TIDMGTC

RNS Number : 0363S

GETECH Group plc

12 March 2021

12 March 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU 596/2014) PURSUANT TO THE MARKET

ABUSE (AMMENT) (EU EXIT) REGULATIONS 2018 ("MAR"). IN ADDITION,

MARKET SOUNDINGS (AS DEFINED IN MAR) WERE TAKEN IN RESPECT OF

CERTAIN OF THE MATTERS CONTAINED IN THIS ANNOUNCEMENT, WITH THE

RESULT THAT CERTAIN PERSONS BECAME AWARE OF SUCH INSIDE

INFORMATION, AS PERMITTED BY MAR. UPON THE PUBLICATION OF THIS

ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH

PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION OF INSIDE

INFORMATION.

Getech Group PLC

("Getech" or the "Company")

Conditional Placing and Subscription to Raise GBP6.0 million

Open Offer to raise up to an additional GBP0.25 million

and

Notice of General Meeting

Getech, a provider of data, knowledge and software products to

the energy industry, is pleased to announce that it has completed a

conditional Placing and Subscription to raise approximately GBP6.0

million (before expenses) by way of the issue of 27,272,728 Placing

and Subscription Shares in two tranches at an Issue Price of 22

pence per new Ordinary Share.

In addition to the Placing and Subscription, the Company is

launching an Open Offer to allow all Qualifying Shareholders to

subscribe for new Ordinary Shares at the Issue Price and to raise

up to approximately GBP0.25 million (before expenses) on the basis

of 1 new Ordinary Share for every 33 Existing Ordinary Shares held

on the Record Date of 10 March 2021.

Highlights

-- Placing and Subscription with new and existing institutional

investors to raise GBP6.0 million (before expenses) to facilitate

diversified growth in areas important to the delivery of a global

Energy Transition.

-- Open Offer to Qualifying Shareholders to raise up to GBP0.25 million (before expenses).

-- The Issue Price of 22 pence represents a 12% discount to the

closing mid-market price on AIM of 25 pence per Ordinary Share on

11 March 2021, being the last dealing day prior to the date of this

announcement.

-- The net proceeds of the Placing and Subscription and Open

Offer will be used by the Company to:

- invest in its core products and services to enable it to add

value to a range of commercial applications in the hydrogen, mining

and geothermal sectors;

- develop established partnerships that can add new content to

existing products, and new customer solutions that are in

development;

- take advantage of opportunities to leverage its offering

through asset exposure, particularly in hydrogen; and

- strengthen the Company's balance sheet in order to allow it to

maintain its baseline of investment in its petroleum products and

services and undertake a broad and tax-efficient programme of

R&D innovation to identify and target additional areas of

opportunity in the Energy Transition.

-- The Company has, on 11 March 2021, exercised its option to

acquire the entire issued share capital of H2 Green, with such

acquisition conditional only on the approval of the Resolution by

Shareholders at the General Meeting and the Placing Agreement not

being terminated prior to that date.

-- Senior management participation and ongoing alignment

demonstrated through the participation of Jonathan Copus, CEO of

Getech, in the Subscription and an amendment to the terms of the H2

Green Option prior to exercise increasing the equity component of

consideration payable to the CEO and COO of H2 Green by GBP40,000,

reflecting their commitment to Getech.

The Placing and Subscription and Open Offer are conditional,

inter alia, upon the approval of the Resolution by Shareholders at

the General Meeting which is scheduled to be held at 11.00 a.m. on

30 March 2021 at the offices of the Company, at Kitson House,

Elmete Hall, Elmete Lane, Leeds LS8 2LU.

A Circular containing the Notice of Meeting to approve a

resolution authorising the allotment of up to 28,411,019 new

Ordinary Shares (being the maximum required for the purposes of the

Placing and Subscription Shares and the Open Offer Shares) and for

such shares to be allotted on a non-pre-emptive basis is expected

to be published by the Company and sent to Shareholders later

today, together with, in the case of Qualifying Shareholders, the

Application Form. In accordance with the Stay at Home Order

relating to the containment and control of COVID-19, Shareholders

will not be able to attend the General Meeting in person. The

Circular contains details as to how Shareholders may raise

questions in advance of the General Meeting and vote on the

Resolution by proxy. Forms of proxy for use at the General Meeting

are not being posted with the Circular. Instead, instructions are

set out in the Notice of Meeting to enable Shareholders to register

to vote electronically. Shareholders may request a paper form of

proxy from the Registrar, Link Group if they do not have access to

the Internet.

A copy of the Circular will be available on the Company's

website at www.getech.com. The attention of Shareholders is drawn

to the letter from the Chairman of the Company that is set out in

the Circular and which contains, amongst other things, the

Directors' unanimous recommendation that Shareholders vote in

favour of the Resolution to be proposed at the General Meeting.

Further details of the Placing and Subscription and the Open

Offer, together with the expected timetable, are set out in the

extract from the Circular below.

Jonathan Copus, CEO of Getech Group Plc, commented:

"We are delighted by the support we have received from new and

existing shareholders. The combination of a Placing and

Subscription with institutional and other investors alongside an

Open Offer both broadens our shareholder base while allowing all

shareholders the opportunity to participate. We look forward to

utilising the net proceeds to execute multiple growth

opportunities, which we have identified through a methodical and

balanced programme of business development.

These growth opportunities, with particular focus on the

hydrogen, mining and geothermal sectors, reflect the changing shape

of the global primary energy mix. This Energy Transition is

occurring at an accelerated pace, which places Getech's customers

in a new commercial landscape - one that is underlain by a web of

complex location-based decision making. Getech's products and

services can add significant value to this landscape and we are

excited by the commercial opportunity that lies ahead of us."

Getech Group plc

Jonathan Copus, Chief Executive Tel: 0113 322 2200

Cenkos Securities plc

Neil McDonald / Pete Lynch (Corporate Finance) Tel: 0207 397 8900

Michael Johnson / Julian Morse (Sales)

Camarco

Georgia Edmonds / James Crothers / Ollie Head Tel: 020 3781

8331

Notes to editors:

Getech (AIM: GTC) has a well-established position within the

global energy market, assisting clients with its unique combination

of products and services, that utilise the Group's sub-surface

skills and geospatial design and implementation capabilities

alongside a deep knowledge and understanding of how to deploy

data.

The Company is leveraging its strong market position, utilising

its existing expertise, and targeting additional commercial

opportunities, to de-risk and accelerate the global transition to

renewable sources of energy while strengthening its existing and

well-established business.

Getech is listed on the AIM market of the London Stock Exchange.

For further information, please visit www.getech.com

1. INTRODUCTION

The Company announces a conditional placing and subscription to

raise approximately GBP6.0 million (before expenses) by way of the

issue of 27,272,728 Placing and Subscription Shares in two tranches

at the Issue Price.

In addition to the Placing and Subscription, in order to provide

Shareholders with an opportunity to participate in the proposed

issue of new Ordinary Shares, the Company is providing all

Qualifying Shareholders the opportunity to subscribe at the Issue

Price, payable in full on acceptance, for an aggregate of 1,138,291

Open Offer Shares, to raise up to approximately GBP0.25 million

before expenses, on the basis of 1 new Ordinary Share for every 33

Existing Ordinary Shares held on the Record Date.

The Placing and Subscription and Open Offer are conditional,

inter alia, upon the Shareholders passing the Resolution to be

proposed at the General Meeting. Accordingly, the Circular will

include notice of the General Meeting which will be held at 11.00

a.m. on 30 March 2021 at the offices of the Company, at Kitson

House, Elmete Hall, Elmete Lane, Leeds LS8 2LU.

The purpose of this announcement is, amongst other things, to

explain the background to and reasons for the Placing and

Subscription and Open Offer and to explain why the Board believes

that they will promote the growth and success of the Company for

the benefit of the Shareholders as a whole, and to seek Shareholder

approval to the passing of the Resolution at the General

Meeting.

The Circular also contains the Directors' recommendation that

Shareholders vote in favour of the Resolution. Notice of the

General Meeting at which the Resolution will be proposed, is set

out at the end of the Circular.

2. BACKGROUND TO AND REASONS FOR THE PLACING AND SUBSCRIPTION AND OPEN OFFER

Introduction

The global primary energy mix is changing and the pace of this

change is accelerating. This Energy Transition places Getech's

customers into a new commercial landscape, one that is underlain by

a web of complex location-based decision making. As a result, new

growth opportunities are emerging for Getech to deploy its skills

and technologies with both existing and new customers.

The Board believes that Getech's approach to the Energy

Transition is methodical and balanced. The Group has identified the

hydrogen, mining, and geothermal sectors, in particular, as having

material growth potential where Getech can unlock value. With a

well-defined growth plan in each focus sector, Getech is now

working to deliver a step change in its diversification, funded by

the Placing and Subscription and Open Offer.

The Getech Group

Getech provides products and services that commercialise its

expertise in the development, application and deployment of the

earth sciences and geospatial technology.

To date, the Group has principally used these skills to build

and sell data, software, and analytical products to petroleum

market customers. These are used by a blue-chip list of global

customers to locate and improve the management of their energy and

natural resource assets.

Through these activities, Getech grew its annually-recurring

revenue by 53 per cent. between 2017 and 2019. In the same period,

the conversion of annual contracts into multi-year contracts

expanded Getech's orderbook by 197 per cent. When combined with a

strong culture of cost management which saw total costs lowered by

42 per cent. between 2016 and 2019, this has enhanced

profitability, and Getech built net cash each year between 2016 and

2019.

From the foundation of increasing net cash in the three years

prior to 2020 Getech has provided downside protection. In 2020,

despite volatility in Getech's projects and data business lines,

the Group's orderbook, annually recurring revenue and customer

relationships have all proved robust. Getech retains a strong

balance sheet, which is further strengthened by the asset value of

Kitson House in Leeds.

Throughout 2020 Getech has remained focussed on its strategy to

grow and diversify its commercial activities and this has

accelerated a number of partnerships and opportunities, which

Getech now looks to support with new funding.

Strategy for diversified growth in focus areas

Getech's products and services can already add value to a range

of commercial applications in the hydrogen, mining and geothermal

sectors. To maximise impact, these products and services require

investment to tailor them to new markets. Getech also intends to

recruit key domain experts to strengthen business development and

extend the Group's sales reach.

Getech has established partnerships that can add new content to

existing products, and new customer solutions are in development.

Through this work, Getech has also identified opportunities to

leverage its offering through asset exposure.

Getech intends to deploy the net proceeds of the Placing and

Subscription and Open Offer to address the opportunities outlined

below.

(a) Hydrogen

Getech's skills and technologies map closely to the hydrogen

economy and a number of the Group's petroleum customers are making

significant hydrogen investments. Geoscience knowledge is essential

to both carbon capture and the geological seasonal storage of

hydrogen. Business opportunities also exist in the spatial

establishment of the infrastructure and value chains that are

needed to deliver the hydrogen economy.

As announced recently, Getech has entered into an exclusive

strategic partnership with H2 Green, which is focused on

establishing a national network of large-scale hydrogen production,

storage, and retail facilities.

Getech is leveraging its expertise through the application of

complex geospatial analytics to help H2 Green locate and build this

hydrogen network. The partnership's goals are to provide commercial

transport consumers with supply confidence at lower production

cost, whilst also establishing a national strategic hydrogen

reserve. The parties are also collaborating on various new product

ideas and optimisation services with the aim of helping customers

commence their transition to net zero.

The Company has the benefit of an exclusive option to acquire H2

Green for a total consideration of up to GBP1 million. Getech has

now exercised the H2 Green Option pursuant to the terms of a call

option notice dated 11 March 2021 and will, conditional only on the

approval of the Resolution by Shareholders at the General Meeting

and the Placing Agreement not being terminated prior to that date,

acquire the entire issued share capital of H2 Green prior to First

Admission. Completion of the acquisition of H2 Green will trigger

the payment of the first two instalments of the consideration

payable to the H2 Green Shareholders under the H2 Green Option,

totalling GBP250,000. Of this amount, GBP196,250 (78.5 per cent.)

will be satisfied through the issue of the Consideration Shares at

the Issue Price with the remaining GBP53,750 paid in cash. This

represents a GBP40,000 reduction in the cash component, and a

GBP40,000 increase in the equity component of the consideration

provided for under the original terms of the H2 Green Option. The

increased equity weighting has been requested by the H2 Green

Shareholders and reflects their commitment to Getech. The remaining

payment terms are structured around commercial and financial

performance milestones and a material equity component will further

align the H2 Green Shareholders with Getech shareholders.

Getech and H2 Green's work has advanced significantly with the

signature of a Memorandum of Understanding ("MoU") between H2 Green

and SGN Commercial Services ("SGN"), which is a part of the SGN

Group, one of the UK's largest gas network operators.

The MoU is focused on the regeneration and redevelopment of

SGN's extensive land portfolio to create green hydrogen hubs to

facilitate hydrogen generation, storage and retail for commercial

transport customers (e.g buses, HGVs, trains). An initial focus

list of 30 potential hydrogen hub asset locations has been agreed,

and in a UK first, the parties are exploring the feasibility for

green hydrogen, which would be produced on site, to be stored in

redundant gas holders. The agreement also provides SGN and

Getech/H2 Green a scalable exposure to a high-value network

opportunity in an exciting growth market.

H2 Green's strategy is structured around the creating of a

holding company with multiple underlying site-specific operating

companies in respect of each hub. Capital investment would be

raised at the operating company level, potentially from different

sources, with H2 Green retaining a carried interest in that

operating entity. This model scales rapidly through the planned

establishment of a regional network of hydrogen hubs, which could

be further built out both nationally and internationally. Following

the Company's exercise of the H2 Green Option, as described above,

the increased funding available through the Placing and

Subscription and Open Offer will allow Getech to progress hub

locations to the point of asset-level investment and construction,

whilst also maximising the Group's exposure to this significant

opportunity.

Getech's proposed acquisition of H2 Green demonstrates Getech's

adaptability and the ambition, scope and materiality of the Group's

zero-carbon business development activities. Scoping economics

indicate that each hydrogen hub has the potential to generate

multi-million-pound annual EBITDA.

This partnership with H2 Green provides Getech shareholders with

a potential path to capturing transformative asset value and

provides a platform from which Getech plans to build out into

related areas of the hydrogen economy.

(b) Mining

The technologies and infrastructure required to deliver a low

carbon future rely heavily on metals and minerals. Meeting this

demand is a significant challenge for the metals and mining

industries.

Getech already counts a number of mining customers in its client

base and these currently account for c.7 per cent. of Group

revenue. These customers use Getech's gravity and magnetic data and

its geoscience and geospatial technology services to help identify,

predict, and rank potential sites for new deposits.

Getech's intention is to expand its footprint in this market,

targeting a multi-million pound revenue opportunity. Key to

delivering this is to align Getech's 'Globe' product to the needs

of mineral explorers.

Globe already comprises many essential components that assist in

targeting giant mineral deposits, but its software interface and

workflows are designed for petroleum customers. However, in the

last 18 months Globe has been adopted by a global minerals major

and presentation of their work has driven sales interest from other

mining companies.

To capture this commercial potential requires investment to

enhance Globe's value offering to mining customers. This will

include: a focus on deeper Earth processes, the extension of

Globe's plate model further back in time, the update of Globe's

palaeoenvironment data and an expansion of Globe's validation to

include mineral occurrences and related key data.

To capture the full value of this work Getech intends to build

its team - adding domain expertise and extending the Group's sales

network - and has established commercial partnerships with

companies which provide access to fresh, exciting and valuable

content.

The work required to position Globe as an essential tool for

mining will also in part bring value to existing petroleum

customers and so the Group expects this investment to both expand

Getech's reach into mining and strengthen its offering to Globe's

current customers.

(c) Geothermal

Heat from the Earth's interior can be harvested to provide a

stable and predictable source of baseload energy. This is an

advantage over key sources of renewable energy, such as wind and

solar, which are variable in nature. With the petroleum majors

poised to make their biggest geothermal investments in 30 years,

Getech is well positioned to catch this rising wave of

investment.

Getech already has products that add value to geothermal

companies - its gravity and magnetic data are an essential tool for

imaging and modelling the structure of the Earth's crust, and

Getech has already developed global heat maps for its petroleum

customers. These products combine with Getech's geoscience and

geospatial services to provide valuable prospecting tools for

geothermal exploration.

By integrating these products and services Getech is developing

a new customer 'solution' that is branded Heat Seeker. This is

positioned as a complete solution for global geothermal

prospectivity analysis and site selection. Getech intends to invest

further in the development and promotion of this solution, and to

accelerate its commercialisation through the recruitment of domain

experts.

Through these activities, Getech targets a multi-million-pound

market opportunity - targeting data sales and recurring

license-based revenue. Getech is also exploring the potential to

enhance the returns that it can generate, by capturing asset

exposures - a commercial model similar in nature to H2 Green.

(d) Balance sheet strengthening

In 2020, Getech has managed its exposure to the COVID-19

business environment by striking a balance between capital

preservation, preserving the capacity to deliver Getech's orderbook

and delivery across a broad front of business development. However,

the Group's net cash position has eroded, and a component of the

net proceeds of the Placing and Subscription and Open Offer will be

used to strengthen this.

From this position, Getech's intention is to maintain its

baseline of investment in its petroleum products and services and

undertake a broad and tax-efficient programme of R&D innovation

to identify and target additional areas of opportunity in the

Energy Transition.

3. CURRENT TRADING

Operational update

2020 was dominated by the COVID-19 pandemic. For Getech this

changed our working practices and led to significant reductions to

customer budgets. It was also Getech's busiest year yet in terms of

product releases and service enhancements. These projects were

delivered on time and to cost.

Getech has maintained a full programme of business development -

focused on the Group's strategy to leverage its skills and

technologies in support of the Energy Transition. This work has

identified the hydrogen, mining, and geothermal sectors as having

material growth potential, where Getech can unlock value for both

existing and new customers.

Revenue and forward sales

In 2020, petroleum companies cut their total spending by c.35

per cent., creating an unprecedented and challenging trading

environment. Despite this, Getech won new customers and extended

licence agreements and service contracts. As a result, Getech's

orderbook, annually recurring revenue and customer relationships

all proved robust. In contrast, revenue from short duration

projects and associated sales of data was impacted as customers

reduced their spend on these items.

Based on unaudited management accounts, revenue for the 12

months to 31 December 2020 is expected to total c.GBP3.6m (2019:

GBP6.1m). In the period, Getech closed additional sales that

convert to revenue after 31 December 2020. These replenished the

Group orderbook, which at 31 December 2020 is expected to total

GBP2.7 million (GBP2.9 million 30 June 2020; GBP3.1 million 31

December 2019).

A significant portion of this orderbook is built from recurring

contracts. At 31 December 2020 Getech's Annualised Recurring

Revenue is expected to total GBP2.1 million (GBP2.2 million 30 June

2020; GBP2.3 million 31 December 2019).

Costs, EBITDA and Getech cash cycle

With the duration of the pandemic unknown, Getech took steps in

April to lower monthly costs by c.26 per cent. (from 1 May).

Adjusted for GBP0.1 million of restructuring costs, and GBP0.1

million of H2 Green business development costs, Getech's cost base

is expected to total c.GBP5.1 million(1) (2019: GBP6.4m).

The Group anticipates a small drop in Gross Margins for the year

(2019: 58 per cent.) and a small adjusted EBITDA loss (2019: GBP0.9

million profit, adjusted for exceptional items).

At the end of H1 2020 Getech's cash balance was GBP2.8m. Across

H2 2020, this balance was largely protected by the cost actions

detailed above. This however is obscured by short-term year-end

'Covid' delays to receivables and customer requests to defer

invoicing to early 2021. Inclusive of late cash receipts of GBP0.2m

and deferment requests of GBP0.3m, the Group cash balance moved to

GBP2.2m at the year end. These transient year-end effects to the

timing of cash flows were largely resolved in January 2021.

(1) Excluding restructuring costs and H2 Green business

development costs.

Outlook

COVID-19 remains a source of business uncertainty but the

potential for vaccines to ease lockdowns has driven a significant

recovery in energy prices, with Brent crude rising to c.US$69/bbl

on 5 March 2021, a threefold increase from its April 2020 low. With

customer confidence fragile, we remain focused on building our

orderbook, managing costs and delivering diversification.

At 31 December 2020 several significant license renewals and

tender/service discussions were at an advanced stage of

negotiation. Getech is focused on successfully concluding these

discussions, which would build orderbook and/or expand recurring

revenue. Getech is also exploring innovative new ways to

commercialise its data - the aim being to increase the

predictability of data sales.

In January, the announcement of Getech's hydrogen partnership

with H2 Green marked a significant step in the Group's

diversification work. The exercise of the H2 Green Option, as

described in paragraph 2(a) above, demonstrate the ambition, scope

and materiality of Getech's business development activities.

In line with these initiatives, Getech has recently appointed

Richard Bennett as Chairman Designate. Richard brings extensive

listed company experience, with a strong track-record growing

technology and clean energy companies. This is the first step in a

process to align Getech's Non-Executive expertise with the

Company's strategy of leveraging our skills and technologies to

support the Energy Transition.

4. DETAILS OF THE PLACING AND SUBSCRIPTION AND THE PLACING AGREEMENT

Under the Placing and Subscription, the Company has

conditionally raised approximately GBP6.0 million (before expenses)

through a placing of 27,272,728 new Ordinary Shares at the Issue

Price with institutional and other investors, including 45,000 new

Ordinary Shares conditionally subscribed for by Jonathan Copus

pursuant to the Subscription. The Company has entered into a

Placing Agreement with Cenkos under which Cenkos has agreed to use

its reasonable endeavours to procure Placees for the First Placing

Shares and Second Placing Shares at the Issue Price. The Placing

and Subscription has not been underwritten.

The Placing and Subscription Shares will represent approximately

41 per cent. of the Enlarged Issued Share Capital following Second

Admission. The Issue Price represents a discount of approximately

12 per cent. to the closing mid-market price on AIM of 25 pence per

Ordinary Share on 11 March 2021, being the last dealing day prior

to the date of this announcement.

The Placing and Subscription is being conducted in two tranches

and will be subject to the approval of Shareholders to allot the

Placing and Subscription Shares and to disapply pre-emption rights

in respect of such allotment at the General Meeting.

The first tranche of the Placing and Subscription will raise

approximately GBP3.95 million (before expenses) by the issue of

17,943,952 new Ordinary Shares (being the First Placing Shares) at

the Issue Price. The First Placing is conditional upon, inter alia,

First Admission becoming effective at 8.00 a.m. on 31 March 2021

(or such later date as the Company and Cenkos may agree, being not

later than 8.00 a.m. on 30 April 2021). The First Placing is not

conditional on completion of the Second Placing or the Subscription

occurring so there is a possibility that the First Placing may

complete and the First Placing Shares are issued but that the

Second Placing and the Subscription do not complete.

The second tranche of the Placing and Subscription will raise

approximately GBP2.05 million (before expenses) by the issue of

9,283,776 new Ordinary Shares (being the Second Placing Shares) and

45,000 new Ordinary Shares (being the Subscription Shares) at the

Issue Price. The Second Placing and the Subscription are

conditional upon, inter alia, First Admission becoming effective.

In addition, the Second Placing and the Subscription are

conditional, inter alia, on Second Admission becoming effective at

8.00 a.m. on 1 April 2021 (or such later date as the Company and

Cenkos may agree, being not later than 8.00 a.m. on 30 April

2021).

Pursuant to the Subscription, Jonathan Copus, Getech's Chief

Executive Officer, has conditionally agreed to subscribe for 45,000

Subscription Shares at the Issue Price. Following the Subscription,

Jonathan Copus will hold 45,000 Ordinary Shares representing 0.07

per cent. of the Enlarged Issued Share Capital. In addition,

Jonathan Copus holds 1,400,000 options over new Ordinary Shares

exercisable at 24.5 pence per share and 350,000 options over new

Ordinary Shares exercisable at 35 pence per share.

The Placing Agreement contains, inter alia, customary

undertakings and warranties given by the Company in favour of

Cenkos as to the accuracy of information contained in the Circular

and other matters relating to the Company. Cenkos may terminate the

Placing Agreement in specified circumstances prior to Admission,

including, inter alia, for material breach of the Placing Agreement

by the Company or of any of the warranties contained in it and in

the event of a force majeure event occurring.

The Placing and Subscription Shares will be issued credited as

fully paid and will rank pari passu in all respects with the

Existing Ordinary Shares, including the right to receive dividends

and other distributions declared on or after the date on which they

are issued.

It is expected that CREST accounts will be credited on the

relevant day of Admission and that share certificates (where

applicable) will be dispatched within 10 Business Days of each

Admission.

Application will be made to the London Stock Exchange for the

Placing and Subscription Shares to be admitted to trading on AIM.

It is anticipated that First Admission will become effective and

that dealings in the First Placing Shares will commence at 8.00

a.m. on 31 March 2021 and that Second Admission will become

effective and dealings in the Second Placing Shares, the

Subscription Shares and the Open Offer Shares will commence at 8.00

a.m. on 1 April 2021.

5. DETAILS OF THE OPEN OFFER

The Company is proposing to raise up to approximately GBP0.25

million before expenses under the Open Offer. Up to 1,138,291 new

Ordinary Shares are available to Qualifying Shareholders pursuant

to the Open Offer at the Issue Price, payable in full on

acceptance. Any Offer Shares not subscribed for by Qualifying

Shareholders will be available to Qualifying Shareholders under the

Excess Application Facility. Qualifying Shareholders may apply for

Open Offer Shares under the Open Offer at the Issue Price on the

following basis:

1 Offer Share for every 33 Existing Ordinary Shares

and so in proportion for any number of Existing Ordinary Shares

held on the Record Date.

Entitlements of Qualifying Shareholders will be rounded down to

the nearest whole number of Open Offer Shares. Fractional

entitlements which would otherwise arise will not be issued to the

Qualifying Shareholders but will be made available under the Excess

Application Facility. The Excess Application Facility enables

Qualifying Shareholders to apply for Excess Shares in excess of

their Open Offer Entitlement.

Not all Shareholders will be Qualifying Shareholders.

Shareholders who are located in, or are citizens of, or have a

registered office in certain Restricted Jurisdictions will not

qualify to participate in the Open Offer.

Application has been made for the Open Offer Entitlements to be

admitted to CREST. It is expected that such Open Offer Entitlements

will be credited to CREST on 16 March 2021. The Open Offer

Entitlements will be enabled for settlement in CREST until 11.00

a.m. on 29 March 2021. Applications through the CREST system may

only be made by the Qualifying CREST Shareholder originally

entitled or by a person entitled by virtue of bona fide market

claims. Payment for the Open Offer Shares must be made in full on

application. The latest time and date for receipt of completed

Application Forms or CREST applications and payment in respect of

the Open Offer is 11.00 a.m. on 29 March 2021.

The Open Offer is conditional on the following:

a. the Resolution being passed at the General Meeting;

b. the Placing Agreement not being terminated prior to Second

Admission and becoming unconditional in all respects; and

c. Admission of the Open Offer Shares becoming effective on or

before 8.00 a.m. on 1 April 2021 (or such later date as the Company

and Cenkos may agree, being not later than 30 April 2021).

Accordingly, if the Placing Agreement conditions are not

satisfied or waived (where capable of waiver), the Open Offer will

not proceed and the Open Offer Shares will not be issued and all

monies received by Link Group will be returned to the applicants

(at the applicants' risk and without interest) as soon as possible

thereafter. Any Open Offer Entitlements admitted to CREST will

thereafter be disabled.

Application will be made for the Open Offer Shares to be

admitted to trading on AIM. It is expected that dealings in the

Open Offer Shares will commence on AIM at 8.00 a.m. on 1 April

2021.

6. GENERAL MEETING AND THE RESOLUTION

Set out at the end of the Circular is the notice convening a

General Meeting of the Company to be held at 11.00 a.m. on 30 March

2021 at the offices of the Company, at Kitson House, Elmete Hall,

Elmete Lane, Leeds LS8 2LU at which the Resolution will be put to

the Company's Shareholders. The Resolution to be proposed at the

General Meeting seeks authority in accordance with section 551 of

the Act for the Directors to allot up to 28,411,019 new Ordinary

Shares (being the maximum required for the purposes of issuing the

Placing and Subscription Shares and the Open Offer Shares) and for

such shares to be allotted on a non-pre-emptive basis to Placees

and to Shareholders who validly accept the Open Offer. The

Resolution does not replace the Directors' existing authorities to

allot equity securities or to allot Ordinary shares for cash on a

non pre-emptive basis which were passed at the Company's annual

general meeting in July 2020, which will remain in force until the

2021 annual general meeting (or, if earlier, 23 October 2021).

7. ACTION TO BE TAKEN BY SHAREHOLDERS

In accordance with the Stay at Home Order relating to the

containment and control of COVID-19, Shareholders will not be able

to attend the General Meeting in person. The Board will be

implementing the following measures in respect of the General

Meeting:

-- we expect only two Shareholders nominated by the Board to

attend the General Meeting in person in order to satisfy the quorum

requirements set out in the Articles to conduct the business of the

meeting;

-- no other Directors will be present in person;

-- other Shareholders will not be permitted to attend the

General meeting and, if they attempt to do so, will be refused

entry to the meeting in line with the Stay at Home Order;

-- voting at the General Meeting will be carried out by way of a

poll so that votes cast in advance appointing the chairman of the

meeting as Shareholders' proxy can be taken into account.

Shareholders who cannot attend are urged to appoint the chairman of

the General Meeting as their proxy for this purpose;

-- relevant questions related to the General Meeting from

Shareholders can be raised in advance of the General Meeting and,

in so far as is relevant to the business of the meeting, will be

responded to by email and taken into account as appropriate at the

General Meeting itself; and

-- as usual, the results of the General Meeting will be

announced as soon as practicable after it has taken place.

Shareholders will not receive a form of proxy for the General

Meeting unless requested from the Registrar, Link Group. Instead

you will find instructions in the "Notes" to the Notice of Meeting

to enable you to vote electronically and how to register to do so.

To register, you will need your Investor Code, which can be found

on your share certificate.

Proxy votes should be submitted as early as possible and in any

event by no later than 11.00 a.m. on 26 March 2021 (or, in the case

of an adjournment, no later than 48 hours, excluding non-Business

Days, before the time fixed for the holding of the adjourned

meeting).

The Company is actively following developments relating to

COVID-19 and will issue further information through a Regulatory

Information Service and/or on its website at www.getech.com if it

becomes necessary or appropriate to make any alternative

arrangements for the General Meeting.

Action to be taken in respect of the Open Offer

Qualifying Non-CREST Shareholders

If you are a Qualifying Non-CREST Shareholder you will have

received an Application Form which gives details of your maximum

entitlement under the Open Offer (as shown by the number of Open

Offer Entitlements allocated to you). If you wish to apply for Open

Offer Shares under the Open Offer (whether in respect of your Open

Offer Entitlement or both your Open Offer Entitlement and any

entitlement under the Excess Application Facility), you should

complete the accompanying Application Form in accordance with the

procedure for application set out in paragraph 3 of Part 3 ("Terms

and conditions of the Open Offer") of the Circular and on the

Application Form itself.

Qualifying CREST Shareholders

If you are a Qualifying CREST Shareholder and do not hold any

Ordinary Shares in certificated form, no Application Form

accompanies the Circular and you will receive a credit to your

appropriate stock account in CREST in respect of the Open Offer

Entitlements representing your maximum entitlement under the Open

Offer except (subject to certain exceptions) if you are an Overseas

Shareholder who has a registered address in, or is a resident in or

a citizen of a Restricted Jurisdiction. Applications by Qualifying

CREST Shareholders for Excess Shares in excess of their Open Offer

Entitlements should be made in accordance with the procedures set

out in paragraph 3 of Part 3 of the Circular, unless you are an

Overseas Shareholder in which event, applications should be made in

accordance with the procedures set out in paragraph 7 of Part 3 of

the Circular.

8. RECOMMATION

The Directors unanimously believe that the Placing and

Subscription and the Open Offer are in the best interests of the

Company and its Shareholders and unanimously recommend Shareholders

to vote in favour of the Resolution as they intend to do in respect

of their own beneficial holdings in the Company.

PLACING AND SUBSCRIPTION AND OPEN OFFER STATISTICS

Number of Existing Ordinary Shares in issue

at the date of this announcement 37,563,615

Issue Price 22 pence

Number of First Placing Shares 17,943,952

Number of Second Placing Shares 9,283,776

Number of Subscription Shares 45,000

Total number of Placing and Subscription Shares 27,272,728

Gross Placing and Subscription proceeds Approximately GBP6.0

million

Basis of Open Offer 1 Open Offer Share

for every 33 Existing

Ordinary Shares

Maximum number of Open Offer Shares* 1,138,291

Maximum gross proceeds of Open Offer* Approximately GBP0.25

million

Estimated net proceeds of the Placing and Subscription Approximately GBP5.72

and Open Offer* million

Number of Consideration Shares 892,046

Issued share capital immediately following

First Admission 56,399,613

Enlarged Issued Share Capital immediately following

Second Admission* 66,866,680

Placing and Subscription Shares as a percentage 41 per cent.

of the Enlarged Issued Share Capital following

Second Admission*

New Shares as a percentage of the Enlarged 44 per cent.

Issued Share Capital following Second Admission*

Market capitalisation of the Company at Second GBP14.7 million

Admission at the Issue Price*

Ordinary Share ISIN GB00B0HZVP95

Basic Open Offer Entitlement ISIN GB00BMVMDK99

Excess CREST Open Offer Entitlement ISIN GB00BMVMDL07

* Assuming maximum number of Open Offer Shares are subscribed

for

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Record Date for the Open Offer 6.00 p.m. on 10 March 2021

Announcement of the Placing 12 March 2021

and Subscription and Open Offer

Posting of the Circular and, 12 March 2021

to Qualifying Non-CREST Shareholders,

the Application Form

Ex-entitlement Date for the 15 March 2021

Open Offer

Open Offer Entitlements and As soon as practical after 8.00

Excess CREST Open Offer Entitlements a.m. on 16 March 2021

credited to stock accounts of

Qualifying CREST Shareholders

in CREST

Latest recommended time and 4.30 p.m. on 23 March 2021

date for requesting withdrawal

of Open Offer Entitlements from

CREST

Latest time and date for depositing 3.00 p.m. on 24 March 2021

Open Offer Entitlements into

CREST

Latest time and date for splitting 3.00 p.m. on 25 March 2021

of Application Forms under the

Open Offer (to satisfy bona

fide market claims only)

Latest time and date for receipt 11.00 a.m. on 26 March 2021

of proxy voting instructions

for the General Meeting

Latest time and date for receipt 11.00 a.m. on 29 March 2021

of the completed Application

Form and appropriate payment

in respect of Open Offer Shares

or settlement of relevant CREST

instruction

General Meeting 11.00 a.m. 30 March 2021

Announcement of result of General 30 March 2021

Meeting and Placing and Subscription

and Open Offer

Completion of the acquisition 30 March 2021

by the Company of H2 Green

Admission and commencement of 8.00 a.m. on 31 March 2021

dealings of the First Placing

Shares on AIM

CREST accounts credited in respect 31 March 2021

of the First Placing Shares

(subject to First Admission)

Admission and commencement of 8.00 a.m. on 1 April 2021

dealings of the Second Placing

Shares, Subscription Shares

and Open Offer Shares on AIM

CREST accounts credited in respect 1 April 2021

of the Placing and Subscription

Shares and Open Offer Shares

Where applicable, expected date Within 10 Business Days of Second

for dispatch of definitive share Admission

certificates for Placing and

Subscription Shares and Open

Offer Shares in certificated

form

Note: All references to times in this timetable are to London

times and each of the times and dates are indicative only and may

be subject to change. Any such change will be notified by an

announcement on a Regulatory Information Service.

DEFINITIONS

In this announcement, the following expressions shall have the

following meanings, unless the context otherwise requires:

"Act" the Companies Act 2006 (as amended)

"Admission" in respect of the:

* Placing and Subscription Shares means First Admission

and/or Second Admission (as the context requires)

* Open Offer Shares means admission of the Open Offer

Shares to trading on AIM becoming effective in

accordance with the AIM Rules

* Consideration Shares means admission of the

Consideration Shares to trading on AIM becoming

effective in accordance with the AIM Rules

"AIM" the market of that name operated by the London

Stock Exchange

"AIM Rules" the AIM Rules for Companies as published and

amended from time to time by the London Stock

Exchange

"Application Form" the application form relating to the Open

Offer and enclosed with the Circular for use

by Qualifying Non-CREST Shareholders

"Articles" the articles of association of the Company

(as amended from time to time)

"Board" or "Directors" the directors of the Company whose names are

set out on page 5 of the Circular, or any

duly authorised committee thereof

"Business Day" any day on which banks in London are open

for business (excluding Saturdays, Sundays

and public holidays)

"Cenkos" Cenkos Securities plc, the Company's nominated

adviser and sole broker

"certificated" or where an Ordinary Share is not in uncertificated

"in certificated form" form (i.e. not in CREST)

"Circular" the Circular to Shareholders in connection

with the Placing and Subscription and Open

Offer dated on or around the date of this

announcement

"Company" or "Getech" Getech Group plc

"Consideration Shares" the 892,046 Ordinary Shares to be issued to

the H2 Green Shareholders in part consideration

of the transfer of the entire issued share

capital of H2 Green to the Company pursuant

to the H2 Green Option

"CREST" the relevant system for the paperless settlement

of trades and the holding of uncerti cated

securities operated by Euroclear in accordance

with the CREST Regulations

"CREST Manual" the CREST Manual referred to in agreements

entered into by Euroclear and available at

www.euroclear.com

"CREST member" a person who has been admitted to CREST as

a system-member (as defined in the CREST Regulations)

"CREST member account the identification code or number attached

ID" to a member account in CREST

"CREST participant" a person who is, in relation to CREST, a system-participant

(as defined in the CREST Regulations)

"CREST participant shall have the meaning given in the CREST

ID" Manual

"CREST payment" shall have the meaning given in the CREST

Manual

"CREST Regulations" the Uncertificated Securities Regulations

2001 (SI 2001/3755) including any enactment

or subordinate legislation which amends or

supersedes those regulations and any applicable

rules made under those regulations or any

such enactment or subordinate legislation

for the time being in force

"CREST sponsor" a CREST participant admitted to CREST as a

CREST sponsor

"CREST sponsored member" a CREST member admitted to CREST as a CREST

sponsored member

"enabled for settlement" in relation to Open Offer Entitlements or

entitlements to Excess Shares, enabled for

the limited purpose of settlement of claim

transactions and unmatched stock event transactions

(each as described in the CREST Manual issued

by Euroclear)

"Enlarged Issued Share 66,866,680 Ordinary Shares, being the issued

Capital" ordinary share capital of the Company immediately

following Second Admission, assuming no exercise

of existing options or warrants over Ordinary

Shares and the take up of the Open Offer in

full

"Euroclear" Euroclear UK & Ireland Limited

"Excess Application the arrangement pursuant to which Qualifying

Facility" Shareholders may apply for additional Open

Offer Shares in excess of their Open Offer

Entitlement in accordance with the terms and

conditions of the Open Offer

"Excess CREST Open in respect of each Qualifying CREST Shareholder,

Offer Entitlement" their entitlement (in addition to their Open

Offer Entitlement) to apply for Open Offer

Shares pursuant to the Excess Application

Facility, which is conditional on them taking

up their Open Offer Entitlement in full

"Excess Shares" Ordinary Shares applied for by Qualifying

Shareholders under the Excess Application

Facility

"Ex-entitlement Date" the date on which the Existing Ordinary Shares

are marked "ex" for entitlement under the

Open Offer, being 15 March 2021

"Existing Ordinary the 37,563,615 Ordinary Shares in issue as

Shares" at the date of this announcement or (as the

context requires) any of such shares

"FCA" the Financial Conduct Authority of the United

Kingdom

"First Admission" admission of the First Placing Shares and

the Consideration Shares to trading on AIM

becoming effective in accordance with Rule

6 of the AIM Rules which is expected to take

place on 31 March 2021

"First Placing" the placing by Cenkos on behalf of the Company

of the First Placing Shares at the Issue Price

pursuant to the terms of the Placing Agreement

"First Placing Shares" the 17,943,952 new Ordinary Shares which have

been conditionally placed by Cenkos with Placees

pursuant to the First Placing

"FSMA" the Financial Services and Markets Act 2000

(as amended)

"General Meeting" the general meeting of the Company convened

for 11.00 a.m. on 30 March 2021 at Kitson

House, Elmete Hall, Elmete Lane, Leeds LS8

2LU, notice of which is set out at the end

of the Circular

"Group" the Company and its subsidiaries from time

to time

"H2 Green" H2 Green Ltd

"H2 Green Option" the exclusive option for the Company to acquire

the entire issued share capital of H2 Green

pursuant to an option agreement dated 2 November

2020 between the Company, the H2 Green Shareholders

and H2 Green

"H2 Green Shareholders" Luke Johnson and Ian Spencer

"ISIN" International Securities Identification Number

"Issue Price" 22 pence per New Share

"Link Group" a trading name of Link Market Services Limited

"London Stock Exchange" London Stock Exchange plc

"Money Laundering the Money Laundering, Terrorist Financing

Regulations" and Transfer of Funds (Information on Payer)

Regulations 2017 and obligations in connection

with money laundering under the Criminal Justice

Act 1993 and the Proceeds of Crime Act 2002

(each as amended)

"New Shares" the First Placing Shares, the Second Placing

Shares, the Subscription Shares, the Consideration

Shares and the Open Offer Shares

"Notice of Meeting" the notice convening the General Meeting which

is set out at the end of the Circular

"Official List" the Official List maintained by the FCA

"Open Offer" the conditional invitation to Qualifying Shareholders

to apply for the Open Offer Shares at the

Issue Price on the terms and conditions outlined

in the Circular and, where relevant, in the

Application Form

"Open Offer Entitlement" the pro rata basic entitlement for Qualifying

Shareholders to subscribe for 1 Open Offer

Share for every 33 Existing Ordinary Shares

held on the Record Date pursuant to the Open

Offer

"Open Offer Shares" up to 1,138,291 new Ordinary Shares to be

issued pursuant to the Open Offer

"Ordinary Shares" ordinary shares of 0.25 pence each in the

Company

"Overseas Shareholders" Shareholders with registered addresses, or

who are citizens or residents of, or incorporated

in a Restricted Jurisdiction

"Placees" those persons who have conditionally agreed

to subscribe for First Placing Shares and

Second Placing Shares

"Placing and Subscription" together, the First Placing, the Second Placing

and the Subscription

"Placing Agreement" the conditional agreement dated 12 March 2021

between the Company and Cenkos relating to

the Placing and Subscription and Open Offer

"Placing and Subscription the First Placing Shares and/or the Second

Shares" Placing Shares and/or the Subscription Shares

(as the context requires)

"Qualifying CREST Qualifying Shareholders holding Existing Ordinary

Shareholders" Shares, which, on the register of members

of the Company on the Record Date, are in

a CREST account

"Qualifying Non-CREST Qualifying Shareholders holding Existing Ordinary

Shareholders" Shares, which, on the register of members

of the Company on the Record Date, are in

certificated form

"Qualifying Shareholders" holders of Existing Ordinary Shares on the

register of members of the Company at the

Record Date (but excluding, subject to certain

exceptions, any Overseas Shareholder who is

located or resident or who has a registered

address in, or who is a citizen of, the United

States of America or any other Restricted

Jurisdiction)

"Receiving Agent" Link Group, Corporate Actions, 10th Floor,

Central Square, 29 Wellington Street, Leeds,

LS1 4DL

"Regulation S" Regulation S under the Securities Act

"Record Date" 6.00 p.m. on 10 March 2021 being the latest

time by which transfers of Existing Ordinary

Shares must be received for registration by

the Company in order to allow transferees

to be recognised as Qualifying Shareholders

"Restricted Jurisdiction" the United States, Canada, Australia, New

Zealand, the Republic of South Africa, the

Republic of Ireland or Japan, and any of their

territories or possessions

"Resolution" the special resolution set out in the notice

of the General Meeting at the end of the Circular

"Second Admission" admission of the Second Placing Shares, the

Subscription Shares and the Open Offer Shares

to trading on AIM becoming effective in accordance

with Rule 6 of the AIM Rules which is expected

to take place on 1 April 2021

"Second Placing" the placing by Cenkos on behalf of the Company

of the Second Placing Shares at the Issue

Price pursuant to the terms of the Placing

Agreement

"Second Placing Shares" the 9,283,776 new Ordinary Shares which have

been conditionally placed by Cenkos with Placees

pursuant to the Second Placing

"Securities Act" the U.S. Securities Act of 1933, as amended

"Shareholders" holders of Existing Ordinary Shares

"Stay at Home Order" the Health Protection (Coronavirus, Restrictions)

(No. 3) and (All Tiers) (England) Regulations

2021

"Subscription" the subscription for the Subscription Shares

at the Issue Price pursuant to the Subscription

Agreement

"Subscription Agreement" the agreement between the Company and Jonathan

Copus relating to the Subscription

"Subscription Shares" the 45,000 new Ordinary Shares which have

been conditionally subscribed for pursuant

to the Subscription

"United Kingdom" or the United Kingdom of Great Britain and Northern

"UK" Ireland

"GBP" UK pounds sterling, being the lawful currency

of the United Kingdom

"EUR" or "Euros" a lawful currency of certain member states

of the European Union

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEUASORASUOAUR

(END) Dow Jones Newswires

March 12, 2021 02:00 ET (07:00 GMT)

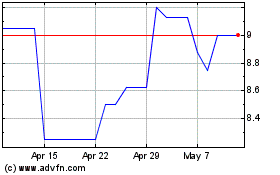

Getech (LSE:GTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Getech (LSE:GTC)

Historical Stock Chart

From Apr 2023 to Apr 2024