TIDMKLR

13 April 2021

Keller Group plc

Annual Report and Accounts for the year ended 31 December 2020 and Notice of

2021 Annual General Meeting

Keller Group plc ("Keller", the "Company") announces that its Annual General

Meeting ("AGM") will be held at 9.00am on Wednesday 19 May 2021 at the offices

of DLA Piper UK LLP, 160 Aldersgate Street, London EC1A 4HT.

In connection with this, the following documents have been posted or otherwise

made available to shareholders:

· Annual Report and Accounts for the year ended 31 December 2020 ("Annual

Report 2020")

· Notice of AGM

· Proxy Form (in the case of shareholders on the register of members)

Copies of these documents have been submitted, where appropriate, to the

National Storage Mechanism and will shortly be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

The Annual Report 2020 and the Notice of AGM are now available to view on the

Company's website at www.keller.com.

Keller is closely monitoring developments relating to COVID-19 and how this may

affect the arrangements for the AGM. Shareholders should therefore continue to

refer to the Company's website and announcements for any updates in relation to

the AGM, including venue.

In addition, should shareholders wish to ask any questions of the Board

relating to the business of the AGM, they are encouraged to email their

questions in advance to secretariat@keller.com or send them by post to the

Company's registered office for the attention of the Group Company Secretary

and Legal Advisor.

In accordance with the DTR 6.3.5, this announcement contains information in the

attached Appendix about the principal risks and uncertainties, the Directors'

responsibility statement and note 28 to the accounts on related party

transactions. This information has been extracted in full unedited text from

the Annual Report 2020. This material should be read in conjunction with and is

not a substitute for reading the full Annual Report 2020. References to page

numbers and notes in the Appendix refer to those in the Annual Report 2020. A

condensed set of financial statements was appended to the Keller's preliminary

results announcement issued on 9 March 2021.

For further information, please contact:

Keller Group plc www.keller.com

Kerry Porritt, Group Company Secretary and Legal Advisor 020 7616

7575

Silvana Glibota-Vigo, Group Head of Secretariat

Notes to editors:

Keller is the world's largest geotechnical specialist contractor providing a

wide portfolio of advanced foundation and ground improvement techniques used

across the entire construction sector. With around 9,000 staff and operations

across five continents, Keller tackles an unrivalled 6,000 projects every year,

generating annual revenue of more than £2bn.

LEI number: 549300QO4MBL43UHSN10

Classification: 1.1 (Annual financial and audit reports)

Appendix

Unedited extract from Annual Report 2020

Principal risks and uncertainties

The table on the following pages lists the principal risks and uncertainties as

determined by the Board that may affect the Group and highlights the mitigating

actions that are being taken. The content of the table, however, is not

intended to be an exhaustive list of all the risks and uncertainties that may

arise.

The COVID-19 pandemic is having and will continue to have an impact across the

entire organisation. We have incorporated commentary into affected principal

risks, which we will continue to manage centrally as well as regionally.

Key: Strategy lever Key: Risk movement

1 Balanced portfolio Increased risk Reduced risk

2 Engineered solutions

3 Operational excellence

4 Expertise and scale Constant risk Link to viability

Financial risk

Risk Potential impact Demonstrable mitigation Risk movement

(since 2019)

Inability to A lack of Mixture of long-term committed

finance available funds debt with varying maturity Constant risk

our business restricts dates which comprise a £375m Link to viability

Insufficient investment in revolving credit facility with

levels of growth a maturity extended to

funding, whether opportunities, November 2025 and a US private

from operating whether through placement debt of $125m ($50m

cash flow or acquisition or note maturing in 2021 and $75m

external innovation. note maturing in 2024).

financing

facilities, that In an extreme Active and open communication

are necessary to circumstance, with the revolving credit

support the the lack of facility banking group ensures

business. available funds that it understands the

could lead to a Group's financial performance

Link to failure of the and is supportive of funding

strategic lever: Group to requirements.

3, 4 continue as a

going concern. Strong free cash flow profile

with the ability to turn off

capital expenditure and reduce

dividends.

Embedded procedures to monitor

the effective management of

cash and debt, including

weekly cash reports and

regular cash flow forecasting

to ensure compliance with

borrowing limits and lender

covenants.

Culture focused on actively

managing our working capital;

the annual bonus plan is

linked to executive

remuneration through an

operating cash flow metric.

Please see the Directors'

remuneration report for

further information on

metrics.

Monitoring of and response to

external factors that may

affect funding availability;

as a result of the strong cash

management, even taking

account of the impact of

COVID-19, the Board announced

in November 2020 reduced

leverage guidance from

1.0x-1.5x to 0.5x-1.5x.

Market risk

Risk Potential impact Demonstrable mitigation Risk movement

(since 2019)

A rapid downturn Reduction in the The diverse markets in which Constant risk

in our markets demand for our the Group operates, both in Link to viability

Inability to products and terms of geography and market

maintain a services may segment, provide protection to

sustainable lead to a individual geographic or While we expect a

level of significant segment slowdowns. slight shrinking

financial deterioration in of the

performance financial Since March 2020, COVID-19 has construction

throughout the performance, caused a decrease in economic market in 2021

construction including cash activity in several of the and an adverse

industry market flow generation. markets in which we operate. impact on our

cycle, which Whilst the Group has shown order book, we

grows more than In an extreme good resilience to this will mitigate

many other circumstance, change, it is likely that through our

industries reduced cash COVID-19 will continue to exposure across a

during periods flow generation depress the economies in number of sectors

of economic could lead to a affected markets over the next of the

expansion and failure of the 12 months. This may cause a construction

falls more Group to reduction in activity in the market and are

harder than many continue as a construction sector which well placed to

other industries going concern. adversely affects the Group's take advantage of

when the economy order book. opportunities,

contracts. especially in

Having strong local businesses infrastructure.

Link to with in-depth knowledge of the We will continue

strategic lever: local markets enables early to monitor this

1, 2 detection and response to risk closely,

market trends. paying close

attention to any

Leveraging the global scale of impact on the

the Group, talent and size of our order

resources can be redeployed to book and take

other parts of the company appropriate

during individual market mitigating

slowdowns. actions.

The diverse customer base,

with no single customer

accounting for more than 3% of

group revenue, reduces the

potential impact of individual

customer failure caused by an

economic downturn.

Strategic risk

Risk Potential impact Demonstrable mitigation Risk movement

(since 2019)

Failure to Failure to A focus on understanding Increased risk

procure new negotiate customers' requirements and

contracts on satisfactory and competitors' capabilities. In addition to a

satisfactory appropriate potential adverse

terms contractual Structured bid review impact on our

Increasing terms may result processes in operation order book as a

competition, in delays and throughout the Group with result of a

changing disputes during well-defined selection downturn in our

customer project criteria that are designed to markets due to

requirements or delivery, ensure we take on contracts COVID-19, it is

a loss of negatively only where we understand and possible that

technological impacting our can manage the risks involved. there is

advantage relationships increased

results in a with our The Project Lifecycle competition for a

failure to customers and Management (PLM) Standard has reduced number of

continue to win the Group's introduced more rigour into contracts within

and retain reputation for how risks are considered those markets.

contracts on delivering during the opportunity, This may increase

satisfactory quality products contract approval and project pressure on bid

terms and and solutions. execution phases. pricing and

conditions in potentially erode

our existing and Inability to Sales training, which includes contract margins.

new target enter into a focus on contractual and We will continue

markets. commercially commercial terms. to monitor any

viable contracts increased

Link to may have a pressure on

strategic lever: negative effect contract margins

1, 2, 3, 4 on the and take

profitability of appropriate

our projects and mitigating

prevent the actions.

Group from

achieving

its targets.

Strategic risk

Risk Potential impact Demonstrable mitigation Risk movement

(since 2019)

Losing our market Delivering A clear business strategy with Constant risk

share sustainable defined short, medium and Link to viability

Inability to growth is a key long-term objectives, which is

achieve component of our monitored at local, divisional

sustainable strategy. and group level.

growth, whether Failure to

through deliver on our Continued analysis of existing

acquisition, new key strategic and target markets to ensure

products, new objective may opportunities that they offer

geographies or result in the are understood.

industry-specific loss of

solutions, may confidence and An opportunities pipeline

jeopardise our trust of our key covering all sectors of the

position as the stakeholders construction market.

preferred including

international investors, A wide-ranging local branch

geotechnical financial network which facilitates

specialist institutions and customer relationships and

contractor. customers. helps secure repeat work.

Link to strategic Continually seeking to

lever: 1, 2 differentiate our offering

through service quality, value

for money and innovation.

North American businesses

reorganisation delivering

on cross-selling

opportunities. However, due to

COVID-19 there is an economic

squeeze globally, increasing

pressure on volume/market

share.

Minimising the risk of

acquisitions, including

getting to know a target

company in advance, often

working in joint venture, to

understand the operational and

cultural differences and

potential synergies. As well

as undertaking these through

due diligence and structured

and carefully managed

integration plans.

Ethical Non-compliance A Code of Business Conduct Constant risk

misconduct and with relevant that sets out minimum Link to viability

non-compliance laws and expectations for all

with regulations regulations colleagues in respect of Strengthened

Keller operates could lead to ethics, integrity and communication of

in many different substantial regulatory requirements and is Keller's tone at

jurisdictions and damage to backed by a training programme the top and a

is subject to Keller's to ensure that it is fully renewed focus on

various rules, reputation and/ embedded across the Group. risk management

regulations and or large and internal

other legal financial A clear and confidential control have

requirements penalties. externally run maintained the

including those 'whistleblowing' facility exposure of this

related to Losing the trust encouraging employees risk.

anti-bribery and of our to report any suspected

anti-corruption. customers, misconduct.

There is a risk suppliers and

that the Group other An Ethics and Compliance

fails to maintain stakeholders Officer at every business unit

the required would have an who supports the ethics and

level of adverse effect compliance culture and ensures

compliance. on our ability best practice developed by the

to deliver Group is communicated and

Link to strategic against our embedded into local business

lever: 3, 4 strategy and practices.

business

objectives. Regular workshops across the

Group to ensure compliance

risks are identified and

addressed.

Strategic risk

Risk Potential impact Demonstrable mitigation Risk movement

(since 2019)

Inability to Without a The Keller Innovation Board Constant risk

maintain our structured works closely with business

technological innovation units, divisions and global

product approach, product teams to ensure a

advantage including structured approach to

Keller has a sufficient innovation is in place across

history of investment, the Group.

innovation that Keller may lose

has given us a its completive Keller's continued investment

technological advantage. in both external and internal

advantage which equipment manufacture.

is recognised by

our clients and Keller Data AcQuisition

competitors. (KDAQ), a group-wide

Inability to innovation project, will bring

maintain this information together and make

advantage it accessible in one simple

through the and concise platform. It will

continued include all technical

technological information from Keller and

advancements in third-party sources at each

our equipment, stage of delivery, including

products and data analysis and

solutions may visualisations where possible,

impact our and it will also be

position in the BIM-compatible.

market.

Link to

strategic lever:

1, 2

Changing Inability to Collaboration with the Constant risk

environmental achieve Keller's University of Surrey's Centre

factors commitment to for Environment and While the focus

Changes in deliver Sustainability to apply around

environmental solutions in an sustainability best practice environmental

legislation and environmentally to all business functions. legislation is

relevant conscious manner increasing, we

standards that may have a A Sustainability Steering believe this will

impact our negative impact Group is responsible for present

product and on our integrating sustainability opportunities to

service reputation, targets and measures into the us that we are

offerings and an affect employee group business plan to well placed to

increasingly morale and lead successfully drive changes exploit. Our

active public to loss of important to the company. increasing

response to confidence from activity to

environmental our customers, Scope 1 and 2 carbon emissions improve

concerns in the suppliers and verified by accredited sustainability

sectors in which investors. external third party (Carbon over and above

we operate. Intelligence). our peers will

Product ensure we are

Link to offerings become Carbon Calculator tool used to ready to take

strategic lever: obsolete because identify/improve carbon opportunities as

3 they are no efficiency. they arise.

longer compliant

with Project team created to

environmental develop processes to meet Task

standards. We Force on Climate-related

may be required Financial Disclosures (TCFD)

to remediate at requirements.

our own cost to

attain Further details can be found

compliance. in the ESG and sustainability

section on pages 40 to 53.

Operational risk

Risk Potential impact Demonstrable mitigation Risk movement

(since 2019)

Service or Failure to meet Continuing to enhance our Constant risk

solutions failure quality technological and operational Link to viability

In designing a standards could capabilities through

product or a damage our investment in our product

solution for reputation, teams, project managers and

customers many result in our engineering capabilities.

factors need to regulatory

be considered action and legal Employing geotechnical

including client liability, and engineers that are focused

requirements, impact financial purely on design.

site and loading performance.

conditions and Disaster Recovery/Business

local constraints The liability Continuity Plans in place

(eg neighbouring limitation across the Group.

buildings, other period of our

underground products is The global product teams set

structures). generally 12 standards, provide guidance

Inadequate design years; and disseminate best practice

of a customer consequently, a across the organisation for

product and/or poorly designed our eight key products.

solution may lead product/solution

to an inability could have an We seek to agree liability

to achieve the impact on our limits in our contracts with

required long-term customers.

standard. profitability.

Insurance solutions are in

Misinterpretation place to limit financial

of client exposure of a potential

requirements or customer claim.

miscommunication

of requirements

by the client may

lead to a poorly

designed solution

and consequently

failure.

Link to strategic

lever: 2, 4

Operational risk

Risk Potential impact Demonstrable mitigation Risk movement

(since 2019)

Ineffective Inability to Ensuring we understand all of Constant risk

execution of our successfully our risks through the bid Link to viability

projects deliver projects appraisal process and applying

Failure to in line with the rigorous policies and

manage our agreed customer processes to manage and

projects to requirements may monitor contract performance.

ensure that they result in cost

are delivered on overruns, Ensuring we have high-quality

time and to contractual people delivering projects.

budget due to disputes and Keller's Project Management

unforeseen reputational Academy and Field Leadership

ground and site damage. Academy are designed to create

conditions, project managers with a

weather-related Ineffective consistent skill set across

delays, project delivery the entire organisation. The

unavailability may also expose academies cover a broad range

of key the Group to of topics including contract

materials, long-term management, planning, risk

workforce obligations assessment, change management,

shortages or including legal decision-making and finance.

equipment action and

breakdowns. additional costs KDAQ system enabling

to remedy comparison of performance

Link to solution across sites using similar

strategic lever: failure. products, identification of

3, 4 areas of best practice and

quickly raising awareness of

where improvement is needed.

Safety Standards for

operations (eg platform, cage

handling), Equipment Standards

and fleet renewal.

The PLM Standard drives a

consistent approach to project

delivery with robust controls

at every project phase.

A formal, structured approach

to LEAN and 5S across the

organisation is being

embedded, which is improving

processes and strengthening

Keller's working culture.

Operational risk

Risk Potential impact Demonstrable mitigation Risk movement

(since 2019)

Causing a Inability to Board-led commitment to drive Constant risk

serious maintain a health and safety programmes Link to viability

injury or positive health and performance with a vision

fatality to an and safety of zero harm.

employee or a culture may lead

member of the to damage to An emphasis on safety

public morale, an leadership to ensure both HSEQ

Failure to increase in professionals and operational

maintain high employee leaders drive implementation

standards of turnover rates and sustainment of our safety

health and and a decrease standards through ongoing site

safety, and an in productivity. presence, using safety tours,

increase safety audits, safety action

in serious Deterioration in groups and mandatory employee

injuries or health and training.

fatalities safety

leading to an performance may Ongoing improvement of

erosion of trust lead to loss of existing HSEQ systems to

of employees and customer, identify and control known and

potential supplier and emerging HSEQ risks, which

clients. partner conform to internal standards.

confidence and

Link to damage to our Incident Management Standard

strategic lever: reputation in an and incident management

3 area that we software driving a robust and

regard as a top consistent management process

priority. across the organisation that

ensures the cause of the

incident is identified and

actions are put in place

to prevent recurrence.

Not having the Failure to Continuing to invest in our Constant risk

right skills to maintain people and organisation in

deliver satisfactory line with the four pillars of

Inability to performance in the Keller People agenda as

attract and respect of our noted below.

develop current projects

excellent people and failure to Ensuring that the 'Right

to create a deliver our Organisation' is in place with

high-quality, strategy and people having clear

vibrant, diverse business targets accountabilities; each

and flexible for growth. organisational unit is

workforce. properly configured with a

matrix of line management,

Link to functional support and product

strategic lever: expertise.

2, 3, 4

As industry leader, that

Keller is made up of 'Great

People' that are well trained,

motivated and have

opportunities to develop to

their full potential. Project

managers and field employees

receive comprehensive training

programmes which cover a broad

range of topics including

contract management, planning,

risk assessment, change

management, decision?making

and finance.

A strong focus on the

'Exceptional Performance'

of employees in delivering

commercial outcomes safely for

Keller based upon project

successes for our customers.

Business leaders are

incentivised to deliver their

annual financial and safety

commitments to the Group.

The 'Keller Way' provides

guidance to the company's

employees and leaders to

comply with local laws

and work within Keller's

values and Code of

Business Conduct.

Operational risk

Risk Potential impact Demonstrable mitigation Risk movement

(since 2019)

Risk of Cyber security Building a cyber security and Constant risk

potential breach could information assurance team and

disruption in result in services. The threat

the business leakage of landscape

operations, proprietary Building a zero trust layered continues to

reputational information, technology capability. evolve each year

damage and/or operational and so we

loss or disruptions, and Creation of an Information continue to adapt

corruption of loss of employee Security Management System our monitoring,

data through and customer framework, referencing detection,

external or data. industry standards to ensure prevention and

internal appropriate governance, education

technical control and risk management processes to

threats and and then onward management for maintain a

malicious action compliance, maturity and balanced risk

Information development of service. perspective.

security

and cyber Introduction of technical We assess cyber

threats are capabilities and services to risks and

a concern across further enable prevention, determine

industries detection, prediction and appropriate

worldwide. The response services. actions for our

introduction of business.

digital Multi-factor authentication Existing

solutions such for all users prevents capabilities

as InSite and unauthorised access to continue to be

KDAQ increases Keller's networks and deployed and

the Group's applications. enhanced if

reliance on IT needed.

and its inherent Advanced threat protection on

cyber risk all IT equipment delivers As an example,

exposure. comprehensive, ongoing and having seen in

real-time protection against 2020 the rise in

Link to viruses, malware and spyware. the number of

strategic lever: ransomware

3, 4 Data protection framework to attacks and the

ensure compliance with the increased number

General Data Protection of reported

Regulation (GDPR) and other attacks that

standards of data protection. target backup as

well as

production

environments

across all

industries, we

shall implement

in 2021 a backup

solution for key

services that is

immutable and

cannot be

encrypted.

Responsibility statement of the Directors in respect of the Annual Report and

the financial statements

We confirm that to the best of our knowledge:

* the financial statements, prepared in accordance with the applicable set of

accounting standards, give a true and fair view of the assets, liabilities,

financial position and profit or loss of the company and the undertakings

included in the consolidation as a whole; and

* the Strategic report and the Directors' report, including content contained

by reference, includes a fair review of the development and performance of

the business and the position and performance of the company and the

undertakings included in the consolidation taken as a whole, together with

a description of the principal risks and uncertainties that they face.

The Board confirms that the Annual Report and the financial statements, taken

as a whole, are fair, balanced and understandable and provide the information

necessary for shareholders to assess the Group's position and performance,

business model and strategy.

28 Related party transactions

Transactions between the parent, its subsidiaries and joint operations, which

are related parties, have been eliminated on consolidation. Other related party

transactions are disclosed below:

Compensation of key management personnel

The remuneration of the Board and Executive Committee, who are the key

management personnel, comprised:

2020 2019

£m £m

Short-term employee benefits 8.3 5.4

Post-employment benefits 0.4 0.4

Termination payments 0.4 0.2

9.1 6.0

Other related party transactions

As at the year end there was a net balance of £0.1m owed by (2019: £0.2m owed

to) the joint venture. These amounts are unsecured, have no fixed date of

repayment and are repayable on demand.

END

(END) Dow Jones Newswires

April 13, 2021 11:05 ET (15:05 GMT)

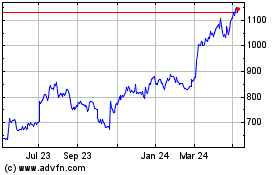

Keller (LSE:KLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

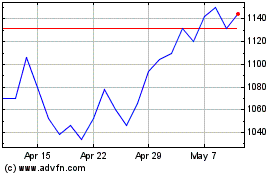

Keller (LSE:KLR)

Historical Stock Chart

From Apr 2023 to Apr 2024