TIDMHAT

RNS Number : 1089T

H&T Group PLC

23 March 2021

H&T Group ("H&T" or the "Group") today announces its

preliminary results for the year ended

31 December 2020.

Chris Gillespie, chief executive of H&T Group, said:

"In response to the Covid-19 pandemic, H&T acted decisively.

We took robust steps throughout 2020 to protect the health, safety

and wellbeing of our customers, colleagues, and community. We

supported pawnbroking customers by freezing interest while stores

were closed and by making payment deferral arrangements with those

financially impacted by Covid-19, where it was in their best

interests to do so. We progressed the digitalisation of our

business to improve choice and flexibility for our customers and

employees. In November an enhanced retail eCommerce site was

launched.

"H&T ended 2020 robustly, given the challenging conditions,

demonstrating the underlying strength of the business. We have

benefitted from the high gold price.

"We are well placed to reinforce our position as the UK's

largest pawnbroker and grow our lines of business once Covid-19

restrictions are lifted and consumer demand for short term

borrowing returns. We have no debt and significant cash resources

to rebuild the pledge book when underlying customer demand

increases.

"Whilst I am delighted with the resilience shown by the business

during the year, we are aware of the impact upon consumer

confidence of the ongoing Covid-19 related restrictions across the

UK which directly affect the communities we serve. Market

conditions remain challenging, but we are confident that our

long-term goals and strategy will deliver growth and value for all

our stakeholders."

Change

2020 2019 %

Financial highlights (GBPm

unless stated)

Gross profit 82.8 101.4 (18.3%)

EBITDA 26.2 30.0 (12.7%)

Operating profit 16.9 22.5 (24.9%)

Profit before tax 15.6 20.1 (22.4%)

Diluted EPS 32.1 43.8p (26.7%)

Dividend per share 8.5p 4.7p 80.9%

Key performance indicators

Pledge book GBP48.3m GBP72.2m (33.1%)

Redemption of annual lending

* 82.30% 82.40% (0.1%)

Retail gross profits GBP11.3m GBP13.6m (16.9%)

Personal loan book GBP5.9m GBP16.6m (64.5%)

Personal loan revenue less impairment GBP8.1m GBP10.8m (25.0%)

Number of stores 253 252 0.4%

* This is a non IFRS measure and represents the actual

percentage of lending in each year which was redeemed or renewed,

the 2020 figure is an estimate based on recent trend and early

performance.

Operational highlights:

-- Profit before tax of GBP15.6m despite the impact of Covid-19, a fall of GBP4.5m, 22.4%

-- Pledge book reduced 33.1% to GBP48.3m from GBP72.2m

-- Pawnbroking net revenue fell by 12.3% from GBP39.0m to GBP34.2m, due to freezing customer

interest while stores were closed and the reduction in pledge book

-- Retail sales dropped 28.2% with gross profits reducing by 16.9% from GBP13.6m to GBP11.3m

-- Foreign currency gross profit reduced by 34.6% from GBP5.2m to GBP3.4m

-- Personal loan net revenue reduced by 25.0% from GBP10.8m to GBP8.1m, as the book dropped to

GBP5.9m from GBP16.6m

-- Updated our est1897.co.uk retail website and generated revenues of GBP3.6m (2019: GBP4.0m)

from our eCommerce platforms

-- Strong returns from precious-metal scrappage with gross profit increasing from GBP2.4m to

GBP6.2m, reflecting the high gold price

-- Gold-buying gross profit increased 19.3% from GBP5.7m to GBP6.8m

-- Robust cash position, with net cash of GBP34.5m and an undrawn GBP35.0m revolving credit facility

-- Development and launch of our customer portals for lending customers

Enquiries:

H&T Group plc

Tel: 020 8225 2797

Chris Gillespie, Chief Executive

Richard Withers, Chief Financial Officer

Numis Securities (Broker and Nominated Adviser)

Tel: 020 7260 1000

Luke Bordewich, Nominated Adviser

Henry Slater

Haggie Partners (Public Relations)

Tel: 020 7562 4444

Damian Beeley

Vivian Lai

Chairman's statement

The Group has delivered a strong financial performance despite

the impact of the Covid-19 pandemic. There is still uncertainty

over the ongoing impact of Covid-19 and its impact on high street

footfall, overseas travel, and consumer demand for short term

credit. Since the outbreak of the virus, our priority has been the

safety and wellbeing of colleagues, customers, and wider

stakeholders.

The exceptional resilience, flexibility and commitment of our

colleagues is a key factor in the ongoing success story of H&T.

I thank everyone who has contributed to H&T delivering a solid

performance during a challenging year.

IMPACT OF COVID-19 AND ACTIONS TAKEN

Trading to 23 March 2020 was strong, with performance ahead of

management expectations. Revenue growth from the 70 new stores

added to our estate in 2019 was particularly pleasing.

With the issue of HM Government advice outlining the need for

strict social distancing measures and the requirement to close

retail stores, our network of 253 stores was temporarily closed on

24 March 2020. While our stores were closed, we took the

opportunity to review and revise health and safety measures within

our stores and implemented an online pawnbroking payment portal,

allowing customers to settle loans remotely.

The Government added the provision of short-term credit to the

essential services list and later in May widened further the

services that could be offered in our stores to incorporate our

full financial services offering. The Group began a phased

reopening of the store estate on 12 May 2020 and by 31 May 2020 all

stores except two were open, providing financial services with the

exception of personal unsecured lending. From 15 June 2020, the

Group recommenced offering retail jewellery through its stores in

line with updated government guidance.

Since May 2020, all but two of our stores have remained open,

albeit retail jewellery being served via our eCommerce and click

and collect operations during the Q4 2020 and Q1 2021 lockdown

periods.

While the stores were closed, store colleagues were furloughed

under the government's Job Retention Scheme. All colleagues

returned to full employment as stores reopened for business. During

the year, our colleagues across the UK offered support in their

local communities, and the Group provided a charitable fund to

support small, local charities who are connected to our customers

and employees. We have since launched a partnership with FareShare,

the UK's largest charity fighting hunger and food waste.

During the year the Group implemented several initiatives to

help our customers including: an interest holiday on all

outstanding secured loans while stores were closed; providing

pawnbroking customers with the opportunity to defer payment by

extending their loan period; allowing personal loan customers the

opportunity to take payment deferrals; and launching our new and

fully functional online pawnbroking payment portal. We supported

and stayed in contact with our customers by offering a dedicated

call centre operation and online chat facility, regularly updating

our website with information and guidance, and issued additional

SMS text and postal communications direct to customers.

The Group has continued to invest in its digital capability

allowing customers to access products both remotely and through its

store estate. In addition, the Group opened a new store in

Edinburgh and acquired a trading business in East London towards

the end of the year.

We withdrew the recommendation to pay a final 2019 dividend and

all directors reduced their salary remuneration for the duration of

store closures.

FINANCIAL PERFORMANCE

Revenues were materially impacted during the period of closure

and the phased reopening. At the end of December 2020, the pledge

book stood at GBP48.3m, having fallen from GBP72.2m at the end of

2019. Throughout the year pawnbroking customers have continued to

repay their loans (either by attending the store or via the payment

portal) at normal pledge redemption rates. New loans have been

subdued, reflecting reduced demand from customers for borrowing

under existing economic conditions.

On the other hand, retail sales have been particularly strong,

reflecting increased consumer demand for competitively priced,

high-quality jewellery and watches. The high gold price during the

year has driven increased gross profits both from pawnbroking and

gold purchasing activities. These strong performances have more

than offset weakness in the Group's foreign currency business due

to reduced international leisure travel.

The Group delivered profit after tax of GBP12.6m (2019:

GBP16.7m) and diluted earnings per share of 32.1 pence (2019: 43.8

pence). Subject to shareholder approval, a final dividend of 6.0

pence per ordinary share (2019: nil) will be paid on 25 June 2021

to those shareholders on the register at the close of business on

14 May 2021. This will bring the full year dividend to 8.5 pence

per ordinary share (2019: 4.7 pence).

The Group's financial position is strong with net assets of

GBP134.5m (31 December 2019: GBP122.6m), GBP34.5m cash and bank

balances (31 December 2019: GBP12.0m), and a GBP35.0m undrawn bank

revolving credit facility (31 December 2019; GBP26.0m drawn,

GBP9.0m undrawn).

OUR TEAM

We remain focused on doing the right thing for our colleagues,

customers, and the communities in which we operate. The health and

safety of our colleagues and our customers remains paramount. In

preparation to reopen our branches in May as an essential service

provider, we invested in training, safety measures and PPE for our

colleagues to deliver our services in a way that is safe for them

and our customers.

The loyalty, dedication and expertise of our colleagues is at

the core of our strong customer relationships. We continue to

invest in training, development, and progression of our valuable

staff. The Group is proud of its culture that fosters passion and

enthusiasm to deliver exceptional customer service and

outcomes.

In October 2020 we announced the appointment of Chris Gillespie,

replacing John Nichols as chief executive officer subject to FCA

approval, which was received on 8 January 2021. I thank John on

behalf of the Board for his nearly 24 years of service and we wish

him a long and happy retirement. Chris brings a wealth of

experience to the business including previous senior roles in

consumer finance, most recently as managing director of Provident

Financial PLC's consumer credit division. Chris' understanding of

our business and our customers, and his expertise will enable us to

accelerate our strategy to blend our combined store and digital

networks to serve our customers and communities and further broaden

our reach.

STRATEGY

Following the 2019 acquisitions of certain assets from the Money

Shop and Albemarle & Bond the Group has an enlarged store

estate and customer reach, together with a talented team to serve

them. We have a strong asset base, significant cash reserves and

highly cash generative products and services, this will enable the

Group to exploit further growth opportunities as they emerge.

The demand for small-sum, short-term cash loans has been subdued

over the past 12 months and this is likely to continue for some

time. The Group will continue to focus on its digital development

journey to better support our store colleagues, and on its

operational effectiveness to improve customer experiences. It will

focus on customer experience and communication strategy to ensure

that H&T is in the best position to deliver excellent service

for customers when they need us.

We will invest in our network of stores, supported by further

digital enhancements, and thus reinforce the important distinction

between H&T and a purely online business.

REGULATION

The Group continues to work with the appointed Skilled Person

and the FCA in respect of the review into its creditworthiness

assessments and lending processes for its unsecured High-Cost Short

Term Loans (HCSTC). Given the ongoing disruption from the pandemic,

the outcome of this review will now likely be delayed into the

second quarter of 2021.

PROSPECTS

The start of 2021 has brought ongoing challenges with the

continuation of further national restrictions across the UK. While

H&T has been able to keep its stores open, as its financial

services are classified as essential by the Government, business

activities have been impacted by reduced high street footfall and

subdued demand for its services. The Group has been offering retail

jewellery only via its eCommerce platforms since early January

2021, and this has impacted sales levels significantly during the

first quarter of the year.

The UK faces further macroeconomic uncertainties resultant from

the Brexit transition. The Board consider the impact on our staff,

customers and our business activity to be limited. While the

macroeconomic impact of these risks is uncertain, we believe our

range of products is well positioned to take advantage of any

eventuality.

OUTLOOK

The extent to which social distancing and pandemic restrictions

remain necessary will determine the pace at which the Group returns

to pre-pandemic activity levels. A successful roll-out of the

vaccine program will likely lead to increased demand for our

services and will determine the extent to which we are able to

rebuild our pledge book.

On behalf of the Board and our shareholders, I would like to

thank everyone at H&T for their hard work and dedication over

the past year.

Peter D McNamara

Chairman

Chief executive's review

INTRODUCTION

The Group has performed resiliently through a challenging year

and ends 2020 in a robust position. All revenue categories have

been impacted by Covid-19 restrictions, lockdowns, reduced high

street footfall and temporary reductions in the demand for our

services. Throughout the year we have communicated regularly with

our customers and colleagues and maintained safe store and support

centre environments.

The Group achieved profit before tax of GBP15.6m (2019:

GBP20.1m) despite these challenges, showing the underlying

resilience of the business

THE MARKET

During 2020 Covid-19 restricted our activities and reduced

consumer need for some of our products and services. The increased

gold price and IFRS9 accounting treatment that requires high

initial impairment charges, helped the results. The core of our

business remains strong and we will continue to invest in the

development of our people and our infrastructure. We will continue

to refine our services as we seek to expand our customer base.

STRATEGY

The Group's strategy is to serve a customer base whose access to

mainstream credit is limited and for whom small-sum loans can help

to address short-term financial challenges. We are a cash

generative business, well placed for growth through product

diversification and investment in our store estate and digital

strategy.

Our Vision: "To make pawnbroking a widely accepted and valued

financial service"

Our purpose is to meet the real need for lending in the

community across the UK, by ensuring that borrowing against an

asset is simple and inclusive. We aim to exceed our customer's

expectations in this and in the development of a diversified suite

of services (including retail, personal lending, FX and money wire

transfer) that improves returns and reduces the Group's exposure to

gold price volatility.

REVIEW OF OPERATIONS

Pawnbroking

Pawnbroking is a small subset of the consumer credit market in

the UK and a simple form of asset-backed lending where an item of

value, known as a pledge (typically jewellery and watches), is

given in exchange for a cash loan. Customers who repay the capital

sum borrowed plus interest receive their pledged item back. If a

customer fails to repay the loan, we sell the pledged item via

auction, retail or for scrap. The value of the item is set by

auction, whether it is the reserve, or the actual sale price should

it sell. After the deduction of interest accrued plus an admin fee,

any surplus is passed back to the customer. Title to any unsold

items passes to the company.

Pawnbroking is our core business. We are the largest UK

pawnbroker in terms of number of outlets, customers and amounts

lent. It is the key area for the business and where we invest the

most in terms of training and development. Yields are attractive,

and the debt is always secured by the item pledged.

During the year revenues were impacted by Covid-19 in several

ways. During the spring lockdown our stores were closed for around

two months. Throughout the closure period, no interest was charged.

Upon reopening in May, many of our customers who had built up cash

reserves, in part due to reduced spending, came in to collect their

pledged items and repaid their loans. This resulted in a decline of

the pledge book in Q3 2020. We have since seen the book stabilise,

but we have yet to see the full return of consumer demand for short

term loans as lockdowns, restrictions and furlough support

continue.

Retail

The Group offers a value-for-money proposition in new high

quality and pre-owned jewellery. We believe there is further growth

potential in this segment by leveraging our retail store estate and

our eCommerce operations as well as by cross-selling to customers

of other services. The Group was unable to retail from our stores

during the national lockdowns, instead offering items through its

eCommerce sites and via a click and collect service during the most

recent lockdown. During the months unaffected by lockdowns, the

months of July to October and particularly during December sales

were especially strong.

Our eCommerce sites generated revenues of GBP3.6m (2019:

GBP4.0m). In November, we updated our "est1897" website, which

holds more than 5,000 high quality pre-owned watches and jewellery

items.

Personal loans

H&T offers unsecured loans in store and online. Our

dedicated underwriting team carry out manual affordability

assessments prior to issuing any loans.

We ceased offering high-cost-short-term-credit unsecured (HCSTC)

loans in October 2019, with all lending paused in March when we

closed our stores. From August we recommenced non-HCSTC lending,

taking a very cautious approach with a modest number of loans being

made.

Our absence from HCSTC lending, the reduced loan book, limited

current lending during 2021 and the uncertainty surrounding the

future of unsecured personal lending for the Group will have a

financial impact in the future.

During the year we worked with the FCA and a Skilled Person to

review our unsecured HCSTC loans. This process is still ongoing,

primarily as a result of Covid-19.

Finally, and most importantly, I would like to add my sincere

thanks to those of the Chairman, in recognising the contribution of

all of our people whose skills, commitment and enthusiasm continue

to drive our success, and who give us confidence in the future.

Chris Gillespie

Chief Executive

Chief financial officer's review

FINANCIAL RESULTS

For the year ended 31 December 2020, gross profit decreased

18.3% from GBP101.4m to GBP82.8, reflecting the impact of Covid-19

with associated store closures and reduced high street footfall.

Despite freezing interest on customer's secured loans, reduced

demand for short term loans and international travel restrictions

impacting foreign currency volumes, the Group delivered profit

before tax of GBP15.6m (2019: GBP20.1m). Group results benefitted

from the high gold price and the IFRS9 financial impact of

impairment releases as our lending books reduced during the

year.

The increased gold price during the year was the key factor in

combined revenues from gold purchasing and scrap increasing by

GBP4.8m, 58.5% to GBP13.0m (2019: GBP8.2m).

H&T received GBP3.8m in government support payments,

included as 'other income' (see note 2) in relation to the Job

Retention and Business Rate support schemes.

Total direct and administrative expenses reduced by GBP13.0m

(16.5%) to GBP65.9m from GBP78.9m.

Total loan impairment charges (included within direct and

administrative expenses) at GBP6.4m are down GBP14.4m on prior

year, with pawnbroking and personal loan impairment charges

respectively GBP5.4m and GBP9.0m lower. This is a result of reduced

lending and the consequence of not having to charge the

proportionally high amounts of initial impairment charges on new

loans. Other things being equal, IFRS9 impairment accounting

results in a drag on reported earnings as loan books grow relative

to IAS 39's incurred loss models and vice versa as the book

reduces.

The pawnbroking and personal lending books have reduced by

GBP23.9m and GBP10.7m respectively since 31 December 2019.

Pawnbroking

Gross profits from pawnbroking after impairment reduced 12.3% to

GBP34.2m (2019: GBP39.0m) and the pledge book reduced 33.1% to

GBP48.3m (31 December 2019: GBP72.2m). The Group lent GBP114.6m

during the year (2019: 149.0m) and had 76,500 customers with

existing loans as at 31 December 2020 (31 December 2019:

118,700).

The risk-adjusted margin (revenue as a percentage of the average

net pledge book) was 58.1% (2019: 64.6%). The reduction reflected

the interest freeze of approximately two months during spring.

Typically, pre lockdown the Group was recognising circa GBP4.0m per

month in net pawnbroking revenue. The reduction in the pledge book

meant a reversal of approximately GBP2.5m of impairment charges in

the year under IFRS9. The rate at which customers redeem their

pledges has remained consistently high and is essentially unchanged

from 2019 at 82.3%.

2020 2019 Change

GBP'm GBP'm %

---------------------------------------------- -------

Year-end net pledge book(1) 48.3 72.2 (33.1%)

Average net pledge book 58.9 60.4 (2.5%)

-------------------------------------- ------- ------- --------

Revenue less impairment 34.2 39.0 (12.3%)

Risk-adjusted margin(2) 58.1% 64.6%

-------------------------------------- ------- ------- --------

Notes to table

1 - Includes accrued interest

and impairment

2 - Revenue as a percentage of the average

net pledge book

----------------------------------------------- ------- --------

Retail

Retail sales for the full year reduced 28.2% to GBP29.8m (2019:

GBP41.5m), gross profits reduced 16.9% to GBP11.3m (2019: GBP13.6m)

and margin increased to 37.9% (2018: 31.8%). Margin increase was a

consequence of fewer promotional activities in the year compared to

prior year.

The Group reduced its investment in average retail inventories

held during the year by GBP0.8m or 2.6% to GBP29.8m (2019:

GBP30.6m).

Personal loans

The net personal loans book has reduced by 64.5% to GBP5.9m (31

December 2019: GBP16.6m). Revenue less impairment has reduced by

25.0% to GBP8.1m (2019: GBP10.8m) as the Group has reduced its

volume of lending.

The increase in the risk-adjusted margin (RAM) to 79.4% (2019:

56.3%) is a consequence of the collect out of the loan book, with a

reversal of impairment charges under IFRS9 accounting of

approximately GBP2.0m and further tightening of credit risk

assessments for the lending made in the year. Other than 40 sample

loans made as part of the S166 review, all lending in the year was

non-HCSTC, a total of GBP4.8m of lending was made in 2020 (2019:

GBP30.0m).

Impairment as a percentage of the average monthly net loan book

was 17.3% (2019: 49.8%), reflecting the increased mix of lower

yield, higher quality loans and the wind down of the book.

2020 2019 Change

----------------------------------------

GBP'm GBP'm %

---------------------------------------- ------ ------- --------

Year-end net loan book 5.9 16.6 (64.5%)

Average monthly net loan book 10.2 19.2 (46.9%)

---------------------------------------- ------ ------- --------

Revenue 9.8 21.5 (54.4%)

Impairment (1.7) (10.7) (84.1%)

Revenue less impairment 8.1 10.8 (25.0%)

---------------------------------------- ------ ------- --------

Interest yield(1) 96.1% 112.0%

Impairment % of revenue 17.3% 49.8%

Impairment % of average monthly

net loan book 16.7% 55.7%

Risk-adjusted margin(2) 79.4% 56.3%

---------------------------------------- ------ ------- --------

1 - Revenue as a percentage of average

loan book

2 - Revenue less impairment as a

percentage of average loan book

---------------------------------------- ------ ------- --------

Pawnbroking scrap

The average gold price during 2020 was GBP1,379 per troy ounce

(2019: GBP1,094), a 26.1% increase. The gold price directly impacts

the revenue received on the sales of scrapped gold.

Gross profits increased by 148% to GBP6.2m (2019: GBP2.5m).

Increased margin, driven by the high gold price, accounts for

GBP3.0m of the increase, with GBP0.7m accounted for by increased

volume of activity.

Gold purchasing

Gross profit increased by GBP1.1m to GBP6.8m (2019: GBP5.7m).

Increased margin contributed GBP1.9m to the GP increase with an 11%

decrease in the volume of gold sold offsetting the uplift by

GBP0.8m.

Other services

Other services principally comprise trading activities of

foreign currency exchange (FX), cheque cashing, money-transfer and

buyback. Gross profits from these activities reduced to GBP6.0m

(2019: GBP9.0m).

FX, cheque cashing and buyback revenues all declined in the year

with gross profits from FX reducing to GBP3.4m (2019: GBP5.2m),

cheque cashing reducing to GBP1.2m (2019: 1.5m) and buyback

reducing to GBP0.3m (2019: GBP1.7m). Money-transfer revenues

increased to GBP1.1m (2019: 0.3m). The buyback operation (the

purchase and sale of mobile phones and tablets) was ceased early in

the year.

Other income

Other income of GBP3.8m (2019: nil) comprises HM Government job

retention scheme and rate grant monies.

Costs

Taking out the impact of loan impairment charges, the Group's

aggregated direct and administration costs increased by GBP1.4m,

2.4%. The uplift is primarily a result of the full year impact of

operating the additional 70 stores acquired during 2019, partially

offset by some operational and transactional cost reductions while

stores were closed. We have incurred some additional Covid-19

related costs, associated with ensuring colleague and customer

safety.

Debt finance costs fell to GBP0.5m (2019: GBP0.9m), as the Group

paid down its borrowing in full during the year. The reduced

borrowing is a direct consequence of the reduction in our personal

and pawnbroking lending books.

CASH FLOW

The reduction in lending books during the year resulted in a

GBP29.6m increase in operating cash flow to GBP55.4m (2019:

GBP25.8m).

Total increase in cash during the year was GBP22.5m after

repaying GBP26.0m of borrowings, with net cash of GBP34.5m (31

December 2019: GBP12.0m). As at 31 December 2020 the GBP35.0m

revolving credit facility was undrawn. This facility, together with

the strong cash position provide the Group with the funds required

to deliver its current strategy.

BALANCE SHEET

As at 31 December 2020, the Group had net assets of GBP134.5m

(2019: GBP122.6m), no debt and GBP34.5m cash (2019: GBP12.0m). The

Group was well within banking covenants with a net debt to EBITDA

ratio of nil (2019: 0.58) and an EBITDA to interest ratio of 49.9

(2018: 30.4) (see note 3 for the definition of EBITDA).

The combination of cash reserves and a secure credit facility

provides the Group with the ability to make selective investments

in the future while maintaining appropriate headroom.

GOING CONCERN

The Group has considered the impact of Covid-19 on its financial

statements. The Group has significant cash resources of GBP34.5m

and access to an undrawn GBP35.0m revolving credit facility with an

expiry date of June 2022.

IMPAIRMENT REVIEW

The Group performs an annual review of the expected earnings of

each acquired store and considers whether the associated goodwill

and other property, plant and equipment values are impaired. The

Group has also considered impairment of its right-of-use-assets

(property leases). A total impairment charge of GBP0.5m (2019: nil)

has been applied in respect of its right-of-use-assets.

SHARE PRICE AND EPS

At 31 December 2020 the share price was 258p (2019: 338p) and

market capitalisation was GBP102.6m (2019: GBP134.3m). Basic

earnings per share were 32.1p (2019: 43.9p), diluted earnings per

share were 32.1p (2019: 43.8p).

Richard Withers

Chief Financial Officer

Group statement of comprehensive income

For the year ended 31 December 2020

2020 2019

Continuing operations: Note GBP'000 GBP'000

Revenue 2 129,115 160,213

Cost of sales (46,316) (58,852)

Gross profit 2 82,799 101,361

Other direct expenses (50,188) (60,842)

Administrative expenses (15,727) (18,031)

Operating profit 16,884 22,488

Investment revenues 5 -

Finance costs 3 (1,257) (2,405)

Profit before taxation 15,632 20,083

Tax charge on profit 4 (3,070) (3,393)

Profit for the financial year and total

comprehensive income 12,562 16,690

2020 2019

Earnings per share from continuing Pence Pence

operations

Basic 5 32.11 43.88

Diluted 5 32.11 43.80

All profit for the year is attributable to equity

shareholders.

Group statement of changes in equity

For the year ended 31 December 2020

Employee

Benefit

Trust

Share premium shares Retained

Share capital account reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2019 1,883 27,153 (35) 74,820 103,821

Profit for the year - - - 16,690 16,690

Total comprehensive

income - - - 16,690 16,690

Issue of share capital 104 6,026 - - 6,130

Share option movement - - - 328 328

Dividends paid - - - (4,363) (4,363)

At 31 December 2019 1,987 33,179 (35) 87,475 122,606

At 1 January 2020 1,987 33,179 (35) 87,475 122,606

Profit for the year - - - 12,562 12,562

Total comprehensive

income - - - 12,562 12,562

Issue of share capital 6 307 - - 313

Share option movement - - - 64 64

Dividends - - - (996) (996)

At 31 December 2020 1,993 33,486 (35) 99,105 134,549

Group balance sheet

As at 31 December 2020

Note 31 December 31 December

2020 2019

GBP'000 GBP'000

Non-current assets

Goodwill 19,330 19,580

Other intangible assets 2,729 3,889

Property, plant and equipment 8,635 7,739

Right-of-use assets 18,337 21,147

Deferred tax assets 2,822 2,180

51,853 54,535

Current assets

Inventories 27,564 29,157

Trade and other receivables 55,751 90,891

Other current assets 1 714

Cash and bank balances 34,453 12,003

117,769 132,765

Total assets 169,622 187,300

Current liabilities

Trade and other payables (10,807) (10,578)

Lease liabilities (3,568) (4,890)

Current tax liability (1,972) (2,066)

(16,347) (17,534)

Net current assets 101,422 115,231

Non-current liabilities

Borrowings - (26,000)

Lease liabilities (17,077) (19,670)

Long term provisions (1,649) (1,490)

(18,726) (47,160)

Total liabilities (35,073) (64,694)

Net assets 134,549 122,606

Equity

Share capital 8 1,993 1,987

Share premium account 33,486 33,179

Employee Benefit Trust shares

reserve (35) (35)

Retained earnings 99,105 87,475

Total equity attributable

to equity holders 134,549 122,606

The financial statements of H&T Group plc, registered number

05188117, were approved by the Board of Directors and authorised

for issue on 22 March 2021. They were signed on its behalf by:

C D Gillespie

Chief Executive

Group cash flow statement

For the year ended 31 December 2020

Note 2020 2019

GBP'000 GBP'000

Net cash generated from operating activities 6 55,350 25,829

Investing activities

Interest received 5 -

Purchases of intangible assets (233) (9)

Purchases of property, plant and equipment (3,005) (3,316)

Acquisition of trade and assets of

businesses (50) (18,740)

Acquisition of Right-of-use assets (2,934) (5,592)

Net cash used in investing activities (6,217) (27,657)

Financing activities

Dividends paid (996) (4,363)

(Reduction)/Increase in borrowings (26,000) 1,000

Debt restructuring costs - (350)

Proceeds on issue of shares 313 6,130

Net cash generated / (used in) from

financing activities (26,683) 2,417

Net increase in cash and cash equivalents 22,450 589

Cash and cash equivalents at beginning

of the year 12,003 11,414

Cash and cash equivalents at end of

the year 34,453 12,003

Notes to the preliminary announcement

for the year ended 31 December 2020

1. Finance information and significant accounting policies

The financial information has been abridged from the audited

financial statements for the year ended 31 December 2020.

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 31 December 2020

or 2019 but is derived from those accounts. Statutory accounts for

2019 have been delivered to the Registrar of Companies and those

for 2020 will be filed with the Registrar in due course. The

auditors have reported on those accounts: their reports were

unqualified, did not draw attention to any matters by way of

emphasis and did not contain statements under s498 (2) or (3)

Companies Act 2006 or equivalent preceding legislation.

Whilst the financial information included in this preliminary

announcement has been prepared in accordance with International

Financial Reporting Standards (as adopted for use in the UK)

('IFRS'), this announcement does not itself contain sufficient

information to comply with IFRS. The Group will be publishing full

financial statements that comply with IFRS in April 2021.

Going concern

The Group has prepared the financial statements on a going

concern basis, with due consideration to the unprecedented impact

of Covid-19 on the economy and society. The Board has considered

the impact of Covid-19 on the business and conducted a going

concern review to ensure this basis remains appropriate.

The Group delivered profit before tax of GBP15.6m for the year

ended 31 December 2020 (2019: GBP20.1m). The Group also increased

its net assets to GBP134.5m (2019: GBP122.6m).

The Group has significant cash resources at 31 December 2020 of

GBP34.5m and access to an unutilised revolving credit facility with

Lloyds Bank plc which allows for maximum borrowings of GBP35.0m,

subject to covenants. The facility terminates on 12 June 2022, with

the potential to extend for two additional years to June 2023 and

2024. This strong balance sheet position provides a high level of

confidence that the Group will be able to repay all liabilities as

they fall due during 2021 and into H1 2022 at least. The Group met

all covenants in 2020 and there is no evidence to suggest that they

will not be met in 2021 or H1 2022.

The Group's activities include services deemed essential by the

government and therefore the Group's stores have been able to open

during recent lockdowns. The Group's essential services include

pawnbroking, foreign currency, money transfer and cheque cashing.

The Group has a strong asset base and the ability to generate cash

quickly through the sale of jewellery stock for its intrinsic value

or by restricting new pawnbroking lending.

The Board has approved a detailed budget for 2021, which has

subsequently been updated to form a reasonable worst-case forecast

taking into consideration the current lockdown. All forecasts and

sensitivities indicate surplus cash generated from operations for

the period reviewed after accounting for the Company's forecast

levels of capital expenditure. In considering the going concern

basis of preparation longer term forecasts are also prepared, with

the financial forecasts revealing no inability to meet financial

covenants or repay liabilities. Covid-19 is an unprecedented event

that has already had and will continue to have for an unknown

period profound impacts on economic and social behaviour.

The Group's offering is principally through secured lending

against pledges. The Group's policies on pawn lending remain

rigorous and prudent, such that the Group has limited exposure to

loss in the event of customers not redeeming their pledges, due to

the value of the pledge collateral held, principally being gold and

precious stones. The Group has no reason to believe that the value

will not be maintained in the near future.

Based on the above considerations and after reviewing in detail

2021 and H1 2022 forecasts, the Directors have formed the view that

the Group has adequate resources to continue as a going concern for

the next 12 months and has prepared the financial statements on

this basis.

Impairment of non--financial assets including goodwill and other

intangibles

The Group assesses at each reporting date whether there is an

indication that an asset may be impaired. If any indication exists,

or when annual impairment testing for an asset is required, the

Group estimates the asset's recoverable amount. An asset's

recoverable amount is the higher of an asset's or cash-generating

unit (CGU)'s fair value and its value in use. It is determined for

an individual asset, unless the asset does not generate cash

inflows that are largely independent of those from other assets or

groups of assets. Where the carrying amount of an asset or CGU

exceeds its recoverable amount, the asset is considered impaired

and is written down to its recoverable amount.

In assessing value in use, the estimated future cash flows are

discounted to their present value using a pre--tax discount rate of

9% (2019: 9%) which reflects the current market assessments of the

time value of money and the risks specific to the asset. In

determining fair value less costs of disposal, recent market

conditions, including Covid-19 are taken into account.

The Group bases its impairment calculation on detailed budgets

and historical performance measures. These are prepared separately

for each of the Group's CGUs to which the individual assets are

allocated, which is usually taken to be at store level.

Impairment losses of continuing operations are recognised in the

statement of comprehensive income in those expense categories

consistent with the function of the impaired asset.

While the impairment review has been conducted based on the best

available estimates at the impairment review dates, the Group notes

that actual events may vary from management expectation, but are

comfortable that other than a right-of-use-assets (property leases)

impairment charge of GBP0.5m (2019: nil) no further impairment

exists at the balance sheet date based on reasonably possible

sensitivities.

Revenue recognition

Revenue is measured at the fair value of the consideration

received or receivable and represents amounts receivable for goods

and services and interest income provided in the normal course of

business, net of discounts, VAT and other sales-related taxes.

The Group recognises revenue from the following major

sources:

-- Pawnbroking, or Pawn Service Charge (PSC);

-- Retail jewellery sales;

-- Pawnbroking scrap and gold purchasing;

-- Personal loans interest income;

-- Income from other services and

-- Other income

Revenue is recognised to the extent that it is probable that the

economic benefits will flow to the Group and the revenue can be

reliably measured.

Pawnbroking, or Pawn Service Charge (PSC)

PSC comprises contractual interest earned on pledge loans, plus

auction profit or loss, less any auction commissions payable and

less surplus payable to the customer. Revenue is recognised over

time in relation to the interest accrued by reference to the

principal outstanding and the effective interest rate applicable as

governed by IFRS 9.

Retail jewellery sales

Jewellery inventory is sourced from unredeemed pawn loans, newly

purchased items and inventory refurbished from the Group's gold

purchasing operation. For sales of goods to retail customers,

revenue is recognised when control of the goods has transferred,

being at the point the customer purchases the goods at the store.

Payment of the transaction price is due immediately at the point

the customer purchases the goods.

Under the Group's standard contract terms, customers have a

right of return within 30 days. Whilst stores were closed owing to

Covid-19 restrictions the returns policy was extended to cover a

period of 30 days after the store reopened. Additional flexibility

was offered during the year to allow customers to return items by

post rather than attend store. At the point of sale, a refund

liability and a corresponding adjustment to revenue is recognised

for those products expected to be returned. At the same time, the

Group has a right to recover the product when customers exercise

their right of return so consequently recognises a right to

returned goods asset and a corresponding adjustment to cost of

sales.

The Group uses its accumulated historical experience to estimate

the number of returns. It is considered highly probable that a

significant reversal in the cumulative revenue recognised will not

occur given the consistent and immaterial level of returns over

previous years; as a proportion of sales 2020 returns were 6%

(2019: 6%)

Pawnbroking scrap and gold purchasing

Scrap revenue comprises proceeds from gold scrap sales. Revenue

is recognised when control of the goods has transferred, being at

the point the smelter purchases the relevant metals.

Personal loans interest income

This comprises income from the Group's unsecured lending

activities. Personal loan revenues are shown stated before

impairment when in stages 1 and 2 of the expected credit loss model

and net of impairment when in stage 3. The impairment charge is

included within other direct expenses in the Group statement of

comprehensive income. Revenue is recognised over time in relation

to the interest accrued, as dictated by IFRS 9.

Other services

Other services comprise revenues from third party cheque

cashing, foreign exchange income, buyback, Western Union and other

income. Commission receivable on cheque cashing, foreign exchange

income and other income is recognised at the time of the

transaction as this is when control of the goods has transferred.

Buyback revenue is recognised at the point of sale of the item back

to the customer, when control of the goods has transferred.

The Group recognises interest income arising on secured and

unsecured lending within trading revenue rather than investment

revenue on the basis that this represents most accurately the

business activities of the Group.

Other income

Government grants, including monies received under the

Coronavirus job retention scheme are recognised as other income

when there is reasonable assurance that the Group will comply with

the scheme conditions and the monies will be received. There are no

unfulfilled conditions and contingencies attaching to recognised

grants.

Gross profit

Gross profit is stated after charging inventory, pledge and

other services provisions and direct costs of inventory items sold

or scrapped in the year.

Other direct expenses

Other direct expenses comprise all expenses associated with the

operation of the various stores and collection centre of the Group,

including premises expenses, such as rent, rates, utilities and

insurance, all staff costs and staff related costs for the relevant

employees.

Inventories provisioning

Where necessary provision is made for obsolete, slow moving and

damaged inventory or inventory shrinkage. The provision for

obsolete, slow moving and damaged inventory represents the

difference between the cost of the inventory and its market value.

The inventory shrinkage provision is based on an estimate of the

inventory missing at the reporting date using historical shrinkage

experience.

2. Operating segments

Business segments

For reporting purposes, the Group is currently organised into

six segments - pawnbroking, gold purchasing, retail, pawnbroking

scrap, personal loans and other services.

The principal activities by segment are as follows:

Pawnbroking:

Pawnbroking is a loan secured against a collateral (the pledge).

In the case of the Group, over 99% of the collateral against which

amounts are lent comprises precious metals (predominantly gold),

diamonds and watches. The pawnbroking contract is a six-month

credit agreement bearing a monthly interest rate of between 1.99%

and 9.99%. The contract is governed by the terms of the Consumer

Credit Act 2008 (previously the Consumer Credit Act 2002). If the

customer does not redeem the goods by repaying the secured loan

before the end of the contract, the Group is required to dispose of

the goods either through public auctions if the value of the pledge

is over GBP75 (disposal proceeds being reported in this segment)

or, if the value of the pledge is GBP75 or under, through public

auctions or the retail or pawnbroking scrap activities of the

Group.

Purchasing:

Jewellery is bought direct from customers through all of the

Group's stores. The transaction is simple with the store agreeing a

price with the customer and purchasing the goods for cash on the

spot. Gold purchasing revenues comprise proceeds from scrap sales

on goods sourced from the Group's purchasing operations.

Retail:

The Group's retail proposition is primarily gold and jewellery

and the majority of the retail sales are forfeited items from the

pawnbroking pledge book or refurbished items from the Group's gold

purchasing operations. The retail offering is complemented with a

small amount of new or second-hand jewellery purchased from third

parties by the Group.

Pawnbroking scrap:

Pawnbroking scrap comprises all other proceeds from gold scrap

sales of the Group's inventory assets other than those reported

within gold purchasing. The items are either damaged beyond repair,

are slow moving or surplus to the Group's requirements, and are

smelted and sold at the current gold spot price less a small

commission.

Personal loans:

Personal loans comprise income from the Group's unsecured

lending activities. Personal loan revenues are stated at amortised

cost after taking into consideration an assessment on a

forward-looking basis of expected credit losses.

Other services:

This segment comprises:

-- Third party cheque encashment which is the provision of cash

in exchange for a cheque payable to our customer for a commission

fee based on the face value of the cheque.

-- Buyback which is a service where items are purchased from

customers, typically high-end electronics, and may be bought back

up to 31 days later for a fee.

-- The foreign exchange currency service where the Group earns a

margin when selling or buying foreign currencies.

-- Western Union commission earned on the Group's money transfer service.

Cheque cashing is subject to bad debt risk which is reflected in

the commissions and fees applied.

Further details on each activity are included in the Chief

Executive's review.

Segment information for these businesses is presented below:

Gold Pawnbroking Personal Other Other

2020 Pawnbroking purchasing Retail scrap loans services income Total

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External revenue 38,970 21,508 29,827 19,249 9,781 6,014 3,766 129,115

Total revenue 38,970 21,508 29,827 19,249 9,781 6,014 3,766 129,115

Gross profit 38,970 6,802 11,303 6,163 9,781 6,014 3,766 82,799

Impairment (4,763) - - - (1,675) - - (6,438)

Segment result 34,207 6,802 11,303 6,163 8,106 6,014 3,766 76,361

Other direct expenses excluding impairment (43,750)

Administrative expenses (15,727)

Operating profit 16,884

Interest receivable 5

Financing costs (1,257)

Profit before taxation 15,632

Tax charge on profit (3,070)

Profit for the financial year and

total comprehensive income 12,562

Gold Pawnbroking Personal Other Other

2019 Pawnbroking purchasing Retail scrap loans services income Total

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External revenue 49,102 24,229 41,516 14,944 21,459 8,963 - 160,213

Total revenue 49,102 24,229 41,516 14,944 21,459 8,963 - 160,213

Gross profit 49,102 5,736 13,639 2,462 21,459 8,963 - 101,361

Impairment (10,142) - - - (10,656) - - (20,798)

Segment result 38,960 5,736 13,639 2,462 10,803 8,963 - 80,563

Other direct expenses excluding impairment (40,044)

Administrative expenses (18,031)

Operating profit 22,488

Interest receivable -

Financing costs (2,405)

Profit before taxation 20,083

Tax charge on profit (3,393)

Profit for the financial year and

total comprehensive income 16,690

Gross profit is stated after charging the direct costs of

inventory items sold or scrapped in the period. Other operating

expenses of the stores are included in other direct expenses. The

Group is unable to meaningfully allocate the other direct expenses

of operating the stores between segments as the activities are

conducted from the same stores, utilising the same assets and

staff. The Group is also unable to meaningfully allocate Group

administrative expenses, or financing costs or income between the

segments. Accordingly, the Group is unable to meaningfully disclose

an allocation of items included in the consolidated statement of

comprehensive income below gross profit, which represents the

reported segment results.

The Group does not apply any inter-segment charges when items

are transferred between the pawnbroking activity and the retail or

pawnbroking scrap activities .

Pawn- Unallocated

2020 Gold broking Personal Other assets/

Pawn-broking purchasing Retail scrap loans services (liabilities) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Other information

Capital additions

(*) 6,060 6,060

Depreciation,

amortisation

and impairment

(*) 9,286 9,286

Balance sheet

Assets

Segment assets 48,344 986 25,740 839 5,891 - 81,800

Unallocated

corporate

assets 72,476 72,476

Consolidated total

assets 169,622

Liabilities

Segment liabilities - - (814) - - (274) (1,088)

Unallocated

corporate

liabilities (33,985) (33,985)

Consolidated total

liabilities (35,073)

Pawn- Unallocated

2019 Gold broking Personal Other assets/

Pawn-broking purchasing Retail scrap loans services (liabilities) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Other information

Capital additions

(*) 15,716 15,716

Depreciation and

amortisation (*) 7,467 7,467

Balance sheet

Assets

Segment assets 72,199 1,414 27,391 1,067 16,628 - 118,699

Unallocated

corporate

assets 45,418 45,418

Consolidated total

assets 187,300

Liabilities

Segment liabilities - - (657) - - (209) (866)

Unallocated

corporate

liabilities (63,828) (63,828)

Consolidated total

liabilities (64,694)

(*) The Group cannot meaningfully allocate this information by

segment due to the fact that all the segments operate from the same

stores and the assets in use are common to all segments.

Geographical segments

The Group's revenue from external customers by geographical

location are detailed below:

2020 2019

GBP'000 GBP'000

United Kingdom 127,487 158,582

Other 1,628 1,631

129,115 160,213

The Group's non-current assets are located entirely in the

United Kingdom. Accordingly, no further geographical segments

analysis is presented.

3. Financing costs

2020 2019

GBP'000 GBP'000

Interest on bank loans 404 693

Other interest 1 1

Interest expense on the

lease liability 735 1,524

Amortisation of debt issue

costs 117 187

Total interest expense 1,257 2,405

4. Tax charge on profit

(a) Tax on profit on ordinary activities

2020 2019

Current tax GBP'000 GBP'000

United Kingdom corporation tax charge at 19%

(2018: 19%)

based on the profit for the year 3,628 3,634

Adjustments in respect of prior years (14) 195

Total current tax 3,614 3,829

Deferred tax

Timing differences, origination and reversal (358) 262

Adjustments in respect of prior years (6) (698)

(180) -

Total deferred tax (note 24) (544) (436)

Tax charge on profit 3,070 3,393

(b) Factors affecting the tax charge for the year

The tax assessed for the year is higher than that resulting from

applying a standard rate of corporation tax in the UK of 19% (2019:

19%). The differences are explained below:

2020 2019

GBP'000 GBP'000

Profit before taxation 15,632 20,083

Tax charge on profit at standard rate 2,970 3,816

Effects of:

Disallowed expenses and non-taxable income 236 150

Non-qualifying depreciation 840 (80)

Effect of change in tax rate (180) -

Movement in short-term timing differences (776) 10

Adjustments to tax charge in respect of

prior years (20) (503)

Tax charge on profit 3,070 3,393

In addition to the amount charged to the income statement and in

accordance with IAS 12, the excess of current and deferred tax over

and above the relative related cumulative remuneration expense

under IFRS 2 has been recognised directly in equity. The amount

released from equity in the current period was GBP98,000 (2019:

GBP61,000).

5. Earnings per share

Basic earnings per share is calculated by dividing the profit

for the year attributable to equity shareholders by the weighted

average number of ordinary shares in issue during the year.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares. With respect to the Group these

represent share options and conditional shares granted to employees

where the exercise price is less than the average market price of

the Company's ordinary shares during the year.

Reconciliations of the earnings per ordinary share and weighted

average number of shares used in the calculations are set out

below:

Year ended 31 December Year ended 31 December

2020 2019

Weighted Weighted

average Per-share average Per-share

Earnings number amount Earnings number amount

GBP'000 of shares pence GBP'000 of shares pence

Earnings per share:

basic 12,562 39,124,959 32.11 16,690 38,039,328 43.88

Effect of dilutive

securities

Options and conditional

shares - 1,278 (0.00) - 68,197 (0.08)

Earnings per share:

diluted 12,562 39,126,237 32.11 16,690 38,107,525 43.80

6. Notes to the Cash Flow Statement

2020 2019

GBP'000 GBP'000

Profit for the year 12,562 16,690

Adjustments for:

Investment revenues (5) -

Financing costs 1,257 2,405

Increase in provisions 160 237

Income tax expense 3,070 3,393

Depreciation of property, plant and equipment 2,204 2,272

Depreciation of right-of-use assets 5,122 4,604

Amortisation of intangible assets 1,428 591

Right of use asset Impairment 531 -

Share-based payment expense (35) 266

Loss on disposal of property, plant and equipment 99 70

Operating cash flows before movements in working

capital 26,393 30,528

Decrease in inventories 1,679 105

Decrease in other current assets 713 163

Decrease/(increase) in receivables 35,200 (5,500)

(Decrease)/increase in payables (3,842) 5,347

Cash generated from operations 60,143 30,643

Income taxes paid (3,707) (2,604)

Interest paid on loan facility (350) (686)

Interest paid on lease liability (736) (1,524)

Net cash generated from operating activities 55,350 25,829

Cash and cash equivalents (which are presented as a single class

of assets on the face of the balance sheet) comprise cash at bank

and other short-term highly liquid investments with a maturity of

three months or less.

7. Earnings before interest, tax, depreciation and amortisation ("EBITDA")

EBITDA

EBITDA is a non IFRS9 measure and is defined as earnings before

interest, taxation, depreciation and amortisation. It is calculated

by adding back depreciation and amortisation to the operating

profit as follows:

2020 2019

GBP'000 GBP'000

Operating profit 16,884 22,488

(i) Depreciation of the right-of-use assets 5,122 4,604

(ii) Depreciation and amortisation- other 3,633 2,862

(iii) Impairment of the right-of-use-assets 531 -

EBITDA 26,170 29,954

The Board consider EBITDA to be a key performance measure as the

Group borrowing facility includes a number of loan covenants based

on it.

8. Share capital

2020 2019

GBP'000 GBP'000

Issued, authorised and fully paid

39,864,077 (2019: 39,736,476) ordinary shares

of GBP0.05 each 1,993 1,987

The Group has one class of ordinary shares which carry no right

to fixed income.

The Group issued share capital amounting to GBP6,000 (2019:

GBP104,000) during the year. Associated share premium of GBP307,000

(2019: GBP6,026,000) was created.

9. Acquisitions

The following acquisitions were made during the year:

Total Total

2020 2019

GBP'000 GBP'000

Assets

Goodwill - 1,937

Intangible assets 35 3,891

Property, plant and equipment 3 1,185

Inventory 86 -

Trade receivables 177 11,727

Cash - 1,012

Total assets acquired 301 19,752

Total consideration:

Cash 301 19,752

Net cash outflow arising

on acquisition

Cash consideration 301 19,752

Less: cash balances acquired - (1,012)

Total assets acquired 301 18,740

On 30 November 2020, the Company acquired trade and assets from

A.F. Discount Jewellery Ltd for total consideration of GBP301k. The

fair value of financial assets includes trade receivables measured

in accordance with IFRS 9 and intangible assets which have been

valued by the Group based on discounted cash flow.

10. Contingent Liabilities

As set out initially in our market release of 18 November 2019

and in subsequent updates the Group has been working with a skilled

person appointed in conjunction with the FCA on a past-book review

of our lending since April 2014 within the High Cost Short Term

unsecured lending (HCSTC) market. The skilled person was appointed

on 3 September 2020 under section 166 of the Financial Services and

Markets Act 2000 to oversee the group's proposed redress

methodology.

Given the ongoing disruption from the pandemic, the skilled

person has currently been unable to carry out sufficient review to

satisfy themselves on the appropriate methodology for establishing

potential customer redress. The outcome of this review will now

likely be delayed into the second quarter of 2021 and it is

primarily for this reason that we are unable to reliably estimate

the financial effect on the Group. H&T expects an outcome

within previous guidance.

11. Events after the balance sheet date

The Directors have proposed a final dividend for the year ended

31 December 2020 of 6.0p (2019: nil).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SEUEFEEFSELD

(END) Dow Jones Newswires

March 23, 2021 03:00 ET (07:00 GMT)

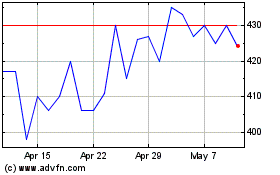

H&t (LSE:HAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

H&t (LSE:HAT)

Historical Stock Chart

From Apr 2023 to Apr 2024