HgCapital Trust PLC Edison issues update on HgCapital Trust (HGT)

June 10 2021 - 2:00AM

RNS Non-Regulatory

TIDMHGT

HgCapital Trust PLC

10 June 2021

London, UK, 10 June 2021

Edison issues update on HgCapital Trust (HGT)

HgCapital Trust (HGT) posted a strong NAV TR of 8.4% in Q121,

driven primarily by double-digit earnings growth across the

portfolio (LTM EBITDA for top 20 holdings up 30% y-o-y). After

record-high transaction volumes in FY20 (investments at GBP403m and

realisations at GBP364m), HGT has maintained a high transaction

activity to date in 2021 (GBP147m and GBP112m, respectively). Its

coverage ratio was a healthy 69% at 12 May 2021, supported by tap

equity issues, which totalled c GBP50m to 8 June 2021 (versus

GBP25m in FY20), and a GBP200m credit facility agreed in Q420,

which remains undrawn.

HGT focuses on the software and services sector, which has been

one of the most sought-after industries (S&P 500 Software and

Services index up 52% over the 12 months to end-March 2021). This

has resulted in overall demanding public valuations. At the same

time, HGT's shares are trading broadly in line with NAV (vs a c 20%

average discount for PE peers, although in line with HGT's

historical trading). However, we note that HGT's recent NAV TR has

been mostly driven by earnings momentum across portfolio companies

rather than public market multiples. Moreover, the company

continues to report healthy uplifts to last carrying value on

exits, suggesting a relatively conservative portfolio valuation

policy. The broader software and services market remains supportive

for HGT's portfolio, with the S&P 500 Software and Services

Index (which historically has been a good valuation proxy for Hg's

portfolio) up 7% since end-March 2021 to 8 June 2021.

Click here to view the full report or here to sign up to receive

research as it is published.

All reports published by Edison are available to download free

of charge from its website

www.edisongroup.com

About Edison: E dison is a leading research and investor

relations consultancy, connecting listed companies to the widest

pool of global investors. By focusing on the volume and quality of

investors reached - across institutions, family offices, wealth

managers and retail investors - Edison can create and gauge intent

to purchase, even in the darkest pools of capital, and then make

introductions via non-deal roadshows, events or virtual

meetings.

Having been the first in-market 17 years ago, Edison now has

more than 100 analysts covering every economic sector.

Headquartered in London, Edison also has offices in New York,

Frankfurt, Amsterdam and Tel Aviv and a presence in Athens,

Johannesburg and Sydney.

Edison is authorised and regulated by the Financial Conduct

Authority .

Edison is not an adviser or broker-dealer and does not provide

investment advice. Edison's reports are not solicitations to buy or

sell any securities.

For more information, please contact Edison:

Milosz Papst +44 (0)20 3681 2519

investmenttrusts@edisongroup.com

Richard Williamson +44 (0)20 3077 5700

investmenttrusts@edisongroup.com

Learn more at www.edisongroup.com and connect with Edison on:

LinkedIn https://www.linkedin.com/company/edison-group-/

Twitter www.twitter.com/Edison_Inv_Res

YouTube www.youtube.com/edisonitv

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAEKLFBFQLFBBB

(END) Dow Jones Newswires

June 10, 2021 03:00 ET (07:00 GMT)

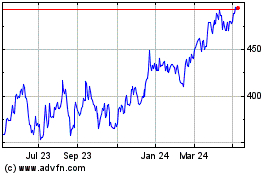

Hg Capital (LSE:HGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

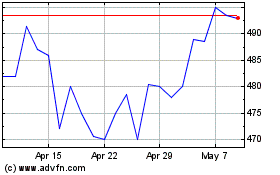

Hg Capital (LSE:HGT)

Historical Stock Chart

From Apr 2023 to Apr 2024