TIDMKIST

RNS Number : 3711V

Kistos PLC

14 April 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO, OR TO

ANY PERSON LOCATED OR RESIDENT IN, ANY JURISDICTION WHERE IT IS

UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT AMOUNTS TO A FINANCIAL PROMOTION FOR THE

PURPOSES OF SECTION 21 OF THE FINANCIAL SERVICES AND MARKETS ACT

2000 (AS AMENDED) ("FSMA") AND HAS BEEN APPROVED BY PRIMARYBID

LIMITED ("PRIMARYBID") WHICH IS AUTHORISED AND REGULATED BY THE

FINANCIAL CONDUCT AUTHORITY ("FCA") (FRN 779021)

14 April 2021

Kistos PLC

(" Kistos " or the " Company ") ( LON: KIST )

PrimaryBid Offer in Relation to Proposed Acquisition

Kistos ( LON: KIST ), the AIM quoted closed-ended investment

company which has been established with the objective of creating

value for its investors through acquisitions and management of

companies or businesses in the energy sector , is pleased to

announce a conditional offer for subscription via PrimaryBid (the

"PrimaryBid Offer") of new ordinary shares of nominal value 10

pence each in the Company ("New Ordinary Shares"). The price at

which the New Ordinary Shares will be placed will be determined at

the end of the bookbuild (the "Issue Price") . The Company is also

conducting a placing (the "Placing") and subscription (the

"Subscription") of New Ordinary Shares at the Issue Price with

institutional and other investors as announced on 12 March

2021.

The Company will use the funds raised from the PrimaryBid Offer,

the Placing and the Subscription to form part of the consideration

to acquire the entire issued and outstanding share capital of Tulip

Oil Netherlands B.V. ("TON") from Tulip Oil Holding B.V. (the

"Acquisition"), which was announced by the Company on 12 March

2021. TON, via its wholly-owned subsidiary, Tulip Oil Netherlands

Offshore B.V., owns an operating interest in the Q10-A offshore gas

field and interests in other fields in the Dutch North Sea,

including the Q10-B, Q11-B and M10/M11 discoveries, and other

exploration and appraisal projects. Upon completion of the

Acquisition, which constitutes a reverse takeover for the purposes

of Rule 14 of the AIM Rules for Companies, the Company expects to

cease to be an investing company under the AIM Rules for Companies

and instead become a trading company.

The PrimaryBid Offer, the Placing and the Subscription are

conditional on the New Ordinary Shares to be issued pursuant to the

PrimaryBid Offer, the Placing and the Subscription being admitted

to trading on AIM, the market of that name operated by London Stock

Exchange plc ("Admission"). Admission is expected to be take place

during the week commencing 17 May 2021. The PrimaryBid Offer will

not complete unless the Placing and the Subscription also complete

and Admission is also subject to approval of the Acquisition by

Kistos' shareholders ("Shareholders") at a general meeting in

accordance with the requirements of Rule 14 of the AIM Rules for

Companies.

Acquisition highlights:

-- The Acquisition comprises a controlling (60%) interest in the

Q10-A offshore gas field together with interests in a suite of

offshore exploration and production licences in the Dutch North

Sea.

-- The Q10-A field has 2P reserves of 19.5 mmboe and generated

total net production of 5.47 mboe/d in 2020.

-- Q10-A is reliant on solar and wind power. Its carbon

emissions from production operations were <10g C0 (2) e/boe in

2020 and 17g C0 (2) e/boe in 2019. These are significantly below

the North Sea average of 21 kg C0 (2) /boe. The Acquisition is

consequently in line with the Company's strategy to acquire assets

with a role in the energy transition.

-- Plans for the future developments of the assets being

acquired by Kistos utilise wind and solar power, which will make

Kistos one of the lowest CO (2) /boe emitters of Scope 1 emissions

from upstream operations in North West Europe.

-- The group to be acquired recorded aggregated EBITDA of EUR

30.60 million in the year to 31 December 2020 (2019: EUR 36.27

million) and profit before tax in the same period of EUR 16.27

million (2019: EUR 38.66 million).

-- The realised gas price in the year to 31 December 2020 was

EUR 11.58/mWh (2019: EUR 12.55/mWh). The realised prices and

forward curve imply an average 2021 gas price of EUR 18.30/mWh.

-- The Q10-B, Q11-B and M10a/M11 discoveries potentially have in

total 78.5 mmboe of 2C resources, each with development plans

prepared, and provide material growth opportunities for Kistos

going forward

-- In addition, TON holds various exploration prospects and

appraisal projects that provide optionality and upside to investors

across the portfolio.

PrimaryBid Offer

The Company values its retail investor base and is therefore

pleased to provide private and other investors the opportunity to

participate in the PrimaryBid Offer by applying exclusively through

the PrimaryBid mobile app available on the Apple App Store and

Google Play. PrimaryBid does not charge investors any commission

for this service.

The PrimaryBid Offer, via the PrimaryBid mobile app, will be

open to individual and institutional investors immediately

following the release of this announcement. The PrimaryBid Offer

will close at 10.00 a.m. on 19 April 2021. The PrimaryBid Offer may

close early if it is oversubscribed.

The Company, in consultation with PrimaryBid, reserves the right

to scale back any order at its discretion. The Company and

PrimaryBid reserve the right to reject any application for

subscription under the PrimaryBid Offer without giving any reason

for such rejection.

No commission is charged to investors on applications to

participate in the PrimaryBid Offer made through PrimaryBid. It is

vital to note that once an application for New Ordinary Shares has

been made and accepted via PrimaryBid, an application cannot be

withdrawn.

For further information on PrimaryBid or the procedure for

applications under the PrimaryBid Offer, visit www.PrimaryBid.com

or email PrimaryBid at enquiries@primarybid.com.

The New Ordinary Shares will be issued free of all liens,

charges and encumbrances and will, when issued and fully paid, rank

pari passu in all respects with the Company's existing ordinary

shares of nominal value 10 pence each.

Enquiries:

Kistos plc

Andrew Austin c/o Camarco Tel: 0203 757

4983

PrimaryBid Limited enquiries@primarybid.com

Fahim Chowdhury / James Deal

Panmure Gordon

Nick Lovering / Atholl Tweedie Tel: 0207 886 2500

/ Ailsa Macmaster

Camarco

Billy Clegg / James Crothers /Hugo Tel: 0203 757 4983

Liddy

Details of the PrimaryBid Offer

The Company highly values its retail investor base. The Company

believes that it is appropriate to provide retail and other

interested investors the opportunity to participate in the

PrimaryBid Offer. The Company is therefore making the PrimaryBid

Offer available exclusively through the PrimaryBid mobile app.

The Offer is offered under the exemptions against the need for a

prospectus allowed under the Prospectus Regulation Rules of the

FCA. As such, there is no need for publication of a prospectus

pursuant to the Prospectus Regulation Rules, or for approval of the

same by the FCA. The PrimaryBid Offer is not being made into any

jurisdiction where it would be unlawful to do so.

There is a minimum subscription of GBP100 per investor under the

terms of the PrimaryBid Offer which is open to existing

Shareholders and other investors subscribing via the PrimaryBid

mobile app.

For further details please refer to the PrimaryBid website at

www.PrimaryBid.com . The terms and conditions on which the

PrimaryBid Offer is made, including the procedure for application

and payment for New Ordinary Shares, is available to all persons

who register with PrimaryBid.

Investors should make their own investigations into the merits

of an investment in the Company. Nothing in this announcement

amounts to a recommendation to invest in the Company or amounts to

investment, taxation or legal advice.

It should be noted that a subscription for New Ordinary Shares

and investment in the Company carries a number of risks. Investors

should consider the risk factors set out on PrimaryBid.com before

making a decision to subscribe for New Ordinary Shares. Investors

should take independent advice from a person experienced in

advising on investment in securities such as the New Ordinary

Shares if they are in any doubt.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQMZGMDZFZGMZZ

(END) Dow Jones Newswires

April 14, 2021 02:00 ET (06:00 GMT)

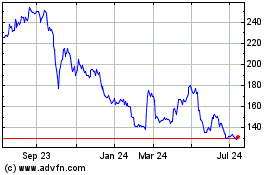

Kistos (LSE:KIST)

Historical Stock Chart

From Mar 2024 to Apr 2024

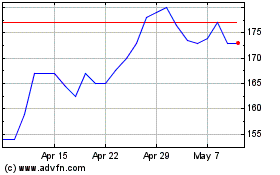

Kistos (LSE:KIST)

Historical Stock Chart

From Apr 2023 to Apr 2024