TIDMJIM

RNS Number : 7350U

Jarvis Securities plc

07 April 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014.

THIS ANNOUNCEMENT IS FOR INFORMATIONAL PURPOSES ONLY, AND DOES

NOT CONSTITUTE OR FORM PART OF ANY OFFER OR INVITATION TO SELL OR

ISSUE, OR ANY SOLICITATION OF AN OFFER TO PURCHASE OR SUBSCRIBE

FOR, ANY SECURITIES OF JARVIS SERCURITIES PLC.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO, OR TO

ANY PERSON LOCATED OR RESIDENT IN, ANY JURISDICTION WHERE IT IS

UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT AMOUNTS TO A FINANCIAL PROMOTION FOR THE

PURPOSES OF SECTION 21 OF THE FINANCIAL SERVICES AND MARKETS ACT

2000 ("FSMA") AND HAS BEEN APPROVED BY PRIMARYBID LIMITED WHICH IS

AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY (FRN

779021)

7 April 2021

Jarvis Securities plc

(" Jarvis " or the " Company " ) ( LON : JIM )

PrimaryBid Offer

Notice of General Meeting

Proposed Capital Reduction

Jarvis ( LON : JIM ), the AIM quoted stockbroking,

administration services and solutions provider , is pleased to

announce, a conditional offer via PrimaryBid (the "Offer") of up to

898,100 ordinary shares of 0.25p each in the Company currently held

in treasury ("Treasury Shares" or "Ordinary Shares") at an issue

price of 250 pence per Ordinary Share (the "Issue Price"), being a

discount of 8.76 per cent to the closing mid-price on 7 April

2021.

The Offer is subject to shareholder approval at a General

Meeting of the Company to be held on 4 May 2021 (more details of

which are set out below). Settlement for the PrimaryBid Offer is

expected to take place on 5 May 2021.

The Treasury Shares, once sold pursuant to the Offer (and

subject to shareholder approval), will be credited as fully paid

and will rank pari passu in all respects with the existing Ordinary

Shares, including the right to receive all dividends and other

distributions declared, made or paid in respect of the Ordinary

Shares. The Treasury Shares will be free of any encumbrances, liens

or other security interests.

Offer

The Company values its retail investor base and is therefore

pleased to provide private and other investors the opportunity to

participate in the Offer by applying through the PrimaryBid mobile

app available on the Apple App Store and Google Play along with the

Jarvis platforms. PrimaryBid does not charge investors any

commission for this service.

The Offer is now open to individual and institutional investors

and will close at 9 p.m. on 7 April 2021. The Offer may close early

if it is oversubscribed.

The Company in consultation with PrimaryBid reserves the right

to scale back any order at its discretion. The Company and

PrimaryBid reserve the right to reject any application for

subscription under the Offer without giving any reason for such

rejection.

No commission is charged to investors on applications to

participate in the Offer made through PrimaryBid. It is vital to

note that once an application for Ordinary Shares has been made and

accepted via PrimaryBid, an application cannot be withdrawn.

For further information on PrimaryBid or the procedure for

applications under the Offer, visit www.PrimaryBid.com or call

PrimaryBid.com on +44 20 3026 4750.

The Ordinary Shares will be issued free of all liens, charges

and encumbrances and will, when issued and fully paid, rank pari

passu in all respects with the Company's existing Ordinary

Shares.

Details of the Offer

The Company highly values its retail investor base which has

supported the Company alongside institutional investors over

several years. Given the longstanding support of retail

shareholders, the Company believes that it is appropriate to

provide retail and other interested investors the opportunity to

participate in the Offer.

The Offer is offered under the exemptions against the need for a

prospectus allowed under the Prospectus Rules. As such, there is no

need for publication of a prospectus pursuant to the Prospectus

Rules, or for approval of the same by the Financial Conduct

Authority in its capacity as the UK Listing Authority. The Offer is

not being made into any Restricted Jurisdiction or any other

jurisdiction where it would be unlawful to do so.

There is a minimum subscription of GBP100 per investor under the

terms of the Offer which is open to existing shareholders and other

investors subscribing via PrimaryBid.com.

Any investment request in excess of GBP50,000 will require the

Company's consent and may be subject to scale back.

For further details please refer to the PrimaryBid.com website

at www.PrimaryBid.com . The terms and conditions on which the Offer

is made, including the procedure for application and payment for

Ordinary Shares, is available to all persons who register on the

PrimaryBid mobile app.

Dispatch of Circular

As set out above, completion of the Primary Bid offer is subject

to shareholder approval which is to be sought at an upcoming

general meeting of the Company. The Company intends to dispatch a

shareholder circular on 9 April 2021 and a copy with be available

on the Company's website ( www.jarvissecurities.co.uk ) from that

date. The proposed date for the General Meeting is 9am on 4 May

2021.

In light of the UK Government's measures introduced in response

to the COVID-19 outbreak, including advice to avoid public

gatherings and all non-essential travel and social contact, the

Board has made the decision that the General Meeting will be held

as a closed meeting. This means that the General Meeting will be

convened with the minimum quorum of Shareholders as is required to

conduct the formal business of the General Meeting. As such, for

the safety and security of all involved, Shareholders and their

proxies will be unable to attend the General Meeting in person.

Shareholders should not seek to attend the meeting in person and

entry to the meeting will be refused to anyone who does try to

attend. Shareholders are therefore strongly advised to appoint the

Chairman of the General Meeting as their proxy to ensure that your

vote is counted. All resolutions will be taken on a poll. Further

information will be contained in the Circular and notice of General

Meeting.

Proposed Capital Reduction

The Circular which will convene the General Meeting of the

Company to approve the Offer will also seek to undertake a capital

reduction. This is not connected to the Offer.

Share premium forms part of the capital of the Company which

arises on the issue by the Company of Ordinary Shares at a premium

to their nominal value. The premium element is credited to the

share premium account. Under the Companies Act 2006, the Company is

generally prohibited from paying any dividends or making other

distributions in the absence of positive distributable reserves,

and the share premium account, being a non-distributable reserve,

can be applied by the Company only for limited purposes. However,

provided the Company obtains the approval of shareholders by way of

a special resolution and the subsequent confirmation by the Court,

it may reduce all or part of its share premium account and the

amount by which the share premium account is cancelled is credited

to the Company's distributable reserves.

The Company is therefore seeking the approval of the

shareholders at the General Meeting to cancel its share premium

account in its entirety. If approved by the shareholders, the

cancellations will require subsequent approval by the Court.

The Capital Reduction has no impact on the ability of the

Company to pay its debts.

Court Approval

If the Capital Reduction is approved by Shareholders, an

application will be made to the Court in order to confirm and

approve the Capital Reductions.

It is anticipated that the initial directions hearing in

relation to the Capital Reduction will take place on 18 June 2021,

with the final Court hearing taking place on 29 June 2021 and the

Capital Reduction becoming effective on the following day, after

the necessary registration of the Court order with the Registrar of

Companies has taken place.

Shareholders should note that the Capital Reduction will not

involve any distribution or repayment of capital or share premium

by the Company and will not reduce the underlying net assets of the

Company. The distributable reserves arising from the Capital

Reduction will, subject to the terms of any undertakings required

by the Court as explained above, enable the Company to pay

dividends or (if the Shareholders give appropriate authority in the

future) buy-back Ordinary Shares in the future.

The Board reserves the right to abandon or to discontinue (in

whole or in part) the application to the Court in the event that

the Board considers that the terms on which the Capital Reduction

would be (or would be likely to be) confirmed by the Court would

not be in the best interests of the Company and/or the Shareholders

as a whole. The Directors have undertaken a review of the Company's

liabilities (including contingent liabilities) and consider that

the Company will be able to satisfy the Court that, as at the date

(if any) on which the Court order relating to the Capital Reduction

and the statement of capital in respect of the Capital Reduction

have both been registered by the Registrar of Companies at

Companies House and the Capital Reductions therefore become

effective, the Company's creditors will be sufficiently

protected.

Following the Capital Reductions, the Company will continue to

meet the statutory requirement of having GBP50,000 minimum nominal

value of issued share capital.

If the proposed Capital Reduction is approved by the Court, the

Company will increase its positive retained earnings allowing for

further dividends to be paid by the Company in the future, should

circumstances at the time make it desirable to do so. In assessing

any future decision to declare dividends, the Board will take

account of all relevant circumstances existing at the time and any

such decision will be taken only after careful analysis of the

Company's financial position, the Company's strategic plans and the

prevailing economic and commercial conditions affecting the

Company's business and prospects.

Following the implementation of the Capital Reduction, there

will be no change in the number of Ordinary Shares in issue.

Further information on the Capital Reduction will be set out in

the Circular.

Investors should make their own investigations into the merits

of an investment in the Company. Nothing in this announcement

amounts to a recommendation to invest in the Company or amounts to

investment, taxation or legal advice.

It should be noted that a subscription for Ordinary Shares and

investment in the Company carries a number of risks. Investors

should consider the risk factors set out on PrimaryBid.com before

making a decision to subscribe for Ordinary Shares. Investors

should take independent advice from a person experienced in

advising on investment in securities such as the Ordinary Shares if

they are in any doubt.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com .

Jarvis Securities plc

A ndrew Grant / Jolyon Head 01892 510 515

PrimaryBid Limited enquiries@primarybid.com

Fahim Chowdhury / James Deal

WH Ireland Limited , Nominated Advisor

Katy Mitchell/Darshan Patel 0207 220 1666

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKZGGDKNFGMZM

(END) Dow Jones Newswires

April 07, 2021 11:54 ET (15:54 GMT)

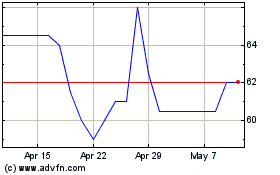

Jarvis Securities (LSE:JIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jarvis Securities (LSE:JIM)

Historical Stock Chart

From Apr 2023 to Apr 2024