HSBC to Move Top Bankers to Hong Kong as Asia Focus Sharpens

April 14 2021 - 8:12AM

Dow Jones News

By Simon Clark

Global banking giant HSBC Holdings PLC will move four senior

bankers from London to Hong Kong to boost its strategy of

refocusing operations on Asia instead of Europe and North

America.

The executives who will move later this year are Barry O'Byrne,

head of global commercial banking; Greg Guyett, co-head of global

banking and markets; Nuno Matos, head of wealth and personal

banking, and Nicolas Moreau, head of global asset management, HSBC

said in notes to staff.

"I want more of our global executive team to be located in key

growth regions," HSBC Chief Executive Noel Quinn wrote in one of

the notes.

HSBC, which was founded in Hong Kong in 1865, has been caught up

in the geopolitical tension between China and the West over the

weakening autonomy of the Asian port city from Beijing. Some U.S.

and British politicians have urged the bank to take a stance

against China but Mr. Quinn has declined to do so, stating that he

is a banker, not a politician.

Mr. Quinn assured colleagues in his note that HSBC will continue

to be based in London and maintain a global presence.

"We remain fully committed to the U.K., both in terms of our

domicile and our significant businesses and client base in the

country," Mr. Quinn wrote. "These moves have no impact on the

location of our headquarters and the management and oversight of

the group executive committee."

HSBC makes most of its profit in Hong Kong and mainland China.

Mr. Quinn said in February that he is considering selling the

bank's unprofitable U.S. retail operations and plans to pour about

$6 billion of investment into Asia in the next five years.

HSBC is in talks to sell its unprofitable French retail bank to

New York-based private-equity firm Cerberus Capital Management

LP.

Georges Elhedery, co-head of global banking and markets

alongside Mr. Guyett, will continue to be based in the U.K.

Mr. Matos's relocation to Hong Kong brings him closer to Trista

Sun, the Chinese banker leading HSBC's Pinnacle venture that

targets wealthy Chinese clients. Mr. Matos said in February that

Pinnacle was exceeding financial targets.

Write to Simon Clark at simon.clark@wsj.com

(END) Dow Jones Newswires

April 14, 2021 08:57 ET (12:57 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

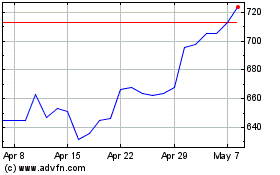

Hsbc (LSE:HSBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hsbc (LSE:HSBA)

Historical Stock Chart

From Apr 2023 to Apr 2024