Halfords Group PLC (HFD) Halfords Group PLC: 20-Week Trading

Update: Financial Year 2022 08-Sep-2021 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

8 September 2021

Halfords Group plc

20-Week Trading Update: Financial Year 2022

A strong start to trading delivered within a challenging

operating environment.

Strong growth in Motoring across retail stores, garages and

vans.

Halfords Group plc ("Halfords" or the "Group"), the UK's leading

provider of Motoring and Cycling products and services, today

announces its trading performance for the 20-week period to 20

August 2021 ("the period").

Given the highly unusual sales patterns in the FY21 comparator

period, our commentary below focusses on revenue growth on a

two-year basis, comparing FY22 revenue to FY20. For completeness,

the table below discloses total and LFL growth on both a one-year

and two-year basis.

Overview

-- Total sales growth of +18.7% (+16.8% LFL) over two years,

driven by:? Increased scale of our Autocentres business, taking

significant share. ? Growth in Retail Motoring, gaining share and

benefitting from staycation trends. ? Strong growth in Retail

Cycling in the first half of the period.

-- Exceptional growth in our areas of strategic importance, with

Service-Related Sales +78%, B2B sales +80%and Online +83%, all on a

two year basis.

-- A strong trading performance, despite the well documented

challenging operating environment.

-- Good cash generation in the period; balance sheet remains

strong.

-- Continue to target full year profit before tax, post-IFRS 16

adjustments, of above GBP75m.

Graham Stapleton, Chief Executive Officer, commented:

"The first 20 weeks of FY22 delivered a strong trading

performance against a hugely challenging backdrop. Our motoring

business now represents 65% of our revenues and continues to go

from strength to strength, driven by the increased scale of our

Autocentres business, the ongoing demand for our Halfords Mobile

Expert Vans, and by recent staycation trends. Although our cycling

business is currently impacted by the considerable disruption in

the global supply chain, as the UK's largest cycling retailer we

are well positioned to adapt and to serve our customers, and we

remain confident in the long-term outlook for the cycling market.

The strength of our overall performance is a clear illustration of

the relevance of our service-led strategy and gives us the

confidence to continue with our investment plans. We remain

positive on our prospects for FY22 and beyond."

Group financial summary 1-Year vs. FY21 2-Year vs. FY20

Total Growth LFL Growth Total Growth LFL Growth

Halfords Group 10.5% 10.8% 18.7% 16.8%

Retail 3.7% 7.6% 7.8% 17.1%

Motoring 48.2% 52.1% 6.5% 11.2%

Cycling -26.0% -22.8% 9.9% 24.2%

Autocentres 43.8% 26.0% 86.2% 15.5%

-- Retail:? Total revenue growth of +7.8% and +17.1% LFL on a

two-year basis. LFL sales were boosted by customertransfer from the

planned store closures in FY21. ? Motoring grew +6.5% and +11.2%

LFL over two years, driven by share gains in key

categories.Maintenance and 3B's (Blade, Bulbs and Batteries) grew

strongly, up +4.3% and +6.9% respectively, whilstTouring products

performed particularly well, up +53.3%, benefitting from staycation

trends. ? Cycling grew strongly, up +9.9% and 24.2% LFL vs FY20,

with Electric mobility up +115%. The globalcycling supply chain

continues to experience considerable capacity constraints, leading

to low availability ofbikes throughout the period. Whilst Kids and

Electric bikes have fared better, availability has been

especiallylow in the Adult Mechanical category, contributing to

materially lower growth rates towards the end of theperiod.

-- Autocentres:? Total revenue growth of +86.2% and +15.5% LFL

on a two-year basis, driven by increased scale,improved

utilisation, and our focus on B2B. ? Our Halfords Mobile Expert

Vans ("HME") grew strongly, up +61.7% on a one-year basis,

demonstratingthe ongoing customer demand for this proposition. ?

The supply of technicians to both garages and HME was impacted by

recruitment challenges andCovid-related absences, which had some

impact on sales in the period.

-- Ongoing challenging operating environment including:? Factory

production constraints and raw material inflation. ? General

freight disruption, capacity constraints and cost inflation. ?

Supply and recruitment challenges in respect of service technicians

and HGV drivers.

Outlook

We expect many of the cycling supply chain issues referred to

above to continue for some time albeit, as the UK's largest cycling

retailer, we are well positioned to navigate these challenges.

Conversely, we are targeting strong growth in our Services and B2B

businesses, alongside an improved Retail Motoring performance. We

plan to continue investing in the initiatives highlighted in our

FY21 Preliminary results on 17 June 2021. These include an

investment in Retail Motoring pricing, Project Fusion trials, which

seek to deliver a seamless, convenient, and consistent experience

to our customers across a town, our Motoring Loyalty scheme, and

scaling our network of garages and vans. We continue to target a

full year profit before tax of above GBP75m on a post IFRS-16

basis.

Notice of results

Our Interim results announcement is on 10 November 2021.

Enquiries

Investors & Analysts (Halfords)

Loraine Woodhouse, Chief Financial Officer

Neil Ferris, Corporate Finance Director

Andy Lynch, Head of Investor Relations +44 (0) 7483 457 415

Media (Powerscourt) +44 (0) 20 7250 1446

Rob Greening halfords@powerscourt-group.com

Lisa Kavanagh

Harold Amoo

Results presentation

A conference call for analysts and investors will be held today,

starting at 09:00am UK time. Attendance is by invitation only. A

copy of the transcript of the call will be available at

www.halfordscompany.com in due course. For further details please

contact Powerscourt on the details above.

Notes to Editors

www.halfords.com www.tredz.co.uk www.halfordscompany.com

Halfords is the UK's leading provider of motoring and cycling

services and products. Customers shop at 404 Halfords stores, 3

Performance Cycling stores (trading as Tredz and Giant), 374

garages (trading as Halfords Autocentres, McConechy's and

Universal) and have access to 166 mobile service vans (trading as

Halfords Mobile Expert and Tyres on the Drive) and 192 Commercial

vans. Customers can also shop at halfords.com and tredz.co.uk for

pick up at their local store or direct home delivery, as well as

booking garage services online at halfords.com.

Cautionary statement

This report contains certain forward-looking statements with

respect to the financial condition, results of operations, and

businesses of Halfords Group plc. These statements and forecasts

involve risk, uncertainty and assumptions because they relate to

events and depend upon circumstances that will occur in the future.

There are a number of factors that could cause actual results or

developments to differ materially from those expressed or implied

by these forward-looking statements. These forward-looking

statements are made only as at the date of this announcement.

Nothing in this announcement should be construed as a profit

forecast. Except as required by law, Halfords Group plc has no

obligation to update the forward-looking statements or to correct

any inaccuracies therein.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00B012TP20

Category Code: TST

TIDM: HFD

LEI Code: 54930086FKBWWJIOBI79

OAM Categories: 3.1. Additional regulated information required to be disclosed under the laws of a Member State

Sequence No.: 121674

EQS News ID: 1231857

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1231857&application_name=news

(END) Dow Jones Newswires

September 08, 2021 02:00 ET (06:00 GMT)

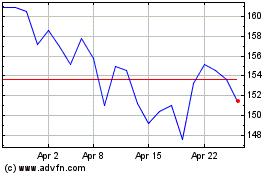

Halfords (LSE:HFD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Halfords (LSE:HFD)

Historical Stock Chart

From Apr 2023 to Apr 2024