AIM Schedule One - HSS Hire Group PLC (0542I)

December 09 2020 - 3:00AM

UK Regulatory

TIDMHSS

RNS Number : 0542I

AIM

09 December 2020

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

HSS Hire Group plc ("HSS Hire" or "the Company")

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

Oakland House

76 Talbot Road

Manchester

M16 0PQ

COUNTRY OF INCORPORATION:

United Kingdom

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

www.hsshiregroup.com

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

The Company and its subsidiary undertakings (the "Group") is

a leading supplier of tool and equipment for hire in the United

Kingdom and Ireland and has provided equipment hire services

in the United Kingdom for more than 60 years, primarily focusing

on the B2B market. The Group's purpose is to equip its customers

with the tools, equipment, training and related services that

enable the construction, maintenance and operation of the United

Kingdom and Ireland's commercial, industrial and residential

infrastructure.

The Group's range of equipment includes over 1,000 product

lines in categories including powered access, lifting, heating,

cooling, drying, lighting, power, breaking, drilling and site

works. Alongside traditional equipment hire, the Group offers

a range of complementary, value added services through its

various businesses, including HSS OneCall and HSS Training.

The Group's operations are segmented into two reportable segments:

Rental - 70% of revenue in the year ended 28 December 2019

This segment comprises rental income from HSS Hire-owned tools

and equipment and directly related revenue, such as resale

of consumables, transport, loss, damage and other ancillary

revenues. The Rental segment serves the very fragmented GBP1.9

billion market, according to internal Company estimates, for

small tools, power generation and powered access, via a combination

of HSS Tool Hire, ABird, Apex and All Seasons Hire. The Rental

segment has a national network of distribution centres and

smaller branches offering a wide range of compliant equipment.

Services - 30% of revenue in the year ended 28 December 2019

This segment comprises income from the Group's rehire business,

known as HSS OneCall, and HSS Training.

HSS OneCall is a marketplace consolidating a comprehensive

range of services from over 500 suppliers and offering them

to thousands of customers. HSS Training is the United Kingdom's

leading technical training business offering a range of over

200 industry-recognised technical and safety courses at 47

training venues throughout the United Kingdom and Ireland.

The Services segment has a network of over 500 accredited suppliers

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

Number of ordinary shares of 1 pence each in nominal value

("Ordinary Shares") for which Admission will be sought: 696,477,654

There are no restrictions as to the transferability of the

Ordinary Shares.

No Ordinary Shares are currently held, or will be held, in

treasury on Admission.

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

No capital to be raised on Admission.

Anticipated market capitalisation on Admission: c.GBP70 million

(based on the closing mid-market price on 8 December 2020,

market capitalisation on Admission will depend on the prevailing

mid-market share price of the Company immediately prior to

Admission).

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

82.2%

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

N/A

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Alan Edward Peterson (Non-Executive Chairman)

Stephen "Steve" Ashmore (Chief Executive Officer)

Paul David Quested (Chief Financial Officer)

Amanda Jane Burton (Independent Non-Executive Director)

Douglas "Doug" Grant Robertson (Independent Non-Executive Director)

Thomas "Tom" Sweet-Escott (Non-Executive Director)

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

Shareholder % of current % of ISC on

ISC admission

---------------------------- ------------- ------------

Exponent 33.8% 33.8%

Toscafund Asset Management 26.0% 26.0%

Ravenscroft (CI)

Limited(1) 21.8% 21.8%

(1) Shares held on behalf of Ravensworth International Limited.

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

* Simpson Thacher & Bartlett LLP

* Tomorrow Partners LLP

* OGG Consulting Limited

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

(i) 26 December (52 weeks)

(ii) N/A - existing issuer transferring to AIM from the Official

List

(iii) 26 June 2021 (annual accounts for the 52 weeks ending

26 December 2020)

3 October 2021 (half yearly report for the 26 weeks ending

3 July 2021)

2 July 2022 (annual accounts for the 53 weeks ending 2 January

2022)

EXPECTED ADMISSION DATE:

14 January 2021

NAME AND ADDRESS OF NOMINATED ADVISER:

Numis Securities Limited

10 Paternoster Square

London

EC4M 7LT

NAME AND ADDRESS OF BROKER:

Numis Securities Limited

10 Paternoster Square

London

EC4M 7LT

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

N/A - Quoted Applicant.

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

QCA Corporate Governance Code

DATE OF NOTIFICATION:

9 December 2020

NEW/ UPDATE:

New

QUOTED APPLICANTS MUST ALSO COMPLETE THE FOLLOWING:

THE NAME OF THE AIM DESIGNATED MARKET UPON WHICH THE APPLICANT'S

SECURITIES HAVE BEEN TRADED:

The Ordinary Shares were listed on the Premium segment of the

FCA's Official List / Main Market of the London Stock Exchange.

THE DATE FROM WHICH THE APPLICANT'S SECURITIES HAVE BEEN SO

TRADED:

9 February 2015

CONFIRMATION THAT, FOLLOWING DUE AND CAREFUL ENQUIRY, THE APPLICANT

HAS ADHERED TO ANY LEGAL AND REGULATORY REQUIREMENTS INVOLVED

IN HAVING ITS SECURITIES TRADED UPON SUCH A MARKET OR DETAILS

OF WHERE THERE HAS BEEN ANY BREACH:

The Company has adhered to the legal and regulatory requirements

applicable to companies admitted to the Official List (premium

segment) and the regulated market of London Stock Exchange

plc in respect of the Ordinary Shares.

It should be noted that the Company has been in dialogue with

the FCA for some time and agreed a modification of Listing

Rule 9.2.15R to allow for a minimum of 13.75% of the Company's

shares to be held in public hands, which would otherwise require

a free float of at least 25%. The current modification expires

on 20 August 2021.

AN ADDRESS OR WEB-SITE ADDRESS WHERE ANY DOCUMENTS OR ANNOUNCEMENTS

WHICH THE APPLICANT HAS MADE PUBLIC OVER THE LAST TWO YEARS

(IN CONSEQUENCE OF HAVING ITS SECURITIES SO TRADED) ARE AVAILABLE:

www.hsshiregroup.com

DETAILS OF THE APPLICANT'S STRATEGY FOLLOWING ADMISSION INCLUDING,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

STRATEGY:

Since early 2018, the Group has been implementing a new strategy

that involves three key strategic priorities: de-lever the

Group, transform the tool hire business and strengthen the

Group's commercial proposition. These priorities have remained

generally unchanged throughout COVID-19 related lockdowns and

government regulation; however they have continued to evolve

and, in some cases, accelerate in response to such challenges,

including with respect to the closure of 134 branches (leaving

around 120 remaining locations, including builders merchant

concessions, providing national coverage) and the redundancy

of approximately 300 colleagues. The Group has also continued

to focus on its digital strategy and systems required to ensure

that optimal service is provided throughout and after the pandemic.

A DESCRIPTION OF ANY SIGNIFICANT CHANGE IN FINANCIAL OR TRADING

POSITION OF THE APPLICANT, WHICH HAS OCCURRED SINCE THE

OF THE LAST FINANCIAL PERIOD FOR WHICH AUDITED STATEMENTS HAVE

BEEN PUBLISHED:

Save as disclosed in the Company's Covid-19 update on 25 March

2020, its update on trading contained in the FY19 results announcement

of 27 May 2020, the interim results issued on 8 October 2020,

the trading update contained in the announcement of 16 November

2020 and the announcements of 4 December 2020 there has been

no significant change in the financial or trading position

of HSS Hire since 29 December 2019, being the end of the last

financial period for which audited financial statements have

been published.

A STATEMENT THAT THE DIRECTORS OF THE APPLICANT HAVE NO REASON

TO BELIEVE THAT THE WORKING CAPITAL AVAILABLE TO IT OR ITS

GROUP WILL BE INSUFFICIENT FOR AT LEAST TWELVE MONTHS FROM

THE DATE OF ITS ADMISSION:

The Directors of the Company have no reason to believe that

the working capital available to it or its Group will be insufficient

for at least 12 months from the date of Admission.

DETAILS OF ANY LOCK-IN ARRANGEMENTS PURSUANT TO RULE 7 OF THE

AIM RULES:

N/A

A BRIEF DESCRIPTION OF THE ARRANGEMENTS FOR SETTLING THE APPLICANT'S

SECURITIES:

For the Company's Ordinary Shares, settlement will be through

the CREST system for uncertificated shares. Shareholders can

also deal based on share certificates.

A WEBSITE ADDRESS DETAILING THE RIGHTS ATTACHING TO THE APPLICANT'S

SECURITIES:

www.hsshiregroup.com

INFORMATION EQUIVALENT TO THAT REQUIRED FOR AN ADMISSION DOCUMENT

WHICH IS NOT CURRENTLY PUBLIC:

None

A WEBSITE ADDRESS OF A PAGE CONTAINING THE APPLICANT'S LATEST

ANNUAL REPORT AND ACCOUNTS WHICH MUST HAVE A FINANCIAL YEAR

END NOT MORE THEN NINE MONTHS PRIOR TO ADMISSION AND INTERIM

RESULTS WHERE APPLICABLE. THE ACCOUNTS MUST BE PREPARED IN

ACCORDANCE WITH ACCOUNTING STANDARDS PERMISSIBLE UNDER AIM

RULE 19:

www.hsshiregroup.com

THE NUMBER OF EACH CLASS OF SECURITIES HELD IN TREASURY:

None.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PAAGIBDDLGGDGGC

(END) Dow Jones Newswires

December 09, 2020 04:00 ET (09:00 GMT)

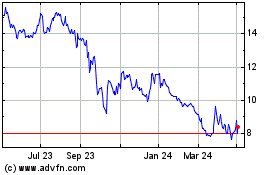

Hss Hire (LSE:HSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

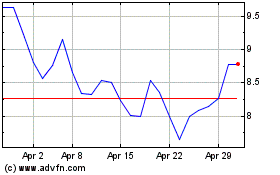

Hss Hire (LSE:HSS)

Historical Stock Chart

From Apr 2023 to Apr 2024