TIDMHSW

RNS Number : 2120T

Hostelworld Group PLC

23 March 2021

LEI: 213800OC94PF2D675H41

23 March 2021

Hostelworld Group plc

("Hostelworld" or the "Company")

Publication of Annual Report for 2020 and Notice of 2021 Annual

General Meeting

Annual Report and Accounts

Hostelworld, the world's leading hostel-focused online booking

platform, is pleased to announce that its Annual Report 2020 has

been posted or is being made available to shareholders today.

Annual General Meeting

The Company confirms that its Annual General Meeting will be

held at 12 noon on 26 April 2021 at the offices of the Company,

Floor 2, One Central Park, Leopardstown, Dublin 18, Ireland. A

Circular containing the Chairman's Letter and Notice of 2021 Annual

General Meeting and Form of Proxy has also been posted or is being

made available to shareholders today.

Whilst the AGM will be held at 12 noon on 26 April 2021 at the

Company's head office: Floor 2, One Central Park, Leopardstown,

Dublin 18, Ireland, please note that in light of the COVID-19

pandemic and in anticipation of social distancing measures

remaining in force, it is intended that the meeting will be run as

a closed meeting and shareholders must not attend in person.

Shareholders are therefore strongly encouraged to submit a proxy

vote in advance of the AGM, in accordance with the explanatory

notes set out in the notice of AGM.

Documents available for inspection

The following documents:

-- Annual Report 2020;

-- Circular containing the Chairman's Letter and Notice of 2021

Annual General Meeting;

-- Form of Proxy;

have been submitted to the UK Listing Authority via the National

Storage Mechanism, and the Irish Stock Exchange (trading as

Euronext Dublin), and will shortly be available for inspection at

the following location:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

and at:

Companies Announcements Office

Euronext Dublin,

28 Anglesea Street,

Dublin 2

The Annual Report 2020 has also been filed with the Central Bank

of Ireland.

The Annual Report 2020, the Circular containing the Chairman's

Letter and Notice of the 2021 Annual General Meeting and the Form

of Proxy are available on the Company's website at

www.hostelworldgroup.com .

Regulated Information

The information set out in the Appendix, which is extracted from

the Annual Report 2020, is included for the purposes of complying

with DTR 6.3.5 and its requirements on how to make public annual

financial reports. The information in the Appendix should be read

in conjunction with the Company's preliminary results for the year

ended 31 December 2020 released on 17 March 2021 which can be

viewed at www.hostelworldgroup.com . Together, these constitute the

material required by DTR 6.3.5 to be communicated in unedited full

text through a Regulatory Information Service.

Contacts:

Hostelworld Group plc

Caroline Sherry, Chief Financial Officer

John Duggan, General Counsel & Company Secretary

Tel: +353 (0) 1 498 0700

Appendix:

Directors' Responsibilities Statement

The Directors are responsible for preparing the Annual Report

and the Financial Statements in accordance with applicable law and

regulations.

Company law requires the Directors to prepare Financial

Statements for each financial year. Under that law the Directors

are required to prepare the Group Financial Statements in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006 and International

Financial Reporting Standards adopted pursuant to Regulation (EC)

No 1606/2002 as it applies in the European Union. The Directors

have elected to prepare the parent Company Financial Statements in

accordance with FRS 101 Reduced Disclosure Framework ("Relevant

Financial Reporting Framework") and applicable law. Under company

law the Directors must not approve the Financial Statements unless

they are satisfied that they give a true and fair view of the

assets, liabilities and financial position of the Group and Company

and of the profit or loss of the Group for that period.

In preparing the parent Company Financial Statements, the

Directors are required to:

-- Select suitable accounting policies and then apply them consistently;

-- Make judgments and accounting estimates that are reasonable and prudent;

-- State whether Financial Reporting Standard 101 Reduced

Disclosures Framework has been followed, subject to any material

departures disclosed and explained in the financial statements;

and

-- Prepare the Financial Statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

In preparing the Group Financial Statements, International

Accounting Standard 1 requires that Directors:

-- Properly select and apply accounting policies;

-- Present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

-- Provide additional disclosures when compliance with the

specific requirements in IFRSs are insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the Group's financial position and financial

performance; and

-- Make an assessment of the Company's ability to continue as a going concern.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the Financial Statements comply with the Companies Act 2006. They

are also responsible for safeguarding the assets of the Company and

hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the United Kingdom governing the

preparation and dissemination of Financial Statements may differ

from legislation in other jurisdictions.

Responsibility Statement

We confirm that to the best of our knowledge:

-- The Financial Statements, prepared in accordance with the

Relevant Financial Reporting Framework, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

taken as a whole;

-- The Strategic Report includes a fair review of the

development and performance of the business and the position of the

Company and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face; and

-- The Annual Report and Financial Statements, taken as a whole,

are fair, balanced and understandable and provide the information

necessary for shareholders to assess the Company's position and

performance, business model and strategy.

This responsibility statement was approved by the Board of

Directors on 16 March 2021 and is signed on its behalf by:

John Duggan

Company Secretary

16 March 2021

Principal risks and Uncertainties

The Board takes overall responsibility for identifying the

nature and extent of the risks to be managed by the Group to ensure

the successful delivery of its strategic and business priorities.

The Audit Committee monitors certain risk areas and the internal

control system, as set out in the report on governance. The Group's

risk register identifies key risks including any emerging risks and

monitors progress in managing and mitigating these risks and is

reviewed regularly during the year by the Audit Committee and at

least annually by the Board. Emerging risks are identified from

areas of uncertainty, which may not have a significant impact on

the business currently but does have the potential to adversely

affect the Group in the future.

The most material risks facing the Group are set out in the

table below, together with comments on how they are managed to

minimise their potential impact. While the table below is not

prioritised nor an exhaustive list of all risks that may impact the

Group, it is the Board's view of the principal risks at this point

in time. Individually or together, these risks could affect our

ability to operate as planned and could have a significant impact

on revenue and shareholder returns. Additional risks and

uncertainties, including those that have not been identified to

date or are currently deemed immaterial, may also, individually or

together, have a negative impact on our revenue, returns, or

financial condition.

Number Category Description and Impact Management and Mitigation Direction

of change

1 Macro Economic Revenue is derived from the wider In circumstances where events cause Increased

Conditions leisure travel sector. a material decline in consumer

The COVID-19 pandemic and the travel behaviours and patterns

resulting measures, including on a global scale, such as the

travel restrictions, implemented recent COVID-19 pandemic, management

by governments around the world to will take necessary actions

reduce the spread of COVID-19 has to conserve cash.

resulted in an unprecedented There has been an increased and

decline in consumer spending, on-going focus by the Group on

travel and related activities. This liquidity management.

pandemic has adversely affected New sources of debt and equity

our business and the outlook for financing have been secured which

the future remains uncertain at provides additional flexibility

present and it is not yet to support the Group as it recovers

known when international travel from the impact of the COVID-19

will return to normal levels. pandemic.

Perceived or actual economic Our business is a global one, with a

conditions, including slowing or dispersed population of users, and a

negative economic growth, rising geographically dispersed

unemployment rates, set of destinations. Whilst market

weakening currencies, higher taxes conditions may decline in certain

or tariffs could impair customer regions, the globally

spending and adversely diversified nature of the business

affect travel demand. In addition, helps to mitigate this.

events beyond our control such as FX movements may impact travel

unusual or extreme weather, decisions and travel patterns by

travel related health concerns customers, but typically there

including the COVID-19 pandemic is a degree of counterbalancing

mentioned above or travel-related movement e.g. the weakening of the

accidents US dollar against the euro

can disrupt travel and result in means fewer US travellers visiting

declines in travel demand. Because the Eurozone, but decreased

these events or concerns marketing costs from USD denominated

are largely unpredictable, suppliers such as Google. FX

influencing customer demand and translation risk is mitigated

behaviour, they can adversely through matching foreign currency

affect cash outflows and foreign currency

our business and results of cash inflows and by minimising

operations. holdings of excess noneuro

Significant movements in FX rates currency above anticipated outflow

can have a material impact on requirements.

travel demand and travel patterns

therefore impacting revenue.

------------------- ------------------------------------ ------------------------------------- -----------

2 Working Capital Resulting from the detrimental When COVID-19 began there was a Increased

Investment and impact that COVID-19 has had on the robust assessment taken by Directors

Going Concern travel sector there of principal risks facing

has been a significant impact on the Group including those that

our working capital resources, threaten its business model, future

which creates a risk that performance, solvency or liquidity.

the Group will not be able to New funding was received through an

continue in operation and meet its equity raise and debt

liabilities as they fall financing.

due. The Group has prepared a The Group is focused on cash

five-year budget which assumes a forecasting, tight cost control and

return to growth. managing supplier and customer

There is a risk that the travel relationships.

sector will not return to trading Key metrics and reporting reviewed

volumes in line with expectations. regularly in management accounts and

Our ability to invest and grow is at management meetings.

further constrained by our

financial resources.

------------------- ------------------------------------ ------------------------------------- -----------

3 Capital The Group has reviewed its capital The Group engaged with large firm Increased

Structure structure and strengthened its corporate finance advisers to review

capital base with two landmark and discuss the

transactions in June 2020: optimal capital structure.

-- Equity Placing The Group has performed weekly

-- Debt Raising forecasting of cash resources and

Since the IPO in 2015, the Group monitored closely the covenants

had neither placed equity nor and obligations caused by any debt

raised debt. These two transactions agreements in place. Monthly

carry inherent risks. Equity reporting has been put in place to

placing leads to higher scrutiny ensure the terms of the new

from shareholders both term loan facility and related

participating reporting requirements are adhered

and non-participating. to.

In 2021 the group entered a new

term loan facility for EUR30m.

Debt, by creating repayment

obligations and covenants, requires

constant monitoring of the Group's

leverage and

liquidity.

------------------- ------------------------------------ ------------------------------------- -----------

4 Impact of The continued threat of terrorist Our target 18-34-year-old population Unchanged

terrorism threat attacks in key cities and on tend to be both flexible as to

on leisure travel aircraft in flight may reduce destination, and are less

the risk adverse.

appetite of the leisure traveller

to undertake trips particularly to

certain geographies,

resulting in declining revenues.

Increased incidence of terrorism

impacts consumer confidence and can

shift demand away from

certain destinations.

------------------- ------------------------------------ ------------------------------------- -----------

5 Competition The risks posed by competition Execution of roadmap for growth and Increased

could adversely impact our market capitalise on our unique market

share and future growth of position, this

the business, these include: involves:

-- Supply: competition from direct -- Targeting new customer

competitors, alternative acquisition and growing the most

accommodation operators and profitable customer cohorts (with

disruptive focus on CLV/CAC) by optimising

new entrants leading to a loss of overall marketing investment.

key accommodation -- Strengthening the Group's core

suppliers. platform in order to improve its

-- Customers: changes in customer flexibility and the experience

behaviour leading to a loss in of our customers.

customer traffic and demand -- Upgrading our third-party

for our services and / or increase platform connectivity in order to

in customer acquisition costs. defend our competitive position.

Consumer preferences could -- Focus on expanding our global

change as a result footprint, meeting emerging demand

of the COVID-19 pandemic which may while also strengthening

be disadvantageous to our business our overall product offering.

and may benefit existing -- Leveraging the capabilities of

and new competitors. With global our partnerships with Goki Pty

travel restrictions, there may be a Limited and Counter App Limited

shift towards domestic to ensure we are delivering best in

travel and alternative class and most advanced tech-based

accommodations. solutions for our customers

-- There has been a rise in and hostel partners.

cancellations and vouchers issued

in lieu of cash refunds for

the Group and with our competitors.

This increases competition for the

Group as it locks customers

into those companies issuing the

credit notes, thereby potentially

reducing the demand for

the Group's offering.

-- Technology and Product: Over

recent years the ever-increasing

pace of change of new technology,

new infrastructure and new software

offerings have changed how

customer's research, purchase

and experience

travel. Notable shift changes

include mobile networks, mobile

applications, meta-search

providers,

display advertising, social

communities etc.

Unless we continue to stay abreast

of technology innovation and

change, we

risk becoming irrelevant to the

modern customer.

------------------- ------------------------------------ ------------------------------------- -----------

6 Search Engine A large proportion of traffic to The Group invests heavily in Unchanged

Algorithms our websites is generated through recruiting and retaining key

internet search engines personnel with the requisite skills

such as Google, from non-paid and capabilities in paid and nonpaid

(organic) searches and through the search. This in-house expertise is

purchase of travel related supplemented by the

keywords (paid search). deployment of leading

We therefore rely significantly on technology tools. The search

practices such as Search Engine marketing team works closely with

Optimisation ("SEO") Google to understand

and Search Engine Marketing ("SEM") any changes in functionality to the

to improve our visibility in AdWords platform so that we can

relevant search results. avail of any efficiencies

Search engines, including Google, in our search traffic. The Group

frequently update and change the participates in alpha and beta

logic that determines the feature tests that give Hostelworld

placement and display of results of first mover advantage with new

a user's search, which can functionality that can help drive

negatively impact placement efficiency.

of our paid and organic results in

search results. This could result

in a decrease in bookings

and

thus revenue. It could also result

in having to replace free traffic

with paid traffic, which

would negatively impact margins.

------------------- ------------------------------------ ------------------------------------- -----------

7 Brand Consumer trust in our brand is We are focused on investing in our Unchanged

essential to ongoing revenue core products, platform and

growth. Negative publicity around technological capabilities

our products or services could to support our brand proposition as

negatively impact on traveller and well as actively managing our brand

accommodation provider confidence portfolio through social media

and result in loss of revenue. channels. Our customer service team

Negative publicity could impact strive to ensure that customers

brand perception and consumer have a positive experience at all

loyalty and ultimately revenue. stages of interacting with us. The

Our exceptional refund policy for Group has a Crisis Management Policy

COVID-19 refunds has the potential in place which includes

to adversely affect our appropriate escalation.

brand.

------------------- ------------------------------------ ------------------------------------- -----------

8 Data Security We capture personal data from our Hostelworld are Level 1 PCI Increased

customers, including credit card compliance with the guidelines of

details and retain this the payment card industry.

on our systems. There is always a Through 2020 we performed a lot of

risk of a cyber security related work to comply with certain aspects

attack or disruption, including of Payment

by criminals, hacktivists or Services Directive 2 ("PSD2") in

foreign 2021 as it relates to customer

governments on our systems or those payment - customer authentication

of third-party suppliers. security measures.

Cybercrime including unauthorised Hostelworld works closely with

access to confidential information internal and external audit

and systems would have significant functions to ensure that our system

reputational impact architectures, work processes and

and could result in financial policies are in place to provide as

and/or other penalties. much protection as possible.

The shift to remote working during We have a privacy compliance

COVID-19 (beginning 12 March 2020) programme to align with our on-going

changed the risk obligations under GDPR and

profile of certain data processing have invested in our own data

activities and gives rise to protection resources to monitor

ongoing data security compliance including the onboarding

challenges and a widening threat of bespoke privacy management

landscape more targeted at endpoint software in mid-2020. Our Data

controls. Protection Officer ("DPO") is

As we plan for a level of return of responsible for informing, advising

colleagues to our offices, the and monitoring compliance on all

COVID-19 Return to Work matters relating to the

Protocol (Ireland) and Working protection of personal data in the

Safely During Coronavirus Group. We regularly review our

Guidelines (UK) require us to employee information

capture security policy and we continue to

from colleagues and office invest in information security

visitors, new categories of training for all staff so

sensitive personal health data that that they remain vigilant and alert

we would not have obtained before. to the possibility of cybercrime.

The General Data Protection We reviewed the impact on servers of

Regulation ("GDPR") places increased remote access loads with

significant data security and teams working from

regulatory compliance obligations home. We issued guidance to

on us when all colleagues during COVID-19

processing such data. regarding

Third party vendors that we engage the personal data and data security

with may not have the appropriate implications of the pandemic and new

Information Security remote

controls in place leading to a working along with enhanced

potential breach of customer data. procedures

For 2021, Hostelworld plan to for accessing company data while

migrate parts of the e-commerce working

platform to the Cloud. Whilst remotely.

risk is minimal, there still is We provide data security training

risk that security for all staff.

gaps may manifest during the We perform due diligence of our

migration. third-party suppliers who process

our personal data including

heightened information security due

diligence.

------------------- ------------------------------------ ------------------------------------- -----------

9 Regulation The global nature of our business Monitor regulatory matters in Increased

means we are exposed to issues locations in which we provide

regarding competition, licensing services with a particular

of local accommodation, language focus on those areas where we have

usage, web-based trading, consumer local operations.

compliance, tax, intellectual Suitable experienced resources have

property, trademarks, data been engaged to ensure consumer

security and commercial disputes in compliance

multiple jurisdictions. requirements, compliance with the

Compliance with new regulations can Listing Rules, the FRC Corporate

mean incurring unforeseen costs, Governance Code and the

and noncompliance could Market Abuse Regulations.

result in penalties and A detailed analysis of the Group's

reputational damage. approach to offering vouchers to

COVID-19 has led to increased focus certain customers

by consumer rights regulators on concluded that the Group's approach

the online sales practices was aligned with the principles

of tourism and travel focused reflected in the EU

companies and may have an impact on Commission recommendations on

the Group's brand if the vouchers for cancelled package

Group's sales practices were travel and transport services

investigated and assessed to be published on 13 May 2020.

noncompliant. In line with guidance from the Irish

COVID-19 has heightened our and UK governments, we have

obligations under employment and developed a robust

health and safety laws to protect COVID-19 Response Plan including

the safety, health and welfare of adopting protocols around returning

colleagues in the workplace. colleagues back to the

GDPR imposes particular compliance office environment.

obligations with respect to our Rolled out an effective refund

COVID-19 management and risk policy and

response measures with risk of procedure to deal with individual

fines and other enforcement consumer complaints and those from

mechanisms being imposed by a data consumer regulators. Our response to

protection authority. requests and complaints

Our position on customer refunds is informed by a cross-departmental

may give rise to customer risk assessment.

complaints to consumer regulators The Group have been working with the

such as the Irish Competition and Central Bank of Ireland to ensure

Consumer Protection Commission or the group are complaint

UK Competition and Markets with the PSD2 EU Directive.

Authority who have a range of

enforcement powers including fines.

PSD2 is a new EU Directive that

applies to payment services in the

EU. The deadline for the

Group to incorporate and be

compliant with this Directive was

31 December 2020.

------------------- ------------------------------------ ------------------------------------- -----------

10 Tax The taxation of e-commerce In collaboration with our tax Increased

businesses is constantly being advisers, a large professional

evaluated and developed by tax services firm, we assess possible

authorities tax impacts in the jurisdictions in

around the world. There is a risk which we operate to ensure our tax

relating to the identification of obligations are aligned

and evaluation of tax to the operational nature of our

legislative changes and the business.

impact of these on the Group. Transactions and mergers and

Due to the global nature of our acquisitions work are properly

business, tax authorities in other documented with support from tax

jurisdictions may consider advisers. Transfer pricing is

that taxes are due in their regularly reviewed and updated to

jurisdiction, for example because reflect Group structure and

the customer is resident in most recent guidance.

that jurisdiction or the travel

service is

deemed to be supplied in such

jurisdiction.

If those tax authorities take a

different view than the Group as to

the basis on which the

Group is subject to tax, it could

result in the Group having to

account for tax that it currently

does not collect or pay, which

could have a material adverse

effect on the Group's financial

condition and results of operation

if it could not reclaim taxes

already accounted for in

the jurisdictions the Group

considers relevant. Changes to tax

legislation or the interpretation

of tax legislation or changes to

tax laws based on recommendations

made by the OECD in relation

to its Action Plan on Base Erosion

and Profits Shifting ("BEPS") or

national governments may

result in additional material tax

being suffered by the Group.

We are currently monitoring the

introduction of the digital

services taxes, and its impact

on our Group.

------------------- ------------------------------------ ------------------------------------- -----------

11 Business Failure in our IT systems or those As an e-commerce organisation, the Increased

Continuity on which we rely such as third Group's

party hosted services could business continuity plan focusses on

disrupt availability of our booking the continued operation of consumer

engines and payments platforms, or facing products and

availability of administrative related services to ensure our

services at our office locations, e-commerce trading systems can

with an adverse impact to our continue

customer service. to process bookings. Our fully

The outbreak of COVID-19 led to distributed and redundant

substantial business and architecture across two data centres

operational disruptions across based in two different countries

the Group and resulted in supports this approach. The Group

Hostelworld and our third-party has

suppliers seeking to suspend or worked with external advisers to

be excused from certain contractual produce robust documented business

obligations. continuity and disaster

recovery capabilities. We have also

extended our eCommerce Business

Continuity Plan("BCP")

to include our corporate offices.

Across 2021 we will carry out

targeted business continuity testing

by business unit to ensure

our systems and processes are

effective as possible.

As part of COVID-19 BCP invocation

all employees have been working from

home via Hostelworld

secured endpoint devices that were

configured and rolled out in 2020.

All

teams had tested access and

functionality and only small

adjustment was needed to have all

teams operational very quickly. All

laptops are encrypted and protected

with

anti-virus and anti-malware

software.

We updated our standard supplier

terms in early 2020 to provide more

robust and comprehensive

contractual provisions regarding

force majeure (covering epidemics/

pandemics) and BCP (requiring

suppliers to implement the

provisions of our BCP at any time).

------------------- ------------------------------------ ------------------------------------- -----------

12 People The Group is dependent on ability The Group has developed stronger Increased

to attract, retain and develop recruitment processes supported by

creative, committed and skilled effective HR policies

employees so as to achieve its and people process to enable the

strategic objectives. attraction and retention of key

Due to the possibility of a long talent.

recovery period for the travel The Group has increased focus on

industry resulting from the understanding the drivers of

COVID-19 pandemic and the employee engagement and are

redundancies and restructurings committed to taking action to

which have taken place within the improve employee engagement levels.

company, employees may not view Robust external benchmarking

employment with us as positively as has ensured there is understanding

they did of the competitiveness of the reward

prior to the pandemic. This may offering and

adversely affect our ability to additional investment in 2019 and

attract and retain highly 2020 aims to reduce voluntary

skilled employees. attrition.

The Group operates from five global

offices, which provides flexibility

for location of key

talent, thereby opening up a larger

talent pool to select from. A move

to increased remote

working would further enhance this.

A non-executive director fulfils a

workforce engagement role as set out

in the 2018 UK Corporate

Governance Code.

------------------- ------------------------------------ ------------------------------------- -----------

13 Brexit The Group is exposed to The Group is a global business and Increased

Brexit-related risks and continues to grow its international

uncertainties in relation to its footprint and

continued presence across its key markets.

impact on global markets and Through continued international

currency exchange rate expansion and

fluctuations. The uncertainties in diversification, the Group will seek

relation to naturally mitigate the impacts of

to the movement of people may Brexit. However,

result in the reduction of bookings the Group will continue to assess

particularly into and from the impacts of Brexit and implement

the UK travel market and from UK any necessary remediation

nationals which could impact on steps to mitigate its impact on the

Group revenue. In the year Group.

ended 31 December 2020, the UK as a Hostelworld has in place with all

destination represented 6% of total Group companies, an intra-group data

Group bookings (2019: transfer agreement

6%) and 16% of Group bookings were with EU Commission-approved

from UK nationals (2019: 14%). Model Clauses, one of the approved

Overall a decline in macroeconomic data transfer mechanisms under the

conditions GDPR - HW UK is a party

in the UK could negatively impact to this agreement. Hostelworld has

consumer confidence and reduce also prepared GDPR compliant data

spending in all areas protection supplemental

including the wider leisure travel contract addendums for UK suppliers

sector. which will provide appropriate

On 1 January 2021, the UK became a safeguards and mechanisms

third country for the purposes of to ensure data transfers to the UK

the GDPR and any transfer are GDPR compliant.

of personal data to HW UK or a

supplier must now comply with the

data transfer rules in the

GDPR. Failure to comply can lead to

fines from the regulator and a

negative impact on market

reputation.

------------------- ------------------------------------ ------------------------------------- -----------

14 Climate Climate change and sustainability Climate change issues may impact Increased

Change and came into travel decisions and travel patterns

Sustainability sharp focus in 2019 and has further by customers but is

evolved as an area of heightened mitigated to the extent that our

concern with consumers business is a global one, with a

and stakeholders in 2020. dispersed population of

There is a request for more users, and a geographically

accountability from our customers, dispersed set of destinations.

employees, other stakeholders We aim to offset our carbon

as to what the Group is doing to footprint through a number of

limit its indirect impact on initiatives. In 2020, we became

climate change. a signatory on the Global Tourism

Plastics Initiative led by the UN

Environment programme

and the World Tourism Organisation.

Our goal is to encourage our hostel

partners to sign up

with the aim of reducing their

single use plastics consumption. We

have also taken steps to

reduce our plastic consumption as a

Group.

Prior to COVID-19, we made efforts

to reduce our plastic consumption

through initiatives such

as purchasing reusable water bottles

for the office, ordering fresh fruit

and other perishables

from suppliers who use fully

recyclable packaging.

------------------- ------------------------------------ ------------------------------------- -----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSLXLFLFXLFBBF

(END) Dow Jones Newswires

March 23, 2021 08:15 ET (12:15 GMT)

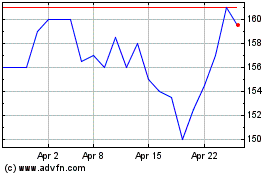

Hostelworld (LSE:HSW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hostelworld (LSE:HSW)

Historical Stock Chart

From Apr 2023 to Apr 2024