TIDMIOM

RNS Number : 0193H

Iomart Group PLC

01 December 2020

1 December 2020

iomart Group plc

("iomart" or the "Group" or the "Company")

Half Yearly Results

Continued resilience, benefiting from high levels of recurring

revenue and cash generation

iomart (AIM:IOM), the cloud computing company, is pleased to

report its consolidated half yearly results for the period ended 30

September 2020 (H1 2021).

FINANCIAL HIGHLIGHTS

H1 2021 H1 2020 Change

Revenue GBP56.3m GBP55.1m +2%

--------- --------- -------

% of recurring revenue(1) 90% 87% +3%

--------- --------- -------

Adjusted EBITDA(2) GBP20.8m GBP21.8m -4%

--------- --------- -------

Adjusted profit before tax(3) GBP9.8m GBP11.5m -15%

--------- --------- -------

Profit before tax GBP6.0m GBP8.4m -29%

--------- --------- -------

Adjusted diluted EPS(4) 7.2p 8.4p -14%

--------- --------- -------

Basic EPS 4.4p 6.4p -31%

--------- --------- -------

Cash generation from operations GBP23.1m GBP20.6m +12%

--------- --------- -------

Interim dividend per share 2.6p 2.6p 0%

--------- --------- -------

-- Group benefiting from strong levels of recurring revenues(1)

-- Revenue up by 2% to GBP56.3m. Contribution from the two

smaller acquisitions made in the final month of the last financial

year offsets some small decline in organic revenues, reflecting the

impact of Covid-19 on discretionary on-premise projects together

with a reduction in revenues from some legacy areas

-- Order levels from existing managed cloud services customers consistent with H1 2020

-- Decrease in adjusted EBITDA (2) margin reflects, as expected,

the greater uptake of lower-margin but strategically valuable

managed cloud solutions. Margin expected to benefit in second half

from cost base adjustments and integration of recently acquired

businesses

-- Adjusted profit before tax(3) and adjusted diluted EPS(4)

reflect higher depreciation and software amortisation charges

-- Cash generated from operations in the period increased with

retention of the consistently strong profit to cash conversion

resulting in GBP20.1m of closing cash

-- Period end net debt of GBP58.1m, comfortable at 1.36 times annualised EBITDA(5)

-- Interim dividend maintained at 2.6 pence per share

OPERATIONAL HIGHLIGHTS

-- Successful launch of iomart Managed Security Service

("iMSS"), with first new customers secured

-- Completion of >GBP1m transformational IT consultancy

project for local government customer, supporting deployment of

modern workplace technology

-- Planning consent agreed for investment in our London

datacentre, in turn reducing our environmental impact

-- Investment in operational team to continue delivering first class service to customers

-- Smooth transition to new CEO, Reece Donovan, appointed post period-end

-- Strategy refresh to "one iomart" commenced with simplified structure and value proposition

OUTLOOK

-- Increase in new business discussions in recent months,

indicating returning confidence in longer-term IT and digital

transformation projects

-- Revenue and profit margins expected to benefit in H2 FY2021

from growth from existing customers and operational

efficiencies

Statutory Equivalents

A full reconciliation between adjusted and statutory profit

before tax is contained within this statement. The largest item is

the consistent add back of the non-cash amortisation of acquired

intangible assets. The largest variance, period on period, is a

GBP0.4m lower gain on the revaluation of contingent consideration

relating to historic acquisitions.

Reece Donovan, CEO commented,

"Whilst we have exciting plans for the future of iomart, the

focus in the first half of the year had to be the protection of our

people, customers and stakeholders in the face of Covid-19. I am

pleased to report such a resilient set of results and would like to

thank our team for their continued efforts and commitment. iomart's

business model has stood us in good stead and despite the global

slowdown in corporate activity, we continue to perform well.

"The previous investments into our sales and operational teams

provide us with a strong foundation to accelerate growth once

companies regain the economic confidence to make infrastructure

transformation decisions. We have no doubt the transition to the

cloud will continue for many years to come and that we can play a

considerable role in being the enablers of that journey for our

customers. We remain confident in the long-term prospects for

iomart."

(1) Recurring revenue is the revenue that repeats either under

long-term contractual arrangement or on a rolling basis by

predictable customer habit.

(2) Throughout this statement adjusted EBITDA is earnings before

interest, tax, depreciation and amortisation (EBITDA) before share

based payment charges, acquisition costs and gain on revaluation of

contingent consideration. Throughout this statement acquisition

costs are defined as acquisition related costs and non-recurring

acquisition integration costs.

(3) Throughout this statement adjusted profit before tax is

profit before tax, amortisation charges on acquired intangible

assets, share based payment charges, acquisition costs and gain on

revaluation of contingent consideration.

(4) Throughout this statement adjusted earnings per share is

earnings per share before amortisation charges on acquired

intangible assets, share based payment charges, acquisition costs,

gain on revaluation of contingent consideration and the taxation

effect of these.

(5) Annualised EBITDA is the last 12 months of EBITDA for the period ended 30 September 2020.

This interim announcement contains forward-looking statements,

which have been made by the directors in good faith based on the

information available to them up to the time of the approval of

this report and such information should be treated with caution due

to the inherent uncertainties, including both economic and business

risk factors, underlying such forward-looking information.

For further information:

iomart Group plc Tel: 0141 931 6400

Reece Donovan, Chief Executive Officer

Scott Cunningham, Chief Financial Officer

Peel Hunt LLP (Nominated Adviser and Joint Tel: 020 7418 8900

Broker)

Edward Knight, Paul Gillam, Nick Prowting

Investec Bank PLC (Joint Broker) Tel: 020 7597 4000

Patrick Robb, Virginia Bull, Sebastian Lawrence

Alma PR Tel: 020 3405 0212

Caroline Forde, Helena Bogle, Joe Pederzolli

About iomart Group plc

For over 20 years iomart Group plc (AIM: IOM) has been helping

growing organisations to maximise the flexibility, cost

effectiveness and scalability of the cloud. From data centres we

own and operate in the U.K., and from connected facilities across

the globe, we can provide multiple secure infrastructure solutions

from branch office backups, to hyper cloud migrations, and

everything in between, delivered typically with a 24/7 managed

service. Our team of over 400 dedicated staff work with our

customers at the strategy stage through to delivery and ongoing

management, to implement the secure cloud solutions that deliver to

their business requirements.

Chief Executive's Statement

Introduction

I am delighted to be presenting the first set of financial

results as the Company's new CEO, having joined the Company as COO

during lockdown in April 2020, before taking over from founder and

long-standing CEO Angus MacSween on 1 October 2020. Angus has led

iomart fantastically for the past 20 years, building a GBP100m

turnover business, with industry leading margins and a growing

reputation in the private cloud market. It is a privilege to start

the Company's next chapter.

Whilst we have exciting plans for the future of iomart, the

focus in these six months under review had to be the protection of

our people and the business in the face of Covid-19. The six months

covered by this report coincided almost to the day with the onset

of the pandemic in the UK. As with all businesses, the pandemic

caused much to be asked of our teams and they have responded with

commitment, resilience, and dedication, ensuring our customers have

received unwavering levels of support and service. I would like to

take this opportunity to thank them for their efforts and continued

support in these unusual times.

iomart's business model has stood it in good stead and, despite

the global slowdown in corporate activity, continues to perform

well. Group revenue was up by 2% for the six months to GBP56.3m (H1

2020: GBP55.1m), benefiting from the strong performance of the two

acquisitions made at the end of the prior year. Organic revenue was

down 4%, as customers delayed discretionary projects and we saw the

ongoing small decline in self-managed infrastructure revenue.

Reassuringly, order levels from existing managed cloud customers

continued at the same levels as in H1 of the prior year, signalling

the ongoing health of the business and the value our customers

place on the services we deliver. The mix of revenue, some

additional investment in our service team and integration of the

acquired lower-margin businesses, resulted in adjusted EBITDA of

GBP20.8m (H1 2020: GBP21.8m) and adjusted profit before tax of

GBP9.8m (H1 2020: GBP11.5m).

As with many businesses across multiple industries, we saw new

business discussions being delayed, but we have subsequently seen

those conversations come back onto the table in recent months,

indicating that confidence in longer-term IT and digital

transformation projects may now be returning. However,

conversations of this nature do take time to come to fruition which

combined with our revenue recognition policies, means any

acceleration in revenue growth from new customer wins will only be

seen in FY22. We anticipate some near-term growth in revenues in

the second half of the year from within our existing customer

base.

Strategy

iomart has delivered on a very consistent basis over a long

period. As a result, whilst a review of the strategy is being

performed under the new leadership, our expectation is that this

will be about refinement, focus and optimisation as opposed to a

radical shift in direction. We remain focused on supporting

customers on the journey to cloud based solutions, be that of a

public, private or hybrid nature or indeed "on premise", as a

substantial number of organisations are still at the very early

stages of digital transformation. Current new initiatives underway

include a review of how the organisation can be simplified via the

building of a single team and brand: "one iomart", accelerating the

integration of the various brands across the Group. In addition, a

project is underway to simplify our value proposition, which is

often very technical in approach, aiming to present our solutions

and services in a clearer way to allow alignment to our customers'

business challenges. Over the coming months we will provide more

details on our strategic actions to all stakeholders.

Market

With the insatiable growth in data requirements from across all

industries, the demand for computer power, storage and connectivity

continues to expand. Organisations are increasingly outsourcing

these requirements to experts, who can help them navigate a

constantly evolving and complex technical landscape, providing high

levels of customer support, flexibility and technical knowledge.

These requirements increasingly come with greater security and

compliance needs.

Public cloud and the hyperscale giants are now well established,

and as is well documented, continue to see high growth globally as

many organisations look for Cloud infrastructure and capabilities.

Future market growth will continue to be driven by public cloud

consumption, however hybrid or multi cloud models will remain a key

market feature for many use cases and iomart is well positioned

given a long established capability in designing and running

private cloud solutions complemented with skills & capabilities

for both on-premise solutions and public cloud provisioning and

management. The complex and untidy nature of the vast majority of

the world's IT infrastructure and demands including security, data

sovereignty and compliance provides us with the reassurance there

will always be customers who are looking for a long-term, trusted

partner in this space.

Operational Review

Cloud Services

The Cloud Services operation entered the year in a good position

with the investment and re-organisation of the commercial

operations complete and momentum being achieved in organic growth

in the second half of the last financial year. Cloud managed

services customer relationships and revenue has remained steady in

the current period as Covid-19 impacted new customer wins,

preventing traditional marketing routes and causing large scale

migration plans to be put temporarily on hold. Business development

and expansion with existing customers has been easier to achieve

and are in line with our expectations.

Cloud Services revenues increased by 3% to GBP50.3m (H1 2020:

GBP48.8m), benefitting from the acquisitions made in the prior

period. Organic Cloud Services revenue declined by 4%, or GBP2.0m,

due to a GBP1.5m reduction in non-recurring revenue, with higher

reductions in on-premise project revenues, due to the impact of

Covid-19 on corporate spend, being partially offset by completion

of a GBP1m consultancy project for a local government customer,

supporting deployment of modern workplace technology. This was

combined with a GBP0.5m net reduction in recurring revenue driven

by a GBP0.8m reduction in self-managed infrastructure revenues,

primarily from smaller legacy customers. This was partially offset

by some growth in recurring cloud managed services where our

investments are focussed. Cloud Services EBITDA (before share based

payments, acquisition costs and central group overheads) was

GBP20.2m being 40.3% of revenue (H1 2020: GBP20.7m (42.5% of

revenue)).

The two acquisitions made in the final month of the last

financial year are making a positive contribution to the Group.

Despite the restrictions on physically meeting our new colleagues

and customers, the integrations of Memset and ServerChoice have

progressed well, with improved profitability being delivered during

the latter months of the half year.

There were no material changes to our infrastructure in the

period, other than the previously reported extension of the London

datacentre property lease to 2035. After some delayed planning

permission, we have now commenced the replacement of the cooling

system in our London datacentre with around GBP2.0m investment

expected during the second half of the year. This investment will

continue to reduce the environmental impact of our operations. In

the last few months we completed the addition of a third level of

diversity into our core fibre network, providing market leading

resilience to our services.

Our iomart Managed Security Service ("iMSS") which offers a

comprehensive managed service capability across the spectrum of

security, with a fully resourced security operation centre ("SOC")

was fully launched during the period. While our customers have

always benefited from security, a number of new and existing

customers have already signed up for this standalone enhanced

security offering. Given the ever-increasing threats from

cyberattacks on systems and data we expect to see continued

uptake.

We continue to expect cloud managed services to be the driver of

revenue and profit growth going forward and we are confident the

investments made in this area in recent years, and the ongoing

strategic initiatives around our value proposition and brand, will

drive accelerated organic growth rates in future years.

Easyspace

Easyspace provides a range of products to the small and micro

business community including domain names, shared hosting, emails

and dedicated servers. The Easyspace segment has performed as

expected during the period, delivering revenues and EBITDA (before

share based payments, acquisition costs and central group

overheads) of GBP6.0m (H1 2020: GBP6.3m) and GBP2.9m (H1 2020:

GBP3.0m), respectively. This represents a small revenue reduction

of 4% from the prior period, partially offset by a slightly better

margin performance.

Easyspace is competing in a large mass market against some very

large competitors. We cannot expect to compete head to head with

these larger organisations in terms of new business generation, but

we believe we have good levels of renewal rates and customer

satisfaction, ensuring that Easyspace will continue to make a

positive contribution to the Group's profitability and cash

generation.

M&A Activity

M&A activity has been a core element of iomart's strategy,

with more than 20 acquisitions completed over the last ten years,

funded primarily from our own annual cash generation. During the

period we saw less inbound acquisition opportunities as most

businesses focussed on dealing with the initial impact of Covid-19

and some potential sale processes were delayed. There were

therefore no acquisitions completed in the period under review. We

believe that M&A will continue as a core element of our

strategy both in terms of acquiring "sticky" recurring customer

bases but also the potential to add capabilities and skills to our

existing customer offering.

Financial Performance

Revenue

Overall revenues from our operations grew by 2% to GBP56.3m (H1

2020: GBP55.1m). We saw a greater share of recurring revenue at 90%

(H1 2020: 87%) compared to prior periods as on-premise related

sales reduced in the period as customers delayed projects.

Recurring revenue growth was 4% driven by the acquisitions in the

prior period.

Our Cloud Services segment revenues were up by 3% to GBP50.3m

(H1 2020: GBP48.8m). The increase includes the contribution for the

full six-month period from the two acquisitions of the ServerChoice

managed private cloud business and Memset Limited, with a 4%

revenue reduction from the underlying business. This reduction is

split between reduction in the non-recurring revenue consisting

mainly of lower on-premise hardware sales as customers conserved

discretionary project spend and reductions from the long tail of

smaller customers who utilise mainly self-service dedicated

servers. The reduction in the level of dedicated servers from

legacy customers continues a trend experienced last year, although

at that time this was, to a greater extent, compensated for by new

business wins from more complex managed cloud services.

Our Easyspace segment has performed in line with expectations

over the period, with revenues for the first half only reducing by

GBP0.3m to GBP6.0m (H1 2020: GBP6.3m).

Gross Profit

The gross profit in the period, which is calculated by deducting

from revenue variable cost of sales such as domain costs, public

cloud costs, the cost of hardware and software sold, power, sales

commission and the relatively fixed costs of operating our

datacentres, increased by 2% to GBP34.4m (H1 2020: GBP33.8m) at a

consistent 61% of revenue. We have not seen any material individual

price change in any of the components of the purchased cost base in

the last six months although power costs have seen a generally

upward trend for us based on specific fixed electricity contracts

which were above market during H1 plus to some degree more general

increases across licences and support agreements from the larger

software/hardware vendors which have not yet been fully passed

through to customers.

Adjusted EBITDA

The Group's adjusted EBITDA reduced by 4% to GBP20.8m (H1 2020:

GBP21.8m) which in EBITDA margin terms translates to 36.9% (H1

2020: 39.5%), broadly consistent with the second half of last year

(H2 2020: 37.9%) reflecting the investments made in our

organisation last year and broader mix of business. The impact of

the acquisitions is the main factor behind the increase in the

administration expense (before depreciation, amortisation, share

based payment charges and acquisition cost) of GBP1.6m versus the

previous period comparative with only a GBP0.5m (2.0%) increase

within the underlying business. We have made some efficiency

adjustments to our own cost base, including within the recently

acquired businesses, with only partial impact in the reporting

period.

Cloud Services saw a 2% reduction in its adjusted EBITDA to

GBP20.2m (H1 2020: GBP20.7m). In percentage terms the Cloud

Services margin decreased to 40.3% (H1 2020: 42.5%). This EBITDA

profitability reflects the reducing revenue contribution from the

higher margin legacy self-managed infrastructure, which cannot be

fully replaced by the initial profitability of wins within the more

complex managed cloud services, along with some investments in the

service team in the period plus only a partial benefit from

efficiency adjustments made to our cost base.

The adjusted EBITDA of Easyspace reduced in line with the small

drop in revenue to GBP2.9m (H1 2020: GBP3.0m). In percentage terms

the margin increased slightly to 47.8% (H1 2020: 47.4%).

Group overheads, which are not allocated to segments, include

the cost of the Board, all the running costs of the headquarters in

Glasgow, and Group led functions such as human resources,

marketing, finance and design. Group overheads saw a small increase

to GBP2.3m (H1 2020: GBP2.0m). The main factor behind this was the

increase from two to three Executive Directors in the first six

months, reverting to two from 1 October 2020.

Adjusted profit before tax

Depreciation charges of GBP8.5m (H1 2020: GBP8.1m) have

increased in absolute terms due to the additional datacentre assets

within the recent acquisitions but is a consistent percentage of

our recurring revenue in the period. The charge for the

amortisation of intangible assets, excluding amortisation of

intangible assets resulting from acquisitions ("amortisation of

acquired intangible assets") has increased to GBP1.5m (H1 2020:

GBP1.1m) due to the software purchased during the last financial

year linked to customer platforms.

Net finance costs have remained stable at GBP1.1m (H1 2020:

GBP1.1m).

After deducting the charges for depreciation, amortisation,

excluding the amortisation of acquired intangible assets, and

finance costs from the adjusted EBITDA, the adjusted profit for the

period before tax decreased by 15% to GBP9.8m (H1 2020: GBP11.5m)

representing an adjusted profit before tax margin of 17.3% (H1

2020: 20.8%).

Profit before tax

The measure of adjusted profit before tax is a non-statutory

measure which is commonly used to analyse the performance of

companies where M&A activity forms a significant part of their

activities.

A reconciliation of adjusted profit before tax to reported

profit before tax is shown below:

6 months 6 months Year

Reconciliation of adjusted profit before to 30/09/2020 to 30/09/2019 to 31/03/2020

tax to profit before tax GBP'000 GBP'000 GBP'000

Adjusted profit before tax 9,759 11,489 22,768

Less: Share based payments (814) (701) (1,243)

Less: Amortisation of acquired intangible

assets (2,835) (3,084) (6,159)

Less: Acquisition costs (383) - (428)

Add: Gain on revaluation of contingent

consideration 290 709 1,856

Profit before tax 6,017 8,413 16,784

-------------------------------------------- ---------------- --------------- ----------------

The adjusting items in the current period are:

-- share based payment charges in the period which increased

slightly to GBP0.8m (H1 2020: GBP0.7m) as a result of the issue of

additional share options;

-- charges for the amortisation of acquired intangible assets of

GBP2.8m (H1 2020: GBP3.1m) which have decreased by GBP0.3m; and

-- gain of GBP0.3m relating to the reassessment of the provision

for contingent consideration on the Memset Limited acquisition

given an updated estimate for a particular portion of the monthly

recurring revenue which is due to be measured in the month of

December 2020.

After deducting the charges for share based payments, the

amortisation of acquired intangible assets, acquisition costs and

the gain on revaluation of contingent consideration, the reported

profit before tax is GBP6.0m (H1 2020: GBP8.4m).

Taxation and profit for the period

There is a tax charge in the period of GBP1.2m (H1 2020:

GBP1.4m), which comprises a current taxation charge of GBP1.9m (H1

2020: GBP2.3m), and a deferred taxation credit of GBP0.7m (H1 2020:

GBP0.9m). The headline effective tax rate has increased to 20%

versus 17% in the prior period due to the movement in the tax

effect of share based remuneration and the reduction in the

non-taxable gain on revaluation of contingent consideration in the

current period. This results in a profit for the period from total

operations of GBP4.8m (H1 2020: GBP7.0m).

Earnings per share

Adjusted diluted earnings per share, which is based on profit

for the period attributed to ordinary shareholders before share

based payment charges, amortisation of acquired intangible assets,

acquisition costs and the tax effect of these items, and the gain

on revaluation of contingent consideration, was 7.2p (H1 2020:

8.4p).

The measure of adjusted diluted earnings per share as described

above is a non-statutory measure which is commonly used to analyse

the performance of companies where M&A activity forms a

significant part of their activities. Basic earnings per share from

continuing operations was 4.4p (H1 2020: 6.4p). The calculation of

both adjusted diluted earnings per share and basic earnings per

share is included at note 3.

Cash flow

The Group generated cash from operations in the period of

GBP23.1m (H1 2020: GBP20.6m) with an EBITDA conversion to cash

ratio in the period of 111% (H1 2020: 95%). During the period the

Group received GBP2.3m of cash deposit back from our landlord as

part of the negotiation of the extension of the London datacentre

lease to June 2035. In line with many businesses at the start of

the pandemic, we delayed our Q1 VAT payment, being GBP1.7m, but

have subsequently repaid post the 30 September period end.

Normalising for these two items takes the EBITDA conversion to cash

ratio to 92% in the period, comparable to our historically high

levels. Cash payments for corporation taxation in the period fell

to GBP1.9m (H1 2020: GBP2.9m), resulting in net cash flow from

operating activities in the period of GBP21.3m (H1 2020:

GBP17.7m).

Expenditure on investing activities of GBP8.8m (H1 2020:

GBP9.6m) was incurred in the period. GBP7.0m (H1 2020: GBP8.4m) was

incurred on the acquisition of property, plant and equipment,

principally to provide services to our customers. We have now

received planning permission for the replacement of the cooling

system in our London data centre and investments of around GBP2.0m

are expected to be completed during the second half of the year. We

made limited purchases of intangible assets (H1 2020: GBP0.5m) and

capitalised GBP0.6m (H1 2020: GBP0.7m) in respect of development

costs during the period. In the current period, in respect of

M&A activity, GBP1.2m was paid out for contingent consideration

due on the LDEX acquisition made in December 2018. There had been

no such M&A related payments made in the six months to 30

September 2019.

During the first half of the year, net cash used in financing

activities was GBP7.9m (H1 2019: GBP9.6m). Any shares issued in the

current period under share options was at nominal value (H1 2020:

GBP0.6m). In the current period we made GBP1.2m drawdowns under our

bank facility (H1 2020: GBPnil) and we made repayments of GBP1.2m

(H1 2020: GBP2.0m) meaning no net movement in the revolver loan

drawn balance in the period. In the current period we repaid

GBP2.9m of lease liabilities (H1 2020: GBP1.8m). We paid GBP0.6m

(H1 2020: GBP1.0m) of finance charges and made a dividend payment

of GBP4.3m (H1 2020: GBP5.4m). As a result, cash and cash

equivalent balances at the end of the period were GBP20.0m (H1

2020: GBP8.6m).

Net Debt

The net debt position of the Group at the end of the period was

GBP58.1m compared to GBP57.6m at 31 March 2020 with the small

increase being a combination in the increase in the closing cash

balance to GBP20.0m (31 March 2020: GBP15.5m) net of an increase in

the lease liability to GBP25.3m (31 March 2020: GBP20.3m) primarily

relating to extensions to existing lease arrangements, including

the five-year extension to our London data centre. Our multiple of

the last 12 months of adjusted EBITDA to net debt is 1.36 times

which remains a comfortable level of leverage. We still have a

significant undrawn amount from our GBP80m credit facility which

matures in September 2022.

Dividend

Recognising our confidence in the future, we will pay an interim

dividend at the same level as last year of 2.60p per share (H1

2020: 2.60p) on 29 January 2021 to shareholders on the register on

8 January 2021, with an ex-dividend date of 7 January 2021. This

dividend represents a pay-out ratio of 37% (H1 2020: 31%) of the

adjusted diluted earnings per share for the interim period.

Current trading and outlook

iomart's high levels of recurring revenue remain a considerable

strength in these continued uncertain times, providing high

visibility for the remainder of the year. We believe the diversity

and limited concentration of our customer base, along with the

critical web centric services we provide, will continue to shelter

us from any unexpected further worsening of the economic

environment in the near future.

We saw signs of improved confidence within new and existing

customers as we completed our first half, with a stronger second

quarter in terms of orders from existing customers, which we

anticipate will have a positive impact on revenues in the second

half of the year. We have also seen signs in recent months that

business confidence may now be returning, resulting in a growing

number of new business discussions, the benefit of which, if

secured, would flow through to revenue growth in future years.

We believe it prudent to continue to exercise strong cash

management measures and have taken steps to ensure an appropriate

cost base in the situation, which alongside the integration of the

acquired businesses should result in an improvement in profit

margins in the second half of the year.

We started the year with a fully invested commercial

organisation, which has been retained, providing us with a stronger

foundation to accelerate growth once companies regain the economic

confidence to make infrastructure transformation decisions. The

Board remains confident in the outlook for the long-term prospects

for the Group.

Reece Donovan

Chief Executive Officer

1 December 2020

Consolidated Interim Statement of Comprehensive Income

Six months ended 30 September 2020

Unaudited Unaudited Audited

6 months 6 months Year

to 30 to 30 to 31

September September March

2020 2019 2020

GBP'000 GBP'000 GBP'000

----------------------------------------------- ----------- ----------- ------------------

Revenue 56,311 55,131 112,581

Cost of sales (21,897) (21,366) (44,093)

----------------------------------------------- ----------- ----------- ------------------

Gross profit 34,414 33,765 68,488

Administrative expenses (27,624) (24,968) (51,387)

Operating profit 6,790 8,797 17,101

Analysed as:

Earnings before interest, tax, depreciation,

amortisation, acquisition costs and

share based payments 20,788 21,756 43,510

Share based payments (814) (701) (1,243)

Acquisition costs 4 (383) - (438)

Depreciation 8 (8,464) (8,096) (15,635)

Amortisation - acquired intangible

assets 7 (2,835) (3,084) (6,159)

Amortisation - other intangible assets 7 (1,502) (1,078) (2,934)

----------------------------------------------- ----------- ----------- ------------------

Gain on revaluation of contingent

consideration 290 709 1,856

Finance income 13 18 39

Finance costs 5 (1,076) (1,111) (2,212)

----------------------------------------------- ----------- ----------- ------------------

Profit before taxation 6,017 8,413 16,784

Taxation 6 (1,207) (1,433) (3,135)

----------------------------------------------- ----------- ----------- ------------------

Profit for the period 4,810 6,980 13,649

Other comprehensive income

Currency translation differences (5) 107 98

----------------------------------------------- ----------- ----------- ------------------

Other comprehensive (expense)/income

for the period (5) 107 98

----------------------------------------------- ----------- ----------- ------------------

Total comprehensive income for the

period attributable to equity

holders of the parent 4,805 7,087 13,747

Basic and diluted earnings per share

Basic earnings per share 3 4.4 p 6.4 p 12.5 p

12.2

Diluted earnings per share 3 4.3 p 6.3 p p

----------------------------------------------- ----------- ----------- ------------------

Consolidated Interim Statement of Financial Position

As at 30 September 2020

Unaudited Unaudited Audited

30 September 30 September 31 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

--------------------------------------- ----- ----------------------- ----------------------- ----------

ASSETS

Non-current assets

Intangible assets - goodwill 7 86,479 85,382 86,479

Intangible assets - other 7 20,924 23,669 24,631

Trade and other receivables - 2,760 2,760

Property, plant and equipment 8 76,323 67,397 72,344

183,726 179,208 186,214

Current assets

Cash and cash equivalents 20,055 8,563 15,497

Trade and other receivables 22,914 23,641 23,237

42,969 32,204 38,734

Total assets 226,695 211,412 224,948

LIABILITIES

Non-current liabilities

Trade and other payables (2,479) (2,017) (2,283)

Non-current borrowings 11 (75,058) (64,162) (70,109)

Provisions for other liabilities

and charges (2,000) (1,147) (1,956)

Deferred tax liability (398) (130) (1,146)

--------------------------------------- ----- ----------------------- ----------------------- ----------

(79,935) (67,456) (75,494)

Current liabilities

Contingent consideration due on

acquisitions 9 (989) (2,300) (2,480)

Trade and other payables (29,350) (30,644) (31,948)

Current income tax liabilities (33) (501) (3)

Current borrowings 11 (3,062) (3,138) (3,029)

(33,434) (36,583) (37,460)

Total liabilities (113,369) (104,039) (112,954)

Net assets 113,326 107,373 111,994

--------------------------------------- ----- ----------------------- ----------------------- ----------

EQUITY

Share capital 1,092 1,089 1,092

Own shares (70) (70) (70)

Capital redemption reserve 1,200 1,200 1,200

Share premium 22,147 22,150 22,147

Merger reserve 4,983 4,983 4,983

Foreign currency translation reserve 45 59 50

Retained earnings 83,929 77,962 82,592

--------------------------------------- ----- ----------------------- ----------------------- ----------

Total equity 113,326 107,373 111,994

--------------------------------------- ----- ----------------------- ----------------------- ----------

Consolidated Interim Statement of Cash Flows

Six months ended 30 September 2020

Unaudited

Unaudited 6 months Audited

6 months to Year to

to 30 September 30 September 31 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

-------------------------------------------- ----------------- -------------- ----------

Profit before tax 6,017 8,413 16,784

Gain on revaluation of contingent

consideration (290) (709) (1,856)

Finance costs - net 1,063 1,093 2,173

Depreciation 8,464 8,096 15,635

Amortisation 4,337 4,162 9,093

Share based payments 814 701 1,243

Movement in trade receivables 3,083 (2,270) (1,107)

Movement in trade payables (366) 1,087 (627)

Cash flow from operations 23,122 20,573 41,338

Taxation paid (1,850) (2,887) (4,179)

----------------- -------------- ----------

Net cash flow from operating activities 21,272 17,686 36,619

Cash flow from investing activities

Purchase of property, plant and equipment (7,021) (8,409) (14,688)

Development costs (614) (729) (1,405)

Purchase of intangible assets (4) (466) (1,065)

Payment for acquisition of subsidiary

undertakings net of cash acquired - - (4,156)

Contingent consideration paid (1,201) - -

Finance income received 11 18 39

Net cash used in investing activities (8,829) (9,586) (21,275)

Cash flow from financing activities

Issue of shares - 636 636

Drawdown of bank loans 1,150 - 6,150

Repayment of bank loans (1,150) (2,000) (2,000)

Repayment of lease liabilities (2,946) (1,750) (4,686)

Finance costs paid (652) (1,044) (1,734)

Dividends paid (4,287) (5,448) (8,282)

----------------- -------------- ----------

Net cash used in financing activities (7,885) (9,606) (9,916)

Net increase/(decrease) in cash and

cash equivalents 4,558 (1,506) (5,428)

Cash and cash equivalents at the beginning

of the period 15,497 10,069 10,069

----------------- -------------- ----------

Cash and cash equivalents at the end

of the period 20,055 8,563 15,497

================= ============== ==========

Consolidated Interim Statement of Changes in Equity

Six months ended 30 September 2020

Foreign

Capital Share currency

Share Own redemption premium Merger translation Retained

capital shares reserve account reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

April 2019 1,085 (70) 1,200 21,518 4,983 (48) 75,729 104,397

Profit in the

period - - - - - - 6,980 6,980

Currency

translation

differences - - - - - 107 - 107

---------------- ---------- --------- ------------- ---------- ---------- ------------- ----------- --------

Total

comprehensive

income - - - - - 107 - 7,087

Dividends - - - - - - (5,448) (5,448)

Share based

payments - - - - - - 701 701

Issue of share

capital 4 - - 632 - - - 636

---------------- ---------- --------- ------------- ---------- ---------- ------------- ----------- --------

Total

transactions

with owners 4 - - 632 - - (4,747) (4,111)

---------------- ---------- --------- ------------- ---------- ---------- ------------- ----------- --------

Balance at 30

September

2019 1,089 (70) 1,200 22,150 4,983 59 77,962 107,373

---------------- ---------- --------- ------------- ---------- ---------- ------------- ----------- --------

Profit in the

period - - - - - - 6,669 6,669

Currency

translation

differences - - - - - (9) - (9)

---------------- ---------- --------- ------------- ---------- ---------- ------------- ----------- --------

Total

comprehensive

income - - - - - (9) 6,669 6,660

Dividends - - - - - - (2,834) (2,834)

Share based

payments - - - - - - 542 542

Deferred tax on

share

based payments - - - - - - 253 253

Issue of share

capital 3 - - (3) - - - -

---------------- ---------- --------- ------------- ---------- ---------- ------------- ----------- --------

Total

transactions

with owners 3 - - (3) - - (2,039) (2,039)

---------------- ---------- --------- ------------- ---------- ---------- ------------- ----------- --------

Balance at 31

March 2020 1,092 (70) 1,200 22,147 4,983 50 82,592 111,994

---------------- ---------- --------- ------------- ---------- ---------- ------------- ----------- --------

Profit in the

period - - - - - - 4,810 4,810

Currency

translation

differences - - - - - (5) - (5)

---------------- ---------- --------- ------------- ---------- ---------- ------------- ----------- --------

Total

comprehensive

income - - - - - (5) 4,810 4,805

Dividends - - - - - - (4,287) (4,287)

Share based

payments - - - - - - 814 814

Total

transactions

with owners - - - - - - (3,473) (3,473)

---------------- ---------- --------- ------------- ---------- ---------- ------------- ----------- --------

Balance at 30

September

2020 1,092 (70) 1,200 22,147 4,983 45 83,929 113,326

---------------- ---------- --------- ------------- ---------- ---------- ------------- ----------- --------

Notes to the Half Yearly Financial Information

Six months ended 30 September 2020

1. Basis of preparation

The half yearly financial information does not constitute

statutory financial statements as defined in section 434 of the

Companies Act 2006. The statutory accounts for the year ended 31

March 2020 have been delivered to the Registrar of Companies and

included an independent auditor's report, which was unqualified and

did not contain a statement under section 493 of the Companies Act

2006.

The half yearly financial information has been prepared using

the same accounting policies and estimation techniques as will be

adopted in the Group financial statements for the year ending 31

March 2021. The Group financial statements for the year ended 31

March 2020 were prepared under International Financial Reporting

Standards as adopted by the European Union. These half yearly

financial statements have been prepared on a consistent basis and

format with the Group financial statements for the year ended 31

March 2020. The provisions of IAS 34 'Interim Financial Reporting'

have not been applied in full.

Going concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Chief Executive's Statement on pages 3 to 8.

iomart's business model continues to stand it in good stead and

despite the global slowdown in corporate activity driven by

Covid-19, continues to perform well. The Group's high levels of

recurring revenue remains a considerable strength in these

uncertain times, providing high levels of forecast visible revenue.

The Group continue to exercise strong cash management measures and

believe the diversity and limited concentration of our customer

base, along with the critical web centric services we provide, will

continue to shelter us from the worst of the expected economic

pressures over the coming period.

The Group has access to a GBP80m multi option revolving credit

facility that matures on 30 September 2022 of which GBP8m

(annually) is available to be drawn on for general business

purposes should that be required. The directors are of the opinion

that the Group can operate within the current facility and comply

with its banking covenants.

At the end of the half year, the Group had net debt of GBP58.1m

(H1 2020: GBP58.7m). The Board is comfortable with the net debt

position given the strong cash generation of the Group and has

considerable financial resources together with long -- term

contracts with a number of customers and suppliers across different

geographic areas and industries. As a consequence, the directors

believe that the Group is well placed to manage its business

risks.

After making enquiries, the directors have a reasonable

expectation that the Group will be able to meet its financial

obligations and has adequate resources to continue in operational

existence for the foreseeable future. For this reason, they

continue to adopt the going concern basis in preparing the

financial statements.

2. Operating segments

Revenue by Operating Segment

6 months 6 months Year to

to 30/09/2020 to 30/09/2019 31/03/2020

GBP'000 GBP'000 GBP'000

---------------- --------------- --------------- ------------

Easyspace 6,045 6,316 12,792

Cloud Services 50,266 48,815 99,789

--------------- --------------- ------------

56,311 55,131 112,581

----------------- --------------- --------------- ------------

Geographical Information

In presenting the consolidated information on a geographical

basis, revenue is based on the geographical location of customers.

The United Kingdom is the place of domicile of the parent company,

iomart Group plc. No individual country other than the United

Kingdom contributes a material amount of revenue therefore revenue

from outside the United Kingdom has been shown as from Rest of the

World.

Analysis of Revenue by Destination

6 months 6 months Year to

to 30/09/2020 to 30/09/2019 31/03/2020

GBP'000 GBP'000 GBP'000

------------------------- --------------- --------------- ------------

United Kingdom 45,054 46,161 95,333

Rest of the

World 11,257 8,970 17,248

--------------- --------------- ------------

Revenue from operations 56,311 55,131 112,581

-------------------------- --------------- --------------- ------------

Profit by Operating Segment

6 months to 30/09/2020 6 months to 30/09/2019 Year to 31/03/2020

EBITDA Share based EBITDA Share based EBITDA Share based

before payments, before payments, before payments,

share based acquisition share based acquisition Operating share based acquisition

payments costs, Operating payments costs, profit/(loss) payments costs, Operating

and depreciation profit/(loss) and depreciation and depreciation profit/(loss)

acquisition & acquisition & acquisition &

costs amortisation costs amortisation costs amortisation

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ------------- -------------- --------------- ------------- -------------- --------------- ------------- -------------- ---------------

Easyspace 2,888 (598) 2,290 2,994 (707) 2,287 5,649 (1,459) 4,190

Cloud Services 20,247 (12,203) 8,044 20,722 (11,551) 9,171 42,307 (23,269) 19,038

Group

overheads (2,347) - (2,347) (1,960) - (1,960) (4,446) - (4,446)

Share based

payments - (814) (814) - (701) (701) - (1,243) (1,243)

Acquisition

costs - (383) (383) - - - - (438) (438)

--------------- ------------- -------------- --------------- ------------- -------------- --------------- ------------- -------------- ---------------

Profit before

tax and

interest 20,788 (13,998) 6,790 21,756 (12,959) 8,797 43,510 (26,409) 17,101

---------------

Gain on

revaluation

of contingent

consideration 290 709 1,856

Group interest

and tax (2,270) (2,526) (5,308)

--------------- ------------- -------------- --------------- ------------- -------------- --------------- ------------- -------------- ---------------

Profit for

the period 4,810 6,980 13,649

--------------- ------------- -------------- --------------- ------------- -------------- --------------- ------------- -------------- ---------------

Group overheads, share based payments, acquisition costs,

interest and tax are not allocated to segments.

3. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares in issue during the year, after deducting

shares held by the Employee Benefit Trust. Diluted earnings per

share is calculated by dividing the earnings attributable to

ordinary shareholders by the total of the weighted average number

of ordinary shares in issue during the year after adjusting for the

dilutive potential ordinary shares relating to share options. The

calculations of earnings per share are based on the following

results:

Year

6 months 6 months to

to 30/09/2020 to 30/09/2019 31/03/2020

GBP'000 GBP'000 GBP'000

Profit for the period and basic earnings

attributed to ordinary shareholders 4,810 6,980 13,649

No No No

Weighted average number of ordinary shares: 000 000 000

Called up, allotted and fully paid at

start of period 109,160 108,510 108,510

Shares held by Employee Benefit Trust (141) (141) (141)

Issued share capital in the period 50 305 436

Weighted average number of ordinary shares

- basic 109,069 108,674 108,805

Dilutive impact of share options 3,538 2,876 2,861

Weighted average number of ordinary shares

- diluted 112,607 111,550 111,666

--------------------------------------------- --------------- --------------- ------------

12.5

Basic earnings per share 4.4 p 6.4 p p

12.2

Diluted earnings per share 4.3 p 6.3 p p

--------------------------------------------- --------------- --------------- ------------

iomart Group plc assess the performance of the Group by

adjusting earnings per share, calculated in accordance with IAS 33,

to exclude certain non-trading items. The calculation of the

earnings per ordinary share on a basis which excludes such items is

based on the following adjusted earnings:

Adjusted earnings per share

6 months 6 months Year

to 30/09/2020 to 30/09/2019 to 31/03/2020

GBP'000 GBP'000 GBP'000

Profit for the financial period and basic

earnings attributed to ordinary shareholders 4,810 6,980 13,649

- Amortisation of acquired intangible

assets 2,835 3,084 6,159

- Acquisition costs 383 - 438

- Share based payments 814 701 1,243

- Gain on revaluation of contingent consideration (290) (709) (1,856)

- Tax impact of adjusted items (693) (718) (1,406)

--------------------------------------------------- --------------- --------------- ---------------

Adjusted profit for the period and adjusted

basic earnings attributed to ordinary

shareholders 7,859 9,338 18,227

16.8

Adjusted basic earnings per share 7.2 p 8.6 p p

Adjusted diluted earnings per share 7.0 p 8.4 p 16.3 p

--------------------------------------------------- --------------- --------------- ---------------

4. Acquisition costs

6 months 6 months Year to

to 30/09/2020 to 30/09/2019 31/03/2020

GBP'000 GBP'000 GBP'000

---------------------------------------- --------------- --------------- ------------

Professional fees - - 438

Non-recurring acquisition integration

costs 383 - -

Total acquisition costs for the

period 383 - 438

----------------------------------------- --------------- --------------- ------------

5. Finance costs

6 months 6 months Year to

to 30/09/2020 to 30/09/2019 31/03/2020

GBP'000 GBP'000 GBP'000

------------------------------- --------------- --------------- ------------

Bank loans (681) (723) (1,545)

Lease finance costs (361) (363) (649)

Other interest charges (34) (25) (18)

-------------------------------- --------------- --------------- ------------

Finance costs for the period (1,076) (1,111) (2,212)

-------------------------------- --------------- --------------- ------------

6. Taxation

6 months 6 months Year to

to 30/09/2020 to 30/09/2019 31/03/2020

GBP'000 GBP'000 GBP'000

---------------------------------------- --------------- --------------- ------------

Corporation Tax:

Tax charge for the period (1,955) (2,341) (3,976)

Effect of different statutory tax

rates of overseas jurisdictions - 21 -

Adjustment relating to prior periods - - 357

----------------------------------------- --------------- --------------- ------------

Total current taxation charge (1,955) (2,320) (3,619)

Deferred Tax:

----------------------------------------- --------------- --------------- ------------

Origination and reversal of temporary

differences 718 861 367

Adjustment relating to prior periods - - 266

Effect of different statutory tax

rates of overseas jurisdictions 30 26 (13)

Effect of changes in tax rates - - (136)

----------------------------------------- --------------- --------------- ------------

Total deferred taxation credit 748 887 484

Total taxation charge for the period (1,207) (1,433) (3,135)

----------------------------------------- --------------- --------------- ------------

7. Intangible assets

Domain

Acquired Acquired names

Customer Development beneficial & IP

Goodwill relationships Costs Software contract addresses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- --------- ---------------- ------------ --------- ------------ ----------- ---------

Cost:

At 1 April 2019 85,382 52,766 9,193 8,039 86 280 155,746

Additions in the

period - 51 729 1,840 - - 2,620

At 30 September

2019 85,382 52,817 9,922 9,879 86 280 158,366

Additions in the

period - - 676 650 - - 1,326

Acquisition of

subsidiary 1,097 4,559 - - - 56 5,712

Disposals - - - (173) - - (173)

Currency translation

differences - 38 - (33) - - 5

At 31 March 2020 86,479 57,414 10,598 10,323 86 336 165,236

Additions in the

period - - 614 4 - - 618

Currency translation

differences - (29) - (19) - - (48)

At 30 September

2020 86,479 57,385 11,212 10,308 86 336 165,806

-------------------------- --------- ---------------- ------------ --------- ------------ ----------- ---------

Accumulated amortisation:

At 1 April 2019 - (33,795) (6,866) (4,164) (48) (280) (45,153)

Charge for the

period - (3,080) (718) (360) (4) - (4,162)

At 30 September

2019 - (36,875) (7,584) (4,524) (52) (280) (49,315)

Charge for the

period - (3,079) (789) (1,060) (3) - (4,931)

Disposals - - - 173 - - 173

Currency translation

differences - - - (53) - - (53)

At 31 March 2020 - (39,954) (8,373) (5,464) (55) (280) (54,126)

Charge for the

period - (2,835) (751) (747) (4) - (4,337)

Currency translation

differences - 29 - 31 - - 60

At 30 September

2020 - (42,760) (9,124) (6,180) (59) (280) (58,403)

-------------------------- --------- ---------------- ------------ --------- ------------ ----------- ---------

Carrying amount:

At 30 September

2020 86,479 14,625 2,088 4,128 27 56 107,403

-------------------------- --------- ---------------- ------------ --------- ------------ ----------- ---------

At 31 March 2020 86,479 17,460 2,225 4,859 31 56 111,110

At 30 September

2019 85,382 15,942 2,338 5,355 34 - 109,051

-------------------------- --------- ---------------- ------------ --------- ------------ ----------- ---------

During the six month period to 30 September 2020, there were no

additions of intangible assets in relation to leased assets. The

total amortisation charge on leased assets is GBP0.1m. See note 12

for further details of right-of-use assets.

8. Property, plant and equipment

Leasehold

Freehold property Datacentre Computer Office Motor

property and improve-ments equipment equipment equipment vehicles Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ---------- ------------------- ----------- ----------- ----------- ---------- ----------

Cost:

At 1 April 2019 8,910 7,943 23,457 81,611 2,920 31 124,872

Additions in

the period - 19,910 1,211 7,323 27 11 28,482

Disposals in

the period - (16) - (465) (61) (9) (551)

Currency

translation

differences - - - 16 - - 16

At 30 September

2019 8,910 27,837 24,668 88,485 2,886 33 152,819

Additions in

the period - 1,377 271 7,524 30 - 9,202

Acquisition

of subsidiary - 457 1,192 1,540 - 2 3,191

Disposals in

the period - - (18) (157) (145) (12) (332)

Currency

translation

differences - - - 200 - - 200

At 31 March

2020 8,910 29,671 26,113 97,592 2,771 23 165,080

Additions in

the period - 7,834 282 4,460 26 - 12,602

Disposals in

the period - - - (36) - - (36)

Currency

translation

differences - (66) - (123) - - (189)

At 30 September

2020 8,910 37,439 26,395 101,893 2,797 23 177,457

-------------------- ---------- ------------------- ----------- ----------- ----------- ---------- ----------

Accumulated

depreciation:

At 1 April 2019 (418) (3,510) (13,635) (58,372) (1,868) (24) (77,827)

Charge for the

period (140) (1,963) (654) (5,201) (134) (4) (8,096)

Disposals in

the period - 16 - 465 61 9 551

Currency

translation

differences - - - (58) - - (58)

At 30 September

2019 (558) (5,457) (14,289) (63,166) (1,941) (19) (85,430)

Charge for the

period (139) (1,647) (1,199) (4,424) (128) (2) (7,539)

Disposals in

the period - - 18 157 145 12 332

Currency

translation

differences - - - (99) - - (99)

At 31 March

2020 (697) (7,104) (15,470) (67,532) (1,924) (9) (92,736)

Charge for the

period (133) (2,302) (699) (5,207) (119) (4) (8,464)

Disposals in

the period - - - 36 - - 36

Currency

translation

differences - 2 - 28 - - 30

At 30 September

2020 (830) (9,404) (16,169) (72,675) (2,043) (13) (101,134)

-------------------- ---------- ------------------- ----------- ----------- ----------- ---------- ----------

Carrying amount:

At 30 September

2020 8,080 28,035 10,226 29,218 754 10 76,323

-------------------- ---------- ------------------- ----------- ----------- ----------- ---------- ----------

At 31 March

2020 8,213 22,567 10,643 30,060 847 14 72,344

At 30 September

2019 8,360 22,380 10,379 25,319 945 14 67,397

-------------------- ---------- ------------------- ----------- ----------- ----------- ---------- ----------

During the six month period to 30 September 2020, there were

additions of GBP3.4m to leasehold property and improvements and

GBP4.2m to datacentre equipment in relation to leased assets. The

total depreciation charge on leased assets is GBP1.9m. See note 12

for further details of right-of-use assets.

9. Contingent consideration due on acquisitions

30/09/2020 30/09/2019 31/03/2020

GBP'000 GBP'000 GBP'000

------------------------------------- ---------- ---------- ----------

Contingent consideration due on

acquisitions

* ServerChoice (779) - (827)

* Memset Limited (210) - (500)

* LDeX Group Limited - (2,300) (1,153)

Total contingent consideration due

on acquisitions (989) (2,300) (2,480)

-------------------------------------- ---------- ---------- ----------

Subsequent to the period end, the ServerChoice deferred

consideration was settled in full at the value provided at 31 March

2020. In the current period, the gain on revaluation of contingent

consideration of GBP0.3m relates to the reassessment of the

provision for contingent consideration on the Memset Limited

acquisition from GBP0.5m to GBP0.2m given an updated estimate for a

particular portion of the monthly recurring revenue which is due to

be measured in the month of December 2020.

10 . Analysis of change in net cash/(debt)

Cash and

cash equivalents Bank Total net

GBP'000 loans Lease liabilities cash/(debt)

GBP'000 GBP'000 GBP'000

---------------------------------- ------------------ --------- ----------------- ------------

At 1 April 2019 10,069 (48,536) (777) (39,244)

Lease liabilities on transition

to IFRS 16 - - (20,421) (20,421)

Additions to lease liabilities - - (1,146) (1,146)

Repayment of bank loans - 2,000 - 2,000

Impact of effective interest

rate - 207 - 207

Currency translation difference - - (15) (15)

Cash and cash equivalents

cash outflow (1,506) - - (1,506)

Lease liabilities cash outflow - - 1,388 1,388

----------------------------------- ------------------ --------- ----------------- ------------

At 30 September 2019 8,563 (46,329) (20,971) (58,737)

Additions to lease liabilities - - (398) (398)

New bank loans - (6,150) - (6,150)

Impact of effective interest

rate - (312) - (312)

Acquired on acquisition

of subsidiary - - (1,705) (1,705)

Currency translation difference - - 15 15

Cash and cash equivalents

cash inflow 6,934 - - 6,934

Lease liabilities cash outflow - - 2,712 2,712

----------------------------------- ------------------ --------- ----------------- ------------

At 31 March 2020 15,497 (52,791) (20,347) (57,641)

Additions to lease liabilities - - (7,622) (7,622)

New bank loans - (1,150) - (1,150)

Repayment of bank loans - 1,150 - 1,150

Cash and cash equivalents

cash inflow 4,558 - - 4,558

Lease liabilities cash outflow - - 2,640 2,640

At 30 September 2020 20,055 (52,791) (25,329) (58,065)

----------------------------------- ------------------ --------- ----------------- ------------

11. Borrowings

30/09/2020 30/09/2019 31/03/2020

GBP'000 GBP'000 GBP'000

------------------------------- ---------- ---------- ----------

Current:

Lease liabilities (note 12) (3,062) (3,138) (3,029)

Total current borrowings (3,062) (3,138) (3,029)

Non-current:

Lease liabilities (note 12) (22,267) (17,833) (17,318)

Bank loans (52,791) (46,329) (52,791)

Total non-current borrowings (75,058) (64,162) (70,109)

Total borrowings (78,120) (67,300) (73,138)

--------------------------------- ---------- ---------- ----------

The Group has an GBP80m multi option revolving credit facility

which expires on 30 September 2022 and can be used by the Group to

finance acquisitions, capital expenditure, general business

purposes and for the issue of guarantees, bonds or indemnities.

Each draw down made under this facility can be for either 3 or 6

months and can either be repaid or continued at the end of the

period. Given the terms of the revolving credit facility and the

ability for any drawdowns made to be extended beyond 30 September

2021 at the discretion of the Company, the total amount outstanding

has been classified as non-current.

Details of the Group's lease liabilities are included in note

12.

12. Leases

The Group leases assets including buildings, fibre contracts,

colocation and software contracts. Information about leases for

which the Group is a lessee is presented below:

Right-of-use assets

Leasehold Datacentre Software Total

property equipment

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- ---------- ----------- --------- ---------

Cost at 1 April 2019 19,748 1,182 - 20,930

Additions - - 1,425 1,425

Depreciation charge (1,374) (232) - (1,606)

Amortisation charge - - (47) (47)

--------------------------------------- ---------- ----------- --------- ---------

Net book value at 30 September 2019 18,374 950 1,378 20,702

Additions 47 72 - 119

Acquired on acquisition of subsidiary 457 - - 457

Depreciation charge (1,384) (234) - (1,618)

Amortisation charge - - (143) (143)

--------------------------------------- ---------- ----------- --------- ---------

Net book value at 31 March 2020 17,494 788 1,235 19,517

Additions 3,438 4,184 - 7,622

Depreciation charge (1,229) (638) - (1,867)

Amortisation charge - - (143) (143)

--------------------------------------- ---------- ----------- --------- ---------

Net book value at 30 September 2020 19,703 4,334 1,092 25,129

--------------------------------------- ---------- ----------- --------- ---------

The right-of-use assets in relation to leasehold property and

datacentre equipment are disclosed as non-current assets and are

disclosed within property, plant and equipment at 30 September 2020

(note 8). The right-of-use assets in relation to software are

disclosed as non-current assets and are disclosed within

intangibles at 30 September 2020 (note 7).

The largest element of the additions to the right-of-use assets

in the six month period to 30 September 2020 relates to extensions

to existing lease arrangements including the five year extension to

our main London data centre.

Lease liabilities

Lease liabilities for right-of-use assets are presented in the

balance sheet within borrowings as follows:

30/09/2020 30/09/2019 31/03/2020

GBP'000 GBP'000 GBP'000

Lease liabilities (current) (note 11) (3,062) (3,138) (3,029)

Lease liabilities (non-current) (note

11) (22,267) (17,833) (17,318)

----------------------------------------- ------------- ------------- -------------

Total lease liabilities (25,329) (20,971) (20,347)

----------------------------------------- ------------- ------------- -------------

The maturity analysis of undiscounted lease liabilities are

shown in the table below:

30/09/2020 30/09/2019 31/03/2020

Amounts payable under leases: GBP'000 GBP'000 GBP'000

Within one year (3,705) (3,636) (3,536)

Between two to five years (13,176) (10,115) (9,823)

After more than five years (12,569) (10,279) (9,709)

------------------------------- ------------- ------------- -------------

(29,450) (24,030) (23,068)

Add: unearned interest 4,121 3,059 2,721

------------------------------- ------------- ------------- -------------

Total lease liabilities (25,329) (20,971) (20,347)

------------------------------- ------------- ------------- -------------

13. Availability of half yearly reports

The Company's Interim Report for the six months ended 30

September 2020 will shortly be available to view on the Company's

website ( www.iomart.com ).

INDEPENT REVIEW REPORT TO iomart Group plc

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 September 2020 which comprises the Consolidated

Interim Statement of Comprehensive Income, the Consolidated Interim

Statement of Changes in Equity, the Consolidated Interim Statement

of Financial Position, the Consolidated Interim Cash Flow Statement

and related notes 1 to 13. We have read the other information

contained in the half-yearly financial report and considered

whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of

financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report have been prepared in

accordance with the accounting policies the group intends to use in

preparing its next annual financial statements.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the set of financial statements in the half-yearly financial report

based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Financial Reporting Council for use in

the United Kingdom. A review of interim financial information

consists of making inquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

September 2020 is not prepared, in all material respects, in

accordance with accounting policies the group intends to use in

preparing its next annual financial statements and the AIM Rules of

the London Stock Exchange.

Use of our report

This report is made solely to the company in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

"Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" issued by the Financial

Reporting Council. Our work has been undertaken so that we might

state to the company those matters we are required to state to it

in an independent review report and for no other purpose. To the

fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the company, for our review

work, for this report, or for the conclusions we have formed.

Deloitte LLP

Statutory Auditor

Glasgow, United Kingdom

1 December 2020

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KKKBNDBDBCDN

(END) Dow Jones Newswires

December 01, 2020 02:00 ET (07:00 GMT)

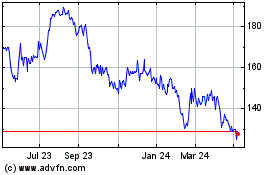

Iomart (LSE:IOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

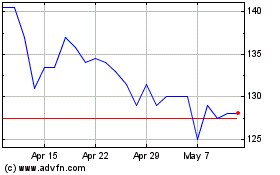

Iomart (LSE:IOM)

Historical Stock Chart

From Apr 2023 to Apr 2024