Johnson Matthey PLC Trading update and strategic review of Health (7478U)

April 08 2021 - 1:00AM

UK Regulatory

TIDMJMAT

RNS Number : 7478U

Johnson Matthey PLC

08 April 2021

Pre-close trading update and strategic review of Health

business

Johnson Matthey releases a pre-close trading update for the financial

year ended 31(st) March 2021, ahead of its full year results scheduled

for 27(th) May 2021.

Robert MacLeod, Chief Executive commented:

In what has been an extraordinary year, I would like to thank all of

our employees for their dedication and efforts throughout this time.

I am very pleased with the progress we made, particularly in the second

half. As a result, group operating performance for the year is expected

to be around the top end of market expectations, alongside continued

strong management of working capital. In the year, we continued to

execute our growth strategy at pace. We are driving cashflow from our

more established businesses to invest in our suite of exciting sustainable

technologies that will enable decarbonisation and enhance circularity,

including our portfolio of eLNO battery materials and hydrogen technologies.

We have commenced a strategic review of Health, as we continue to focus

resources to maximise value for our shareholders. As the world builds

back greener following the pandemic, we have an important role to play

in helping society address climate change through our sustainable technologies,

and we remain focused on commercialising these and delivering our growth

ambitions.

Update for the year ended 31(st) March 2021

In 2020/21, group operating performance is expected to be around the

top end of market expectations(1)(,) (2). Following the disruption

from COVID-19 earlier in the year, our second half was materially stronger.

This reflected increased activity in autos and other key end markets,

and the actions taken to transform our business including tight cost

management. Our strong operational performance has enabled us to continue

to invest at pace into our strategic growth projects.

Strategic review of Health business

We continue to review our portfolio to focus on areas of greatest opportunity

to maximise value for our shareholders. As part of that ongoing process,

we are undertaking a strategic review of our Health business.

Clean Air saw a strong recovery in demand

Following the disruption from the pandemic at the start of the year,

we saw a strong recovery in demand across all regions towards the end

of our first half. This strength continued through the second half,

with global auto production better than previous expectations. As a

result, Clean Air full year operating performance is expected to be

only moderately below the prior year. We expect a significant improvement

in margin in the second half to above 13% and approaching pre-COVID-19

levels, driven by an improvement in volumes and early benefits from

our transformation programme. In our final quarter, there was limited

impact on automotive OEM customer production levels from the shortage

of semi-conductor chips. As we transform Clean Air and ramp up our

new highly efficient plants in Europe and Asia, we remain focused on

driving efficiency and cash generation across our business.

Notes:

Unless otherwise stated, commentary refers to performance at constant

rates. Growth at constant rates excludes the translation impact of foreign

exchange movements, with 2019/20 results converted at 2020/21 average

exchange rates.

1. In 2020/21, the translation impact of exchange rates on

group underlying

operating profit is expected to be negative

c.GBP6 million.

2. Vara consensus for full year underlying operating profit in

2020/21

is GBP469 million (range: GBP405 million to GBP502

million). 2019/20

underlying operating profit was GBP539 million.

By region, Asia was strong - particularly China - driven

mainly by

increased volumes from higher consumer demand supported by

government

stimulus, and inventory rebuild, as well as some benefits

from China

6 legislation. In Europe and Americas, following the

temporary disruption

in the first quarter, there was a steady improvement in

demand. We

expect to see the benefits of the rebound in the US Class 8

truck cycle

in 2021/22, given the recent strength of orders in that

market.

Efficient Natural Resources performed strongly

Efficient Natural Resources' performed strongly with full

year operating

performance expected to be broadly in line with the prior

year, despite

challenges from COVID-19. Catalyst Technologies was lower

driven by

weaker demand due to COVID-19 and the comparison to a

strong performance

in the prior year from methanol and ammonia catalyst

refills. We continue

to see positive momentum in licensing. During the year we

won 10 new

licences across various segments and we have a strong

pipeline of future

projects. We also made good progress on commercialising our

new technologies

which enable decarbonisation, including our low carbon

hydrogen offering

(blue hydrogen) where we are currently working on a

growing, global

pipeline of around 15 projects in a market with significant

growth

opportunity.

In PGM Services performance was exceptionally strong in our

refinery

and trading businesses, benefiting from more volatile and

higher average

precious metal prices. We made excellent progress in

reducing our refinery

backlogs and we expect to end the year at historically low

levels,

representing a significant improvement in precious metal

working capital

volumes.

Health benefited from new customer contracts

In Health, we expect full year operating performance to be

above the

prior year. This reflects continued progress with our new

customer

contracts for active pharmaceutical ingredients used in

generic opioid

addiction therapies and our work with innovator customers,

particularly

the supply of an immuno-oncology drug linker to Gilead

(formerly Immunomedics).

New Markets - further progress with eLNO, fuel cells and

green hydrogen

In New Markets, we expect full year operating performance

to be above

the prior year. In Battery Materials, commercialisation of

our high

nickel cathode material, eLNO, remains on track. The

construction of

our first commercial plant is on schedule and we are making

progress

with our plans for a second commercial plant with 30kt

capacity. We

continue to carefully evaluate a range of scale up models

for our battery

materials business, including strategic partnerships.

Fuel Cells continued its rapid growth, with sales expected

to be up

over 20% for the full year. We are supplying key fuel cell

components

for a range of automotive, non-automotive and stationary

applications.

Most recently, we signed a memorandum of understanding with

a major

European automotive supplier for the long term supply of

components

for automotive applications. In addition, we have existing

supply contracts

with fuel cell players including Doosan, SFC, Unilia and

Sino Fuel

Cell plus a number of joint development programmes in place

with automotive

and truck OEMs, stack and system manufacturers. We have

completed the

doubling of our manufacturing capacity in the UK and China

to give

an overall capacity of 2GW and, given the sizeable

opportunity, we

are already working on major capacity expansion plans.

Our green hydrogen business builds on our fuel cells

technology, leading

pgm expertise and circularity offering. We are making fast

progress

and have received positive feedback from testing with

leading electrolyser

manufacturers. We recently announced new manufacturing

capacity for

products used in green hydrogen production, with the

ability to scale

to multi-GW capacity as the market continues its

anticipated growth.

Maintained strong balance sheet

As part of our continued focus on balance sheet efficiency,

our leverage

ratio (net debt to EBITDA) is expected to be below our

target range

of 1.5 to 2.0 times, with net debt under GBP850 million.

This is despite

a backdrop of higher average precious metal prices and

increased activity

within the Clean Air business, reflecting the significant

improvement

we have made across the group through our ongoing programme

of precious

metal working capital management.

Efficiency initiatives on track

We remain focused on driving efficiency and are making good

progress

against our targeted annualised savings of c.GBP225 million

by 2022/23.

For the year ended 31(st) March 2021, we expect to deliver

benefits

of c.GBP60 million(3) as planned.

Foreign exchange

In 2020/21, the translation impact of exchange rates on

group underlying

operating profit is expected to be negative c.GBP6 million

based on

average exchange rates of GBP:$ 1.31, GBP:EUR 1.12, GBP:RMB

8.85. A

one cent change in the average US dollar exchange rate has

an impact

of approximately GBP1 million on full year underlying

operating profit,

a one cent change in the average euro exchange rate has an

impact of

approximately GBP2 million and a ten fen change in the

average rate

of the Chinese renminbi has an impact of approximately GBP1

million.

Full year results: We plan to announce our full year

results for the

year ended 31(st) March 2021 as scheduled on Thursday

27(th) May 2021.

Ends

Enquiries:

Investor Relations Director of Investor Relations 020 7269 8241

Martin Dunwoodie Senior Investor Relations Manager 020 7269 8235

Louise Curran Investor Relations Manager 020 7269 8242

Jane Crosby

Media 020 7269 8407

Sally Jones Director of Corporate Relations 020 7353 4200

Simon Pilkington Tulchan Communications

Notes:

eLNO is a trademark of Johnson Matthey Public Limited Company.

3. c.GBP60 million includes GBP30 million relating to Clean Air footprint

and driving group organisational efficiency, and GBP29 million of

procurement savings.

Johnson Matthey Plc is listed on the London Stock Exchange

(JMAT)

Registered in England & Wales number: 00033774

Legal Entity Identifier number: 2138001AVBSD1HSC6Z10

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFEDSSIDIIL

(END) Dow Jones Newswires

April 08, 2021 02:00 ET (06:00 GMT)

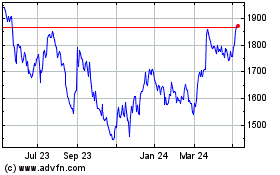

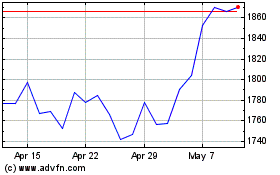

Johnson Matthey (LSE:JMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Johnson Matthey (LSE:JMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024