TIDMGOOD

RNS Number : 3819U

Good Energy Group PLC

01 April 2021

Good Energy Group PLC

("Good Energy" or "the Company")

Restructuring of renewable generation debt

Good Energy Group PLC (AIM: GOOD), the 100% renewable

electricity supplier and innovative energy services provider,

announces the restructuring of the financing on its renewable

generation asset portfolio to consolidate and simplify funding

facilities, that together with a strong net cash position gives the

Company greater capital flexibility going forwards.

Restructuring of generation assets financing

At the 30th June 2020, the latest balance sheet reporting date

prior to this restructuring, Good Energy had two secured bank loans

against its 50MW of wind and solar assets, comprising:

-- GBP5.1m secured against Good Energy's Delabole wind farm

financed by the Cooperative Bank ("Co-Op");

-- GBP33.2m secured against the rest of the solar and wind asset

portfolio, financed by funds managed by Gravis Capital Management

Limited ("Gravis").

Today's refinancing and restructuring consolidates the

generation assets into one portfolio that will be solely financed

by funds managed by Gravis and will amortise through to June 2035.

The cost of settling the Co-Op debt is de minimis.

Significant liquidity and cash flow benefits

Whilst headline gearing will not change on completion, the

restructuring and refinancing provide a number of real benefits to

Good Energy, both short term and long term.

Initially, it will provide GBP7.8m of unrestricted cash on

completion, of which:

o GBP4.7m relates to the release of various reserve accounts and

other restricted cash balances which form part of the existing

facilities;

o GBP3.1m of additional debt raised against the Delabole

windfarm, associated with mirroring the terms of Delabole in line

with the rest of the portfolio.

Longer term, the transaction also provides on-going improved

visibility of cash flows, with a rebalancing of the performance

covenants over the entire generation portfolio. This frees up

future cash generated by the generation portfolio to be utilised by

the Company.

The upfront cash provided, combined with existing strong levels

of cash on the balance sheet gives the Company the ability to

wholly repay Good Energy Bonds II. It is anticipated that this will

be completed during FY2022. At the end of December 2020, the

outstanding capital on Good Energy Bonds II was GBP16.8m, while

associated interest costs are GBP0.8m per annum.

Further Transaction Details

Today's refinancing and restructuring consolidates the

generation assets into one portfolio that will be solely financed

by Gravis through a revised facility of GBP39.8m and which will be

amortised to June 2035. Good Energy Generation Asset No. 1, a

wholly owned subsidiary of Good Energy, has entered into an Amended

and Restated Loan Facilities Agreement ("ARA LFA") with its

incumbent lender GCP Green Energy 1 Limited. In addition to the

restructuring of the existing facility and terms, the ARA LFA

provides Good Energy with an additional GBP7.1m in bank loans to

prepay its outstanding loan facility with the Cooperative Bank PLC

("Co-Op Facility"), whilst consolidating all generation assets

under one financing facility. The Co-Op Facility was previously

used to finance the 9MW Delabole windfarm on a standalone

basis.

Gravis is the investment advisor to GCP Infrastructure

Investments Limited, a FTSE 250 investment company listed on the

Main Market of the London Stock Exchange that focuses on

investments in debt secured against UK infrastructure projects.

Juliet Davenport, Founder and Chief Executive Officer of Good

Energy, said:

"This transaction provides the business with simplicity and

clarity over the funding of our high performing generation

portfolio and delivers greater capital flexibility and further

underpinning our balance sheet resilience.

We are really pleased with the underlying performance of the

group and look forward to building on these successes in 2021 as we

continue to invest for the future"

Good Energy was advised on the transaction by KPMG (financial),

Burgess Salmon (legal), PKF (tax) and TLT (property).

Gravis was advised on the transaction by CMS Cameron McKenna

Nabarro Olswang LLP (legal), K2 Management (technical) and PMC

Treasury (hedging).

Enquiries:

Good Energy Group PLC Email: press@goodenergy.co.uk

Juliet Davenport, Chief Executive Email: press@zap-map.com

Charles Parry, Investor Relations Phone: +44 (0) 7718

Luke Bigwood, Communications 671003

Investec Bank plc (Nominated Adviser Tel: +44 (0) 20 7597

and Joint Broker) 5970

Jeremy Ellis

Sara Hale

Canaccord Genuity Limited (Joint Broker) Tel: +44 (0) 20 7523

Henry Fitzgerald - O'Connor 4617

Georgina McCooke

Notes to editors:

About Good Energy www.goodenergy.co.uk

Good Energy is a generator and supplier of 100% renewable power

and an innovator in energy services. It currently owns two wind

farms, six solar farms and sources electricity from a community of

1,600 independent UK generators.

Since it was founded 20 years ago, the company has been at the

forefront of the charge towards a cleaner, distributed energy

system. Its mission is to support UK households and businesses

generate, store and share clean power.

Good Energy is recognised as a leader in this market, through

our green kite accreditation with the London Stock Exchange and as

a top rated Green energy supplier by Which?.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEASLFEEAFEFA

(END) Dow Jones Newswires

April 01, 2021 11:05 ET (15:05 GMT)

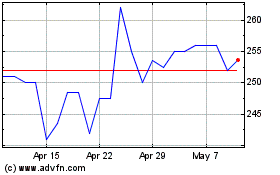

Good Energy (LSE:GOOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Good Energy (LSE:GOOD)

Historical Stock Chart

From Apr 2023 to Apr 2024