HSBC's Profit Jumps as Global Economy Recovers -- 2nd Update

April 27 2021 - 1:49AM

Dow Jones News

By Simon Clark and Quentin Webb

Global banking giant HSBC Holdings PLC said quarterly net profit

more than doubled, as a nascent economic recovery allowed it to

free up funds previously set aside to offset potential

pandemic-related losses.

The London-based lender, which makes most of its profit in Hong

Kong and mainland China, earned a forecast-beating $3.88 billion in

the first three months of the year, up from $1.79 billion in the

same period last year.

"The economic outlook has improved, giving us increasing

confidence in our revenue growth plans," the bank said Tuesday. The

lender's global banking and markets business had a good quarter,

HSBC said, while growth was solid in areas like wealth management

and trade finance in Asia, and in U.K. and Hong Kong mortgages.

HSBC reduced provisions for bad loans by $435 million in the

quarter, which it said was mostly due to a brighter economic

outlook. It had taken more than $3 billion of new provisions in the

same period last year.

The bank said lower provisions in the U.K., in particular, had

helped boost its results. This time last year, it also took a big

one-off charge tied to a corporate borrower in Singapore.

Both net profit and provisions beat analysts' forecasts. On

average, they had expected HSBC would report $1.88 billion of net

income for the quarter and that it would make about $1.08 billion

of new provisions, according to data compiled by HSBC.

In Hong Kong, the bank's stock jumped in early afternoon trading

to stand 2.1% higher at 46.05 Hong Kong dollars a share.

HSBC Chief Executive Noel Quinn is one year into overhauling the

bank to refocus its operations on Asia. In February, he said he was

considering selling the unprofitable U.S. retail operations and

pouring about $6 billion of investment into Asia in the next five

years. HSBC is also in talks to sell its unprofitable French retail

bank.

Geopolitical tensions between China and the West have strained

Mr. Quinn's ambitions. Last year, HSBC supported China's imposition

of a national-security law in Hong Kong, which the U.S. and British

governments opposed.

Mr. Quinn has ruled out moving HSBC's headquarters back to Hong

Kong, where the bank was founded in 1865. But he told staff this

month that executives in charge of commercial lending, banking and

markets, wealth and personal banking, and asset management would

relocate to Hong Kong from London this year.

Pretax profit from HSBC's Hong Kong and mainland China

operations fell 18% to $2.86 billion in the first quarter. The bank

reported a $484 million pretax profit in North America.

HSBC cut its forecast for full-year loan-loss charges this year.

But it warned: "there remains a high degree of uncertainty as

countries emerge from the pandemic at different speeds and as

government support measures unwind."

Write to Simon Clark at simon.clark@wsj.com and Quentin Webb at

quentin.webb@wsj.com

(END) Dow Jones Newswires

April 27, 2021 02:34 ET (06:34 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

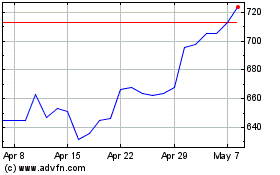

Hsbc (LSE:HSBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hsbc (LSE:HSBA)

Historical Stock Chart

From Apr 2023 to Apr 2024