JD Sports Fashion Plc AGM Trading Update (7318D)

July 01 2021 - 1:00AM

UK Regulatory

TIDMJD.

RNS Number : 7318D

JD Sports Fashion Plc

01 July 2021

1 July 2021

JD Sports Fashion Plc

AGM Trading Update

Peter Cowgill, the Executive Chairman of JD Sports Fashion Plc

(the "Group"), the leading retailer of sports, fashion and outdoor

brands, will make the following trading statement to shareholders

attending its AGM today.

Trading Update

After the acquisitions in the year of DTLR Villa LLC in the

United States and Marketing Investment Group S.A. in Central

Europe, the Group now has approximately 3,300 stores across 29

countries. Substantially all of the stores are now trading although

we continue to experience some temporary closures in parts of the

Asia Pacific region.

In those markets across Europe where stores were closed in the

early part of the year we saw sales retention slightly ahead of

that seen in the first closure period in Spring 2020. Trading in

the immediate period after reopening was particularly encouraging

in the UK as both loyal and new consumers, seeking to refresh their

personal style as hospitality and workplaces began to reopen,

reacted positively to JD's innovative and exciting product mix.

Consistent with other retailers, store footfall remains fragile

with online traffic at elevated levels.

In the United States, a second round of fiscal stimulus was

introduced by the Federal Government in March. As with the first

round of fiscal stimulus last year, this was paid directly to

individuals as opposed to supporting the cost base of corporates.

As a consequence, this has resulted in enhanced levels of consumer

demand across all of our businesses. The JD fascia continues to

make positive progress in the United States with 60 stores now

trading following the opening of five new stores and the conversion

of a further six stores which previously traded as Finish Line. It

is still our intention to convert approximately 50 stores from

Finish Line to JD during the current financial year.

Government Support

A number of countries, including the UK, have offered further

support to corporates this year to help cover the fixed costs of

physical retail, including salaries, while stores have been unable

to trade. The Group accepted this support where it has been

offered, using it for the purposes intended. In particular,

payments from the Job Retention Scheme in the UK helped ensure that

the thousands of people that we employ continue to be supported and

have sustainable and long term employment prospects with our

business.

As has been the case throughout the period of the pandemic, our

priority remains the health and wellbeing of our global workforce.

We remain focussed on the long term future and ongoing expansion of

the Group and our ability to offer jobs and career development

opportunities to young people throughout our business continues to

be a key part of this strategy. The latest example of this is the

1,228 young people who we are currently recruiting across the UK on

the Government's Kickstart scheme. We are very proud to be involved

in such a positive initiative which provides employment

opportunities for young people who were previously on Universal

Credit and who faced significant barriers to employment as a result

of the pandemic.

We are cognisant that the retention of sales in the period when

the stores were closed combined with the positive trading in the

immediate period after reopening did help to offset the negative

financial impacts associated with the period of temporary closures.

However, we must also acknowledge that the uncertainty surrounding

COVID has not yet fully passed and the current resurgence in

infection rates is affecting our core customer demographic more

than was the case previously. Accordingly, we will consider

repaying government support on payroll costs which we have received

whilst stores have been temporarily closed during the current year.

We will defer a final decision on this until there is certainty on

both the full easing of restrictions and the consequences of any

further lockdowns during our peak trading period this Winter.

Update on Governance Matters

With regard to governance matters, we would like to clarify the

following points:

-- In conjunction with the Board's succession planning and to

strengthen the depth of the management team it is our intention to

divide the current role of Executive Chairman and CEO before the

next Annual General Meeting and a comprehensive process will

commence shortly.

-- We fully accept that the composition of our Board should

reflect the current scale, momentum and global positioning of the

Group as well as its increased level of market capitalisation. In

addition, the Board fully supports the initiatives driven by the

Hampton-Alexander Review and the Parker Review and acknowledges the

need to create additional diversity within its membership. We are

also mindful that certain Board members have served on the Board

for longer than the recommended period of tenure within the

Corporate Governance Code. The Board, therefore, recognises the

need to address its composition as soon as possible and have

invited the independent non-executive directors to commence the

selection process and make recommendations to the Nominations

Committee.

Updated Guidance

While we must recognise the risk of further temporary store

closures across our global estate and the potential repayment of

government support to payroll costs in the current year, we

presently believe that the Group is on track to deliver profit

before tax and exceptional items for the full year at an increased

level of no less than GBP550 million.

The Group will announce Interim Results for the period to 31

July 2021 on 14 September 2021.

Enquiries:

JD Sports Fashion Plc Tel: 0161 767 1000

Peter Cowgill, Executive Chairman

Neil Greenhalgh, Chief Financial Officer

Jennifer Iveson, Investor Relations

MHP Communications Tel: 0203 128 8788

Andrew Jaques

Giles Robinson

Charles Hirst

Catherine Chapman

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGMQBLFXFQLLBBF

(END) Dow Jones Newswires

July 01, 2021 02:00 ET (06:00 GMT)

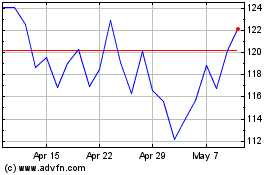

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Mar 2024 to Apr 2024

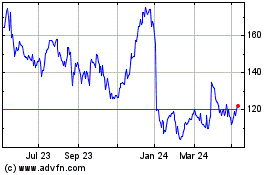

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Apr 2023 to Apr 2024