By Benjamin Katz

LONDON -- British Airways and Virgin Atlantic Airways Ltd. are

pushing for the establishment of a travel corridor between the U.K.

and U.S. without requirements for expensive Covid-19 tests and

quarantines on both sides of the Atlantic, as carriers here try to

capitalize on a robust vaccination drive and falling coronavirus

cases.

Contrasting that optimism, Air France-KLM Group said it won

approval for another large government-financed lifeline as it faces

months of reduced traffic amid soaring infections and slow

vaccination efforts across continental Europe.

The diverging tacks highlight how a resumption of air travel is

moving at significantly different speeds around the world. In the

U.S., airlines are gearing up for a busy summer amid a relatively

smooth vaccination drive across the country in recent months.

Chinese travelers returned to airports in droves late last year,

though traffic fell again at the start of the year as Covid-19

cases picked up in some parts of the country.

Travel between countries, meanwhile, has remained largely

grounded amid a wide array of country-specific travel restrictions.

That has hampered European carriers, dependent on international

service.

"Large domestic markets are doing great," said Alex Irving, an

aviation analyst at Bernstein. "Of course, Europe doesn't have

that. Ultimately it depends on vaccine rollouts when governments

will be comfortable unlocking their borders."

The U.K. government could be a test case. It is preparing to

disclose details of plans to allow residents to fly internationally

as early as next month. Speaking to reporters Tuesday, aviation

executives in the U.K. pointed to new guidance from the U.S.

Centers for Disease Control and Prevention saying fully vaccinated

travelers can fly again with low risk to themselves and others.

In the U.S., discussions are also under way to determine what

conditions are necessary for lifting restrictions on international

travel, according to people familiar with the matter.

The industry has floated the idea of easing U.S.-U.K. travel

requirements before, but vaccine success on both sides of the

Atlantic has emboldened them to push harder now.

Executives are also pushing the U.K. government to move quickly

on detailing which overseas air markets will get the green light

for service, saying they need time to prepare facilities, return

parked aircraft to service and bring back furloughed staff. British

Airways Chief Executive Sean Doyle warned the U.K. government not

to "waste the opportunity of having had an incredibly successful

vaccine rollout." British Airways is a unit of International

Consolidated Airlines Group SA.

U.K. airlines hope an accelerating recovery in the U.S., led by

domestic travel, bodes well for a pickup in international demand.

Both Delta Air Lines Inc. and United Airlines Holdings Inc. have

said they may have stopped bleeding cash last month, and in

mid-March U.S. airports posted their busiest weekend since March

2020.

Anticipating a surge in travel, U.S. airlines in recent weeks

announced plans to fly more than 150 new domestic routes. Delta

also said it would stop blocking the middle seat on its flights

from May 1, while United is restarting its pilot recruitment

programs. Discount operators Frontier Group Holdings Inc. and Sun

Country Airlines Holdings Inc. have raised hundreds of million of

dollars in separate initial public offerings as they look to ride a

surge in passenger travel heading into the summer.

On continental Europe, however, new Covid-19 cases are soaring

in places. Major travel markets like Germany and France have fallen

behind in vaccinations, and governments have reimposed lockdowns

and other pandemic restrictions.

Discounters Ryanair Holdings PLC and Hungary-based Wizz Air

Holdings PLC, both heavily dependent on cross-border European

flights, said demand remained depressed in March amid the rise in

infections across the continent. Ryanair, Europe's biggest airline

by passengers, said it flew just 500,000 passengers in March, a 95%

decline from last year, while Wizz recorded a 73% drop to 480,200

travelers.

Ryanair is planning to operate at about 15% of its April 2019

capacity this month, according to aviation data firm OAG. Michael

O'Leary, the Dublin-based carrier's chief executive, said last week

he expects vaccination numbers to continue to rise in Portugal,

Spain and Italy, setting a path for a jump in travel as early as

this summer.

Air France-KLM said it was being hit by the "surge in the third

wave of the pandemic in several European countries" and expects

losses in the current quarter to reach 750 million euros,

equivalent to $888 million. The company posted a loss of EUR1.7

billion for its most recent fiscal year.

It is still hopeful of a recovery in the summer, expecting that

vaccination campaigns on the continent will speed up and lead to

less-stringent travel restrictions. Still, the airline said the

French government agreed to convert a shareholder loan of EUR3

billion issued last year into perpetual hybrid bonds in order to

recapitalize the carrier. The government will also participate in a

share capital increase to raise an additional EUR1 billion. The

Dutch government is in separate talks with KLM on a similar

recapitalization plan. The moves follow EUR10.4 billion in

liquidity provided to Air France-KLM since the start of the

pandemic.

Deutsche Lufthansa AG said it would seek shareholder approval

next month to raise EUR5.5 billion to help pay down some of the

EUR9 billion it received in bailouts from the German state last

year.

In China, where almost all foreign travel has been barred since

March 2020, domestic demand staged a recovery as airlines offered

cheap deals to encourage people to fly. Monthly passenger numbers

returned to pre-pandemic levels in September and in December were

10% higher than a year earlier, according to the Civil Aviation

Administration of China.

But that recovery has proven fragile. A Covid-19 outbreak early

this year centered on the northern city of Shijiazhuang disrupted

the traditionally busy Spring Festival period. That triggered tens

of millions of cancellations. Chinese airlines carried 8% fewer

passengers during the holiday season, from Jan. 28 to March 8,

compared with a year earlier, according to the civil aviation

administration.

Wholly reliant on cross-border travel, Hong Kong's aviation

sector remains largely grounded. Flagship carrier Cathay Pacific

Airways Ltd. reported that it transported only 21,134 passengers in

February, down 98% from a year earlier.

Alison Sider in Chicago and Trefor Moss in Shanghai contributed

to this article.

Write to Benjamin Katz at ben.katz@wsj.com

(END) Dow Jones Newswires

April 06, 2021 14:38 ET (18:38 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

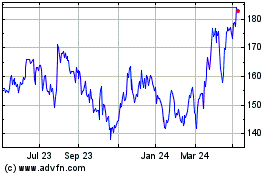

International Consolidat... (LSE:IAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

International Consolidat... (LSE:IAG)

Historical Stock Chart

From Apr 2023 to Apr 2024