased to

7,363,200 shares. The weighted average number of ordinary shares in

issue during the year ended 30th April, 2020 was 7,288,289. The

relevant profits attributable to ordinary shareholders were

GBP7,866,000 ( 2019 : GBP11,505,000).

There is a share option scheme in place for the Directors of the

Company under the Company's Equity Long Term Incentive Plan (LTIP),

based on the Company exceeding a target growth in the total

shareholder return of the Company over the period from 1st May,

2016 to 30th April, 2019 . Under the scheme, a maximum of 489,600

share options vested at 1st May, 2019, of which 163,200 were

exercised during the current period. The total number of ordinary

shares used as the denominator for the diluted earnings per share

is 7,613,654 ( 2019 : 7,688,056).

Note 5

Going concern

The Directors, after having reviewed the projections and

possible challenges that may lie ahead, believe that, armed at the

time of writing with GBP74.5 million of committed facility

(including GBP30 million CCFF funds, which are repayable within one

year (see notes 28 and 31 of the financial statements to be

published shortly), there is a reasonable expectation that the

Group has adequate resources to continue in operational existence

for at least twelve months from the date of approval of these

financial statements, and have continued to adopt the going concern

basis in preparing the financial statements.

Furthermore, we are pleased to report that the Group has

recently completed the refinancing of one of its significant

facilities which was due to retire by 31st December, 2020. In terms

of total debt quantum, the refinancing has given the Group the same

funding availability but with proportionally more of the facility

moving to committed five year funding. The Group is also in the

final stages of renegotiating a GBP10 million revolving credit

facility which expires in October 2020. The Directors do not see an

issue in renewing these facilities.

The Directors have, as part of this going concern assessment,

specifically considered the impact of Covid-19 on the Group's

operations and in particular have developed a series of in-depth

financial models covering at least twelve months following the

approval of the financial statements. The models show the base case

(our reasonable expectation in light of Covid-19), with an

alternative scenario that stress tests this base case model for

severe but plausible downside outcomes. Within the base case model,

the Directors have considered the current trading conditions and

assumed similar activity levels within the Mechanical Engineering

Division as a result of its workload and assumed the Refractory

activity levels may be reduced due to it being more exposed to the

global downturn. We forecast that after 30th April 2021 activity

levels will return to those seen prior to Covid-19 and growth will

return.

Within our severe but plausible downside model, it is

demonstrable that the Group has sufficient funds to cover the

Group's and the Company's commitments during the forecast period

and is forecast to be within its financial covenants. The model

also incorporates various assumptions including the assumption of a

series of customer failures and the failure of a major supplier

within the refractory division, the inability to achieve CV-19 cost

reduction targets and the impact of further lockdowns that last

three to six months in Europe, China, India and Brazil. The failure

of a major supplier is modelled to result in three months of

business interruption. These assumptions, whilst plausible, are

considered extreme in the Board's view.

As referred to elsewhere in these financial statements, the

Mechanical Engineering Division currently has a record order book

and whilst we have down rated our expectations within this division

within in our forecasts we would emphasise that our factories

largely remained open during the height of the first phase lockdown

and we are not seeing any issues regarding the suspension of works

on these orders. Whilst the Refractory Engineering Division would

be exposed to events such as a second lockdown, as a

well-diversified Group, our severe but plausible downside model

clearly demonstrates we are well set to absorb the impact of a

protracted Covid-19 resolution.

Consequently, the Directors are confident that the Group and

Company will have sufficient funds to continue to meet their

liabilities as they fall due for at least 12 months from the date

of approval of the financial statements and therefore have prepared

the financial statements on a going concern basis.

Note 6

Annual General Meeting

The Annual General Meeting will be held at 10.30 a.m. on 7th

October, 2020 at Crewe Hall, Weston Road, Crewe, Cheshire CW1

6UZ.

Note 7

Alternative performance measures

Measure 2020 2019

Gross profit (GBP'000) 34,769 40,632

Revenue (GBP'000) 144,512 127,046

Gross profit as percentage

of revenue (%) 24.1 32.0

Operating profit (GBP'000) 12,858 16,411

Capital employed (GBP'000) 123,834 126,413

Return on capital employed

(%) 10.4 13.0

Net debt (GBP'000) 18,817 21,248

Deferred consideration (GBP'000) - 204

Net debt excluding deferred

consideration (GBP'000) 18,817 21,044

Net assets attributable

to equity holders of the

parent(GBP'000) 105,017 105,165

Gearing (%) 17.9 20.0

Net profit attributable

to equity holders of the

parent (GBP'000) 7,866 11,505

Net assets attributable

to equity holders of the

parent(GBP'000) 105,017 105,165

Return on investment (%) 7.5 10.9

Revenue (GBP'000) 144,512 127,046

Average number of employees 1,190 1,082

Sales per employee (GBP'000) 121 117

Annual post tax profit (GBP'000) 8,340 12,447

Depreciation owned assets

(GBP'000) 5,874 5,571

Depreciation finance leased

assets 290 248

Amortisation (GBP'000) 1,328 1,312

Annual post tax profit +

depreciation +

amortisation (GBP'000) 15,832 19,578

Annual pre-tax profit (GBP'000) 12,115 16,410

Impact of IFRS 16 implementation 28 -

Impact of IFRS 15 implementation - (1,682)

Like-for-like annual pre

tax profit (GBP'000) 12,143 14,728

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR FFFIVTSIFLII

(END) Dow Jones Newswires

August 13, 2020 02:00 ET (06:00 GMT)

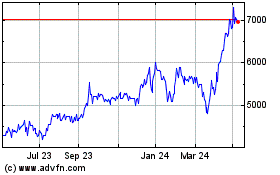

Goodwin (LSE:GDWN)

Historical Stock Chart

From Mar 2024 to Apr 2024

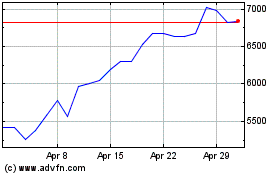

Goodwin (LSE:GDWN)

Historical Stock Chart

From Apr 2023 to Apr 2024