TIDMJARA TIDMJARU TIDMJARE

RNS Number : 1038T

JPMorgan Global Core Real Assets Ld

23 March 2021

LONDON STOCK EXCHANGE ANNOUNCEMENT

JPMORGAN GLOBAL CORE REAL ASSETS LIMITED

QUARTERLY NET ASSET VALUE AND DISCLOSURE UPDATE

Legal Entity Identifier: 549300D8JHZTH6GI8F97

JPMorgan Global Core Real Assets Limited ("JARA" or "the

Company") announces an unaudited Net Asset Value ("NAV") per share

as at 28th February 2021 of 87.96 pence. During the quarter to 28th

February 2021 the Company paid a dividend of 1 penny per share on

25th February 2021 to shareholders on the register as at the close

of business on 29th January 2021, bringing the total return for the

quarter to -2.64%. Due to the timing of NAV releases from the

underlying strategies, JARA's Transportation and Asia-Pacific Real

Estate allocations are still held at cost.

Across both public and private allocations, and measured in

local currency, JARA's real estate and infrastructure allocations

rose 2.1% and 1.5%, respectively (1) . The 4.6% depreciation of the

US dollar versus sterling over the quarter delivered a material

drag to performance. The Manager however notes the reversal of some

of this weakness post the quarter end.

(1) Latest performance statistics for the Infrastructure and

Transport private strategy allocations are as at 31st December

2020.

Disclosure Update

Now JARA is near fully invested across its major strategies of

Infrastructure, Global Real Estate and Transportation, the Manager

is pleased to provide the following portfolio disclosure which it

intends to continue to develop:

1. Occupancy and Asset Productivity

As at the 31st December 2020, occupancy of leased assets was

97%, of which 96% paid income as expected in Q4 of 2020. These

takings are not dissimilar to historical averages and show the

benefit of a focus on high quality assets and counterparties,

broadly diversified across asset, sector, geography and regulatory

regimes.

Across the portfolio there is currently an exposure of under 5%

to development assets, primarily focused within the real estate

allocation where it is deemed there is a benefit to targeting newer

industrial/logistics assets in prime locations. We feel this is an

example of how JARA's underlying strategy teams are actively

managing their portfolios to capitalise on local opportunities.

2. Lease/Contract Duration

Current average lease duration was 4.9 years with just 3.2% of

JARA's portfolio leases due to expire in 2021. We break out the

lease/contract profile further below:

Lease

Year Expiry

2021 3.2%

2022 6.5%

2023 6.9%

2024 8.5%

------ --------

3. Leverage

The team also note that, despite the volatility of 2020,

leverage remains moderate with JARA's portfolio weighted average

loan to value being 33.8%. The blended LTV on the property

allocation sits at 28.9% and the Infrastructure and Transport

segment is at 55.6%. The underlying strategies generally take a

conservative view on overall leverage use and this approach has

benefitted them over the past year of COVID related volatility.

Where reported, the blended average cost of debt across the

portfolio is 3.3%, with 82% being fixed and 18% floating and a

weighted average maturity of 4.8 years.

Maturity

year % Maturing

2021 8.7%

2022 11.4%

2023 12.6%

2024 9.0%

2025 + 41.0%

---------- -----------

4. Investment Progress

The Company is currently 90% invested. This represents full

investment of IPO proceeds as well as significant investment of any

capital raised since IPO.

5. Ownership

Another strength of the JPM Alternatives platform is, due to its

scale, being able to gain access to large assets with control

positions. Below we break out JARA's look through exposure. The

vast majority of the asset base has majority or control positions

and just 1.4% of the portfolio is minority owned.

Ownership

Wholly Owned 63.8%

Majority

Owned 10.7%

Join Venture 24.2%

Minority

Owned 1.4%

-------------- ------

6. Portfolio Diversity

The portfolio as at the latest reporting dates of each of the

underlying strategies has 262 investments and, at a more granular

individual asset level, there is a look through exposure to 886

individual assets.

The Company aims to provide holders of the Ordinary Shares with

a stable income and constant currency capital appreciation through

exposure to a globally diversified portfolio of Core Real Assets in

accordance with the Company's investment policy. The Company is

seeking exposure to Core Real Assets through various real asset

strategies, namely: Global Infrastructure, Global Real Estate,

Global Transport and Global Liquid Real Assets. J.P. Morgan's

Alternative Solutions Group has the primary responsibility for

managing the Company's portfolio. JARA remains invested in line

with the original allocations as outlined in the 2019 IPO

Prospectus.

7. Currency

The main currency exposures of the portfolio (including

liquidity funds) have diversified considerably since the last

quarter end due to the drawdown into the other private strategies

and they are as follows:

Currency % of NAV

USD 66.8%

---------

EUR 8.6%

---------

AUD 6.6%

---------

JPY 5.6%

---------

GBP 3.5%

---------

RMB 2.9%

---------

CAD 2.0%

---------

NZD 1.3%

---------

SGD 0.8%

---------

HKD 0.6%

---------

8. Dividend Yield

The most recent dividend of 1 penny per share paid to investors

on 2 5th February 2021, brings the forward yield on a constant

basis to 4.0 pence per share. As the portfolio approaches full

investment, the Manager expects the level of income to increase

further and the Board will assess the dividend level, which in the

absence of unforeseen circumstances, it expects to be within the

target range of 4%-6% yield on issue price as set out in the

Company's prospectus.

9. Issuance

During the period the Company issued no new shares and there are

currently 208,807,952 shares in issue.

23rd March 2021

Alison Vincent

JPMorgan Funds Limited - Company Secretary

Telephone 0207 742 4000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVKLLFLFXLLBBD

(END) Dow Jones Newswires

March 23, 2021 03:00 ET (07:00 GMT)

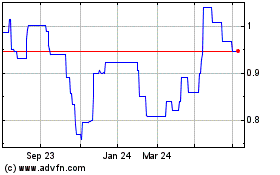

Jpmorgan Global Core Rea... (LSE:JARU)

Historical Stock Chart

From Mar 2024 to Apr 2024

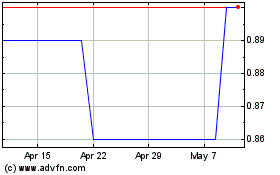

Jpmorgan Global Core Rea... (LSE:JARU)

Historical Stock Chart

From Apr 2023 to Apr 2024