TIDMGRP

RNS Number : 2589N

Greencoat Renewables PLC

28 January 2021

Greencoat Renewables PLC EGM Result

Dublin, London, 28 January 2021: Greencoat Renewables PLC

("Greencoat Renewables" or the "Company") the renewable

infrastructure company invested in euro-dominated assets, is

pleased to announce that at the Company's EGM held at 9.00 am

today, 28 January 2021, each of the Resolutions were duly passed

without amendment.

All resolutions as set out in the Notice of EGM were voted on by

way of a poll and the results were as follows:

In Favour

(including discretionary) Against Withheld*

Resolution Votes % Votes % Votes

1 446,711,124 100 5,900 0 10,347

2 446,710,924 100 5,900 0 10,547

3 446,711,124 100 5,900 0 10,347

*A vote withheld is not a vote in law and is therefore not

counted towards the proportion of votes "in favour" or "against"

the Resolution.

The full wording of the resolutions can be found below:-

SPECIAL BUSINESS

1. Special Resolution within the meaning of sections 4, 5 and 8

of the Migration of Participating Securities Act 2019

"WHEREAS:-

(a) the Company has notified Euroclear Bank by a letter dated 10

November 2020 of the proposal that the relevant Participating

Securities in the Company are to be the subject of the Migration,

in accordance with the Migration of Participating Securities Act

2019 (the "Migration Act");

(b) the Company has received a statement in writing from

Euroclear Bank dated 11 November 2020 (as required by section

5(6)(a) of the Migration Act) to the effect that the provision of

the services of Euroclear Bank's settlement system to the Company

will, on and from the Live Date, be in compliance with Article 23

of Regulation (EU) No 909/2014 of the European Parliament and of

the Council of 23 July 2014 (CSDR); and

(c) the Company has received the statement from Euroclear Bank

dated 11 November 2020 (as required by section 5(6)(b) of the

Migration Act) to the effect that following:

(i) such enquiries as have been made of the Company by Euroclear Bank, and

(ii) the provision of such information by or on behalf of the

Company, in writing, to Euroclear Bank as specified by Euroclear

Bank,

Euroclear Bank is satisfied that the relevant Participating

Securities in the Company meet the criteria stipulated by Euroclear

Bank for the entry of the Participating Securities into the

settlement system operated by Euroclear Bank.

IT IS HEREBY RESOLVED that this meeting approves of the Company

giving its consent to the Migration of the Migrating Shares to

Euroclear Bank's central securities depository (which is authorised

in Belgium for the purposes of CSDR) on the basis that the

implementation of the Migration shall be determined by and take

effect subject to a resolution of the board of directors of the

Company (or a committee thereof) at its discretion and provided

that, as part of the Migration, the title to the Migrating Shares

will become and be vested in Euroclear Nominees Limited being a

company incorporated under the laws of England and Wales with

registration number 02369969 ("Euroclear Nominees") acting in its

capacity as the trustee for Euroclear Bank for the purposes of the

Migrating Shares being admitted to the Euroclear System. It being

understood that:-

"Circular" means the circular issued by the Company to its

shareholders and dated 17 December 2020;

"Euroclear System" has the same meaning as defined in the

Circular;

"Live Date" has the same meaning as defined in the Circular;

"Migration" has the same meaning as defined in the Circular;

"Migrating Shares" has the same meaning as defined in the

Circular;

"Participating Securities" has the same meaning as defined in

the Circular; and

"relevant Participating Securities" means all Participating

Securities recorded in the register of members of the Company on

the Live Date."

2. Special Resolution for the purposes of the Companies Act 2014

"That, subject to the adoption of Resolution 1 in the Notice of

this meeting and subject to the board of directors of the Company

(or a committee thereof) adopting a resolution to implement the

Migration as described in Resolution 1, the Articles of Association

of the Company, which have been signed by the Chairman of this

Extraordinary General Meeting for identification purposes and which

have been available for inspection at the registered office of the

Company since the date of the Notice of this Extraordinary General

Meeting, be approved and adopted as the new Articles of Association

of the Company to the exclusion of, the existing Articles of

Association of the Company."

ORDINARY BUSINESS

3. Ordinary Resolution for the purposes of the Companies Act 2014

"That, subject to the adoption of Resolutions 1 and 2 in the

Notice of this meeting, the Company be and hereby is authorised

to:

(a) take any and all actions which the Directors, in their

absolute discretion, consider necessary or desirable to implement

the Migration and/or the matters in connection with the Migration

referred to in the Circular (including the procedures and processes

described in the EB Migration Guide (as amended from time to

time)); and

(b) appoint any persons as attorney or agent for the holders of

the Migrating Shares to do any and all things, including the

execution and delivery of all such documents and/or instructions as

may, in the opinion of the attorney or agent, be necessary or

desirable to implement the Migration and/or the matters in

connection with the Migration referred to in the Circular

(including the procedures and processes described in the EB

Migration Guide (as amended from time to time)) including:

(i) instructing Euroclear Bank and/or Euroclear Nominees to

credit the interests of the holders of the Migrating Shares in the

Migrating Shares (i.e. the Belgian Law Rights representing the

Migrating Shares to which such holder was entitled) to the account

of the CREST Nominee (CIN (Belgium) Limited) in the Euroclear

System, as nominee and for the benefit of the CREST Depository (or

the account of such other nominee(s) of the CREST Depository as it

may determine);

(ii) any action necessary or desirable to enable the CREST

Depository to hold the interests in the Migrating Shares referred

to in sub-paragraph (i) above on trust pursuant to the terms of the

CREST Deed Poll or otherwise and for the benefit of the holders of

the CREST Depository Interests ("CDIs") (being the relevant holders

of the Migrating Shares);

(iii) any action necessary or desirable to enable the issuance

of CDIs by the CREST Depository to the relevant holders of the

Migrating Shares, including any action deemed necessary or

desirable in order to authorise Euroclear Bank, the CREST Nominee

and/or any other relevant entity to instruct the CREST Depository

and/or EUI to issue the CDIs to the relevant holders of the

Migrating Shares pursuant to the terms of the CREST Deed Poll or

otherwise; and

(iv) the release by the Company's registrar, the secretary of

the Company and/or EUI of such personal data of a holder of

Migrating Shares to the extent required by Euroclear Bank, the

CREST Depository and/or EUI to effect the Migration and the issue

of the CDIs;

It being understood that capitalised terms used in this

Resolution shall have the meaning given to them in the circular

issued by the Company to its shareholders on 17 December 2020."

T he full text of each resolution and a summary of proxy votes

received will shortly be available on the Company's website and

will also be submitted to the National Storage Mechanism for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

---S ---

For further information on the Announcement, please contact:

Greencoat Renewables PLC: +44 20 7832 9400

Bertrand Gautier

Paul O'Donnell

Tom Rayner

Davy (Joint Broker, Nomad and

Euronext Growth Adviser) +353 1 6796363

Fergal Meegan

Ronan Veale

Barry Murphy

RBC (Joint Broker) +44 20 7653 4000

Matthew Coakes

Duncan Smith

Elizabeth Evans

FTI Consulting (Media Enquiries) +353 1 765 0886

Jonathan Neilan

Melanie Farrell

About Greencoat Renewables PLC

Greencoat Renewables PLC is an investor in euro-denominated

renewable energy infrastructure assets. Initially focused solely on

the acquisition and management of operating wind farms in Ireland,

the Company is now also investing in wind and solar assets in

certain other Northern European countries with stable and robust

renewable energy frameworks. It is managed by Greencoat Capital

LLP, an experienced investment manager in the listed renewable

energy infrastructure sector.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROMSESFLAEFSELF

(END) Dow Jones Newswires

January 28, 2021 10:00 ET (15:00 GMT)

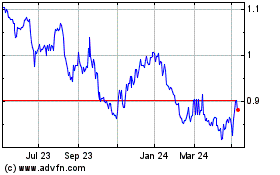

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

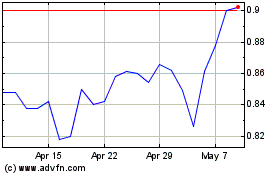

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Apr 2023 to Apr 2024