TIDMGDWN

RNS Number : 6925U

Goodwin PLC

03 August 2022

PRELIMINARY ANNOUNCEMENT

Goodwin PLC today announces its preliminary results for the year

ended 30(th) April, 2022.

CHAIRMANS STATEMENT

The "Trading" pre-tax profit for the Group for the twelve month

period ended 30th April, 2022, was GBP17.2 million (2021: GBP16.5

million) an increase of 4% despite the Group having to contend with

GBP3.8 million of additional energy costs versus the prior year.

The revenue was GBP144 million (2021: GBP131 million).

Trading profit for this purpose is defined as the Group pre -

tax reported profit of GBP19.9 million less the impact of our

GBP2.74 million interest rate swap valuation. The GBP2.74 million

relates to the 30th April , 2022 valuation of our GBP30 million

debt interest rate swap derivative that expires in August 2031

whereby we have fixed our interest rate for ten years at less than

1% for the full term. In our view, this derivative is an effective

hedge and should not go through the profit and loss account . The

Board's view was that it was highly probable that we would still

have 25% gearing in ten years' time, having secured the interest

rate swap to fix interest rates at less than 1% on GBP30 million

debt for this period. Our auditor was unconvinced that it could

meet the highly probable criteria and that other requirements under

IFRS9 for hedge accounting were not met. The reason the Board

considers the level of debt to be highly probable is due to the

Board having a responsibility to invest in a responsible manner to

grow the business for all the stakeholders. The Board has, however,

complied with the auditor's view and has shown the GBP2.74 million

unrealised mark to market gain within the profit before taxation

figure. As the GBP2.74 million gain is a non-cash item, it has been

excluded for dividend purposes. The Directors propose an increased

dividend of 10 7.80 p (2021: 102.24p) per share.

Given that we believe turnover and profitability are projected

to rise in future years, the level of dividend payments in line

with the current policy is also set to rise. In view of this,

coupled with the significant capital expenditure needed to fund the

Duvelco activity, the Directors are of the opinion that it will be

of long-term benefit for the Group to ease pressures on the Group

cash flows by paying the current and future dividends bi-annually.

It is proposed that dividend payments will be made in equal

instalments o n 7th October , 2022 and 12th April, 2023 .

Refractory Engineering Division

The increase in Group profits achieved in the year having just

ended can largely be attributed to the growing Refractory

Engineering Division activity, whose year-on-year operating profits

have grown a further 37 % following the 40% growth that was

achieved in the prior year. The D ivision has continued to maximise

its position with sales of jewellery casting consumable products

(investment casting powder, waxes, natural and silicone rubbers)

and to construction markets that have seen a surge in activity

globally.

The Division has also benefited from strong demand for its newer

products, AVD being Dupré Minerals' vermiculite-based solution for

lithium-ion battery fires that is still in its product life cycle

infancy, and has delivered in excess of 100% year-on-year growth,

along with Castaldo rubber, which has achieved 45% year - on - year

growth.

The challenges faced by companies from the ongoing global supply

chain and energy market disruption have been well reported in the

news over the past year and the Refractory Division has acted

dynamically to ensure cost increases are passed on to our customers

to ensure the impact to our margin is minimised . Whilst the

success of the Division has been seen across all companies, special

mention should be made of our jewellery investment casting powder

companies in China and in India having generated record profits in

the year, even though the domestic market in China is still

depressed due to the prolonged lockdowns and travel

restrictions.

Mechanical Engineering Division

Whilst not always being outwardly visible, the Mechanical

Engineering D ivision has had a very difficult seven years. Over

this period the product offerings pretty much across all the

companies have had to evolve to the changing conditions in the

markets from which the companies generate their turnover and gross

margin.

The fact that the companies within the Division have managed to

evolve is a credit to them and their management teams. Contending

with huge energy and commodity increases within the year has not

been straightforward. The metal pricing volatility has been extreme

at its highs with nickel trebling in price and iron more than

doubling in price at times. As a matter of course, our long term

contracts have variation clauses to adjust for annual inflationary

costs. However, the volatility of metals and energy costs has been

so extreme that these clauses have proved to be totally ineffective

. Therefore, across the board every contract where this could have

posed significant issues has been successfully re-negotiated with

our customers. If we were not a high quality, critical supplier to

our customers , then this could have been more problematic, but

that is not the case.

Despite the decline of the workload in our traditional markets

over the prior years associated with the demise of our product

sales to the non green oil and coal sectors, our re-aligned

business offerings are more in demand than they ever have been,

which is seen by the growing workload that customers are booking up

to be delivered now years in advance. With the confidence of a

solid and growing forward order book the tide has turned; all

things being equal, the next few years should see the Mechanical

Engineering Division returning to its former glory with even higher

levels of turnover than at the peak of the o il and gas industry in

2014.

Notably within the year, expanding on the nuclear

decommissioning front, Goodwin International L imi t e d has

successfully tendered and been awarded 50% of the initial phase of

the multi year multi million pound Sellafield Hybrid 2, 63 Can

Racks as reported on the OJEU website in October last year. Gaining

initial process and documentation approvals to proceed with

manufacture will take time , but once ramped up, the initial

production rate will be 20 r acks per year, with 80 r acks

currently committed. Our customer has the option within the

contract to make further commitment(s) of up to an additional 160

racks, as well as increasing the demand to 40 r acks per year.

It is also pleasing to report that in addition to Goodwin Steel

Castings Limited having completed its transition away from a

reliance on the oil and gas market, the company has also managed to

successfully settle the two commercial disputes that were

referenced in my Chairman's Statement of year ending 30th April ,

2020. Part of the settlement is reflected in these results, with

the balance being realised in the current financial year.

On top of its base load, with the excellent work done at getting

on to new programmes, Goodwin Steel Castings Limited will build on

its workload and expect to finish the current year with forward

order levels in excess of the levels the Group experienced when it

was really busy a decade ago. However , it will not be for oil and

coal industries as it was previously; it will be for nuclear

decommissioning; or nuclear power station castings; or surface ship

and aircraft carrier castings as well as submarine hull

castings.

With these successes, and the hard work and perseverance of the

Group in achieving a positive conclusion to prior years '

contractual claims we have been pursuing; the successful

re-negotiation of multiple contracts for unforeseeable energy and

raw materials pricing volatility whilst at the same time growing,

it has resulted in a n excellent Group workload of GBP 175 m illion

as at the time of writing. It is pleasing to report that the bulk

of the increased workload relates to contracts to supply products

that the Group has successfully and consistently delivered before,

and is a workload figure that is likely to grow over the coming

years even with the knowledge that the Group is likely to achieve

record activity levels within this current year.

W hat is not visible yet in the workload figure is an

appropriate workload for Easat Radar Systems Limited . Once up to

speed (which still may be another year away) the Board and I

believe there will be a workload for Easat , the likes of which

readers of their accounts for the past thirty years have never

seen. Easat order input has been hampered by lack of cash

generation at civilian airports globally, and military airports

being starved of cash as a result of Covid -19 over the past two

years hampering their purchasing decisions. However , it would

appear that the r adar market is starting to wake up again. We have

considerably more firm buy quotations due for decision in the next

six months, and , in order to give a flavour of what we are seeing,

in the week following the latest ATM Madrid exhibition in June

2022, an additional GBP47 m illion of firm buy r adar systems were

quoted.

Energy

As initially reported in our 31st October, 2021 Interim

Statement, over the course of the year the most significant

headwind that the Group has faced has been the increased energy

costs. Nonetheless, the Group managed to deliver the more than

respectable profits reported above, after having incurred a total

of GBP3.8 million of additional energy costs due to price increases

versus the year end ed 30th April, 2021. Goodwin Steel Castings

Limited and Hoben International Limited were the most affected due

to their energy intensive operations , melting metal and high

temperature treatment of refractories. However , now armed with a

multitude of short and long - term hedges in place the Group is set

to deliver substantially higher profitability in the current year,

partly as a result of not having to absorb the price volatility of

the energy markets that have been seen over the past twelve months,

irrespective of the improving performance.

Green Investments

We recognise the importance of adopting a strategy to transition

to lower carbon manufacturing. We have put in place a separate

GBP10 m illion finance line to fund a range of 'green' investments

which were approved at the beginning of the financial year end ed

30th April , 2022. A total of 4.8 MWp of solar panels have been

installed and commissioned as at the time of writing. Each

individual system has been designed specifically to match the power

demand at each facility, subject to available roof space. The

payback of each system varies dependent on the size and roof

configuration and all were between three and six years; however ,

that payback was calculated prior to energy costs more than

doubling, so at current market prices the payback time has halved

from the original plan, with all the solar systems having an

insurance backed 20 year minimum lifespan. There are other solar

projects and plant control modification projects that , subject to

us obtaining the agreement from the Electricity Supplier ( District

Network Operator ) , for the former we expect to bring on line over

the next two years . This will provide a further 7.8 MWp of green

electricity generation and so further reduce our consumption. Over

the course of the year a total of GBP8.2 m illion has been invested

in green projects.

We are also looking at schemes that would reduce our carbon

footprint in instances where we cannot reduce or eliminate CO(2)

production without ceasing the operation in its entirety. Typically

this is where we utilise natural gas in a process, and it is not

economically viable or possible to change the process. I look

forward to updating you further on this in twelve months' time.

Capital expenditure / cash flow

With the Group's intrinsically strong cash flows , the Group's

net debt stands in line with the Board ' s expectations at GBP29. 8

million as at 30th April , 20 22, which is a GBP2 million

improvement since the half year despite having proceeded with our

substantial investment programme. As mentioned earlier we are

making full use of the ten year duration GBP30 million interest

swap that was executed at the height of Covid-19 in light of our

planned activities, whereby the SONIA interest chargeable to the

Company is capped at less than 1% on GBP30 million of

borrowings.

The headline investments that the Board has authorised and the

Group has been getting on with are four fold, and whilst these

activities all commenced in year end ed 30th April , 2022, due to

the timescales the latter three are still in the course of

construction.

Firstly nearly GBP10 million relates to green investments, with

the majority being spent on CO(2) offsetting projects .

Secondly, due to the outstanding performance of the Refractory

Engineering Division in growing sales by winning market share so

impressively, for both capacity and business continuity

requirements, as we are running dangerously close to full capacity

, authorisation has been given to spen d GBP4.5 million installing

a second calciner at Hoben International Limited , as without it,

we would have two problems. We would be limiting the Refractory

Division the opportunity to grow further investment powder sales,

and in the eventuality of a breakdown we would struggle to ever

catch up with the demand again, and would lose market share to

competitors who could deliver product to keep our customers

operational . This was why the Board deemed this a necessary

investment as it is underpinning substantial Group

profitability.

Thirdly , for Goodwin Steel Castings Limited, despite allocat

ing a significant amount of G roup capital expenditure on

infrastructure there in recent years , t o enable the foundry to

deliver what will be required of the foundry , there have been

additional planning applications approved and work commenced on

additional casting pit space which will allow further increased

activity. Such modifications would likely be impossible to carry

out in a couple of years' time with the envisaged activity levels

there.

Finally for Duvelco L imi t e d, part of the Mechanical

Engineering D ivision, which was incorporated in January 2020. Over

the Company's 139 years existence to date, as well as designing or

buying bolt on complimentary products and companies , it has

occasionally branched out into totally new product lines whi l st

utilising skill-sets within the organisation. After working on this

idea for some time , Duvelco L imi t e d was set up as a business

to channel the Company's ambition to become a specialist polymer

manufacturer, one that we hope will truly excel over the coming

decades. We will manufacture high performance polyimide polymer

resins that can be moulded into parts and shapes for high

temperature and critical applications that very few polymers can be

used for.

With the development work that was done before and since the

incorporation of Duvelco L imi t e d, utilising a bespoke pilot

scale plant the team designed, we have developed the product and a

process that will allow us to deliver a higher performing directly

comparable polyimide polymer than the market leader. With an annual

addressable, and growing, market size bigger than any product tha t

the Group has supplied to before, the Board believes that , with

limited existing market competition, a very high technology

barrier, coupled with the fact we have a patent pending process

that gives us markedly better high temperature performance than

anybody else for directly comparable chemistry product, this should

hopefully give Duvelco Limited, as a market invader, good prospects

of long term success, so that one day it should be a major

contributor to Group profitability.

The initial, custom designed and bespoke plant the Group is

building should be coming into operation in the first half of the

calendar year 2024, after which we will start growing the sales

internationally as we have done with our other products over the

year s . Our initial investment inclusive of R&D costs and

working capital for materials is forecast to come in at GBP12.5

million; from this we would have an initial annual capacity in

excess of GBP40 million of material. The reason I have elaborated

about this is because costs are being incurred now , and it will be

a long time until the plant will be in commission . With the effort

being put into this by the Group, it should deliver a new niche

market, high technology product to the Group with a long life cycle

ahead of it , thus providing the Group with long - term benefit,

which the Board believes is in the best interest of all

stakeholders.

For both Hoben International Limited and Duvelco Limited, most

supplier purchase orders w ere placed in Q3 Financial Year 2022,

giving suppliers large down payments to have fixed price contracts.

If the start of placing orders for either project had been delayed

by several months the prices would have been significantly more

with labour and materials increasing , as we ourselves have

experienced and have had to mitigate and manage. The Board

estimates that by getting on with the projects and contracting when

we did, the saving versus starting either project today is in

excess of 25%.

As contracts within the Mechanical Engineering Division become

larger and span longer periods, the engineering companies are being

targeted to ensure contracts incorporate down payments / stage

payments to allow their execution with as neutral overall cash flow

status as can be obtained over the life of a contract, so that work

in progress does not consume a disproportionate amount of cash as

we get busier.

With the profitability, positive outlook and strong

understanding of the various subsidiaries ' cash flows the Board

believes it is appropriate to continue to follow the Group's

investment plans and pay the proposed dividend that is in line with

the dividend policy with 50% being paid on 7th October , 2022 and

50% o n 12th April , 20 23.

We are once again extremely grateful to our UK and overseas

Directors, managers and employees for their hard work in driving

forward the performance of the Group, which will likely improve

again in the new financial year with the strong foundations that

have been put in place in many areas around the Group.

3(rd) August 2022

T.J.W Goodwin

Chairman

Alternative performance measures mentioned above are defined in

Note 6.

OBJECTIVES, STRATEGY AND BUSINESS MODEL

The Group's main OBJECTIVE is to have a sustainable long-term

engineering based business with good potential for profitable

growth while providing a fair return to our shareholders.

The Board's STRATEGY to achieve this is:

-- to supply a range of technically advanced products to growth

markets in the Mechanical Engineering and Refractory Engineering

segments in which we have built up a global reputation for

engineering excellence, quality, efficiency, reliability,

competitive price and delivery;

-- to manufacture advanced technical products profitably, efficiently and economically;

-- to maintain an ongoing programme of investment in plant,

facilities, sales and marketing, research and development with a

view to increasing efficiency, reducing costs, increasing

performance, delivering better products for our customers,

expanding our global customer base and keeping us at the forefront

of technology within our markets, whilst at all times taking

appropriate steps to ensure the health and safety of our employees

and customers;

-- to control our working capital and investment programme to ensure a safe level of gearing;

-- to maintain a strong capital base to retain investor,

customer, creditor and market confidence and so help sustain future

development of the business;

-- to support a local presence and a local workforce in order to stay close to our customers;

-- to invest in training and development of skills for the Group's future;

-- to manage the environmental and social impacts of our

business to support its long-term sustainability.

BUSINESS MODEL

The Group's focus is on manufacturing within two sectors,

Mechanical Engineering and Refractory Engineering, and through this

division of our manufacturing activities, our overseas business

facilities and our global sales and marketing activities, the Group

benefits from market diversity. Further details of our business and

products are shown on our website www.goodwin.co.uk

Mechanical Engineering

The Group specialises in supplying precision engineered

solutions and industrial goods into critical applications,

generally on a project basis, more often than not involving the

complementary skill set of other group companies to deliver the

requirement. The projects normally involve international

procurement, high integrity castings, forgings or wrought high

alloy steels, carbon fibre composite structures, precision CNC

machining, complex welding and fabrication, and other operations as

are required. In addition to specialist projects, the Group

manufactures and sells a wide range of dual plate check valves,

axial nozzle check valves and axial piston control and isolation

valves. These solutions and products typically form part of large

construction projects, including the construction of naval vessels,

nuclear waste treatment, nuclear power generation, liquefied

natural gas (LNG), gas, oil, petrochemical, mining, and water

markets.

We generate value by creating leading edge technology designs,

globally sourcing the best quality raw material at good prices,

manufacturing in highly efficient facilities using up to date

technology to provide very reliable products to the required

specification, at competitive prices and with timely

deliveries.

The Group through its foundry, Goodwin Steel Castings Limited,

has the capability to pour high performance alloy castings up to 35

tonnes, radiograph and also finish CNC machine and fabricate them

at the foundry's sister company, Goodwin International Limited.

This capability is targeting the defence industry and nuclear

decommissioning, the oil and gas industry, as well as large, global

projects requiring high integrity machined castings.

Goodwin International Limited, the largest company in the

Mechanical Engineering Division, not only designs and manufactures

dual plate check valves, axial nozzle check valves and axial piston

control and isolation valves but also undertakes specialised CNC

machining and fabrication work for nuclear decommissioning

projects. Goodwin International Limited also has a division that is

focused on manufacturing / machining high precision, high integrity

components for naval marine vessels. Noreva GmbH also designs,

manufactures and sells axial nozzle check valves. Both Goodwin

International Limited and Noreva GmbH purchase the majority of the

value of their sand mould castings from Goodwin Steel Castings

Limited for their ranges of check valves and this vertical

integration gives rise to competitive benefits, increased

efficiencies and timely deliveries.

At Goodwin Pumps India Private Limited we manufacture a superior

range of submersible slurry pumps for end users in India, Brazil,

Australia and Africa. Easat Radar Systems Limited and its

subsidiary, NRPL Aero Oy, design and build bespoke high-performance

radar surveillance systems for the global market of major defence

contractors, civil aviation authorities and coastal border security

agencies. Easat has a sister company, Easat Radar Systems India

Private Limited, that also manufactures, sells and maintains radar

systems for air traffic control. We create value on these by

innovative design, assembly and testing in our own facilities using

bought in or engineered in-house components.

Refractory Engineering

Within the Refractory Engineering Division, Goodwin Refractory

Services Limited (GRS) generates value primarily from designing,

manufacturing and selling investment casting powders , injection

moulding rubbers and waxes to the jewellery casting industry. GRS

also manufactures and sells these products to the tyre mould and

aerospace industries. The Refractory Engineering Division has five

other investment powder manufacturing companies located in China,

India and Thailand which sell the casting powders directly and

through distributors to the jewellery casting industry and also

directly to tyre mould and aerospace industries.

These companies are vertically integrated with another of our UK

companies, Hoben International Limited, which manufactures

cristobalite, which it sells to the six casting powder

manufacturing companies as well as producing ground silica that

also goes into casting powders and other UK uses of silica. Hoben

now also manufactures different grades of perlite, and a patented

range of biodegradable bags, known as Soluform, for use inside

traditional hessian / jute bags for the placement of concrete in or

around rivers.

The other UK refractory company is Dupré Minerals Limited (

Dupré ) which focuses on producing exfoliated vermiculite that is

used in insulation, brake linings and fire protection products,

including technical textiles that can withstand exposure to high

temperatures and for lithium -ion battery fire extinguishers. Dupré

also sells consumable refractories to the shell moulding precision

casting industry. Dupré has designed, patented and is now selling a

range of fire extinguishers and an extinguishing agent for lithium

-ion battery fires that utilises a vermiculite dispersion as the

fire extinguishing agent.

CONSOLIDATED STATEMENT OF PROFIT OR LOSS

for the year ended 30th April, 2022

2022 2021

GBP'000 GBP'000

CONTINUING OPERATIONS

Revenue 144,108 131,231

Cost of sales (101,404) (92,230)

GROSS PROFIT 42,704 39,001

Other income -- 763

Distribution expenses (3,743) (2,988)

Administrative expenses (20,654) (19,682)

OPERATING PROFIT 18,307 17,094

Finance costs (net) (1,169) (640)

Share of profit of associate company 63 60

PROFIT BEFORE TAXATION AND MOVEMENT IN

FAIR VALUE OF INTEREST RATE SWAP 17,201 16,514

Unrealised g ain on 10 y ear i nterest

r ate s wap d erivative 2,740 --

PROFIT BEFORE TAXATION 19,941 16,514

Tax on profit (6,321) (3,508)

PROFIT AFTER TAXATION 13,620 13,006

---------- ---------

ATTRIBUTABLE TO:

Equity holders of the parent 12,980 12,494

Non-controlling interests 640 512

PROFIT FOR THE YEAR 13,620 13,006

---------- ---------

BASIC EARNINGS PER ORDINARY SHARE (in

pence) 169.14 167.82

---------- ---------

DILUTED EARNINGS PER ORDINARY SHARE (in

pence) 169.14 164.23

---------- ---------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 30th April, 2022

2022 2021

GBP'000 GBP'000

PROFIT FOR THE YEAR 13,620 13,006

OTHER COMPREHENSIVE (EXPENSE) / INCOME

ITEMS THAT MAY BE RECLASSIFIED SUBSEQUENTLY TO PROFIT OR LOSS:

Foreign exchange translation differences 1,493 (1,371)

Effective portion of changes in fair value of cash flow hedges (3,834) 1,296

Ineffectiveness in cash flow hedges transferred to profit or loss (339) (657)

Change in fair value of cash flow hedges transferred to profit or loss (1,432) 1,932

Effective portion of changes in fair value of cost of hedging 275 (37)

Ineffectiveness in cost of hedging transferred to profit or loss (23) 631

Change in fair value of cost of hedging transferred to profit or loss (75) 381

Tax credit / (charge) on items that may be reclassified subsequently to profit or loss 1,114 (673)

OTHER COMPREHENSIVE (EXPENSE) / INCOME FOR THE YEAR, NET OF INCOME TAX (2,821) 1,502

TOTAL COMPREHENSIVE INCOME FOR THE YEAR 10,799 14,508

-------- --------

ATTRIBUTABLE TO:

Equity holders of the parent 10,089 14,081

Non-controlling interests 710 427

-------- --------

10,799 14,508

-------- --------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 30th April, 2022

Share Translation Share-based Cash Cost Retained Total Non-controlling Total

capital reserve payments flow of earnings attributable interests equity

reserve hedge hedging to equity

reserve reserve holders

of the

parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

YEARED

30TH APRIL,

2022

Balance at

1st May, 2021 753 (852) 5,244 1,601 (1) 106,396 113,141 4,887 118,028

Total

comprehensive

income:

Profit for

the year -- -- -- -- -- 12,980 12,980 640 13,620

Other

comprehensive

income:

Foreign exchange

translation

differences -- 1,315 -- -- -- -- 1,315 178 1,493

Effective

portion

of changes

in fair value -- -- -- (3,790) 275 -- (3,515) (44) (3,559)

Ineffectiveness

transferred

to profit or

loss -- -- -- (333) (23) -- (356) (6) (362)

Change in fair

value

transferred

to profit or

loss -- -- -- (1,359) (64) -- (1,423) (84) (1,507)

Tax -- -- -- 1,135 (47) -- 1,088 26 1,114

-------- ------------ ------------ -------- -------- --------- ------------- ---------------- --------

TOTAL

COMPREHENSIVE

INCOME /

(EXPENSE)

FOR THE YEAR -- 1,315 -- (4,347) 141 12,980 10,089 710 10,799

Transactions

with owners:

Issue of shares 16 -- -- -- -- -- 16 -- 16

Acquisition

of NCI without

a change in

control -- -- -- -- -- (74) (74) (356) (430)

Dividends paid -- -- -- -- -- (7,862) (7,862) (808) (8,670)

BALANCE AT

30TH APRIL,

2022 769 463 5,244 (2,746) 140 111,440 115,310 4,433 119,743

-------- ------------ ------------ -------- -------- --------- ------------- ---------------- --------

GOODWIN PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (continued)

for the year ended 30th April, 2021

Share Translation Share-based Cash Cost Retained Total Non-controlling Total

capital reserve payments flow of earnings attributable interests equity

reserve hedge hedging to equity

reserve reserve holders

of the

parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

YEARED

30TH APRIL,

2021

Balance at

1st May, 2020 736 361 5,244 (499) (743) 99,918 105,017 4,585 109,602

Total

comprehensive

income:

Profit for

the year -- -- -- -- -- 12,494 12,494 512 13,006

Other

comprehensive

income:

Foreign exchange

translation

differences -- (1,255) -- -- -- -- (1,255) (116) (1,371)

Effective

portion

of changes

in fair value -- -- -- 1,252 (42) -- 1,210 49 1,259

Ineffectiveness

transferred

to profit or

loss -- -- -- (617) 596 -- (21) (5) (26)

Change in fair

value

transferred

to profit or

loss -- -- -- 1,957 362 -- 2,319 (6) 2,313

Tax -- -- -- (492) (174) -- (666) (7) (673)

-------- ------------ ------------ -------- -------- --------- ------------- ---------------- --------

TOTAL

COMPREHENSIVE

INCOME /

(EXPENSE)

FOR THE YEAR -- (1,255) -- 2,100 742 12,494 14,081 427 14,508

Transactions

with owners:

Issue of shares 17 -- -- -- -- -- 17 -- 17

Dividends paid -- -- -- -- -- (6,016) (6,016) (125) (6,141)

Rec ycl ing

of translation

reserve on

the disp o

sal of

subsidiary -- 42 -- -- -- -- 42 -- 42

-------- ------------ ------------ -------- -------- --------- ------------- ---------------- --------

BALANCE AT

30TH APRIL,

2021 753 (852) 5,244 1,601 (1) 106,396 113,141 4,887 118,028

-------- ------------ ------------ -------- -------- --------- ------------- ---------------- --------

CONSOLIDATED BALANCE SHEET

at 30th April, 2022

2022 2021

GBP'000 GBP'000

NON-CURRENT ASSETS

Property, plant and equipment 87,594 77,063

Right-of-use assets 6,191 3,691

Investment in associate 896 829

Intangible assets 24,817 24,813

Long-term trade receivables 1,191 --

Derivative financial assets 2,741 191

-------- --------

123,430 106,587

-------- --------

CURRENT ASSETS

Inventories 40,364 34,547

Contract assets 12,331 15,844

Trade receivables and other financial assets 23,717 20,540

Other receivables 6,277 5,627

Derivative financial assets 1,211 4,106

Cash and cash equivalents 11,651 15,160

-------- --------

95,551 95,824

-------- --------

TOTAL ASSETS 218,981 202,411

CURRENT LIABILITIES

Borrowings 2,764 1,607

Contract liabilities 14,749 14,332

Trade payables and other financial liabilities 23,004 21,730

Other payables 4,256 4,025

Derivative financial liabilities 2,393 2,016

Liabilities for current tax 1,886 1,174

Provisions for liabilities and charges 205 608

-------- --------

49,257 45,492

-------- --------

NON-CURRENT LIABILITIES

Borrowings 40,376 33,066

Derivative financial liabilities 1,643 --

Provisions for liabilities and charges 251 251

Deferred tax liabilities 7,711 5,574

-------- --------

49,981 38,891

-------- --------

TOTAL LIABILITIES 99,238 84,383

-------- --------

NET ASSETS 119,743 118,028

-------- --------

EQUITY ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT

Share capital 769 753

Translation reserve 463 (852)

Share-based payments reserve 5,244 5,244

Cash flow hedge reserve (2,746) 1,601

Cost of hedging reserve 140 (1)

Retained earnings 111,440 106,396

-------- --------

TOTAL EQUITY ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT 115,310 113,141

-------- --------

NON-CONTROLLING INTERESTS 4,433 4,887

TOTAL EQUITY 119,743 118,028

-------- --------

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 30th April, 2022

2022 2021

GBP'000 GBP'000

CASH FLOW FROM OPERATING ACTIVITIES

Profit from continuing operations after tax 13,620 13,006

Adjustments for:

Depreciation of property, plant and equipment 6,202 5,696

Depreciation of right of use assets 1,192 972

Amortisation and impairment of intangible assets 1,572 1,566

Finance costs (net) 1,169 640

Currency (gains) / losses net of unhedged derivative movements (1,535) 292

Profit on sale of property, plant and equipment (18) (745)

Profit on disposal of subsidiary -- (32)

Unrealised gain on 10 year interest rate swap derivative (2,740) --

Share of profit of associate company (63) (60)

UK tax incentive credit on research and development (675) --

Tax expense 6,321 3,508

--------- ---------

OPERATING CASH FLOW BEFORE CHANGES IN WORKING CAPITAL AND PROVISIONS 25,045 24,843

(Increase) / decrease in inventories (5,175) 10,344

Decrease / (in crease ) in contract assets 3,498 (9,242)

(I ncrease) / decrease in trade and other receivables (3,341) 2,885

Increase / (d ecrease) in contract liabilities 472 (4,428)

I ncrease in trade and other payables 804 1,047

Decrease / (i ncrease ) in unhedged derivative balances -- (438)

--------- ---------

CASH GENERATED FROM OPERATIONS 21,303 25,011

Interest received 157 111

Interest paid (1,415) (845)

Corporation tax paid (2,051) (3,068)

--------- ---------

NET CASH INFLOW FROM OPERATING ACTIVITIES 17,994 21,209

--------- ---------

CASH FLOW FROM INVESTING ACTIVITIES

Proceeds from sale of property, plant and equipment 341 1,958

Acquisition of property, plant and equipment (16,215) (11,738)

Additional investment in existing subsidiaries (430) --

Acquisition of intangible assets (282) (719)

Development expenditure capitalised (1,505) (1,420)

--------- ---------

NET CASH OUTFLOW FROM INVESTING ACTIVITIES (18,091) (11,919)

--------- ---------

CASH FLOW FROM FINANCING ACTIVITIES

Issue of shares 16 17

Payment of capital element of lease liabilities (1,153) (1,635)

Dividends paid (7,862) (6,016)

Dividends paid to non-controlling interests (808) (125)

Proceeds from new loans 6,702 35,048

Repayment of loans and committed facilities (683) (30,772)

--------- ---------

NET CASH OUTFLOW FROM FINANCING ACTIVITIES (3,788) (3,483)

--------- ---------

NET (DECREASE) / INCREASE IN CASH AND CASH EQUIVALENTS (3,885) 5,807

Cash and cash equivalents at beginning of year 15,160 9,449

Effect of exchange rate fluctuations on cash held 376 (96)

--------- ---------

CASH AND CASH EQUIVALENTS AT OF YEAR 11,651 15,160

--------- ---------

PRINCIPAL RISKS AND UNCERTAINTIES

The Group's operations expose it to a variety of risks and

uncertainties. The Directors confirm that they have carried out a

robust assessment of the principal risks the Company faced ,

including those that would threaten its business model, future

performance, solvency or liquidity.

Market risk: The Group provides a range of products and

services, and there is a risk that the demand for these products

and services will vary from time to time because of competitor

action or economic cycles or international trade friction or even

wars. As shown in note 3 to the financial statements to be

published shortly, the Group operates across a range of

geographical regions, and its turnover is split across the UK,

Europe, USA, the Pacific Basin and the Rest of the World.

Operating in many territories helps spread market risk.

Similarly, the Group operates in both Mechanical Engineering and

Refractory Engineering sectors, mitigating the impact of a downturn

in any one product area as has been seen in recent financial

years.

The potential risk of the loss of any key customer is limited

as, typically, no single customer accounts for more than 1 0 % of

annual turnover.

As described in the Business Model, the Group generates

significant sales not only from valves it supplies to LNG, oil,

chemical and water markets, but increasingly significant amounts

from nuclear new build and decommissioning, naval propulsion marine

applications and ship hull components. The Mechanical Engineering

Division also supplies submersible pumps that are supplied to the

mining industries and radar systems that are supplied for civil and

defence applications. The Refractory Engineering Division sells

vermiculite and perlite to the insulating and fire prevention

industry and our investment casting powder companies indirectly

selling to the jewellery consumer market through the supply of

investment casting moulding powders, waxes, silicone and natural

rubber.

Technical risk: The Group develops and launches new products as

part of its strategy to enhance the long-term value of the Group.

Such development projects carry business risks, including

reputational risk, abortive expenditure and potential customer

claims which may have a material impact on the Group. The potential

risk here is seen as manageable given the Group is developing

products in areas in which it is knowledgeable and new products are

tested as far as possible prior to their release into the

market.

Product failure / Contractual risk: The risks that the Group

supplies products that fail or are not manufactured to

specification are risks that all manufacturing companies are

exposed to but we try to minimise these risks through the use of

highly skilled personnel operating within robust quality control

system environments, using third party accreditations where

appropriate. With regard to the risk of failure in relation to new

products coming on line, the additional risks here are minimised at

the research and development stage, where prototype testing and the

deployment of a robust closed loop product performance quality

control system provides feedback to the design department for the

products we manufacture and sell. The risk of not meeting safety

expectations, or causing significant adverse impacts to customers

or the environment, is countered by the combination of the controls

mentioned within this section and the purchase of product liability

insurance. The risk of product obsolescence is countered by

research and development investment.

Supply chain and equipment risk: Failure of a major supplier or

essential item of equipment presents a constant risk of disruption

to the manufacturing in progress, especially in these post Covid

-19 pandemic times. Where reasonably possible, management mitigates

and controls the risk with the use of dual sourcing, continual

maintenance programmes, and by carrying adequate levels of stocks

and spares to reduce any disruption.

Health and safety: The Group's operations involve the typical

health and safety hazards inherent in manufacturing and business

operations. The Group is subject to numerous laws and regulations

relating to health and safety around the world. Hazards are managed

by carrying out risk assessments and introducing appropriate

controls, as well as attending safety training courses.

Acquisitions: The Group's growth plan over recent years has

included a number of acquisitions. There is the risk that these, or

future acquisitions, fail to provide the planned value. This risk

is mitigated through financial and technical due diligence during

the acquisition process and the Group's inherent knowledge of the

markets they operate in.

Financial risk: The principal financial risks faced by the Group

are changes in market prices (interest rates, foreign exchange

rates and commodity prices). As reported elsewhere within these

financial statements , the Company , on 2nd July , 2021 , signed a

contract to mitigate the impact of interest rate risk by taking out

an interest rate swap derivative fixing GBP30 million of notional

debt at less than 1% v ersus the variable SONIA rate for a period

of ten years , commencing 1st September, 2021 . Detailed

information on the financial risk management objectives and

policies is set out in note 26 to the financial statements to be

published shortly. The Group has in place risk management policies

that seek to limit the adverse effects on the financial performance

of the Group by using various instruments and techniques, including

credit insurance, stage payments, forward foreign exchange

contracts, secured and unsecured credit lines.

Regulatory compliance: The Group's operations are subject to a

wide range of laws and regulations. Both within Goodwin PLC and its

subsidiaries, the Directors and Senior Managers within the

companies make best endeavours to ensure we comply with the

relevant laws and regulations.

IT security: The Group performs regular and remote off site

backups of its IT systems, from time to time engaging external

companies to test and report any weaknesses and deficiencies found

to enable solutions to be put in place to mitigate and minimise the

risk of an IT security breach. The Group is in the process of

re-evaluating the need to invest further in this area over the next

12 months, but for security reasons we will not be disclosing the

details of what we do.

Covid-19 risk: The Covid-19 pandemic continues to have a global

impact in varying degrees that has been seen during the year

through labour shortages, supply chain disruption, shipping

availability and inflationary pressures. The impact of labour

shortages ha s been eased by the strength of our employee retention

and our apprentice school continuing to feed the Group's

requirements with eager engineers. The supply chain issues have

been mitigated by the Group's ability to dynamically acquire and

hold appropriate levels of stock so as to avoid disruption to the

manufacturing processes. Furthermore, the continuation of the post

lock down exceptionally high activity levels within the Refractory

Division, in addition to the significant workload within the

Mechanical Division ha ve meant that the Group has continued to

operate as normal across all of its 23 sites around the world for

the past twenty-four months.

Energy : The recent geopolitical tensions, with the current

conflict in Ukraine, combined with the UK Government ' s energy

policy over the last few years to reduce carbon emissions has left

the country exposed to the fragile global energy system which has

driven significant increases in the cost of power. Following the

impact t his has had on the Group earlier on in the year, the Group

has amended its strategy to manage the risk through hedging

strategies , incorporating price escalation clauses into the longer

term contracts , aided by the coming on stream of increasing levels

of low cost solar power around the Group. We also have two

significant program me s of enhancing the control of plant and

utilising more inverter drives around the Group, which within 24

months sh ould save an additional 6% of the Group's electricity and

gas consumption.

FORWARD-LOOKING STATEMENTS

The Group Strategic Report contains forward-looking type

statements and information based on current expectations, and

assumptions and forecasts made by the Group. These expectations and

assumptions are subject to various known and unknown risks,

uncertainties and other factors, which could lead to substantial

differences between the actual future results, financial

performance and the estimates and historical results given in this

report. Many of these factors are outside the Group's control. The

Group accepts no liability to publicly revise or update these

forward-looking statements or adjust them for future events or

developments, whether as a result of new information, future events

or otherwise, except to the extent legally required.

Directors' statement pursuant to the Disclosure and Transparency

Rules

Each of the Directors, whose names are listed below , confirm

that to the best of each person's knowledge:

a. the financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit of the

Company and the undertakings included in the consolidation taken as

a whole; and

b. the Strategic Report contained in the Annual Report includes

a fair review of the development and performance of the business

and the position of the Com p any and the undertakings included in

the consolidation taken as a whole, together with a description of

the principal risks and uncertainties that they face.

Directors

The Directors of the Company who have served during the year are

set out below.

M.S. Goodwin

S.R. Goodwin

T.J.W. Goodwin

J. Connolly

B.R.E. Goodwin

N. Brown

J.E. Kelly (Non-Executive Director)

Accounting policies

Goodwin PLC (the "Company") is incorporated in England and

Wales.

The Group financial statements consolidate those of the Company

and its subsidiaries (together referred to as the "Group") and

equity account the Group's interest in associates. The parent

Company financial statements present information about the Company

as a separate entity and not about its Group.

The Group's financial statements have been prepared in

accordance with UK adopted I nternational A ccounting S tandards

(IAS) and interpretations issued by the IFRS Interpretations

Committee (IFRS IC) applicable to companies reporting under UK

adopted IFRS.

The financial statements for the year ended 30th April, 2021

were prepared in accordance with international

accounting standards in conformity with the requirements of the

Companies Act 2006 and IFRS adopted pursuant to Regulation (EC) No

1606/2002 as it applies in the European Union. There is no

difference for the Group in applying each of these accounting

frameworks or on the recognition, measurement or disclosure in the

period reported as a result of the change in framework .

The Company has elected to prepare its financial statements in

accordance with Financial Reporting Standard (FRS) 101 issued in

the UK. These are presented on pages 95 to 107 to the financial

statements to be published shortly.

The accounting policies set out below have been applied

consistently to all periods presented in these Group financial

statements.

Judgements made by the Directors, in the application of these

accounting policies that have significant effect on the financial

statements and estimates with a significant risk of material

adjustment in the next year are discussed in note 2 of to the

financial statements to be published shortly .

New IFRS standards and interpretations adopted during 2021 /

2022

The IASB and IFRIC issued the following amendments:

-- Amendments to IFRS 9, IAS39, IFRS 7, IFRS 4 and IFRS 16 -

Interest rate benchmark reform phase 2, which is effective for

annual periods beginning on or after 1st January , 2021.

-- Amendment to IFRS 16 'Leases' - Covid 19 rent concession

extensions, which is effective for annual periods beginning on or

after 1 st June , 2020

The implementation of these amendments has not had a material

impact on the Group's financial statements

The financial information previously set out does not constitute

the Company's statutory accounts for the years ended 30th April,

2022 or 2021 but is derived from those accounts. Statutory accounts

for 2021 have been delivered to the Registrar of Companies, and

those for 2022 will be delivered in due course. The auditors have

reported on those accounts; their report was:

i. unqualified;

ii. did not include references to any matters to which the

auditors drew attention by way of emphasis without qualifying their

report; and

iii. did not contain a statement under Section 498(2) or (3) of the Companies Act 2006.

Copies of the 2022 accounts are expected to be posted to

shareholders within the next two weeks and will also be available

on the Company's website: www.goodwin.co.uk and from the Company's

Registered Office: Ivy House Foundry, Hanley, Stoke-on-Trent ST1

3NR.

Note 1

Segmental information

Products and services from which reportable segments derive

their revenues

For the purposes of management reporting to the chief operating

decision maker, the Board of Directors, the Group is organised into

two reportable operating divisions: mechanical engineering and

refractory engineering. Segment assets and liabilities include

items directly attributable to segments as well as those that can

be allocated on a reasonable basis. Associates are included in

refractory engineering. In accordance with the requirements of IFRS

8, information regarding the Group's operating segments is reported

below.

2022 2021

Mechanical Refractory Total Mechanical Refractory Total

Engineering Engineering Engineering Engineering

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External sales 87,605 56,503 144,108 86,616 44,615 131,231

Inter-segment

sales 17,784 15,523 33,307 20,871 11,526 32,397

Total revenue 105,389 72,026 177,415 107,487 56,141 163,628

--------------- -------------------------------------- ----------------------------------- ----------------------

Reconciliation to consolidated revenue:

Inter-segment

sales (33,307) (32,397)

Consolidated revenue

for the year 144,108 131,231

-------------------------- ------------------------

2022 2021

Refractory Mechanical Refractory

Mechanical Engineering Engineering Total Engineering Engineering Total

Profits

Segment

o perating

profit 9,139 12,657 21,796 10,823 9,280 20,103

------------------------------ --------------------------- ---------------------------------------------- ----------------------------------- ---------------------- ------------------ ----

% of

operating

profit 42 % 58 % 100 % 54 % 46 % 100 %

Group

centre (3,489) (3,009)

---------------------------------------------- ------------------ ----

Group

operating

profit 18,307 17,094

Share

of profit

of associate

company -- 63 63 -- 60 60

Unrealised gain on 10 year Interest Rate Swap

Derivative 2,740 --

Group finance expenses (net) (1,169) (640)

-------------------------- ------------------ ----

Consolidated profit before tax for the year 19,941 16,514

Tax (6,321) (3,508)

-------------------------- ------------------ ----

Consolidated profit after tax for the year 13,620 13,006

-------------------------- ------------------ ----

2022 2021

Mechanical Refractory Mechanical Refractory

Engineering Engineering Total Engineering Engineering Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Net assets

Total

assets 93,049 48,843 141,892 92,929 44,114 137,043

Total

liabilities (71,950) (22,643) (94,593) (66,909) (20,591) (87,500)

------------------------------ --------------------------- ---------------------------------------------- ----------------------------------- ---------------------- ------------------------

Subtotal 21,099 26,200 47,299 26,020 23,523 49,543

------------------------------ --------------------------- ---------------------------------------------- ----------------------------------- ---------------------- ------------------------

Goodwin

PLC net

assets 88,595 83,998

Elimination of Goodwin

PLC investments (25,822) (25,392)

Goodwill 9,671 9,879

---------------------------------------------- ------------------------

Consolidated total

net assets 119,743 118,028

---------------------------------------------- ------------------------

2022 2021

Goodwin PLC Mechanical Refractory Total Goodwin Mechanical Refractory Total

Engineering Engineering PLC Engineering Engineering

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segmental capital expenditure

Property,

plant and

equipment 9,326 5,396 1,631 16,353 5,315 4,952 1,570 11,837

Right-of-use

assets 441 2,401 881 3,723 1,180 1,146 74 2,400

Intangible

assets 237 1,121 429 1,787 151 1,123 456 1,730

---------------------- --------------- ------------------ ------------------ ------------ ----------------------------- ------------------ ----------------------

Total 10,004 8,918 2,941 21,863 6,646 7,221 2,100 15,967

---------------------- --------------- ------------------ ------------------ ------------ ----------------------------- ------------------ ----------------------

Segmental depreciation, amortisation and impairment

Depreciation 3,808 2,200 1,386 7,394 2,970 2,346 1,352 6,668

Amortisation

and impairment 1,195 47 330 1,572 1,106 20 440 1,566

---------------------- ------ ------- ------------------ ------------------ ------------ ------------ -----------------

Total 5,003 2,247 1,716 8,966 4,076 2,366 1,792 8,234

---------------------- ------ ------- ------------------ ------------------ ------------ ------------ -----------------

Geographical segments

The Group operates in the following principal locations. In

presenting the information on geogr a phical segments, revenue is

based on the location of its customers and assets on the location

of the assets.

2022 2021

Revenue Net assets Non-current Capital Revenue Net assets Non-current Capital

assets expenditure assets expenditure

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

UK 38,599 77,447 104,995 19,670 39,755 81,982 89,944 13,634

Rest of

Europe 21,388 8,648 3,728 1,009 21,473 8,309 3,264 279

USA 14,046 -- -- -- 8,027 -- -- --

Pacific

Basin 31,085 15,867 6,703 278 28,255 13,708 6,499 719

Rest of

World 38,990 17,781 8,004 906 33,721 14,029 6,880 1,335

-------- ----------- ------------ ------------- -------- ----------- ------------ -------------

Total 144,108 119,743 123,430 21,863 131,231 118,028 106,587 15,967

-------- ----------- ------------ ------------- -------- ----------- ------------ -------------

Note 2

Dividends

The Board proposes to pay a dividend of 10 7.80 pence per share,

up 5 % on the previous year (2021: 102.24 p ) . The proposed

dividend has been calculated using the Group's profit after

taxation figure, plus depreciation and amortisation for the year

ending 30th April 2022.

The Board proposes to smooth the Group's cash flow by splitting

the payment of the proposed ordinary dividend s of 107.80 pence per

share into equal instalments of 53.9 pence per share on 7th

October, 2022 and on or around 12th April, 2023 to shareholders on

the register on 16th September, 2022 and on or around 24th March,

2023 respectively.

Note 3

Earnings per share

2022 2021

Number Number

Ordinary shares in issue

Opening shares in issue 7,526,400 7,363,200

Shares issued in the year 163,200 163,200

---------- ----------

7,689,600 7,526,400

Outstanding ordinary share options -- 163,200

---------- ----------

Total ordinary shares (issued and options) 7,689,600 7,689,600

---------- ----------

Weighted average number of ordinary shares

in issue 7,673,951 7,445,024

Weighted average number of outstanding ordinary

share options -- 162,651

---------- ----------

Denominator used for diluted earnings per

share calculation 7,673,951 7,607,675

---------- ----------

2022 2021

GBP'000 GBP'000

Relevant profits attributable to ordinary

shareholders 12,980 12,494

-------- --------

Note 4

Going concern

The Directors, after having reviewed the projections and

possible challenges that may lie ahead, believe that there is a

reasonable expectation that the Group has adequate resources to

continue in operational existence for at least twelve months from

the date of approval of these financial statements, and have

continued to adopt the going concern basis in preparing the

financial statements.

As at 30th April 2022, the Group's gearing ratio stood at 25. 8

% (2021: 15.4%) against a substantial shareholders' net worth of

GBP115 million (2021: GBP113 million). The retained reserves of the

Group put it in a strong position to deal with unforeseen material

adverse issues.

In previous years we have reported on the potential impact of

Covid-19 and its limited impact on the business. As you might

expect given our previous comments, our pandemic risk profile is

low and whilst there are minor Covid-19 impacts we do not see the

pandemic as a cause for concern for the Group moving forwards.

The reported results for the year are after having incurred what

have been unprecedented increases in energy costs. Whilst the Group

is not complacent and there is work to be done here, we do not see

the impact of energy costs giving rise to a going concern

issue.

Within our severe but plausible stress test model, it is

demonstrable that the Group has sufficient funds to cover the

Group's and the Company's financial commitments during the forecast

period whilst remaining compliant with its financial covenants. The

stress test model starts with the forecasts generated by the

subsidiary directors and reflects their specific knowledge of the

market conditions, strategy and outlook. Each of these subsidiary

level forecasts is then reviewed, challenged and approved by the

relevant Group Managing Director who themselves are immersed in

each of the businesses. The stress test model then predicts the

impact of a severe but plausible reduction in the pre-tax profit

forecast without pulling back on our capital expenditure forecast.

The results of the stress test modelling did not highlight any

going concern issues.

Whilst our carrying values of trade debtors and contract assets

are significant, we see little risk here in terms of recovery.

Where possible, we credit insure the majority of our debtors and

our pre credit risk (work in progress), and for significant

contracts where credit insurance is not available, we ensure, where

possible, that these contracts are backed by letters of credit or

cash positive milestone payments.

As discussed elsewhere within these accounts, the Mechanical

Engineering order book remains high and the Refractory Engineering

segment continues to be buoyant.

The Directors are confident that the Group and Company will have

sufficient funds to continue to meet their liabilities as they fall

due for at least twelve months from the date of approval of the

financial statements and therefore have prepared the financial

statements on a going concern basis.

Note 5

Annual General Meeting

The Annual General Meeting will be held at 10.30 a.m. on 5th

October, 2022 at Crewe Hall, Weston Road, Crewe, Cheshire CW1

6UZ.

Note 6

ALTERNATIVE PERFORMANCE MEASURES

Measure 2022 2021

Gross profit (GBP'000) 42,704 39,001

Revenue (GBP'000) 144,108 131,231

Gross profit as percentage

of revenue (%) 29.6 29.7

-------------- --------------

Profit before tax (GBP'000) 19,941 16,514

Unrealised gain on 10

year interest rate swap

derivative (2,740) --

-------------- --------------

Trading profit (GBP'000) 17,201 16,514

-------------- --------------

Operating profit (GBP'000) 18,307 17,094

Capital employed (GBP'000) 145,095 130,572

Return on capital employed

(%) 12.6 13.1

-------------- --------------

Net debt (GBP'000) 29,785 17,431

Net assets attributable

to equity holders of

the parent(GBP'000) 115,310 113,141

Gearing (%) 25.8 15.4

-------------- --------------

Net profit attributable

to equity holders of

the parent (GBP'000) 12,980 12,494

Net assets attributable

to equity holders of

the parent(GBP'000) 115,310 113,141

Return on investment

(%) 11.3 11.0

-------------- --------------

Revenue (GBP'000) 144,108 131,231

Average number of employees 1,112 1,129

Sales per employee (GBP'000) 130 116

-------------- --------------

Annual post tax profit

(GBP'000) 13,620 13,006

Interest rate SWAP mark

to market net of tax

@ 19% (GBP'000) (2,219) --

Deferred tax rate change

(GBP'000) 2,012 --

Depreciation owned assets

(GBP'000) 6,202 5,696

Depreciation right-of-use

assets (GBP'000) 1,192 972

Amortisation and impairment

(GBP'000) 1,572 1,566

Exclude operating lease

depreciation (GBP'000) (508) (550)

-------------- --------------

Annual post tax profit

+ depreciation+amortisation

(GBP'000) 21,871 20,690

-------------- --------------

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FFFLFTEIFIIF

(END) Dow Jones Newswires

August 03, 2022 02:00 ET (06:00 GMT)

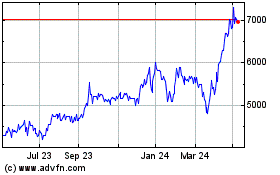

Goodwin (LSE:GDWN)

Historical Stock Chart

From Mar 2024 to Apr 2024

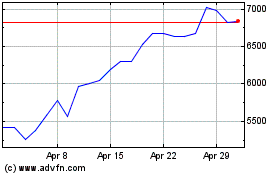

Goodwin (LSE:GDWN)

Historical Stock Chart

From Apr 2023 to Apr 2024