Gulf Keystone Petroleum Ltd (GKP) Operational, Corporate &

AGM Update 19-Dec-2022 / 07:00 GMT/BST Dissemination of a

Regulatory Announcement, transmitted by EQS Group. The issuer is

solely responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

19 December 2022

Gulf Keystone Petroleum Ltd. (LSE: GKP)

("Gulf Keystone", "GKP" or "the Company")

Operational, Corporate & AGM Update

Gulf Keystone, a leading independent operator and producer in

the Kurdistan Region of Iraq ("KRI"), today provides an

operational, corporate and AGM update.

Jon Harris, Gulf Keystone's Chief Executive Officer, said:

"Our leverage to strong oil prices, low-cost production base and

focus on capital discipline has led to significant cash flow

generation in 2022, enabling us to deliver sector leading dividends

of USD215 million, repay our USD100 million bond leaving us

debt-free and continue to invest in Shaikan Field production

growth.

2022 production is expected to be at the lower end of our 44,000

- 47,000 bopd guidance range, recently impacted by the temporary

shut-in of one well due to an isolated Electrical Submersible Pump

("ESP") electrical failure, which has just been worked over and

restarted. We are currently producing c.44,400 bopd as we gradually

ramp up production from both the restarted well and SH-16, which

was brought online earlier this month.

To drive production and cash flow growth, we are maintaining

drilling momentum, recently spudding SH-17 and subsequently

planning to drill SH-P. We are reviewing our 2023 work programme

with our partner and look forward to providing production, capex

and opex guidance in the new year.

Jaap Huijskes, GKP's Non-Executive Chairman, has expressed his

intention to retire from the Board following the 2023 AGM. I would

like to thank him for his outstanding contributions to the company

over the past five years and in particular his guidance during my

tenure."

Operational

-- Continued strong focus on safety, with no Lost Time Incident

("LTI") recorded for over 420 days

-- Gross average production in 2022 year to date of c.44,100

bopd; current production of c.44,400 bopd as at17 December 2022?

Production recently impacted by temporary shut-in of one well

caused by an isolated ESP electricalfailure ? Following a prompt

workover, the well has just been restarted and is gradually ramping

up. All otherwell ESPs continue to function without any issues ?

Ahead of installation of water handling facilities, we continue to

prudently manage our wells toavoid traces of water and optimise

production

-- Maintaining drilling momentum:? SH-16 drilled, completed and

brought online this month on schedule and on budget ? While the

SH-16 well has good productivity, production is currently

constrained due to the temporaryuse of a SH-12 flowline. We are

planning to further ramp up production following installation of a

dedicatedflowline into PF-2 in Q1 2023 ? SH-17, situated on the

same well pad as SH-16, was recently spudded with first production

targetedinto PF-2 in Q1 2023 ? Plan to drill SH-P, the next well in

the sequence, following completion of SH-17; SH-P will bedrilled

from the existing SH-9 well pad and will produce into PF-1 with

targeted start up in Q2 2023

-- Carefully managing ongoing equipment lead time and cost

pressures in a supply constrained market toprogress preparatory

work for the expansion of the production facilities, including

water handling capacityprocurement activities

Financial

-- Significant cash flow generation in 2022 year to date, with

USD450.4 million net to GKP received from theKurdistan Regional

Government ("KRG") for crude oil sales and revenue arrears

-- Record dividends paid in 2022 of USD215 million, representing

a sector-leading dividend yield of 41% basedon GKP's closing price

on 16 December 2022

-- Robust, debt-free balance sheet, with a cash balance of

USD116.9 million at 16 December 2022

Outlook

-- 2022 gross average production expected to be at lower end of

44,000 - 47,000 bopd guidance range,recently impacted by the

temporary shut-in of one well caused by an isolated ESP electrical

failure. The well wasrecently brought back online after a work over

and production is gradually being ramped up

-- 2022 net capital expenditure guidance of USD110-USD120

million unchanged, with additional costs related tothe drilling of

SH-17 offset by phasing of production facility expansion

procurement activities

-- 2022 gross Opex guidance of USD2.9-USD3.3/bbl unchanged

-- While timing of FDP approval remains uncertain, we continue

to engage with the Ministry of NaturalResources ("MNR") towards

project sanction and are progressing the tendering process for the

Gas Management projectthat will materially reduce emissions

-- We are currently in the process of agreeing the 2023 work

programme with our partner and look forward toproviding production,

capex and opex guidance in the new year

-- The Company is currently negotiating with the MNR to amend

the Shaikan Lifting Agreement, including achange in reference price

for Shaikan crude oil sales from Dated Brent to the local benchmark

KBT ("KurdistanBlend"), effective 1 September 2022. The final

outcome and impact on realised prices remain uncertain and

furtherupdates will be provided as appropriate

-- Assuming timely payment of invoices and strong oil prices, we

expect continued robust cash flowgeneration, which would provide

flexibility to continue to invest in the Shaikan Field and consider

furtherdistributions to shareholders, while preserving adequate

liquidity

Board changes

Jaap Huijskes, the Company's Non-Executive Chair, has expressed

his intention to retire from the Board and will not seek

re-election at the 2023 AGM. In line with our succession plan, we

are reviewing alternatives, including commencing a process to

appoint a new Non-Executive Chair with Mr Huijskes remaining as

Chair until the AGM to ensure a smooth transition. The Company

would like to thank Mr Huijskes for his leadership and guidance

over the past five years, a period which has seen significant

progress by the Company.

Update on Federal Iraqi Government & KRG dispute regarding

Kurdistan oil & gas assets

In our 2022 Half Year Results Announcement, we reported the

Iraqi Ministry of Oil had commenced proceedings in the Baghdad

Commercial Court against various International Oil Companies

("IOCs") operating in the KRI, including GKP, seeking to nullify

the Production Sharing Contracts ("PSCs") issued under the

Kurdistan Oil and Gas Law ("KROGL"). Since then, the Company has

learned from media reports that, on 23 October 2022, the Court

issued decisions in absentia against Gulf Keystone and two other

IOCs. Gulf Keystone did not have legal representation in the Court.

Media has also reported similar judgements issued against several

other IOCs.

The KRG continues to affirm that KROGL is validly constituted

and the PSCs issued are valid and in full force and effect. Media

reports indicate that high level political discussions are ongoing

between the KRG and the recently appointed Federal Iraqi Government

with a view to resolving the matter. The Company's operations in

the Shaikan Field are currently unaffected. However, the matter

continues to be closely monitored, including any potential impact

on the restrictions placed on the export of crude oil, service

contractors or any other parties by the Iraqi Ministry of Oil.

The Company is also aware of the ongoing arbitration case

between the Federal Government of Iraq and the Turkish Government

on the management of the Iraq to Turkey pipeline.

AGM update

At the Company's Annual General Meeting ("AGM") held on 24 June

2022, all resolutions were successfully passed. However,

resolutions 2 and 7, being the re-election of the Company's

Chairman and Chief Financial Officer, failed to attain the support

of 80% of the shareholders who voted. Voting turnout continued to

be low relative to prior years, with approximately 52% of the total

shareholder register voting. The Company continues to look at ways

to increase voting turnout at future general meetings.

Substantially all the votes against resolutions 2 and 7 were

from a single major shareholder, who voted against the re-election

of the same Directors at the 2021 AGM. The Company also notes that

the proxy agencies Glass Lewis and ISS were in favour of all

resolutions, including resolutions 2 and 7. In accordance with

Provision 4 of the 2018 UK Corporate Governance Code, the Board has

consulted with the single shareholder, and, as part of this

exercise, also consulted with the Company's other major

shareholders. Feedback received from the single shareholder

encompassed issues principally related to the Company's operational

progress, organisational structure and capital allocation.

The Board has carefully considered all feedback and has

addressed issues, to the extent possible or necessary. The

independent members of the Board continue to hold every confidence

in both the Chairman and Chief Financial Officer, recognising the

value and contribution each bring to the Company.

The Company will continue to engage with the major shareholder

in question and welcomes ongoing engagement and feedback from all

shareholders.

Enquiries:

Gulf Keystone: +44 (0) 20 7514 1400

Aaron Clark, Head of Investor Relations aclark@gulfkeystone.com

FTI Consulting +44 (0) 20 3727 1000

Ben Brewerton

GKP@fticonsulting.com

Nick Hennis

or visit: www.gulfkeystone.com

Notes to Editors:

Gulf Keystone Petroleum Ltd. (LSE: GKP) is a leading independent

operator and producer in the Kurdistan Region of Iraq. Further

information on Gulf Keystone is available on its website

www.gulfkeystone.com

Disclaimer

(MORE TO FOLLOW) Dow Jones Newswires

December 19, 2022 02:00 ET (07:00 GMT)

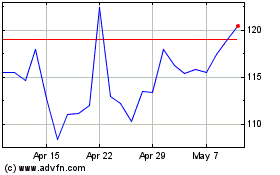

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Apr 2023 to Apr 2024