TIDMIII

RNS Number : 0517G

3i Group PLC

22 July 2021

22 July 2021

3i Group plc

FY2022 Q1 performance update

A strong start to FY2022

* Increase in NAV per share to 1,063 pence (31 March

2021: 947 pence) and total return of 12.2% for the

three months to 30 June 2021

* Another strong quarter from the Private Equity

portfolio with notable contributions from Action, AES,

Basic-Fit, BoConcept, GartenHaus, Luqom, Q Holding,

Royal Sanders, SaniSure and Tato

* A powerful performance from Action in the quarter

with very good sales and EBITDA growth. EBITDA for

the quarter was EUR205 million, 107% above 2020 and

67% above 2019. Sales for the quarter were EUR1,688

million, 52% above 2020 and 39% above 2019

* Received GBP84 million of refinancing proceeds from

Royal Sanders and completed one bolt-on acquisition

for Luqom with no further investment from 3i

* 3i Infrastructure plc ("3iN") completed its

investment in DNS:NET and a bolt-on acquisition for

Joulz, an existing portfolio company

* Both investment divisions remain active with a

healthy pipeline of new investment opportunities,

bolt-ons and refinancing and realisation transactions

Simon Borrows, Chief Executive, commented:

"3i has made a strong start to its new financial year. Our

investment portfolios in Private Equity and Infrastructure are well

positioned for another year of good progress. Action's impressive

performance continues, and the group is trading very well now that

all stores have fully reopened. We are working on a number of

investment and realisation opportunities across the investment

teams, but we remain highly selective when deploying new capital in

the current environment."

Private Equity

Portfolio performance and valuation at 30 June 2021

The Private Equity portfolio generated a strong return for the

quarter, including a marked step-up in Action's performance. Sales

of EUR1,688 million in the quarter were up 31% from Q1 2021, while

EBITDA increased by 151% over the same period. At the start of

2021, Action was impacted by widespread store closures and

restrictions. However, the business executed an impressive trading

recovery through the end of its Q1 2021 and in Q2 2021.

Like-for-like ("LFL") sales comparisons between 2020 and 2021 are

difficult due to differing store closures and restrictions over the

two periods. However, June (P6) is the one period with all stores

substantially open in both years: P6, 2020 delivered 11% LFL

growth; P6, 2021 delivered 14.7% LFL growth. Action opened 63 new

stores in the quarter and continues to target c.300 new stores in

2021. Cash flow has been strong with the group's cash balance now

over EUR700 million.

At 30 June 2021, Action was valued using the last twelve months'

("LTM") run-rate earnings to 30 June 2021 (EUR783 million) and an

unchanged multiple of 18.5x net of the liquidity discount,

resulting in a valuation of GBP5,512 million (31 March 2021:

GBP4,566 million) for 3i's 52.7% equity stake.

The remainder of the Private Equity portfolio generated good

returns in the quarter, with good momentum across most of our top

20 assets. Our portfolio is well positioned to benefit from a

number of structural growth trends which have continued to support

strong performance in a number of our investments, and particularly

in assets operating in markets such as biologics (SaniSure),

e-commerce (Luqom and GartenHaus), or with exposure to the

value-for-money theme (Royal Sanders, Hans Anders). BoConcept and Q

Holding are also trading significantly ahead of last year. Of our

top 20 portfolio companies, 94% by value grew their LTM adjusted

earnings to March 2021.

Private Equity investments and realisations

In April 2021, Luqom funded and completed the bolt-on

acquisition of Lampemesteren, an online retailer of premium

lighting products in the Nordic region.

In June 2021, we received proceeds of GBP84 million, of which

GBP4 million was recognised as income, from the refinancing of

Royal Sanders.

Infrastructure

3iN's share price was stable in the three months to 30 June 2021

closing at 298 pence (31 March 2021: 296 pence), valuing 3i's 30%

stake at GBP801 million (31 March 2021: GBP797 million). We also

recognised dividend income of GBP13 million from 3iN in the

quarter. In the period, 3iN completed the acquisition of a 60%

stake in DNS:NET, an independent telecommunications provider in

Germany for EUR182 million, and Joulz, one of 3iN's existing

portfolio companies, completed the acquisition of Zonel Energy, a

provider of solar rooftop solutions to businesses across the

Netherlands.

Scandlines

Scandlines continued to be impacted by travel restrictions in

the three months to 30 June 2021. However, freight continued to

perform strongly with volumes ahead of the prior year YTD. Leisure

volumes started to pick up towards the end of the period. Our core

DCF valuation assumptions remain consistent with the March 2021

valuation.

Top 10 investments by value at 30 June 2021

Valuation Valuation

Valuation Valuation Mar-21 Jun-21

basis currency GBPm GBPm Activity in the quarter

---------------- ----------- ----------- ---------- ---------- --------------------------------------------------

Action Earnings EUR 4,566 5,512

----------- ----------- ---------- ---------- --------------------------------------------------

3iN Quoted GBP 797 801

----------- ----------- ---------- ---------- --------------------------------------------------

Cirtec Medical Earnings USD 444 450

----------- ----------- ---------- ---------- --------------------------------------------------

Scandlines DCF EUR 435 449

----------- ----------- ---------- ---------- --------------------------------------------------

Tato Earnings GBP 368 386

----------- ----------- ---------- ---------- --------------------------------------------------

Luqom Earnings EUR 307 359 Completed the bolt-on acquisition of

Lampemesteren in April 2021.

----------- ----------- ---------- ---------- --------------------------------------------------

Royal Sanders Earnings EUR 364 291 Returned GBP84 million of proceeds to 3i.

----------- ----------- ---------- ---------- --------------------------------------------------

Evernex Earnings EUR 281 278

----------- ----------- ---------- ---------- --------------------------------------------------

Hans Anders Earnings EUR 262 270

----------- ----------- ---------- ---------- --------------------------------------------------

WP Earnings EUR 259 263

----------- ----------- ---------- ---------- --------------------------------------------------

The 10 investments in this table comprise 78% (31 March 2021:

78%) of the total Proprietary Capital portfolio value of GBP11,558

million (31 March 2021: GBP10,408 million).

Total return and NAV position

We recognised a net gain on foreign exchange of GBP47 million in

the quarter, as sterling weakened against the euro. Based on the

balance sheet at 30 June 2021 , 6 9% of the Group's net assets were

denominated in euro and 15% in US dollar. A 1% movement in the euro

and US dollar would result in a total return movement of GBP70

million and GBP15 million respectively, net of any hedging. The

diluted NAV per share increased to 1,063 pence (31 March 2021: 947

pence) or 1,042 pence after deducting the 21 pence per share second

FY2021 dividend , which will be paid on 23 July 2021 .

Balance sheet

At 30 June 2021, cash was GBP286 million (31 March 2021: GBP225

million), and including our undrawn GBP500 million revolving credit

facility liquidity was GBP786 million (31 March 2021: GBP725

million). Net debt was GBP689 million and gearing 6.7% (31 March

2021: GBP750 million and 8.2%). The 21 pence per share second

FY2021 dividend, totaling GBP203 million, will be paid on 23 July

2021.

-S -

Notes

1. Balance sheet values are stated net of foreign exchange translation. Where applicable, the

GBP equivalents at 30 June 2021 in this update have been calculated at a currency exchange

rate of EUR 1.1652: GBP1 and $1.3812: GBP1 respectively.

2. At 30 June 2021 3i had 969 million diluted shares.

3. Action was valued using a post discount run-rate EBITDA multiple of 18.5x based on its run-rate

earnings to 30 June 2021.

For further information, please contact:

Silvia Santoro

Investor Relations Director

Tel: 020 7975 3258

Kathryn van der Kroft

Communications Director

Tel: 020 7975 3021

About 3i Group

3i is a leading international investment manager focused on

mid-market Private Equity and Infrastructure. Our core investment

markets are northern Europe and North America. For further

information, please visit: www.3i.com .

All statements in this performance update relate to the

three-month period ended 30 June 2021 unless otherwise stated. The

financial information is unaudited and is presented on 3i's

non-GAAP Investment basis in order to provide users with the most

appropriate description of the drivers of 3i's performance. Net

asset value ("NAV") and total return are the same on the Investment

basis and on an IFRS basis. Details of the differences between 3i's

consolidated financial statements prepared on an IFRS basis and

under the Investment basis are provided in the 2021 Annual report

and accounts. There have been no material changes to the financial

position of 3i from the end of this quarter to the date of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUASBRAVUBUAR

(END) Dow Jones Newswires

July 22, 2021 02:00 ET (06:00 GMT)

3i (LSE:III)

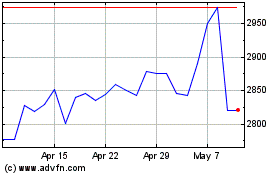

Historical Stock Chart

From Mar 2024 to Apr 2024

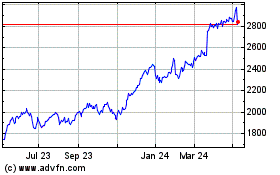

3i (LSE:III)

Historical Stock Chart

From Apr 2023 to Apr 2024