Halfords Group PLC (HFD) Halfords Group PLC: Retail Offer by

PrimaryBid 01-Dec-2021 / 16:37 GMT/BST Dissemination of a

Regulatory Announcement that contains inside information according

to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group. The

issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, SOUTH AFRICA OR JAPAN OR ANY OTHER JURISDICTION

WHERE SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE

UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

IS NOT AN OFFER OF SECURITIES IN ANY JURISDICTION.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act

2018.

THIS ANNOUNCEMENT AMOUNTS TO A FINANCIAL PROMOTION FOR THE

PURPOSES OF SECTION 21 OF THE FINANCIAL SERVICES AND MARKETS ACT

2000 ("FSMA") AND HAS BEEN APPROVED BY PRIMARYBID LIMITED WHICH IS

AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY (FRN

779021).

FOR IMMEDIATE RELEASE

1 December 2021

Halfords Group plc

("Halfords" or the "Company")

Retail Offer by PrimaryBid

Halfords is pleased to announce a conditional retail offer via

PrimaryBid of new ordinary shares of one penny each in the capital

of the Company (the "Retail Offer Shares") and the "Retail

Offer").

As separately announced today, the Company is conducting a

non-pre-emptive placing of new ordinary shares of one penny each

(the "Placing Shares") in the capital of the Company (the

"Placing") through an accelerated bookbuilding process (the

"Bookbuilding Process"). The price at which the Placing Shares are

to be placed (the "Offer Price") will be determined at the close of

the Bookbuilding Process. In addition, certain directors of the

Company intend to subscribe for new ordinary shares of one penny

each in the capital of the Company (the "Management Subscription

Shares ") alongside the Placing and the Retail Offer (the

"Management Subscription").

The issue price for the Retail Offer Shares, as well as the

ordinary shares that will be issued pursuant to the Management

Subscription, will be equal to the Offer Price. Reasons for the

Retail Offer

Whilst the Placing has been structured as a non-pre-emptive

offer to institutional investors so as to minimise cost, time to

completion and use of management resource at an important time for

the Company, the Company values its long-standing and substantial

retail investor base and welcomes the opportunity to give those

shareholders an opportunity to participate in the equity

fundraising, alongside other investors.

After consideration of the various options available to it, the

Company believes that the separate Retail Offer, which will enable

retail investors to participate in the Company's equity fundraising

without diminishing the strategic benefits of the structure of the

Placing, is in the best interest of shareholders, as well as wider

stakeholders in Halfords.

The net proceeds of the Retail Offer will be used by Halfords to

part fund the acquisition of the entire issued share capital of

Axle Group Holdings Limited (the "Acquisition"), further details on

which are set out in the Company's announcements regarding the

Placing and the Acquisition, released earlier today. Details of the

Retail Offer

Members of the public in the UK may participate in the Retail

Offer by applying exclusively through the PrimaryBid mobile app

available on the Apple App Store and Google Play.

The Retail Offer will be open to retail investors following

publication of this announcement. The Retail Offer will close at

the same time as the Bookbuilding Process is completed. The Retail

Offer may close early if it is oversubscribed.

Subscriptions under the Retail Offer will be considered by the

Company with preference to be given to the Company's existing

retail investors, subject to conditions which are available to view

on www.PrimaryBid.com. There is a minimum subscription of GBP250

per investor under the terms of the Retail Offer. The Company

reserves the right to scale back any order at its discretion. The

Company and PrimaryBid reserve the right to reject any application

for subscription under the Offer without giving any reason for such

rejection.

No commission will be charged to investors on applications to

participate in the Retail Offer made through PrimaryBid. It is

important to note that once an application for the Retail Offer

Shares has been made and accepted via PrimaryBid, that application

is irrevocable and cannot be withdrawn.

It is a term of the Retail Offer that the total value of the

Retail Offer Shares available for subscription at the Placing Price

does not exceed EUR8 million equivalent. Accordingly, the Company

is not required to publish (and has not published) a prospectus in

connection with the Retail Offer as it falls within the exemption

set out in sections 86(1) (e) and 86(4) of FSMA. The Retail Offer

is only being made in the United Kingdom and is not being made into

any jurisdiction where it would be unlawful to do so. In

particular, the Retail Offer is being made only to persons who are,

and at the time the Retail Offer Shares are subscribed for, will be

outside the United States and subscribing for the Retail Offer

Shares in an "offshore transaction" as defined in, and in

accordance with, Regulation S under the U.S. Securities Act of

1933, as amended (the "Securities Act"). Persons who are resident

or otherwise located in the United States will not be eligible to

register for participation in the offer through PrimaryBid or

subscribe for Retail Offer Shares.

The Retail Offer Shares, if issued, will be fully paid and will

rank pari passu in all respects with the existing ordinary shares

of the Company, the Placing Shares and the Management Subscription

Shares, including the right to receive all dividends and other

distributions declared, made or paid after the date of issue.

Application will be made for the Retail Offer Shares to be

admitted to the premium listing segment of the Official List of the

Financial Conduct Authority and to trading on the Main Market for

listed securities of the London Stock Exchange plc (together,

"Admission").

Settlement for the Retail Offer Shares and Admission is expected

to take place at or before 8.00 a.m. on 6 December 2021. The Retail

Offer is conditional, among other things, upon Admission becoming

effective and the placing agreement entered into by the Company in

connection with the Placing not being terminated in accordance with

its terms.

For further details, please refer to www.PrimaryBid.com. The

terms and conditions on which the Retail Offer is made, including

the procedure for application and payment for the Retail Offer

Shares, are available to all persons who register with

PrimaryBid.

It should be noted that a subscription for the Retail Offer

Shares and any investment in the Company carry a number of risks.

Investors should make their own investigations into the merits of

an investment in the Company. In particular, investors should

consider the risk factors set out on www.PrimaryBid.com before

making a decision to subscribe for Retail Offer Shares. Nothing in

this announcement amounts to a recommendation to invest in the

Company or amounts to investment, taxation or legal advice.

Investors should take independent advice from a person experienced

in advising on investment in securities such as the Company's

ordinary shares if they are in any doubt.

This announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notices" section of this announcement.

For further information on the announcement, please contact:

Halfords: +44 (0) 7483 457 415

Loraine Woodhouse, Chief Financial Officer

Neil Ferris, Corporate Finance Director

Andy Lynch, Head of Investor Relations

PrimaryBid Limited:

enquiries@primarybid.com

Fahim Chowdhury / James Deal

Powerscourt (Financial PR): +44 (0) 20 7250 1446

Rob Greening / Nick Hayns halfords@powerscourt-group.com

Important Notices

This announcement has been issued by and is the sole

responsibility of the Company.

Persons distributing this announcement must satisfy themselves

that it is lawful to do so. This announcement is for information

purposes only and shall not constitute an offer to sell or issue or

the solicitation of an offer to buy, subscribe for or otherwise

acquire securities in any jurisdiction in which any such offer or

solicitation would be unlawful. Any failure to comply with this

restriction may constitute a violation of the securities laws of

such jurisdictions. Persons needing advice should consult an

independent financial adviser.

The distribution of this announcement and the offering, placing

and/or issue of the Retail Offer Shares in certain jurisdictions

may be restricted by law. No action has been taken by the Company,

PrimaryBid or any of their respective affiliates, or any person

acting on any of their behalves, that would permit an offer of the

Retail Offer Shares or possession or distribution of this

announcement or any other offering or publicity material relating

to such Retail Offer Shares in any jurisdiction where action for

that purpose is required. Persons into whose possession this

announcement comes are required by the Company to inform themselves

about, and to observe, such restrictions.

No prospectus will be made available in connection with the

matters contained in this announcement and no such prospectus is

required (in accordance with the Prospectus Regulation (EU)

2017/1129 (as it forms part of English law pursuant to the European

Union (Withdrawal) Act 2018 (as amended)) to be published.

(MORE TO FOLLOW) Dow Jones Newswires

December 01, 2021 11:37 ET (16:37 GMT)

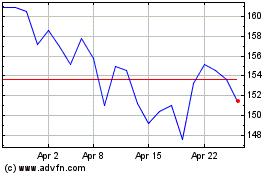

Halfords (LSE:HFD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Halfords (LSE:HFD)

Historical Stock Chart

From Apr 2023 to Apr 2024