TIDMJAN

RNS Number : 7172T

Jangada Mines PLC

29 March 2021

Jangada Mines plc / EPIC: JAN.L / Market: AIM / Sector:

Mining

29 March 2021

Jangada Mines plc

Annual Results for the 18 Months Ended 31 December 2020

Jangada Mines plc ('Jangada' or 'the Company'), a natural

resources company, is pleased to announce its audited financial

results for the 18-month period ended 31 December 2020. The Company

is today posting its Annual Report & Accounts and Notice of AGM

to Shareholders, which will also shortly be available on the

Company's website.

REVIEW OF THE BUSINESS

Pitombeiras Vanadium Project

During the period under review, the Company continued to develop

its 100% owned Pitombeiras Vanadium Project ('Pitombeiras' or 'the

Project'), located in the state of Ceará, Brazil and I am pleased

to confirm that we have made great progress in this regard.

C onsistent vanadium-titanium-iron grades and widths confirmed;

n ew drilling targets delineated; an initial National Instrument

43-101 ('NI 43-101') compliant resource estimate of 5.70Mt

released; and post period end, a Preliminary Economic Assessment

('PEA') defining robust economics and remarkable potential for

further growth delivered. We are rapidly ticking boxes as we look

to fast-track the exciting Pitombeiras Vanadium Project

('Pitombeiras' or 'the Project') in Brazil to production, realise

its potential and, in the process, generate value for all our

shareholders.

The 18-month period under review saw us embark on a plethora of

activity at Pitombeiras including drilling programmes,

metallurgical tests, and airborne magnetic surveys to delineate

vanadium titanomagnetite ('VTM') drilling targets. The positive

data generated from these activities enabled us to report an

initial National Instrument 43-101 ('NI 43-101') compliant resource

estimate for the Project mid 2020:

-- Total Resource estimate of 5.70Mt at an average grade of

0.51% vanadium pentoxide (' V2O5'), 10.09% titanium dioxide

('TiO2') and 50.42% of ferric oxide ('Fe2O3') for a contained

resource of 28,990 tonnes V2O5

-- Indicated Resource estimate of 1.47Mt at an average grade of

0.50% V2O5, 9.85 % TiO2 and 49.78% of Fe2O3 for a contained

resource of 7,297 tonnes V2O5

-- Inferred Resource estimate of 4.23Mt at an average of 0.51%

V2O5, 10.17% TiO2 and 50.64% of Fe2O3 for a contained resource of

21,693 tonnes V2O5

Post period end, using this estimate, we were delighted to

deliver an initial PEA that confirmed our own confidence in the

economic viability of the Project and its excellent potential to

become a profitable producer of Ferro-Vanadium concentrate (62%/65%

iron ('Fe'), plus V2O5 credit).

The PEA, prepared by GE21 Consultoria Mineral ('GE21') and

compliant with National Instrument 43-101 ('NI 43-101'), projected

a $9.5m initial capital cost and post-tax payback period of 3

months. It also reported an estimated post-tax NPV (at a 8%

discount rate) and IRR of $106.5 million and 317.8%,

respectively.

Notably, the PEA suggests a simple processing route providing

opportunity to a fast-track approach to production and cash flow.

Furthermore, the total resource considered in the PEA is based on

just two out of 20 known targets selected based on a ground

magnetic survey.

ValOre Metals Corp

Our investment in ValOre Metals Corp (TSX-V:VO) ('ValOre') has

yielded positive results .

As previously advised, in August 2019, we divested our 100%

interest in our former subsidiary, Pedra Branca Brasil Mineracao

Ltda, the entity that held the advanced palladium, platinum, and

nickel project, the Pedra Branca Project in Brazil ('Pedra

Branca'), to ValOre whilst retaining a strategic upside exposure

through a significant shareholding in ValOre. The consideration

received on the divestment was CAD$3,000,000 alongside the issue of

25,000,000 ValOre common shares to Jangada (of which 22,000,000

shares were received on completion and 3,000,000 deferred

consideration shares over 3 years). The divestment resulted in a

reported profit on disposal of $6.2 million for the reporting

period.

During the period, we have sold down part of the investment in

ValOre to support the Company's working capital requirements,

allowing us to substantially progress the development of

Pitombeiras, including the PEA and identification of the JORC

resource.

At the end of the reporting period, the Company had a 17.23%

interest in ValOre's share capital. As Brian McMaster and Luiz

Azevedo are both on the board of directors of ValOre, it is

considered an associate for the purposes of preparing these

financial statements.

ValOre continues to generate notable results from Pedra Branca.

With a reported maiden NI 43-101 compliant inferred resource of

1,067,000 ounces PGE+Au at an average grade of 1.22 g/t PGE+Au,

ValOre's focus in 2020 was to increase the resource and undertake

discovery drilling. To this end, a 6,000 metre two phase diamond

drill programme was undertaken with the bulk aimed at expanding

specific zones, which form part of the inferred resource, namely

Trapia (Trapia 1 and Trapia 2) and Santo Amaro. Results reported so

far indicate that the " ore body thickens at depth and that

mineralisation remains open in all directions".

Furthermore, work related to mineralogy, processing and

metallurgy has provided very positive initial results and some

additional options which warrant immediate follow up. We are

expecting continued newsflow throughout the year as ValOre

continues with a property-wide exploration programme at Pedra

Branca.

Fodere Titanium Limited

By channelling capital in a responsible way towards companies

that innovate and address global challenges to create a more

sustainable world, investing can make a difference. With this in

mind, the decision was made to take a 3.6% interest in Fodere

Titanium Limited ('Fodere'), a company that is making great strides

towards commercialising the production of titanium dioxide and

vanadium from waste materials.

Fodere is rapidly advancing the commercialisation of its

environmentally sustainable and highly innovative technology to

extract high value metals from the titanium, vanadium, iron, and

steel industries. Fodere is currently in discussion with industrial

offtakers as it moves toward building an initial plant to commence

production. One of the Company's Non-Executive Directors, Nick von

Schirnding, is Chairman of Fodere.

COVID-19

The directors note that COVID-19 has had a significant negative

impact on the global economy during 2020 with disruption felt

globally. The Group has thankfully seen its inherent value signi

cantly increase from its value in 2019 because of our successful

exploration programme and project development initiatives. On a

wider level COVID-19 has highlighted to the world the importance of

sustainability across every aspect of life. With a portfolio of

assets and investments that support the drive towards greater

sustainability, Jangada is well placed to contribute to the world's

needs without compromising the ability of future generations to

meet their own needs.

Financial Results

The progress during the financial year of advancing the

Pitombeiras project resulted in the Group incurring an operating

Loss from Continuing Operations of $1.6 million (2019: $1.6

million). As stated above, the reported profit on the disposal of

the Pedra Branca project was $6.2 million (2019: loss of $0.09

million).

Overall and pleasingly, the reported Total Comprehensive Profit

attributable to the Group for the 18-month reporting period was

$3.9 million (2019: loss of $1.7 million).

B K McMaster

Director

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE 18 MONTHS PERIODED 31 DECEMBER 2020

18 Months 12 Months

Period ended Year ended

31 December 30 June

2020 2019

$'000 $'000

Other Income

Profit on disposal of investment 29 -

Administration expenses (1,580) (1,590)

-------------- ------------

Operating loss from continuing operations (1,551) (1,590)

Finance expense 7 (3) (4)

Share of loss from associates 14 (714)

-------------- ------------

Loss before tax (2,268) (1,594)

Tax expense 8 - -

-------------- ------------

Loss from continuing operations (2,268) (1,594)

Discontinued operation

Profit / (Loss) from discontinued operation 6 6,190 (88)

-------------- ------------

Financial profit / (loss) for the year 3,922 (1,682)

Other comprehensive income:

Items that will or may be reclassified

to profit or loss:

Fair value differences arising from 38 -

OCI in associates

Currency translation differences arising

on translation of foreign operations (18) 3

Total comprehensive profit / (loss)

attributable to owners of the parent 3,942 (1,679)

============== ============

Earnings / (Loss) per share from loss

from continuing operations attributable Cents Cents

to the ordinary equity holders of the

Company during the period

- Basic (cents) 9 (0.94) (0.71)

- Diluted (cents) 9 (0.94) (0.71)

Earnings / (Loss) per share attributable

to the ordinary equity holders of the Cents Cents

Company during the period

- Basic (cents) 9 1.63 (0.75)

- Diluted (cents) 9 1.63 (0.75)

CONSOLIDATED BALANCE SHEET

AS AT 31 DECEMBER 2020

As at As at

31 December 30 June

2020 2019

Assets $'000 $'000

Non-current assets

Exploration and evaluation assets 12 550 41

Property, plant and equipment 1 -

Investments 13 600 -

Investments in associates 14 2,194 -

3,345 41

Current assets

Other receivables 15 554 15

Cash and cash equivalents 513 117

Assets held for sale - 782

1,067 914

Total assets 4,412 955

============= =========

Liabilities

Current liabilities

Trade payables 36 41

Loans and borrowings 16 - 62

Accruals and other payables 17 93 698

Liabilities associated with assets held

for sale - 22

------------- ---------

Total liabilities 129 823

Issued capital and reserves attributable

to owners of the parent

Share capital 18 126 123

Share premium 18 4,389 4,202

Translation reserve (8) 10

Fair Value Reserve 38 -

Retained earnings (262) (4,203)

------------- ---------

Total equity 4,283 132

------------- ---------

Total equity and liabilities 4,412 955

============= =========

COMPANY BALANCE SHEET

AS AT 31 DECEMBER 2020

As at As at

30 December 30 June

2020 2019

Assets $'000 $'000

Non-current assets

Investment in subsidiary 800 -

Investment 13 600 -

Investments in associates 14 2,870 -

------------- ---------

4,270 -

Current assets

Group and other receivables 15 549 1,082

Cash and cash equivalents 447 117

------------- ---------

996 1,199

------------- ---------

Total assets 5,266 1,199

============= =========

Liabilities

Current liabilities

Trade payables 35 41

Loans and borrowings 16 - 62

Accruals and other payables 17 76 698

------------- ---------

Total liabilities 111 801

Issued capital and reserves attributable

to owners of the parent

Share capital 18 126 123

Share premium 18 4,389 4,202

Translation reserve 30 -

Retained earnings 610 (3,927)

------------- ---------

Total equity 5,155 398

------------- ---------

Total equity & liabilities 5,266 1,199

============= =========

The profit for the year dealt with in the accounts of the parent

company, Jangada Mines plc, was $4,518,000 (2019: loss of

$1,594,000). As permitted under Section 408 of the Companies Act

2006, no Income Statement or Statement of Comprehensive Income is

presented for the parent company.

CONSOLIDATED CASH FLOW STATEMENT

FOR THE 18 MONTHS PERIODED 31 DECEMBER 2020

18 Months 12 Months

Period ended Year ended

31 December 30 June

2020 2019

Cash flows from operating activities $'000 $'000

Profit/(Loss) before Tax from continuing

operations (2,268) (1,594)

Profit/(Loss) before Tax from discontinued

operations 6,190 (88)

-------------- ------------

Profit/(Loss) before Tax 3,922 (1,682)

Cash proceeds on sale of subsidiary (2,259) -

Non-cash share consideration received (4,207) -

on disposal of subsidiary

Non-cash exchange differences (18) -

Non-cash share option charge 19 169

Non-cash shares issued in lieu of fees 190 96

Share of losses in associate 714 -

Decrease/(increase) in other receivables 245 -

(Decrease)/increase in trade and other

payables (632) 535

Net cash outflow from operating activities (2,026) (880)

-------------- ------------

Investing activities

Development of exploration and evaluation

assets (509) (477)

Purchase of plant, property and equipment (1) -

Cash proceeds on sale of subsidiary 2,259 -

Sale of shares in investment 1,337 -

Purchase of shares in investments (600) -

Net cash inflow/(outflow) from investing

activities 2,486 (477)

-------------- ------------

Financing activities

Share capital issue - 1,496

Cost of issuing share capital - (213)

(Repayment)/Increase in related party

borrowings (62) 4

Net cash from financing activities (62) 1,287

-------------- ------------

Net movement in cash and cash equivalents 398 (70)

-------------- ------------

Cash and cash equivalents at beginning

of period 117 198

Movements in foreign exchange (2) 2

Cash and cash equivalents at end of

year 513 117

============== ============

COMPANY CASH FLOW STATEMENT

FOR THE 18 MONTHS PERIODED 31 DECEMBER 2020

18 Months 12 Months

Year ended Year ended

Notes 31 December 30 June

2020 2019

Cash flows from operating activities $'000 $'000

Profit/(loss) before tax 4,518 (1,594)

Cash proceeds on sale of subsidiary (2,259)

Non-cash share received on disposal (4,207) -

of subsidiary

Non-cash exchange differences 30 -

Non-cash share option charge 19 169

Non-cash shares issued in lieu

of fees 190 96

Decrease/(increase) in other receivables (265) 2

(Decrease)/increase in trade and

other payables (628) 524

Net cash flows from operating activities (2,602) (803)

------------- ------------

Investing activities

Proceeds on sale of subsidiary 2,259 -

Sale of shares in Valore Metals 1,337 -

Corp

Purchase of shares in investment (600) -

------------- ------------

2,996 -

------------- ------------

Financing activities

Share capital issue - 1,496

Cost of issuing share capital - (213)

Loans to subsidiary - (563)

Repayment of convertible loan notes - -

Increase / (repayment) in related

party borrowings (62) 4

Net cash from financing activities (62) 724

------------- ------------

Net movement in cash and cash equivalents 332 (79)

------------- ------------

Cash and cash equivalents at beginning

of period 117 196

Movements in foreign exchange (2) -

Cash and cash equivalents at end

of year 447 117

============= ============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE 18 MONTHS PERIODED 31 DECEMBER 2020

Share Share Translation Fair Retained Total

Value equity

capital premium reserve reserve earnings

$'000 $'000 $'000 $'000 $'000 $'000

As at 1 July 2018 102 2,844 7 - (2,690) 263

Comprehensive income

for the year

Loss for the period - - - - (1,682) (1,682)

Other comprehensive income - - 3 - - 3

-------- -------- ------------ -------- --------- --------

Total comprehensive income

for the year - - 3 - (1,682) (1,679)

Transactions with owners

Shares issued 21 1,358 - - - 1,379

Share options issued - - - - 169 169

-------- -------- ------------ -------- --------- --------

Total transactions with

owners 21 1,358 - - 169 1,548

As at 30 June 2019 123 4,202 10 - (4,203) 132

======== ======== ============ ======== ========= ========

Comprehensive income

for the period

Profit for the period - - - - 3,922 3,922

Other comprehensive income - - (18) 38 - 20

-------- -------- ------------ -------- --------- --------

Total comprehensive income

for the period - - (18) 38 3,922 3,942

Transactions with owners

Share issued 3 187 - - - 190

Share options issued - - - - 19 19

-------- -------- ------------ -------- --------- --------

Total transactions with

owners 3 187 - - 19 209

As at 31 December 2020 126 4,389 (8) 38 (262) 4,283

======== ======== ============ ======== ========= ========

COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE 18 MONTHS PERIODED 31 DECEMBER 2020

Share Share Translation Retained Total equity

capital Premium reserve earnings attributable

to owners

$'000 $'000 $'000 $'000 $'000

As at 1 July 2018 102 2,844 - (2,502) 444

Comprehensive income

for the year

Loss for the period - - - (1,594) (1,594)

Other comprehensive - - - - -

income

-------- -------- ------------ --------- -------------

Total comprehensive

income for the year - - - (1,594) (1,594)

Transactions with owners

Share issued 21 1,358 - - 1,379

Share options issued - - - 169 169

-------- -------- ------------ --------- -------------

Total transactions with

owners 21 1,358 - 169 1,548

As at 30 June 2019 123 4,202 - (3,927) 398

-------- -------- ------------ --------- -------------

Comprehensive income

for the year

Profit for the period - - - 4,518 4,518

Other comprehensive

income - - 30 - 30

-------- -------- ------------ --------- -------------

Total comprehensive

income for the year - - 30 4,518 4,548

Transactions with owners

Share issued 3 187 - - 190

Share options issued - - - 19 19

-------- -------- ------------ --------- -------------

Total transactions with

owners 3 187 - 19 209

As at 31 December 2020 126 4,389 30 610 5,155

======== ======== ============ ========= =============

NOTES TO THE FINANCIAL STATEMENTS

For the 18 month period ended 31 December 2020

1. General information

The Company is a public limited company limited by shares,

incorporated in England and Wales on 30 June 2015 with the

registration number 09663756 and with its registered office at 20

North Audley Street, London W1K 6WE.

The nature of the Company's operations and its principal

activities are set out within the Annual Report in the Strategic

Report and the Report of the Directors on pages 4 and 13

respectively.

2. Accounting policies

Basis of preparation and going concern basis

These financial statements have been prepared on a historical

cost basis in accordance with International Financial Reporting

Standards (IFRS) and IFRIC interpretations issued by the

International Accounting Standards Board (IASB) adopted by the

European Union and in accordance with applicable UK Law. The

adoption of all of the new and revised Standards and

Interpretations issued by the IASB and the IFRIC of the IASB that

are relevant to the operations and effective for annual reporting

periods beginning on 1 July 2019 are reflected in these financial

statements.

The preparation of financial statements in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of policies and reported amounts of

assets and liabilities, income and expenses. The estimates and

associated assumptions are based on historical experience and

factors that are believed to be reasonable under the circumstances,

the results of which form the basis of making judgements about

carrying values of assets and liabilities that are not readily

apparent from other sources. Actual results may differ from these

estimates.

The consolidated financial information is presented in United

States Dollars ($).

The functional currency of the subsidiary, VTF Mineração Ltda is

Brazilian Real. The functional of the Company is British Pounds

Sterling (GBP). Amounts are rounded to the nearest thousand

($'000), unless otherwise stated.

During the period, the Group changed its accounting reference

date from 30 June to 31 December and consequently the current

period covers the 18 months period ended 31 December 2020. The

comparative period covers the year ended 30 June 2019.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Changes in accounting estimates may be necessary if

there are changes in the circumstances on which the estimate was

based, or as a result of new information or more experience. Such

changes are recognised in the period in which the estimate is

revised.

The Group's business activities together with the factors likely

to affect its future development, performance and position are set

out on pages 4 to 12 within the Annual Report. In addition, note 4

to the Financial Statements includes the Group's objectives,

policies, and processes for managing its capital; its financial

risk management objectives; details of its financial instruments

and its exposure to credit and liquidity risk.

The Financial Statements have been prepared on a going concern

basis. Although the Group's assets are not generating revenues and

an operating loss has been reported from its continued operations,

the Directors consider that the Group has sufficient funds to

undertake its operating activities for a period of at least the

next 12 months including any additional expenditure required in

relation to its current exploration projects. The Group has cash

reserves which are considered sufficient by the Directors to fund

the Group's committed expenditure both operationally and on its

exploration project for the foreseeable future. However, as

additional projects are identified and the Pitombeiras project

moves towards production, additional funding will be required.

As discussed in the Directors' report, the directors do not

consider there to be a material uncertainty, which may cast doubt

about the Group and Company's ability to continue as a going

concern. Given the proceeds from the sale of the Pedra Branca

project and based on the Group's planned expenditure on the

Pitombeiras vanadium deposit and the Group's working capital

requirements, the Directors have a reasonable expectation that the

Group will have adequate resources to meet its capital requirements

for the foreseeable future. For that reason, the Directors have

concluded that the financial statements should be prepared on a

going concern basis.

The financial information in this announcement has been

extracted from the audited Group Financial Statements for the

period ended 31 December 2020 and does not constitute statutory

accounts within the meaning of section 434 of the Companies Act

2006. The Group Financial Statements for the period ended 31

December 2020 will be delivered to the Registrar of Companies in

due course. The auditor's report on the Group Financial Statements

was unqualified and unmodified and was signed on 26 March 2021. The

Group Financial Statements and this announcement were approved by

the Board of Directors on 26 March 2021.

Changes in accounting principles and adoption of new and revised

standards

In the period ended 31 December 2020, the Directors have

reviewed all the new and revised Standards. The only relevant new

standard that is effective for this year's financial statements is

IFRS 16 "Leases", but this does not have a material impact on the

financial statements.

Standards issued and relevant to the Group, but not yet

effective at the date of these Group financial statements are

listed below.

The standards discussed are those that the Group reasonably

expects to be applicable to the financial statements in the future,

and therefore do not include those standards or interpretations

that the directors consider will not be relevant to the Group. The

Group intends to adopt these standards when they become effective.

The directors do not expect that the adoption of these standards

will have a material impact on the Group's financial statements

either in the period of initial application or thereafter. An

assessment of the impact of each relevant standard is included

below.

There are a number of standards, amendments to standards, and

interpretations which have been issued by the IASB that are

effective in future accounting periods that the group has decided

not to adopt early. The following amendments are effective for the

period beginning 1 January 2020:

-- IAS 1 Presentation of Financial Statements and IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors

(Amendment - Definition of Material).

-- IFRS 3 Business Combinations (Amendment - Definition of Business).

In January 2020, the IASB issued amendments to IAS 1, which

clarify the criteria used to determine whether liabilities are

classified as current or non-current. These amendments clarify that

current or non-current classification is based on whether an entity

has a right at the end of the reporting period to defer settlement

of the liability for at least twelve months after the reporting

period. The amendments also clarify that 'settlement' includes the

transfer of cash, goods, services, or equity instruments unless the

obligation to transfer equity instruments arises from a conversion

feature classified as an equity instrument separately from the

liability component of a compound financial instrument. The

amendments are effective for annual reporting periods beginning on

or after 1 January 2023.

There are no standards in issue but not yet effective which

could have a material impact on the financial statements.

Basis of Consolidation

Subsidiaries

The subsidiaries are consolidated from the date of acquisition,

being the date on which the Group obtains control, and continues to

be consolidated until the date that such control ceases. The

Company has control over a subsidiary if all three of the following

elements are present:

-- Power over the investee,

-- exposure to variable returns from the investee, and

-- the ability of the investor to use its power to affect those variable returns.

Control is reassessed whenever facts and circumstances indicate

that there may be a change in any of these elements of control.

The financial information of the subsidiary is prepared for the

same reporting year as the parent company, using consistent

accounting policies and is consolidated using the acquisition

method. Intra-group balances and transactions, including unrealised

profits arising from intra-group transactions, have been

eliminated. Unrealised losses are eliminated unless the transaction

provides evidence of an impairment of the asset transferred.

During the period, the Group changed its accounting reference

date from 30 June to 31 December allowing the Parent Company to

report in line with VTF Mineração Ltda's statutory year end which

is 31 December.

Business combinations

The acquisition method of accounting is used to account for

business combinations by the Group. The consideration transferred

for the acquisition of a business is the fair value of the assets

transferred, liabilities incurred, and the equity interests issued

by the Group. The consideration transferred includes the fair value

of any asset or liability resulting from a contingent consideration

arrangement. Acquisition related costs are expensed as incurred.

Identifiable assets acquired and liabilities and contingent

liabilities assumed in a business combination are measured at their

fair values at the acquisition date. A business is an integrated

set of activities and assets that is capable of being conducted and

managed for the purpose of providing a return in the form of

dividends, lower costs, or other economic benefits. A business

consists of inputs and processes applied to those inputs that have

the ability to create outputs that provide a return to the Company

and its shareholders.

A business need not include all of the inputs and processes that

were used by the acquiree to produce outputs if the business can be

integrated with the inputs and processes of the Company to continue

to produce outputs. If the integrated set of activities and assets

is in the exploration and development stage, and thus, may not have

outputs, the Company considers other factors to determine whether

the set of activities and assets is a business. Those factors

include, but are not limited to, whether the set of activities and

assets:

-- Has begun planned principal activities;

-- Has employees, intellectual property and other inputs and

processes that could be applied to those inputs;

-- Is pursuing a plan to produce outputs; and

-- Will be able to obtain access to customers that will purchase the outputs.

Foreign currency

Transactions entered into by the Group in a currency other than

the currency of its primary economic environment in which it

operates (the "functional currency") are recorded at the rates

ruling when the transactions occur. Foreign currency monetary

assets and liabilities are translated at the rates ruling at the

reporting date. Exchange differences are taken to the Statement of

Comprehensive Income.

Financial instruments

Financial instruments are measured as set out below. Financial

instruments carried on the statement of financial position include

cash and cash equivalents, trade and other receivables, trade and

other payables and loans to group companies.

Financial instruments are initially recognised at fair value

when the group becomes a party to their contractual arrangements.

Transaction costs directly attributable to the instrument's

acquisition or issue are included in the initial measurement of

financial assets and financial liabilities, except financial

instruments classified as at fair value through profit or loss

(FVTPL). The subsequent measurement of financial instruments is

dealt with below.

Financial assets and financial liabilities are recognised on the

Group's balance sheet when the Group becomes party to the

contractual provisions of the instrument.

Fair value

Fair value is the price that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between

market participants at the measurement date. All assets and

liabilities, for which fair value is measured or disclosed in the

Financial Statements, are categorised within the fair value

hierarchy, described as follows, based on the lowest-level input

that is significant to the fair value measurement as a whole:

Level 1 - quoted (unadjusted) market prices in active markets

for identical assets or liabilities;

Level 2 - valuation techniques for which the lowest-level input

that is significant to the fair value measurement is directly or

indirectly observable; and

Level 3 - valuation techniques for which the lowest-level input

that is significant to the fair value measurement is

unobservable.

Financial assets

All of the Group's financial assets are held within a business

model whose objective is to collect contractual cash flows which

are solely payments of principals and interest and therefore

classified as subsequently measured at amortised cost.

Group's financial assets include cash and cash equivalents,

Company's financial assets include cash and other receivables. The

Group assesses on a forward-looking basis the expected credit

losses, defined as the difference between the contractual cash

flows and the cash flows that are expected to be received.

Impairment provisions for receivables from related parties and

loans to related parties are recognised based on a forward looking

expected credit loss model. The methodology used to determine the

amount of the provision is based on whether there has been a

significant increase in credit risk since initial recognition of

the financial asset.

For those where the credit risk has not increased significantly

since initial recognition of the financial asset, twelve month

expected credit losses along with gross interest income are

recognised. For those for which credit risk has increased

significantly, lifetime expected credit losses along with the gross

interest income are recognised. For those that are determined to be

credit impaired, lifetime expected credit losses along with

interest income on a net basis are recognised.

Financial liabilities

Financial liabilities are classified as either financial

liabilities at fair value through profit and loss (FVTPL) or as

other financial liabilities. The Group derecognises financial

liabilities when, and only when, the Group's obligations are

discharged or cancelled, or they expire.

Financial liabilities are classified at FVTPL when the financial

liability is either held for trading or it is designated at FVTPL.

A financial liability is classified as held for trading if it has

been incurred principally for the purpose of repurchasing it in the

near term or is a derivative that is not a designated or effective

hedging instrument.

Financial liabilities at FVTPL are measured at fair value, with

any gains or losses arising on changes in fair value recognised in

profit or loss. The net gain or loss recognised in profit or loss

incorporates any interest paid on the financial liability.

Other financial liabilities, including borrowings, are initially

measured at fair value, net of transaction costs and are

subsequently measured at amortised cost using the effective

interest method, with interest expense recognised on an effective

yield basis.

The effective interest method is a method of calculating the

amortised cost of a financial liability and of allocating interest

expense over the relevant period. The effective interest rate is

the rate that exactly discounts estimated future cash payments

through the expected life of the financial liability, or, where

appropriate, a shorter period, to the net carrying amount on

initial recognition.

Exploration and evaluation assets

Costs capitalised in respect of the Group's development and

production assets are required to be assessed for impairment under

the provisions of IAS 36. Such an estimate requires the Group to

exercise judgement in respect of the indicators of impairment and

also in respect of inputs used in the models which are used to

support the carrying value of the assets. Such inputs include costs

of exploration work, studies, field costs, government fees and the

associated support costs. The directors concluded there were no

impairment indicators in the current period. Therefore, no

impairment to the carrying value of the Pitmobeiras asset was

considered necessary.

Costs incurred prior to obtaining the legal rights to explore an

area are expensed immediately to the Statements of Profit or Loss

and Other Comprehensive Income. Only material expenditures incurred

after the acquisition of a licence interest are capitalised.

Interests in associates

Associates are those entities in which the Company has

significant influence, but not control or joint control, over the

financial and operating policies.

The results and assets and liabilities of associates are

incorporated using the equity method of accounting. Under the

equity method, an investment in an associate is initially

recognised in the consolidated statement of financial position at

cost and adjusted thereafter to recognise the Company's share of

profit or loss and other comprehensive income of the associate.

Share Options - estimates and assumptions

The fair value of options and warrants granted to directors and

others in respect of services provided is recognised as an expense

in the Statement of Comprehensive Income with a corresponding

increase in equity reserves.

Taxation

The charge for current tax is based on the taxable income for

the period. The taxable result for the period differs from the

result as reported in the statement of comprehensive income because

it excludes items which are not assessable or disallowed and it

further excludes items that are taxable and deductible in other

years. It is calculated using tax rates that have been enacted or

substantially enacted by the statement of financial position

date.

Investments

Investments are carried at fair value.

Deferred tax assets and liabilities are recognised where the

carrying amount of an asset or liability in the audited

consolidated balance sheet differs from its tax base. Recognition

of deferred tax assets is restricted to those instances where it is

probable that taxable profit will be available against which the

difference can be utilised.

The amount of the asset or liability is determined using tax

rates that have been enacted or substantively enacted by the

reporting date and are expected to apply when the deferred tax

liabilities/(assets) are settled/(recovered).

Deferred tax assets and liabilities are offset when the Company

has a legally enforceable right to offset current tax assets and

liabilities and the deferred tax assets and liabilities relate to

taxes levied by the same tax authority.

3. Critical accounting estimates and judgements

The preparation of the Financial Statements in conformity with

IFRSs requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the end of the

reporting period and the reported amount of expenses during the

year. Actual results may vary from the estimates used to produce

these Financial Statements.

Estimates and judgements are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

Significant items subject to such judgements and estimates

include, but are not limited to:

Judgements

ValOre is considered an associate despite Jangada holding less

than 20% shareholdings due to 2 directors of the Company (Messrs

McMaster and De Azevedo) being on the board of ValOre during the

financial period.

The Directors have considered the criteria of IFRS 6 regarding

the impairment of exploration and evaluation assets and have

decided based on this assessment that there is no basis to impair

the carrying value of its exploration assets in respect to the

Pitmobeiras project (2020: $550,000, 2019: $41,000) at this

time.

Estimates and assumptions

Share based payments

Share options issued by the Group relates to the Jangada Plc

Share Option Plan. The grant date fair value of such options is

calculated using a Black-Scholes model whose input assumptions are

derived from market and other internal estimates.

The key estimates include volatility rates and the expected life

of the options, together with the likelihood of non-market

performance conditions being achieved. Refer note 19.

On exercise or cancellation of share options and warrants, the

proportion of the share based payment reserve relevant to those

options and warrants is transferred from other reserves to the

accumulated deficit. On exercise, equity is also increased by the

amount of the proceeds received. The fair value is measured at

grant date charged in the accounting period during which the option

and warrants becomes unconditional.

The fair value of options and warrants are calculated using the

Black-Scholes model, taking into account the terms and conditions

upon which the options and warrants were granted. Vesting

conditions are non-market and there are no market vesting

conditions. These vesting conditions are included in the

assumptions about the number of options and warrants that are

expected to vest. At the end of each reporting period, the Company

revises its estimate of the number of options and warrants that are

expected to vest. The exercise price is fixed at the date of grant

and no compensation is due at the date of grant. Where equity

instruments are granted to

persons other than employees, the statement of comprehensive

income is charged with the fair value of the goods and services

received. Please refer to note 19.

Company - Application of the expected credit loss model

prescribed by IFRS 9

IFRS 9 requires the Parent company to make assumptions when

implementing the forward-looking expected credit loss model. This

model is required to be used to assess the intercompany loan

receivables from the company's Brazilian subsidiaries for

impairment.

Arriving at the expected credit loss allowance involved

considering different scenarios for the recovery of the

intercompany loan receivables, the possible credit losses that

could arise and the probabilities for these scenarios. The

following was considered; the exploration project risk for

Pitombeiras, positive NPV of the Pitombeiras project as

demonstrated by the Feasibility Study, ability to raise the finance

to develop the projects, ability to sell the projects, market and

technical risks relating to the project. The Directors therefore

considered that there was no impairment of the subsidiary loan

(2020: nil, 2019: $1,067,000).

4. Financial instruments - Risk Management

The Company is exposed through its operations to the following

financial risks:

-- Credit risk;

-- Foreign exchange risk; and

-- Liquidity risk.

Credit risk

Credit risk arises from cash and cash equivalents and

outstanding receivables. The Group maintains cash and short-term

deposits with a variety of credit worthy financial institutions and

considers the credit ratings of these institutions before investing

in order to mitigate against the associated credit risk.

The Group's exposure to credit risk amounted to $1,067,000

(2019: $132,000). Of this amount, $513,000 represents the Group's

cash holdings (2019: $117,000).

The directors monitor the utilisation of the credit limits

regularly and at the reporting date does not expect any losses from

non-performance by the counterparties.

Liquidity risk

In keeping with similar sized mining exploration groups, the

Group's continued future operations depend on the ability to raise

sufficient working capital through the issue of equity share

capital. The Group monitors its cash and future funding

requirements through the use of cash flow forecasts.

The Company's policy is to ensure that it will always have

sufficient cash to allow it to meet its liabilities when they

become due.

In common with all other businesses, the Company is exposed to

risks that arise from its use of financial instruments.

Foreign exchange risk

The Group operates internationally and is exposed to foreign

exchange risk arising from various currency exposures, primarily

with respect to the Brazilian Real, US Dollar and the Pound

Sterling.

Foreign exchange risk arises from future commercial

transactions, recognised assets and liabilities and net investments

in foreign operations that are denominated in a foreign currency.

The Group holds a proportion of its cash in GBP and Brazilian Reals

to hedge its exposure to foreign currency fluctuations and

recognises the profits and losses resulting from currency

fluctuations as and when they arise. The volume of transactions is

not deemed sufficient to enter into forward contracts.

The Group's financial instruments are

set out below:

As at As at

31 December 30 June

2020 2019

$'000 $'000

Financial assets

Cash and cash equivalents 513 130

Other receivables 83 22

------------ --------

Total financial assets 596 152

============ ========

As at As at

31 December 30 June

2020 2019

$'000 $'000

Financial liabilities

Trade payables 36 53

Related party loans - 62

Accruals and other payables 93 708

Total financial liabilities 129 823

============ ========

As at As at

31 December 30 June

2020 2019

$'000 $'000

US Dollar - -

Brazilian Real 17 22

Pound Sterling 112 801

------------ --------

129 823

============ ========

The potential impact of a 10% movement in the exchange rate of

the currencies to which the Group is exposed is shown below:

2020 2019

$'000 $'000

Foreign currency risk sensitivity analysis

Brazilian Real

Strengthened by 10% 2 3

Weakened by 10% (2) (3)

Pound Sterling

Strengthened by 10% 37 46

Weakened by 10% (45) (56)

Capital risk management

The Group's objectives when managing capital are to safeguard

the Group's ability to continue as a going concern, to provide

returns for shareholders and to enable the Group to continue its

exploration and evaluation activities. The Group has only

short-term trade payables and accruals at 31 December 2020 and

defines capital based on the total equity of the Group. The Group

monitors its level of cash resources available against future

planned exploration and evaluation activities and may issue new

shares to raise further funds from time to time.

There were no changes in the Company's approach to capital

management during the period. The Company is not subject to

externally imposed capital requirements.

General objectives, policies and processes

The board of directors has overall responsibility for the

determination of the Company's risk management objectives and

policies. The overall objective of the board is to set policies

that seek to reduce risk as far as possible without unduly

affecting the Company's competitiveness and flexibility.

Principal financial instruments

The principal financial instrument used by the Company, from

which financial instrument risk arises, is related party

borrowings.

5. Segment information

The Company evaluates segmental performance on the basis of

profit or loss from operations calculated in accordance with IFRS

8. In the Directors' opinion, the Group only operates in one

segment being mining services. All non-current assets have been

generated in Brazil.

6. Discontinued operation

On 14 August 2019, the Company completed the disposal of Pedra

Branca do Brasil Mineracao S/A ('Pedra Branca') to ValOre Metals

Corp ('ValOre' or the 'Purchaser') pursuant to the share purchase

agreement dated 16 July 2019 ('Share Purchase Agreement'). The

subsidiary was reported in the annual report for the year ended 30

June 2019 as a discontinued operation. Financial information

relating to the discontinued operation for the period to the date

of disposal is set out below.

a) Consideration received or receivable

The financial performance and cash flow information presented

reflects the operations for the period ending 14 August 2019.

18 months ended Year ended

31 December 30 June

2020 2019

$'000 $'000

Cash Consideration 2,259

-

Initial Consideration Shares in the Purchaser, 3,987

ValOre Metals Corp, totalling 22,000,000 -

common shares

Post Share Consideration totalling 1,000,000

common shares 219 -

Fair value of Deferred Consideration

Shares in the Purchaser, totalling 2,000,000

common shares 471 -

--------------- ----------

Total disposal consideration 6,936 -

--------------- ----------

Less: Net liabilities of disposed subsidiary 499 -

Add: Share of loss to disposal (21) -

Less: Write off on debts owed (1,224) -

--------------- ----------

Gain on disposal before income tax 6,190 -

--------------- ----------

Income tax expense - -

--------------- ----------

Gain on disposal before income tax 6,190 -

=============== ==========

The Company received the final cash payment of CAD$1,000,000

(USD $751,944) and 500,000 Deferred Consideration Shares on 10

February 2020 with a further 500,000 deferred Consideration Shares

received on 14 August 2020. As at 31 December 2020, the Company was

due to receive the remaining 2,000,000 ValOre common shares over

the next 2 years (Deferred Consideration Shares). As at 31 December

2020 the fair value of the Deferred Consideration Shares was

determined to be $471,000.

b) Financial performance and cash flow information

The financial performance and cash flow information presented

reflects the operations for the period ending 14 August 2019.

Period ended Year ended

14 August 30 June

2019 2019

Financial performance from discontinued $'000 $'000

operations

Expenses (21) (88)

-------------------- -----------------

Loss before tax from discontinued operations (21) (88)

Tax - -

-------------------- -----------------

Loss for the period from discontinued operations (21) (88)

==================== =================

Period ended Year ended

14 August 30 June

2019 2019

Cash flows from discontinued operation $'000 $'000

Net cash flows from operating activities (9) (77)

Net cash flows from investing activities (31) (477)

Net cash flows from financing activities - 563

-------------- ------------------

Net cash flow (outflow) / inflow (40) 9

============== ==================

c) Net assets as at date of sale

The carrying amounts of assets and liabilities as at the date of

sale on 14 August 2019 were:

14 August 30 June

2019 2019

$'000 $'000

Assets

Exploration and evaluation assets 753 760

Property, plant and equipment 2 2

Trade and receivables 6 7

Cash and cash equivalents - 13

--------- -------

Assets held for sale 761 782

--------- -------

Liabilities

Trade payables 24 11

Loans and borrowings 1,224 -

Accruals and other payables 12 11

--------- -------

Liabilities directly associated with assets

held for sale 1,260 22

--------- -------

Net (liabilities)/assets associated with

disposal group (499) 760

========= =======

7. Finance expense

18 months Year ended

ended 30 June

31 December 2019

2020

$'000 $'000

Interest expense (3) (4)

Total finance expense (3) (4)

============= ===========

8. Tax expense

18 months ended Year ended

31 December 2020 30 June 2019

Continuing Discontinued Continuing Discontinued

operations operations operations operations

$'000 $'000 $'000 $'000

Profit on ordinary

activities before

tax (2,268) 6,190 (1,594) (88)

------------------ ------------------- ------------------ -------------------

Profit on ordinary

activities multiplied

by standard rate

of corporation tax

in the UK of 19%

(2019: 19%) (431) 1,176 (303) (17)

Effects of:

Unrelieved tax losses

carried forward 431 (1,176) 303 17

Total tax charge - - - -

for the period

================== =================== ================== ===================

Factors that may affect future tax charges

Apart from the losses incurred to date, there are no factors

that may affect future tax charges.

At the period end, $4,424,000 (2019: $2,870,000) of cumulative

estimated unrelieved tax losses arose in Brazil and the United

Kingdom, which could be utilised in the foreseeable future.

9. Earnings per share

31 December 2020 30 June 2019

Continuing Discontinued Total Continuing Discontinued Total

operations operations operations operations

$'000 $'000 $'000 $'000 $'000 $'000

Loss for the

period (2,268) 6,190 4,377 (1,594) (88) (1,682)

============ ============= ====== ============ ============== ========

2020 2019

Weighted average

number of shares

(basic & diluted) 240,627,396 224,270,445

============ ===================== ============ ========================

Loss per share

- basic & diluted

(US 'cents) (0.94) 2.57 1.63 (0.71) (0.04) (0.75)

============ ============= ====== ============ ============== ========

There have been no transactions involving ordinary shares or

potential ordinary shares that would significantly change the

number of ordinary shares or potential ordinary shares outstanding

between the reporting date and the date of completion of these

financial statements.

10. Staff costs and directors' remuneration

Staff costs, including directors' remuneration, were as

follows:

Monetary Share

Remuneration options Total Total

18 months 18 months 18 months

ended 31 ended 31 ended 31 Year ended

December December December 30 June

2020 2020 2020 2019

$'000 $'000 $'000 $'000

B K McMaster 246 - 246 169

L M F De Azevedo 123 - 123 87

L E Castro 55 - 55 52

N K von Schirnding 74 6 80 52

498 6 504 360

============= ========== ========== =============

Excluding directors, there were no members of staff during the

period ended 31 December 2020 (2019: 5). Excluding directors

remuneration, staff costs during the period were salaries $nil

(2019: $30,381), social security $nil (2019: $8,480), other

benefits $nil (2019: $2,409).

11. Auditors remuneration

18 months Year ended

ended 30 June

31 December 2019

2020

$'000 $'000

Fees payable to the Company's auditor and its

associates for the audit of the Company's annual

accounts 30 25

Fees payable for other services:

- Taxation 3 3

============= ===========

12. Exploration and evaluation assets

As at 31 December As at 30 June 2019

2020

Continuing Discontinued Continuing Discontinued

operations operations operations operations

$'000 $'000 $'000 $'000

Cost and net book value

At beginning of year 41 - - 324

Expenditure capitalised during

the period 509 - 41 436

------------ ------------- ------------ -------------

Cost and net book value at

31 December 2020 550 - 41 760

============ ============= ============ =============

13. Investments

As at As at

31 December 2020 30 June 2019

$'000 $'000

Equity securities 600 -

----------------- ------------------

Carrying amount of investments 600 -

================= ==================

The Company acquired shares in the share capital of Fodere

Titanium Limited during the financial period for $600,000 (2019:

$nil). Fodere Titanium Limited is a United Kingdom registered

minerals technology company which has developed innovative

processes for the titanium, vanadium, iron and steel

industries.

14. Investment in associates

As at As at

31 December 2020 30 June 2019

$'000 $'000

Cost of investment in ValOre

Metals Corp 4,207 -

Sale of ValOre Metals Corp shares (1,337) -

----------------- -------------

Balance at 31 December 2020

(Company) 2,870 -

Share of losses from continuing

operations (714) -

Share of gains from OCI 38 -

Balance at 31 December 2020

(Consolidated) 2,194 -

================= =============

On 14 August 2019 pursuant to the Share Purchase Agreement

following the completion of the disposal of Pedra Branca to ValOre,

the Company received the initial Consideration Shares in ValOre,

totalling 22,000,000 common shares, equating to the Company owning

25.87% of ValOre's then enlarged share capital. As at 31 December

2020 the Company held 17.23% of ValOre's share capital.

ValOre is a Vancouver based company with a portfolio of

high-quality uranium and precious metal exploration projects in

Canada and Brazil that is listed on the Toronto Stock Exchange

("TSX") Venture Exchange.

During the period, the Company received both the first and

second tranche of 500,000 Deferred Consideration Shares in February

2020 and August 2020. The Company will receive the remaining

Deferred Consideration Shares totalling 2,000,000 payable in four

equal tranches of 500,000. Post the balance sheet date, in February

2021, the third tranche of 500,000 Deferred Consideration Shares

was received by the Company. Refer to Note 22.

At the reporting date, the Company held 17.23% interest in

ValOre's share capital, however, as Messrs McMaster and De Azevedo

are both on the board of directors of ValOre, ValOre is considered

an associate. ValOre is a Canadian domiciled company with a

reporting period ending on 30 September.

The Company recently changed its accounting reporting period

from 30 June to 31 December to align its financial year end to that

of its Brazilian subsidiary VTF Mineração Ltda. Whilst the

Company's reporting period differs to that of ValOre, the share of

losses from continuing operations of ValOre have been calculated

based on the period from acquisition through to 31 December 2020.

The quoted market price of ValOre as at 31 December 2020 was CAD

$0.30 (US$0.23).

Summarised financial information in respect of ValOre Metals

Corp are shown below. ValOre results are reported in Canadian

Dollars and have been translated into US Dollars using the

appropriate exchange rates.

31 December

2020

$'000

Current assets 96

Non-current assets 8,254

Current liabilities (2,131)

Non-current liabilities (328)

-----------

Equity attributable to the owners of the

Company 5,891

-----------

Revenue -

Profit/(loss) for the period from acquisition

through to 31 December 2020 (4,519)

Other comprehensive income 162

-----------

Total comprehensive income (4,357)

-----------

15. Group and other receivables

Group Group Company Company

As at As at As at 31 As at

31 December 30 June December 30 June

2020 2019 2020 2019

$'000 $'000 $'000 $'000

Current

Other receivables 83 15 78 15

Accrued income 471 - 471 -

Group receivables - - - 1,067

Total other receivables 554 15 549 1,082

============= ========= ========== =========

Accrued income totalling $471,000 relating to the disposal of

Pedra Branca being 2,000,000 Deferred Consideration Shares in

ValOre with fair value determined to be $471,000 at the balance

sheet date.

16. Loans and borrowings

Group Group Company Company

As at As at As at 31 As at

31 30 June December 30 June

December 2019 2020 2019

2020

$'000 $'000 $'000 $'000

Current

Related party loan - 62 - 62

----------- --------- ---------- ---------

Total loans and borrowings - 62 - 62

=========== ========= ========== =========

17. Accruals and other payables

Group Group Company Company

As at As at As at 31 As at

31 30 June December 30 June

December 2019 2020 2019

2020

$'000 $'000 $'000 $'000

Current

Accruals 62 51 45 51

Amounts owed to Directors 31 262 31 262

Disposal purchase consideration - 180 - 180

Share provision in lieu

of fees - 205 - 205

---------- --------- ---------- ---------

Total accruals and other

payables 93 698 76 698

========== ========= ========== =========

Under the terms of the Share Purchase Agreement ValOre Metals

Corp paid $180,000 upon signing of the binding letter of

agreement.

18. Share capital

31 December 2020 30 June 2019

Share Share Share

Issued Share Capital premium Issued Capital premium

Number $'000 $'000 Number $'000 $'000

At beginning

of the period

ordinary shares

of 0.04p each: 237,315,053 123 4,202 197,515,600 102 2,844

============ ============== ========= ============ ========= =========

3 October 2018:

shares Issued

as part of placement - - - 38,273,328 20 1,476

25 April 2019:

share issue in

lieu of fees - - - 1,526,125 1 95

Share issue costs

charged to share

premium - - - - - (213)

18 December 2019:

share issue in

lieu of fees 4,798,091 3 187 - - -

At 31 December

2020: ordinary

shares of 0.04p

each: 242,113,144 126 4,389 237,315,053 123 4,202

============ ============== ========= ============ ========= =========

Ordinary shares

Ordinary shares have the right to receive dividends as declared

and, in the event of a winding up of the Company, to participate in

the proceeds from sale of all surplus assets in proportion to the

number of and amounts paid up on shares held. Ordinary shares

entitle their holder to one vote, either in person or proxy, at a

meeting of the Company.

19. Share options and warrants

18

months

ended

31

December Year ended

2020 30 June 2019

Average Number Average exercise Number of

exercise of price per share options

price per options option

share $

option

$

At the

beginning

of the period 0.075 50,249,996 0.065 15,250,000

Warrants issued

15 October

2018 - - 0.079 34,999,996

Share options

issued 1

December

2019 0.023 9,000,000 - -

Warrants issued

12 December

2019 0.079 4,798,091 - -

Expired and

surrendered

share options

expired 31

December

2019 0.065 (15,250,000) - -

Lapsed warrants

15 October 2020 - (39,798,087) - -

At the end of

the period 9,000,000 50,249,996

--------- ------------------------------------------------- ----------------------------------------------------- -----------------------------------------------------

In December 2019, as part of the new award of the

Director/Consultant Options, all of the individuals concerned,

together with the other Directors of the Company who were not

receiving new share options surrendered their existing holdings of

share options, which in total aggregated 8,000,000 share options.

These share options were awarded at the time of the Company's IPO

on AIM in June 2017, with an exercise price of 5.5 pence per share

option (6.5 US cents), and an expiry date of 31 December 2019.

Other carried forward options outstanding in the Company, which in

total aggregated 7,250,000, were on the same terms and expired

unexercised on 31 December 2019.

Warrants issued in October 2018 of 34,999,996 new ordinary

shares and to Consulmet Metals (Pty) Ltd for the consultancy work

undertaken of 4,798,091 shares lapsed on 15 October 2020.

Share options granted during the 18-month period ended 31

December 2020 have the following expiry date and exercise

prices:

Grant date Expiry date Exercise price Share options Share options

$ 31 December 2020 30 June 2019

30 November

1 December 2019 2024 0.023 9,000,000 -

The fair value at grant date is independently determined using

an adjusted form of the Black Scholes Model that takes into account

the exercise price, the term of the option, the impact of dilution

(where material), the share price at grant date and expected price

volatility of the underlying share, the expected dividend yield,

the risk-free interest rate for the term of the option and the

correlations and volatilities of the peer group companies. In

addition to the inputs in the table above, further inputs as

follows:

The model inputs for options granted during the period

included:

(a) options are granted for no consideration and vested options

are exercisable for a period of five years after the grant date: 1

December 2019.

(b) expiry date: 30 November 2024.

(c) share price at grant date: 1.75 pence.

(d) expected price volatility of the company's shares: 50%.

(e) risk-free interest rate: 1.0%.

20. Subsidiary

The details of the subsidiaries of the Company, which have been

included in these consolidated financial statements are:

Name Country of incorporation Proportion of

ownership interest

VTF Mineração Ltda. Brazil 99.99%

21. Related party transactions

During the period the Company entered into the following

transactions with related parties.

18 months

ended 31 Year ended

December 30 June

2020 2019

$'000 $'000

Garrison Capital Partners Limited:

Purchases made on Company's behalf and

administrative fees expensed during the

year 95 114

Interest charge included within Company

and Group borrowings 3 4

Brian McMaster:

Rent paid by the Company to Countrywide

Residential Letting, in respect to premises

leased in the name of Brian McMaster

on behalf of; the Group that were made

available at no cost to officers and

staff of the Group. 80 15

Nicholas Von Schirnding:

600 -

Investment in Fodere Titanium Limited

of which Nicolas Von Schirnding is the

Chairman

Lauren McMaster:

Consultancy services - 15

FFA Legal Ltda:

Legal and accountancy services expensed

during year 135 79

Harvest Minerals Limited:

Employment services reimbursed - (104)

Garrison Capital Partners Limited is a related party to the

Company due to having directors in common. The balance owed as at

31 December 2020 was $nil (2019: $62,000) as disclosed in note

16.

Lauren McMaster is a related party to the Company due to being

married to the Chairman. At the year-end the amount owed was $nil

(2019: $8,000).

FFA Legal Ltda is a related party to the Group due to having a

director in common with Group companies. At the year-end they were

owed $nil (2019: $nil).

Directors' remuneration is disclosed within note 10.

22. Subsequent Events

a) Deferred consideration shares

On 15 February 2021, the company received the third tranche of

500,000 common shares in ValOre under the terms of the Share

Purchase Agreement.

b) Share placing

On 19 February 2021, Jangada raised GBP1.25 million (USD$1.75

million) via a placing of 13,888,888 new Ordinary shares of

GBP0.0004 each in the Company at a price of GBP0.09 per Placing

Share through Brandon Hill Capital. As part payment for Brandon

Hill Capital's services in relation to the Placing, it has been

issued with 694,444 warrants to subscribe for new Ordinary Shares,

exercisable at the Placing Price, for a period of three years.

c) Share disposal

On 24 February 2021, the Company disposed of 2 million of its

common shares in ValOre at a price of CAD$0.30 per share, providing

Jangada with gross proceeds of CAD$600,000 (USD$477,779). On 5

March 2021, the Company disposed of a further 3.875 million of its

common shares in ValOre at a price of CAD$0.30 per share, providing

Jangada with gross proceeds of CAD$1,162,500 (USD$917,300). Jangada

now holds a total of 10,305,000 ValOre common shares, representing

8.6 per cent of ValOre's current share capital.

23. Ultimate controlling party

The Directors consider that the Company has no single

controlling party.

ENDS

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014. Upon the publication of

this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

For further information please visit www.jangadamines.com or

contact:

Jangada Mines plc Brian McMaster (Chairman) Tel: +44 (0) 20

7317 6629

Strand Hanson Limited James Spinney Tel: +44 (0)20 7409

(Nominated & Financial Ritchie Balmer 3494

Adviser)

Brandon Hill Capital Jonathan Evans Tel: +44 (0)20 3463

(Broker) Oliver Stansfield 5000

St Brides Partners Isabel de Salis info@stbridespartners.co.uk

Ltd Charlie Hollinshead

(Financial PR)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR MZGZFRNNGMZG

(END) Dow Jones Newswires

March 29, 2021 02:00 ET (06:00 GMT)

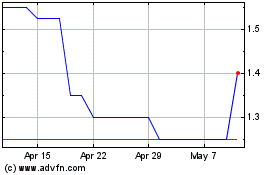

Jangada Mines (LSE:JAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jangada Mines (LSE:JAN)

Historical Stock Chart

From Apr 2023 to Apr 2024