TIDMGRIT

RNS Number : 3545H

Global Resources Investment Tst PLC

03 December 2020

Market Abuse Regulation (MAR) disclosure

Certain statements in this announcement contain inside

information for the purpose of Article 7 of EU Regulation

596/2014.

Global Resources Investment Trust Plc

("GRIT" or the "Company")

Notice of General Meeting

Company Voluntary Arrangement

GBP125,893 Placing of Ordinary Shares

Issue of GBP100,000 Convertible Unsecured Loan Notes

1. Introduction

On 30 June 2020 the Company announced the suspension of trading

of its securities on the Main Market resulting from its failure to

publish by that date an audited annual report and financial

statements for the year ended 31 December 2019. At the same time

the Company announced that, subject only to the resumption in

trading of the Company's Ordinary Shares, it had conditionally

raised GBP167,858 through the issue of 8,392,902 Shares at a price

of 2p per share.

The Company's main remaining asset is its 25.4% shareholding in

Anglo-African Minerals PLC ('AAM') and the loans made to AAM, which

amount, with accumulated interest, to some $2.1 million. As

announced on 24 February 2020, TerraCom Limited, a mining company

listed in Australia ('ASX:TER'), itself announced that it had

executed what it described as a binding term sheet to acquire 100%

of AAM, subject to due diligence and regulatory approvals.

In an announcement made on 30 October, TerraCom stated that 'due

diligence on [AAM] has been significantly hampered...by

international travel restrictions brought about by the impacts of

COVID-19. However, as restrictions are now easing, members of

TerraCom's management team will be visiting the site in Guinea in

the coming weeks and will meet with potential contractors and

government officials to progress the project'. While this is

encouraging, at the time of writing it nevertheless remains unclear

whether the proposed sale of AAM to TerraCom will proceed and

therefore when or whether the Company will be able to realise its

investment in AAM or receive repayment of its loans to AAM.

The Board has therefore concluded that, in order to avoid the

need for a formal insolvency process, it is in the best interests

of the Company to renegotiate the terms of the conditional placing

which was announced on 30 June 2020 and for the Company to enter

into a Company Voluntary Arrangement ('CVA'). The Company's broker,

Peterhouse Capital Limited, has negotiated with the Placees of the

placing announced on 30 June 2020 a revised price of 1.5 pence per

share (instead of the previously agreed 2 pence) to raise

GBP125,893, subject only to approval by Creditors of the CVA ('CVA

Approval') and the passing by shareholders of the Resolutions. In

return, the Placees have waived their requirement for the current

suspension of trading in the Company's Ordinary Shares to be

lifted. Additionally, the Company will issue GBP100,000 Convertible

Unsecured Loan Notes ('CULNs'), again subject only to CVA Approval

and the passing of the Resolutions.

The proceeds of the Placing and the CULNs will allow the Company

to implement the CVA.

In order to issue the Placing Shares and enable the conversion

of the CULNs, the Company is seeking authority to issue and to

disapply statutory pre-emption rights for 8,392,902 Shares

(representing 20 per cent. of the issued share capital of the

Company as at 27 November 2020 (the latest practicable date prior

to the date of this document)) until the end of the Company's next

annual general meeting (at which the Company will seek renewal of

such authority).

A Circular has been posted to Shareholders and will shortly be

available on the National Storage Mechanism ("NSM"). This Circular

also seeks shareholders' approval for the CVA. A Notice convening

the General Meeting to be held at 11.00 a.m. on 21 December 2020,

at the offices of Peterhouse Capital Limited, 80 Cheapside, London

EC2V 6EE, to consider the Resolutions as set out at the end of this

Circular.

Shareholders should be aware that the Placing and the issue of

the CULNs are conditional upon CVA Approval and the passing of the

Resolutions. If either of these conditions is not satisfied, then

the Placing and the issuance of the CULNs will not proceed. In this

case the Company would then have insufficient working capital to

continue to trade as a going concern and, in the absence of any

other source of funding, the Board may have no alternative but to

place the Company into an insolvency process, probably

administration.

2. Background to and reasons for the CVA

The Company has creditors of GBP828,928. Due to the continuing

delay in completing a sale of its shares in AAM the Company has

insufficient funds to settle these Creditors as and when they fall

due.

The Board has concluded that, in order to preserve the Company

and avoid it trading insolvently, it should invite an insolvency

practitioner to propose to Creditors a CVA.

It is intended that, once a CVA has been agreed by Creditors and

endorsed by Shareholders, the following steps will be taken:

-- the Placing and the issue of CULNs are implemented;

-- an initial payment to creditors of an estimated 20 pence in the GBP is made;

-- new directors are appointed;

-- the existing directors resign;

-- the new Board raises sufficient additional funds to enable

the Company to carry on trading as a going concern;

-- the audit of the annual report and financial statements for

the year ended 31 December 2019 is completed and published;

-- the results for the six months ended 30 June 2020 are published; and

-- application is made to the FCA to lift the suspension of

trading in the Company's Ordinary Shares.

It is then anticipated that, whether or not the Company's shares

in AAM are sold and/or the loans repaid, the new Board will submit

to shareholders a plan for the recapitalisation of the Company and

its re-launch as an active investment trust. Whenever the sale of

AAM occurs, the proceeds from the sale and/or repayment of loans

will pass automatically under the terms of the CVA to the

supervisor of the CVA (the "Supervisor") and be applied by the

Supervisor to the payment of the remaining 80% of the amounts due

to Creditors, with any balance remaining being returned to the

Company.

3. Company Voluntary Arrangement

It is proposed that, on CVA Approval and the passing of the

Resolutions, the Company's Creditors will initially be paid an

estimated sum of 20 pence for every GBP1 of debt, with the

remaining balance, up to 100 pence, payable from the sale proceeds

of the Company's shares in AAM and/or by repayment by AAM of the

Company's loans to it.

The Directors have appointed Antony Batty of Antony Batty &

Company LLP to act as nominee (the "Nominee") in respect of the

proposal of the Directors for a CVA (the "CVA Proposal"). Mr Batty

has provided his consent to act as Nominee and, if the CVA Proposal

is approved, as Supervisor of the same, and his Nominee's Report

has been filed at Court as required.

A CVA requires the approval of 75 per cent. or more by value of

the creditors voting on the resolution in person or by proxy. It

also requires the approval of 50% or more by value of creditors who

are 'unconnected.' Once approved, the CVA binds all relevant

creditors who were entitled to vote, whether or not they were

present or represented at that meeting and so voted and whether or

not they actually received notice of the meeting.

A CVA also requires shareholder approval. The CVA Resolution in

the following Meeting Notice seeks that approval. It is being

proposed as an ordinary resolution and therefore requires the

approval of 50 per cent. by value of Shareholders present in person

or by proxy and voting on the CVA Resolution.

Approval by Creditors of the proposed CVA Proposal will be put

to a meeting of Creditors to be held at 10.30 a.m. on 21 December

2020 and, if approved by Creditors at that meeting, the CVA

Resolution will be put to Shareholders at a meeting to be held at

11.00 a.m. the same day.

For the avoidance of doubt, Shareholders will retain their

existing Ordinary Shares in the Company; and the CVA will not

result in any distribution being made to Shareholders of the

Company in their capacity as Shareholders.

A copy of the Directors' CVA Proposal incorporating the

Nominee's Report is available for download from the following

website: http://www.antonybatty.net/client-login.php access code

1976146269

Any Shareholder wishing to receive a paper copy of the proposal,

should contact Antony Batty on

020 7831 1234 , or email antonyb@antonybatty.com, or in writing

to Antony Batty, Anthony Batty & Company LLP, 3 Field Court,

London WC1R 5EF.

The CVA Proposal is conditional upon the approval of the

Resolutions, completion of the Placing and the issuance of the

CULNs.

Directors' participation in the CVA

The Directors, under the terms of their existing service

contracts and other arrangements, are currently owed in aggregate

GBP251,541. Under the terms of the CVA Proposal, the Directors are

entitled to make a claim for these contractual amounts owing to

them. Assuming all Creditors make a valid claim under the CVA

Proposal, the Directors will receive an initial payment of up to 20

pence in the GBP1 pari passu with all other creditors. Should fewer

of the Creditors make a valid claim under the CVA then the amount

issued to the Directors may increase.

The Placing and the CULNs

Peterhouse has conditionally raised GBP125,893 before expenses

through the Placing and GBP100,000 via the issue of the CULNs. The

Placing and the issue of the CULNs are conditional on CVA Approval

and approval of the Resolutions.

The proceeds of the Placing and the issuance of the CULNs will

allow the Company to implement the CVA Proposal.

Following completion of the Placing, the Placees will, in

aggregate, hold approximately 16.66 per cent. of the Enlarged Share

Capital.

The CULNs are convertible at 1.5p and repayable within 18

months.

Gledhow Investments PLC ("Gledhow") has conditionally subscribed

for 4,666,667 Placing Shares at the Placing Price, which will

equate to 9.27 per cent of the Enlarged Share Capital. Gledhow has

also conditionally subscribed for GBP80,000 of the CULNs. On

conversion of these CULNs into Ordinary Shares, Gledhow will hold

an aggregate 17.54 per cent of the Fully Enlarged Share Capital.

Gledhow is an investment vehicle currently quoted on the AQSE

Growth Market.

In addition, Phillip J Milton & Company Plc on behalf of its

discretionary clients has conditionally subscribed for 2,666,667

Placing Shares. Phillip J Milton & Company Plc's total direct

and indirect holding will increase to 25.28 per cent of the

Enlarged Share Capital (before conversion of the CULNs). As Phillip

J Milton & Company Plc is currently a 22.4% shareholder in the

Company, it is a Related Party under the Listing Rules. This

conditional placing is however deemed to be a smaller related party

transaction within the definition of Listing Rule 11.1.10R because

the percentage ratios are less than 5% but exceed the 0.25%

threshold as set out in LR 11.1.10R(1).

It is the intention that there will be Board changes following

the completion of the Placing and the issue of the CULNs.

Shareholders should be aware that the Placing and the issuance

of the CULNs are conditional upon the CVA Approval and the passing

of the Resolutions. If these conditions are not met, then the

Placing and issuance of the CULNs will not proceed, and the Company

would then have insufficient capital to continue trading as a going

concern; and, in the absence of any other source of funding, the

Board may have no alternative but to place it into a formal

insolvency process, probably administration.

Use of Proceeds

The proceeds of the Placing and the issue of the CULNs will be

used to settle outstanding Creditors under the terms of the CVA

Proposal. Following the full settlement of Creditors as part of the

proposed CVA Proposal (that is to say the estimated initial payment

of 20 pence in the GBP1 and subsequent settlement of the remaining

80 pence, assuming that the proceeds of sale of the Company's

shares in AAM and/or the repayment of the Company's loans to AAM

suffice), the Company will be free of debt.

General Meeting

The Notice convening the General Meeting at which the

Resolutions will be proposed is set out at the end of this

Circular. A summary of the Resolutions is set out below.

The Resolutions

Resolution 1 , which will be proposed as an ordinary resolution,

will, if passed, give the Directors the authority to allot up to a

further 8,392,902 new Shares, equal to 16.66 per cent. of the

Enlarged Share Capital.

Resolution 2 , which will be proposed as an ordinary resolution,

seeks approval for the CVA.

Resolution 3 , which will be proposed as a special resolution,

will, if passed, give the Directors the authority to allot all the

Shares over which they are granted authority pursuant to Resolution

1 for cash on a non-pre-emptive basis.

Action to be taken

Given the current Covid-19 pandemic, the Company and the Board

remind all Shareholders of the British Government's current

restrictions on gatherings of persons from different households and

the rules regarding social distancing. Unless and until the current

restrictions are relaxed or lifted, the Directors are asking all

Shareholders not to attend the General Meeting. Shareholders who

intend to attend the General Meeting in person in breach of any

stay at home measures, which are in place on the date of the

General Meeting, will not be admitted. Instead, you are asked to

vote by way of proxy in advance of the General Meeting and we

encourage you to appoint the chairman of the General Meeting as

your proxy with your voting instructions.

Shareholders will find a Form of Proxy enclosed for use at the

General Meeting. You are requested to complete and return the Form

of Proxy in accordance with the instructions printed thereon as

soon as possible.

To be valid, completed Forms of Proxy must be received by the

Company's registrars, Computershare Investor Services PLC, The

Pavilions, Bridgwater Road, Bristol, BS99 6ZY not later than 11.00

a.m. on 17 December 2020, being 48 hours (two working days) before

the time appointed for holding the General Meeting.

You are entitled to appoint a proxy to exercise all or any of

your rights to vote at the General Meeting instead of you. Your

attention is drawn to the notes to the Form of Proxy.

Recommendation

The Directors consider that the CVA Proposal, the Placing, and

the issuance of the CULNs are in the best interests of the Company,

its Creditors and the Shareholders as a whole.

In the absence of any other source of funding, the only

alternative course of action, in the opinion of the Board, would be

to place the Company into a formal insolvency process, probably

administration; and, while this might result in a similar outcome

for Shareholders as a CVA (in that an administrator would return

surplus funds to the Company in the same way as a CVA Supervisor

would), the Board is advised that the Company would very likely

lose its public listing; and the opportunity to create future value

for Shareholders would therefore be severely constrained.

The Directors therefore unanimously recommend that Shareholders

vote in favour of all the Resolutions.

Yours faithfully

James Normand

Chairman

The Directors accept responsibility for this announcement.

For further information, please contact:

Global Resources Investment Trust Tel: +44 (0) 203 198 2554

PLC

Martin Lampshire

---------------------------

Beaumont Cornish Ltd Tel: +44 (0) 207 628 3396

---------------------------

Roland Cornish

Felicity Geidt

---------------------------

Peterhouse Capital Limited Tel: +44 (0) 207 469 0930

---------------------------

Lucy Williams

Duncan Vasey

Heena Karani

DEFINITIONS

The following definitions apply throughout this document and the

Form of Proxy, unless the context requires otherwise:

AQSE Growth Market the primary market for unlisted securities

operated by the Aquis Stock Exchange

Board the board of Directors

CULNs the convertible unsecured loan note instrument for

GBP100,000 between the Company and the Noteholders

CULN Shares the 6,666,667 Ordinary Shares issued to the CULN

holders upon converting the CULNs

Company Global Resources Investment Trust plc

CREST the computerised settlement system operated by Euroclear

which facilitates the transfer of title to shares in uncertificated

form

Creditors the creditors of the Company

Creditors' Meeting the meetings of creditors to be convened at

10.30 a.m. on 21 December 2020 pursuant to the CVA

CVA a Company Voluntary Arrangement, pursuant to Part 1 of the

Insolvency Act 1986, details of which are set out in this document

and a proposal document available to Creditors and Shareholders

dated 30 November 2020 (the "CVA Proposal").

CVA Approval approval of the terms of the CVA Proposal at the

Creditors' Meeting and the General Meeting convened for such

purposes

CVA Resolution the resolution to approve the terms of the CVA

Directors the directors of the Company or any duly constituted

committee of the Board

Enlarged Share Capital the Issued Share Capital plus the Placing Shares

Euroclear Euroclear UK & Ireland Limited, being the operator

of CREST

Form of Proxy the form of proxy provided with this document for

use by Shareholders in connection with the General Meeting

Fully Enlarged Share Capital the Enlarged Share Capital plus the CULNs Shares

General Meeting the general meeting of the Company to consider

the Resolutions, convened for 21 December 2020 at 11.00 a.m, notice

of which is set out on page 10 of this document

Issued Share Capital 41,964,512 Ordinary Shares currently in issue

London Stock Exchange London Stock Exchange plc

Nominee or Supervisor Antony Batty of Antony Batty & Company LLP

Noteholders holders of the CULNs

Notice of General Meeting the notice of the General Meeting as

set out on page 8 of this document

Ordinary Shares ordinary shares of 0.1p each in the capital of

the Company

Placees a subscriber of the Placing Shares under the Placing

Placing the conditional placing of the Placing Shares

Placing Shares the 8,392,902 Ordinary Shares to be issued as

part of the Placing

Registrar Computershare Investor Services PLC

Resolutions the resolutions being proposed at the General Meeting

Shareholder a holder of Shares

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLLLBBLLBFBK

(END) Dow Jones Newswires

December 03, 2020 02:00 ET (07:00 GMT)

Grit Investment (LSE:GRIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

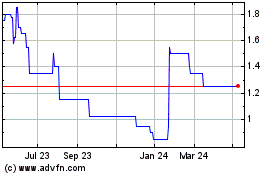

Grit Investment (LSE:GRIT)

Historical Stock Chart

From Apr 2023 to Apr 2024