TIDMIMC

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY IMC TO

CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION

(EU) NO. 596/2014, AS AMED ("MAR"), WHICH IS PART OF UK LAW BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018. ON THE PUBLICATION OF THIS ANNOUNCEMENT

VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED

TO BE IN THE PUBLIC DOMAIN.

INTERIM RESULTS FOR THE PERIOD 1ST JULY 2020 TO 31ST DECEMBER 2020

IMC Exploration Group Public Limited Company

Chairman's Statement for the period 1st July 2020 to 31st December 2020

The Directors of IMC Exploration Group plc are pleased to present the

unaudited, consolidated interim financial results for IMC for the first six

months to 31st December 2020 of the current financial year.

The six months under review were a busy and exciting time for IMC. On 7th

September 2020, I was able to announce that the Company had raised £267,500

before transaction expenses by means of a placing of 26,750.000 new ordinary

shares.

With our spoils and tailings project in Co. Wicklow, our on-going collaboration

with Trinity College Dublin, Ireland and our appraisal drilling on our North

Wexford Gold Project, we continue to make significant progress.

Trial pits were excavated proving greater depths and densities than expected at

West Avoca, indicating the presence of a larger tonnage of spoils and tailings

than had originally been estimated in the CSA Global Report of 2019. The gold

assays from the trial pits, combined with the expected increase in tonnage,

imply that the existing gold Exploration Target at West Avoca is likely to have

been underestimated. Significantly elevated copper, lead and silver grades are

also present.

We continue to work closely with our collaborative partners, Trinity College

Dublin, on a number of developments including clarifying and understanding the

paragenesis of gold at IMC's Avoca VMS deposit.

The last six months have been extremely productive and positive for IMC and we

are confident that the balance of the current financial year will bring further

progress for the benefit of shareholders.

Post- Balance Sheet Developments

The preliminary drilling information from our recent drilling on our North

Wexford Gold Project, updates on which were issued to the market on 28th

January and 23rd February 2021, reinforces the highly prospective geology and

supports IMC's strategy of understanding the gold mineralisation with the

objective of establishing another gold resource. In addition, IMC is

commissioning an update of the existing West Avoca Exploration Target with the

objective of upgrading this to an Inferred Resource.

I look forward to being able to report further news on our spoils and tailings

project at Avoca, Co. Wicklow and on our North Wexford gold project over the

coming weeks and months.

Eamon O'Brien,

Executive Chairman

IMC Exploration Group Public Limited Company

Consolidated Statement of Comprehensive Income

for the period 1st July 2020 to 31st December 2020

Continuing

Operations

Notes Dec'20 Jun'20

? ?

Administrative expenses (122,744) (251,947)

Operating Loss for the period (122,744) (251,947)

Finance Income - -

Amount written off Intangible - -

Assets

Amount written off investment - -

__________ __________

Loss for period before tax (122,744) (251,947)

Income tax expenses - -

_________ _________

Total comprehensive loss for the period (122,744) (251,947)

========= =========

Loss attributable to:

Equity holders of the Company (122,744) (251,947)

========= =========

Total Comprehensive Loss attributable to:

Equity holders of the Company (122,744) (251,947)

========= =========

Earnings per share

From continuing operations

Basic and Diluted loss per share (cent) 0.03 0.09

All activities derived from continuing operations. All losses and total

comprehensive losses for the period are attributable to the owners of the

Company.

The Company has no recognised gains or losses other than those dealt with in

the statement of comprehensive income.

IMC Exploration Group Public Limited Company

Consolidated Statement of Financial Position

As at 31st December 2020

Notes Dec'20 Jun'20

? ?

Assets

Intangible assets 479,287 472,487

Property, plant and equipment 860 1,291

Investments - -

__________ __________

Total Non-Current Assets 480,147 473,778

__________ __________

Current Assets

Trade and other receivables 26,367 112,864

Cash and cash equivalents 62,074 (34,767)

__________ __________

Total Current Assets 88,441 78,097

__________ __________

Total Assets 568,588 551,875

========= =========

Equity

Share Capital 349,589 322,839

Share premium 4,182,118 3,925,015

Retained deficit (4,023,870) (3,901,126)

__________ __________

Attributable to owners of the Company 507,837 346,728

__________ __________

Total Equity 507,837 346,728

__________ __________

Liabilities - Current

Trade and other payables 58,704 203,100

Current tax liabilities 2,047 2,047

__________ __________

Total Liabilities 60,751 205,147

__________ __________

Total Equity and Liabilities 568,588 551,875

IMC Exploration Group Public Limited Company

Consolidated Statement of Changes in Equity

for the period 1st July 2020 to 31st December 2020

Share Share Retained Total ?

Capital ? Premium ? Losses ?

Balance at 30 June 2019 293,107 3,645,171 (3,649,179) 289,099

___________ __________ _________ _______

Total comprehensive income for

the period

Loss for the period - - (251,947) (251,947)

__________ ___________ __________ _________

Total comprehensive income for - (251,947) (251,947)

the period

Transactions with owners,

recorded directly in equity

contributions by and

distributions to owners

Shares issued 29,732 296,224 - 325,956

Share issue costs - (16,380) - (16,380)

__________ ___________ __________ _________

Total transactions with owners 29,732 279,844 - 309,576

__________ ___________ __________ _________

Balance at 30 June 2020 322,839 3,925,015 (3,901,126) 346,728

__________ ___________ __________ _________

Total comprehensive income for

the period

Loss for the period - - (122,744) (122,744)

__________ ___________ __________ _________

Total comprehensive income for - (122,744) (122,744)

the period

Transactions with owners,

recorded directly in equity

contributions by and

distributions to owners

Shares issued 26,750 269,558 - 296,308

Share issue costs - (12,455) - (12,455)

__________ ___________ __________ _________

Balance at 31 December 2020 349,589 4,182,118 (4,023,870) 507,837

__________ ___________ __________ _________

IMC Exploration Group Public Limited Company

Consolidated Statement of Cash Flows

for the period 1st July 2020 to 31st December 2020

Notes Dec'20 Jun'20

? ?

Cash flows from operating activities

Loss for the period (122,744) (251,947)

Adjustments for:

Intangible Assets Write Off - -

Income Tax recognised in profit and loss - -

Depreciation 431 431

________ ________

Cash from operations before changes in working (122,313) (251,516)

capital

Movement in trade and other receivables 86,497 (73,490)

Movement in trade and other payables (144,396) 12,436

_________ _________

Net cash flow from operating activities (180,212) (312,570)

Cash flows from investing activities

Interest received - -

Proceeds from sale of investments - -

Taxation - -

Acquisitions and disposals (6,800) (1,370)

_________ _________

Net cash (used in) investing activities (6,800) (1,370)

_________ _________

Cash flows from financing activities

Proceeds from the issue of new shares 283,853 309,576

Finance income/(expense) - -

_________ _________

Net cash generated by financing activities 283,853 309,576

_________ _________

Movement in cash and cash equivalents 96,841 (4,364)

Cash and cash equivalents at beginning of period (34,767) (30,403)

_________ _________

Cash and cash equivalents at end of period 62,074 (34,767)

The Directors of IMC, after due and careful enquiry, accept responsibility for

the contents of this announcement.

REGULATORY ANNOUNCEMENT ENDS.

Enquiries:

Keith, Bayley, Rogers & Co. Limited

Graham Atthill-Beck: +44 20 7464 4091 / +44 7506 43 41 07 /

Graham.Atthill-Beck@kbrl.co.uk; Brinsley Holman: +44 20 7464 4098 /

Brinsley.Holman@kbrl.co.uk

IMC Exploration Group plc

Kathryn Byrne: +353 85 233 6033

END

(END) Dow Jones Newswires

February 26, 2021 02:41 ET (07:41 GMT)

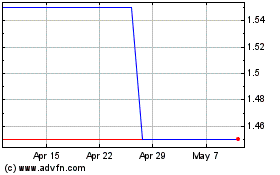

Imc Exploration (LSE:IMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Imc Exploration (LSE:IMC)

Historical Stock Chart

From Apr 2023 to Apr 2024