International Public Partnerships Extension of Corporate Debt Facility (0908R)

March 04 2021 - 1:00AM

UK Regulatory

TIDMINPP

RNS Number : 0908R

International Public Partnerships

04 March 2021

INPP EXTENDS corporate debt facility FOR FURTHER THREE YEARS

4 March 2021

International Public Partnerships ('the Company', 'INPP'), the

listed infrastructure investment company, is pleased to announce

that it has renewed its corporate debt facility for a further three

years to March 2024 to support its future investment pipeline.

The new facility has the same overall GBP400 million capacity as

the previous fully committed arrangement but is structured to more

efficiently support the Company's near-term pipeline comprising

GBP250 million on a fully committed basis together with a flexible

'accordion' component which will, subject to lender approval, allow

for a future extension by an additional GBP150 million. The new

facility will expire in March 2024 and the following key pricing

terms have been negotiated:

-- a margin of 165bps over EURIBOR for Euro drawings and 170bps

over SONIA for Sterling drawings; and

-- a ratchet mechanism applies to the commitment fee such that

it varies between 50bps and 90bps depending on the level of

utilisation.

The banking group for the existing facility has been retained.

This includes National Australia Bank, The Royal Bank of Scotland

International, Sumitomo Mitsui Banking Corporation and Barclays

Bank.

As at 3 March 2021, the Company had utilised GBP38 million of

the credit available to it under the debt facility, leaving GBP212

million of the new GBP250 million committed facility available.

This available funding will be used to finance the Company's

existing preferred bidder Offshore Transmission Project ('OFTO')

investment commitments including Beatrice, Rampion and East Anglia

One OFTOs, as well as further investments into Diabolo Rail,

Offenbach Police Headquarters and existing digital infrastructure

investments.

ENDS.

For further information:

Erica Sibree/Amy Edwards +44 (0)20 7939 0558/0587

Amber Fund Management Limited

Hugh Jonathan +44 (0)20 7260 1263

Numis Securities

Ed Berry/Mitch Barltrop +44 (0) 20 3727 1046/1039

FTI Consulting

About International Public Partnerships (INPP):

INPP is a listed infrastructure investment company that invests

in global public infrastructure projects and businesses, which

meets societal and environmental needs, both now, and into the

future.

INPP is a responsible, long-term investor in 130 infrastructure

projects and businesses. The portfolio consists of utility and

transmission, transport, education, health, justice and digital

infrastructure projects and businesses, in the UK, Europe,

Australia and North America. INPP seeks to provide its shareholders

with both a long-term yield and capital growth.

Amber Infrastructure Group ('Amber') is the Investment Adviser

to INPP and consists of over 130 staff who are responsible for the

management of, advice on and origination of infrastructure

investments.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSSWFWDEFSEFD

(END) Dow Jones Newswires

March 04, 2021 02:00 ET (07:00 GMT)

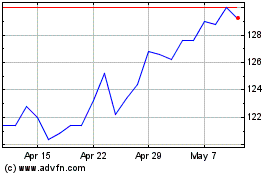

International Public Par... (LSE:INPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

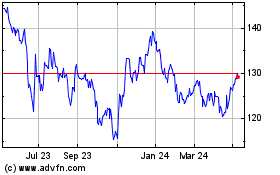

International Public Par... (LSE:INPP)

Historical Stock Chart

From Apr 2023 to Apr 2024