HSBC in Talks to Sell French Retail Bank to Cerberus

March 17 2021 - 12:23PM

Dow Jones News

By Simon Clark

HSBC Holdings PLC is in exclusive talks to sell its unprofitable

French retail bank to New York-based private-equity firm Cerberus

Capital Management LP as part of a global reorganization of its

operations, the bank told employees this week.

HSBC, which once marketed itself as the world's local bank, is

withdrawing from retail banking in France as it scales back in

Europe and North America and boosts its presence in Asia, where it

makes most of its profit. The London-based bank also is considering

selling its unprofitable U.S. retail-banking network.

Cerberus plans to combine HSBC France with My Money Group, a

French lender it acquired in 2017 from General Electric Co.,

according to a message Jean Beunardeau, the head of HSBC's

Continental European operations, sent to French employees and

reviewed by The Wall Street Journal.

"Discussions are still ongoing and are expected to be for some

weeks to come, and these may or may not lead to a transaction," Mr.

Beunardeau wrote. The proposed transaction includes HSBC's French

retail-banking and wealth-management operations but not its

insurance and asset-management operations, according to the

message. HSBC may continue to distribute insurance and

asset-management products through the French bank after the sale,

Mr. Beunardeau said.

European banks are selling or closing operations in an effort to

boost profitability. In December, HSBC rebranded its French unit as

HSBC Continental Europe and combined it with operations in Belgium,

Spain, Italy and other nations. The sale would unwind a continental

expansion that took root in 2000 with HSBC's $10.6 billion takeover

of Credit Commercial de France, which it won in a bidding war with

Dutch lender ING Groep NV.

Cerberus, which manages about $50 billion, previously acquired

Austria's Bawag Group and Germany's Hamburg Commercial Bank and

bought stakes in Deutsche Bank AG and Commerzbank AG.

Cerberus was competing for HSBC France with AnaCap Financial

Partners Ltd., a London-based private-equity firm that specializes

in financial companies, according to people familiar with the

situation. AnaCap planned to combine the HSBC unit with the French

retail operations of Barclays PLC, which it acquired in 2017.

AnaCap rebranded the Barclays assets as Milleis Banque SA.

(END) Dow Jones Newswires

March 17, 2021 13:08 ET (17:08 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

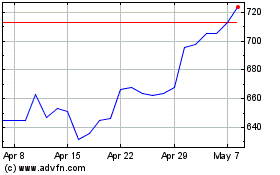

Hsbc (LSE:HSBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hsbc (LSE:HSBA)

Historical Stock Chart

From Apr 2023 to Apr 2024