TIDMKMR

Kenmare Resources plc ("Kenmare" or "the Company" or "the Group")

13 January 2021

Q4 2020 Production Report and FY 2021 Guidance

Kenmare Resources plc (LSE:KMR, ISE:KMR), one of the leading global

producers of titanium minerals and zircon, which operates the Moma

Titanium Minerals Mine (the "Mine" or "Moma") in northern Mozambique, is

pleased to provide a trading update for the full year ("FY") and fourth

quarter ending 31 December 2020 ("Q4 2020") and production guidance for

FY 2021.

Statement from Michael Carvill, Managing Director:

"Q4 2020 was a pivotal quarter for Kenmare, as we began mining the

Pilivili ore zone, following the successful move of Wet Concentrator

Plant B in Q3. WCP B began operating in late October and made a

significant contribution to our best production quarter of 2020,

benefitting from exceptionally high grades mined. It was also pleasing

to see a strong quarter for shipments, with over 300,000 tonnes shipped

during the period.

We achieved or exceeded the midpoint of our August 2020 guidance ranges

for all finished products and we are targeting an uplift of ilmenite

production in 2021 of between approximately 45% and 60%. In addition to

higher revenues, increased production will deliver lower unit costs,

significantly increasing cash flows and bringing us closer to our target

of becoming a first quartile producer on the industry revenue to cost

curve.

Global demand for ilmenite, our primary product, exceeded supply in Q4

2020 and led to significant price increases. Following our second and

third consecutive dividends paid in 2020, these positive operational and

market dynamics are expected to support increased cashflow, and in turn

our objective to increase shareholder returns."

Overview

-- Lost time injury frequency rate ("LTIFR") of 0.25 per 200,000 man-hours

worked for the 12-months to 31 December 2020 (31 December 2019: 0.27)

-- Increased COVID-19 positive test results were received for employees and

contractors in December 2020 as cases in Mozambique, and other parts of

the world, have also seen a recent upward trend - management remains

focused on limiting transmission and mitigating the impact of the virus

-- Production of all finished products at or above the midpoint of the FY

2020 revised guidance ranges

-- Q4 2020 represented the strongest quarter of the year for production and

shipments, as expected, benefitting from the higher ore grades being

mined by Wet Concentrator Plant ("WCP") B at Pilivili and calmer sea

conditions

-- Heavy Mineral Concentrate ("HMC") production of 1,201,100 tonnes in FY

2020, in line with FY 2019 (1,202,100 tonnes), benefitting from the

higher ore grades mined in Q4 2020 but offset by the decrease in

excavated ore volumes resulting from WCP B's relocation

-- Ilmenite production of 756,000 tonnes, a 15% decrease compared to FY 2019

(892,900 tonnes) due to lower HMC consumption, changes in intermediate

stocks and lower ilmenite recoveries in FY 2020

-- Total shipments of finished products of 853,100 tonnes, representing a

17% decrease compared to FY 2019 (1,029,300 tonnes), impacted by poor sea

conditions, and works to upgrade transhipment capacity

-- WCP B began mining in Pilivili in October, with operations connected to

grid power in December 2020 and the HMC pumping system on track to begin

commissioning and ramp-up in Q1 2021

-- At the end of 2020 Kenmare had US$64.0 million of net debt (year-end

2019: US$13.7 million net cash), with cash and cash equivalents of

US$87.2 million (year-end 2019: US$81.1 million)

-- Higher average prices achieved for ilmenite in Q4 2020, compared to the

prior quarter, with strong ilmenite pricing momentum continuing into H1

2021

-- FY 2021 ilmenite production guidance range of 1,100,000 to 1,200,000

tonnes

Production

Production from the Moma Mine in Q4 2020 and FY 2020 was as follows:

Q4 2020 vs Q4 2019 vs Q3 2020 FY 2020 vs FY 2019

----------------- --------- ---------- ---------- ---------- ----------

tonnes % change % change tonnes % change

----------------- --------- ---------- ---------- ---------- ----------

Excavated ore(1) 7,554,000 -9% -9% 34,357,000 -7%

----------------- --------- ---------- ---------- ---------- ----------

Grade(1) 5.64% 57% 58% 3.90% 9%

----------------- --------- ---------- ---------- ---------- ----------

Production

----------------- --------- ---------- ---------- ---------- ----------

HMC production 384,700 45% 49% 1,201,100 0%

----------------- --------- ---------- ---------- ---------- ----------

HMC consumption 338,900 26% 30% 1,157,900 -5%

----------------- --------- ---------- ---------- ---------- ----------

Ilmenite 219,100 7% 30% 756,000 -15%

----------------- --------- ---------- ---------- ---------- ----------

Primary zircon 11,200 3% 3% 43,300 -8%

----------------- --------- ---------- ---------- ---------- ----------

Rutile 1,400 -26% -13% 6,000 -28%

----------------- --------- ---------- ---------- ---------- ----------

Concentrates(2) 8,600 -14% -4% 35,200 -12%

----------------- --------- ---------- ---------- ---------- ----------

Shipments 321,300 -9% 172% 853,100 -17%

----------------- --------- ---------- ---------- ---------- ----------

1. Excavated ore and grade prior to any floor losses.

2. Concentrates include secondary zircon and mineral sands concentrate.

Kenmare recorded a LTIFR of 0.25 per 200,000 man-hours worked for the 12

months to 31 December 2020, which represents a marginal improvement

compared to the 12 months to 31 December 2019 (0.27). Whilst two lost

time injuries were recorded in Q4 2020, the rolling LTIFR improved from

0.29 in the 12 months to the end of Q3 2020, a result of continuing

improvements in safety leadership and risk assessment practices.

HMC production in FY 2020 was 1,201,100 tonnes, in line with FY 2019

(1,202,100 tonnes). FY 2020 ore grades increased by 9% to 3.90%,

compared to FY 2019 (3.58%). Higher grades were offset by reduced

excavated ore volumes due to the two-month interruption to operations at

WCP B during relocation. Although ore volumes were down 7% year-on-year,

WCP C commenced production in late February 2020, and contributed to

both grades mined and tonnes excavated.

As expected, Q4 2020 was the strongest quarter of the year for HMC

production, benefitting from the exceptionally high ore grades mined by

WCP B in Pilivili during November and December. Mining commenced in the

highest-grade area of Pilivili, resulting in a 57% increase in Q4 2020

grades to 5.64%, compared to Q4 2019 (3.60%).

Production of all finished products was at or above the midpoint of the

revised August 2020 guidance ranges. Ilmenite production was 756,000

tonnes, representing a 15% decrease compared to FY 2019 (892,900

tonnes). This was due to a 5% reduction in HMC consumption during the

year and lower MSP recoveries due to the impact of limited HMC

availability and reduced ilmenite content in the HMC during the first

nine months of the year. As expected, the ilmenite content in the HMC

increased as mining commenced in Pilivili.

Production of all finished products in Q4 2020 was impacted by

seasonally poor power reliability at the MSP. Typically, this would have

been mitigated by the use of diesel-powered electric generators, but

these were being utilised to power the Pilivili operations until grid

power was established in mid-December. This was one of the temporary

measures to alleviate COVID-19-related delays. From late December when

the generators were reinstalled at the MSP, production of all finished

products strengthened significantly due to improved recoveries and

operating time.

In Q4 2020, Kenmare produced 219,100 tonnes of ilmenite, a 7% increase

compared to Q4 2019 and a 30% increase compared to Q3 2020. Compared to

Q4 2019, ilmenite production was lower relative to HMC consumption due

to intermediate stockpile movements. Ilmenite recoveries were also lower

in Q4 2020 relative to the prior period as a result of power

interruptions and increased levels of contaminants in a part of WCP C's

mining area, which has now been resolved.

Primary zircon production in FY 2020 was 43,300 tonnes, an 8% decrease

compared to FY 2019 (46,900 tonnes) and rutile production was 6,000

tonnes, a 28% decrease compared to FY 2019 (8,300 tonnes). Production of

both products was impacted by decreased HMC availability year-on-year,

with weaker recoveries due to changes in feed characteristic, which also

continued to affect rutile production. A solution to improve rutile

production is under investigation. Concentrates production was 35,200

tonnes, a 12% decrease compared to FY 2019 (40,200 tonnes) but

benefitting from some of the recovery losses from rutile production,

which were captured in this product stream.

Whilst there was a 26% increase in HMC consumption in Q4 2020,

production of primary zircon only increased by 3% to 11,200 tonnes (Q4

2019: 10,900 tonnes) as a result of a build-up of intermediate stocks

offset by poorer recoveries, due primarily to power instability.

Production of rutile decreased by 26% to 1,400 tonnes (Q4 2019: 1,900

tonnes) and concentrates by 14% to 8,600 tonnes (Q4 2019: 10,000 tonnes)

for the same reasons.

Shipment volumes in FY 2020 were 853,100 tonnes, a 17% decrease compared

to FY 2019 (1,029,300 tonnes), impacted by adverse weather conditions

during a significant portion of the year and reduced availability of the

transhipment vessels, which underwent works to increase capacity.

Shipments were comprised of 766,500 tonnes of ilmenite, 43,100 tonnes of

primary zircon, 6,300 tonnes of rutile and 37,200 tonnes of

concentrates.

However as expected, Q4 2020 was the strongest quarter of the year for

shipments and the third strongest quarter in Kenmare's history, with

321,300 tonnes shipped. Q4 2020 represents a 9% decrease compared to Q4

2019, the quarterly record, impacted by two months of improvement works

relating to one of the transhipment vessels. Shipments in Q4 2020 were

comprised of 283,300 tonnes of ilmenite, 22,900 tonnes of primary zircon,

3,100 tonnes of rutile and 12,000 tonnes of concentrates.

Closing stock of HMC at the end of FY 2020 was 50,200 tonnes, compared

with 7,000 tonnes at the start of the year. Closing stock of finished

products at the end of FY 2020 was 145,500 tonnes (year-end 2019:

160,100 tonnes).

COVID-19 update

The State of National Public Calamity, declared by the Government of

Mozambique on 7 September 2020, remains in place. In addition, as with

other parts of the world, Mozambique has seen a recent increase in

COVID-19 cases.

In relation to cases at Moma, prior to December 2020, a limited number

of employees and contractors had tested positive for the Coronavirus. In

December 2020, the number of positive test results during the month

increased to approximately 25.

Stringent mitigation measures remain in place at site, including

heightened health protocols, social distancing measures and testing

procedures, including an on-site testing laboratory. All individuals

with positive test results are required to self-isolate in the Moma camp

until they receive a negative test result. Management continues to be

focused on limiting transmission and minimising the impact of COVID-19

on its employees, contractors and host communities.

Capital projects update

Kenmare previously announced three development projects that together

have the objective of increasing ilmenite production to 1.2 million

tonnes (plus co-products) per annum on a sustainable basis. The first

development project, a 20% expansion of WCP B, was commissioned

successfully in late 2018.

The second project, the development of WCP C, commenced production in

late February 2020. Although Kenmare is in discussions with the

contractor for the concentrator plant in relation to a number of

outstanding matters, such as acceptance and performance testing and

defect remediation, the project has been operating at expected

throughput levels and remains on track to be completed within the

original budget of US$45 million.

The third project, the relocation of WCP B to Pilivili, was successfully

undertaken in Q3 2020. The ramp-up began in Q4 2020 and continues to

progress well, with production in line with expectations and ore grades

significantly higher than previously being mined in Namalope.

Operations at Pilivili were connected to grid power in mid-December

2020, as expected, whilst the temporary trucking of HMC from Pilivili to

the MSP continues to run smoothly. The final parts of the HMC pumping

pipeline are expected to arrive on site in early February, with

commissioning and ramp-up expected to start during Q1 2021. The total

capital cost of the WCP B move is estimated at US$124 million, as

outlined in the Q3 2020 Production Report.

Several community development initiatives in Pilivili and the

surrounding area are under construction, including a new community

health centre and water supply systems. The Kenmare Moma Development

Association (KMAD) has also approved financial support for six

income-generating projects in the area, including grocery stores and a

small-scale flour mill.

Finance update

On 23 October 2020 Kenmare paid its third consecutive dividend, an

interim dividend of USc2.31 per share, in line with the policy to pay a

minimum of 20% of profit after tax. As previously stated, following

completion of the development projects, the Company expects to make

higher capital returns from 2021.

At 31 December 2020, Kenmare had net debt of US$64.0 million, compared

to net cash at the end of 2019 of US$13.7 million. Kenmare continues to

maintain an invoice discounting facility of up to US$30 million, which

was partially used in 2020. Cash and cash equivalents were US$87.2

million (2019: US$81.1 million) and gross bank loans, including accrued

interest, were US$151.2 million, in line with the debt position at the

end of H1 2020 (2019: US$67.4 million).

Market update

FY 2020 was a strong year for the titanium feedstocks market, with

Kenmare achieving higher average prices for its ilmenite and rutile

products compared with FY 2019. However, in FY 2020 zircon prices

decreased for the second consecutive year, due to continued oversupply

in the market.

Despite the disruption caused by the global COVID-19 pandemic, demand

for ilmenite remained strong in H1 2020. There was a marginal softening

in Q3 2020, but market conditions tightened strongly in Q4 2020,

delivering a 5% increase in average received prices over the prior

quarter. This momentum has continued into 2021.

Low supply chain inventories, in combination with global stimulus

efforts, supported a downstream pigment recovery during H2 2020. This

recovery was most pronounced in China, which saw pigment production

increase by more than 10% in FY 2020 compared to FY 2019, a record high.

This was supported by high utilisation rates at existing plants and the

ramp-up of new chloride pigment plants, building strong demand for

imported ilmenite.

Global ilmenite supply constraints remained in place due to depleting

ore bodies in Africa and mine closures in Australia, as well as

continued government restrictions in Vietnam and India. However,

ilmenite production in China increased, as well as global production of

low-quality ilmenite and ilmenite concentrates, which offset the reduced

supply from other mines. There is little new ilmenite supply forecast to

enter the market in the near term, with existing demand levels expected

to comfortably absorb Kenmare's increased 2021 production.

The zircon market continued to weaken in FY 2020 due to the impact of

the pandemic on global demand, particularly in Europe and China. Coupled

with a market already in oversupply, this resulted in sequentially

softer pricing through the first nine months of the year. However,

demand for zircon showed signs of recovery in Q4 2020 and Kenmare has

seen prices beginning to stabilise in early 2021.

FY 2021 guidance

The FY 2021 guidance for production and operating costs is as follows:

Unit FY 2021 Guidance FY 2020 Actual

--------------------------- ------- --------------------- --------------

Production

--------------------------- ------- --------------------- --------------

Ilmenite tonnes 1,100,000 - 1,200,000 756,000

--------------------------- ------- --------------------- --------------

Primary zircon tonnes 53,100 - 57,900 43,300

--------------------------- ------- --------------------- --------------

Rutile Tonnes 9,500 - 10,300 6,000

--------------------------- ------- --------------------- --------------

Concentrates(1) tonnes 37,900 - 41,400 35,200

--------------------------- ------- --------------------- --------------

Costs

------------------------------------ --------------------- --------------

Total cash operating costs US$m 166 - 184 N/R(2)

--------------------------- ------- --------------------- --------------

Cash costs per tonne of US$/t 132 - 146 N/R(2)

finished product

--------------------------- ------- --------------------- --------------

1. Concentrates include secondary zircon and mineral sands concentrate.

2. To be reported in full year financial statements

Production of all finished products in FY 2021 is expected to be higher

than in FY 2020, due primarily to WCP B mining higher grade ore in

Pilivili. Ilmenite production in FY 2021 is expected to be 1.1 million

to 1.2 million tonnes, building towards 1.2 million tonnes per annum on

a consistent basis. More than 50% of Moma's production is attributable

to WCP B following its relocation, as Pilivili is the highest grade ore

zone in Moma's portfolio. This guidance does not make any significant

allowance for further potential business interruption, such as through

the restriction on movement of goods or people, relating to the

continuing global pandemic.

Expenditure on development projects and studies is expected to be

approximately US$39 million in FY 2021. These costs primarily relate to

the remaining costs associated with the relocation of WCP B (US$19

million), some of which have been carried over from FY 2020 due to

timing of invoices, and improvement projects to enhance the resilience

of existing operations (US$9 million). The balance is attributable to

studies and community resettlement costs in preparation for the

relocation of WCP A to Nataka in 2025.

Sustaining capital costs in FY 2021 are expected to be approximately

US$25 million, in line with previously guided sustaining capital costs

of US$20-25 million per annum from 2020 to 2025.

Total cash operating costs are anticipated to increase in FY 2021 due to

increased production and the need to transport WCP B's HMC production

from Pilivili, which is a greater distance than the previous mining area

of Namalope, to the MSP. However, cash operating costs per tonne are

expected to decrease in FY 2021 due to higher anticipated production

volumes, and further decrease in 2022 as the Company targets a first

quartile position on the industry revenue to cost curve.

Kenmare will release its 2020 Preliminary Results on Wednesday 24 March

2021.

For further information, please contact:

Kenmare Resources plc

Jeremy Dibb / Katharine Sutton

Investor Relations

https://www.globenewswire.com/Tracker?data=bSWAjX-9ib1R7ecAJVojR_JkzlM9Q112ZcpRd4wrL6tsMCSwdFkAeXb1MuD0xIMp64V3FTD6nUkKN3rL0-gxXUyL1efeduEAi9xfMRIbU40=

ir@kenmareresources.com

Tel: +353 1 671 0411

Mob: + 353 87 943 0367 / + 353 87 663 0875

Murray (PR advisor)

Joe Heron

Tel: +353 1 498 0300

Mob: +353 87 690 9735

About Kenmare Resources

Kenmare Resources plc is one of the world's largest producers of mineral

sands products. Listed on the London Stock Exchange and the Euronext

Dublin, Kenmare operates the Moma Titanium Minerals Mine in Mozambique.

Moma's production accounts for approximately 7% of global titanium

feedstocks and the Company supplies to customers operating in more than

15 countries. Kenmare produces raw materials that are ultimately

consumed in everyday "quality-of life" items such as paints, plastics

and ceramic tiles.

Forward Looking Statements

This announcement contains some forward-looking statements that

represent Kenmare's expectations for its business, based on current

expectations about future events, which by their nature involve risks

and uncertainties. Kenmare believes that its expectations and

assumptions with respect to these forward-looking statements are

reasonable. However, because they involve risk and uncertainty, which

are in some cases beyond Kenmare's control. Actual results or

performance may differ materially from those expressed or implied by

such forward-looking information.

(END) Dow Jones Newswires

January 13, 2021 02:00 ET (07:00 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

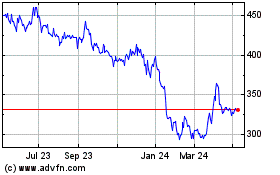

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

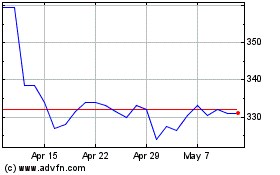

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Apr 2023 to Apr 2024