TIDMHGT

RNS Number : 6630V

HgCapital Trust PLC

16 April 2021

Hg, the Manager of HgCapital Trust plc ("HGT"), today announces

an investment in AUVESY GmbH ("AUVESY"), a leading global provider

of version control and change management software solutions for

automated industrial environments.

The terms of the transaction have not been disclosed and the

transaction is subject to completion.

HgCapital Trust plc will invest approximately GBP7.4 million in

AUVESY, with other institutional clients of Hg investing alongside

HGT through the Hg Mercury 3 Fund.

HGT, whose shares are listed on the London Stock Exchange, gives

private and institutional investors the opportunity to participate

in all Hg's investments.

Note that these figures only relate to HGTs share of Hg's

overall investment in AUVESY.

HGT's liquid resources available for future deployment

(including all announced transactions, the proposed full-year

dividend payable in May 2021 and equity raised via tap issuance)

are estimated to be GBP129 million (10% of the 28 February 2021

pro-forma NAV of GBP1.3 billion). In addition, HGT has access to a

GBP200 million standby facility, which is currently undrawn.

The investment will reduce HGT's outstanding commitments to

invest in Hg transactions to approximately GBP493 million (37% of

the 28 February 2021 pro-forma NAV).

Hg invests in AUVESY

to support the business' leading position in the growing

industrial automation sector

Landau, Germany and London, United Kingdom: 16 April 2021 - Hg,

a leading global software investor, today announces an investment

in AUVESY GmbH ("AUVESY"), a leading global provider of version

control and change management software solutions for automated

industrial environments.

As part of the transaction, the AUVESY management team will

maintain a significant investment in the business whilst the former

majority owner Brockhaus Private Equity has fully exited its

position. The terms of the transaction have not been disclosed and

the transaction is subject to completion.

Founded in 2007 and headquartered in Germany, AUVESY is a

provider of version control software for smart production machinery

and other industrial Internet of Things ("IoT") devices. AUVESY

manages over 5 million industrial IoT devices across 45 countries,

serving over 700 loyal customers.

Software developed by AUVESY enables its customers with

automated production facilities and other smart machinery to

automatically backup, secure and centralise their machine data and

executable code. Customers also benefit from fully-featured change

management, detailed change detection, easily comprehensible

documentation, and a high degree of user-friendliness. All machine

level data is easy to backup and access when needed, simplifying

maintenance, and freeing up time for optimising production

processes. Downtime is significantly reduced, due to easy and

reliable code management, trouble shooting and disaster recovery.

The AUVESY software product "versiondog" is in use across a wide

range of sectors, including automotive, chemical, energy, food

& beverage, pharma and utilities.

AUVESY is the first investment from the Hg Mercury 3 Fund and

represents the 8th investment in Hg's Automation & Engineering

cluster focus, including the recently announced agreement with

Trackunit. The investment will support AUVESY's position in a

growing sector, which sits an important inflection point as

shopfloors and industrial devices are getting increasingly

digitalised, requiring version control solutions from a technical,

cybersecurity, compliance and, for certain industries, even a

regulatory perspective.

Dr. Tim Weckerle, CEO of AUVESY, said: "This is positive news

for everyone at AUVESY and I thank all my colleagues who have

worked so hard to get us to this very strong position. We are

delighted to be partnering with a software expert in Hg. We see

their operational experience and expertise in areas such as

international sales, marketing and M&A being hugely beneficial

to the future growth of the firm, all supporting our 'Never Stand

Still' mission to ensure that our customers around the world

experience less down time in their production."

Benedikt Joeris, Director at Hg, said: "AUVESY is a highly

innovative business, building a leading position in industrial IoT

version control software globally. We see significant growth

potential in this sector, both across new industry verticals and

expansion into additional use cases. AUVESY is incredibly well

positioned to benefit from this potential. Its excellent software

enjoys high customer satisfaction and loyalty due to the efficiency

increase and risk protection it provides."

Markus Reithwiesner, an industry advisor at Hg and serving board

member for several companies in the production and industry

automation sector, will join AUVESY as Chairman: "Digitalisation at

the shopfloor level is an increasing requirement across many

sectors right now. As this trend continues, AUVESY is well

positioned to enable customers to follow this trend. We see

significant room to grow dynamically in the years ahead and look

forward to working with the team."

"As a technology investor focusing on high margin companies in

innovation-driven markets, AUVESY was a perfect fit for our

investment strategy when we acquired the company from its founders

in 2017. After having supported the company in internationalisation

by opening offices in the USA and in China, we see a prospering

future for AUVESY" added Marco Brockhaus, founder and Managing

Director of Brockhaus Private Equity.

For further details:

Hg

Laura Dixon +44 (0)20 8396 0930

Brunswick

Samantha Chiene +44 (0)207 404 5959

Hg@brunswickgroup.com

About HgCapital Trust plc

HgCapital Trust plc, whose shares are listed on the London Stock

Exchange (ticker: HGT.L), gives investors exposure through a liquid

vehicle to a portfolio of high-growth private companies in the

software and services sector. The selection of new investments and

creation of value in these businesses are managed by Hg, an

experienced and well-resourced private equity firm with a long-term

track record of delivering superior risk-adjusted returns for its

investors. For further details, please see www.hgcapitaltrust.com

.

The contents of the Hg, HgCapital Trust, AUVESY and Brockhaus

Private Equity websites are not incorporated into, and do not form

part of, this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUVAARAOUSAUR

(END) Dow Jones Newswires

April 16, 2021 02:00 ET (06:00 GMT)

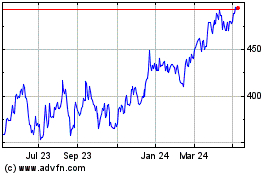

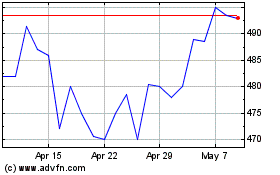

Hg Capital (LSE:HGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hg Capital (LSE:HGT)

Historical Stock Chart

From Apr 2023 to Apr 2024