Kenmare Resources Update On Migration Of Uncertificated Shares From Crest To The Euroclear Bank System

March 11 2021 - 1:00AM

UK Regulatory

TIDMKMR

Kenmare Resources plc ("Kenmare" or "the Company" or "the Group")

11 March 2021

Update on migration of uncertificated shares

from CREST to the Euroclear Bank system

Kenmare confirms that it has taken all steps required to be taken by it

in connection with the proposed migration of the electronic holding and

settlement of its shares from the CREST system to the Euroclear Bank

system ("Migration").

Migration is expected to take effect on Monday, 15 March 2021, with the

migration to Euroclear Bank of the holding and settlement of the

securities of all Irish companies with securities that are listed and

traded in Dublin and/or London.

Migration

As previously announced, at the extraordinary general meeting of the

Company held on 21 January 2021 (the "EGM") shareholders approved the

Migration and authorised the Board to take all steps necessary to

implement it.

In accordance with the terms of the Migration of Participating

Securities Act 2019 and these authorities, the Company has consented to

the Migration and has made the requisite notifications to the Irish

Companies Registration Office and Euronext Dublin. Accordingly, all

steps required to be taken by the Company to give effect to Migration

have now been completed.

Timetable for Migration

Euronext Dublin announced on 8 March 2021 that Market Migration remains

scheduled to occur over the weekend of 12-15 March 2021 in line with the

indicative timetable that was included in the Company's circular to

Shareholders in relation to the EGM dated 23 December 2020 (the "EGM

Circular"). Euronext Dublin has advised that the 'live date' on which

Migration is to take effect is 15 March 2021. This timetable remains

subject to change by decision of Euronext Dublin.

Euronext Dublin maintains a dedicated web page relating to Market

Migration (on which details of the timetable and other relevant details

can be found) at the following link:

https://www.euronext.com/en/migration-csd-services-for-irish-securities-crest-euroclear-bank

Actions to be taken by Kenmare shareholders

For Kenmare shareholders who hold their shares in paper form (i.e.

outside of CREST and in "certificated" form) there will be no change to

what is owned and how it is held. Therefore, the impact of Migration on

such shareholders is expected to be minimal and no immediate action is

required.

For Kenmare shareholders who hold their shares through CREST (in

uncertificated form), Migration will result in changes to what is

technically owned, how the interest is held, and how rights related to

the shares will be exercised. Details of those changes are set out in

the EGM Circular. Specifically:

-- Retail shareholders who hold their shares electronically in CREST -

through a broker, custodian or nominee - will continue to hold their

interest through that broker, custodian or nominee, as a CREST Depository

Interest or (assuming the broker, custodian or nominee is or becomes a

participant in the Euroclear System in the way they are in CREST) as a

Belgian Law Right in the Euroclear System.

-- Institutional shareholders who hold their Shares electronically in CREST

directly in their own name (i.e. as a CREST member), will continue to be

able to hold their interests in shares directly in their own name as a

CREST Depository Interest or (provided they become a participant in the

Euroclear Bank system) as a Belgian Law Right in the Euroclear Bank

system. Where such shareholders wish to hold in the Euroclear Bank system

but are not or do not become a Euroclear Bank participant, they will need

to enter into an arrangement with a broker, custodian or nominee who is a

participant, so that they can hold the relevant interest for them.

If they have not done so already, Kenmare shareholders holding their

shares in CREST are strongly encouraged to consult with their

stockbroker or other intermediary at the earliest opportunity. Migration

will result in a significant change in both the form and nature of

shareholding in the Company, and the substance of, and manner in which,

rights can be exercised. In particular, Migration will result in

important changes to the processes and timelines for submitting proxy

voting instructions for the Company's forthcoming AGM. Shareholders

should familiarise themselves with the new processes and timelines, and

ensure all necessary actions have been taken on their part and by their

stockbroker or other intermediary, to ensure they can continue to enjoy

their rights as a Kenmare shareholder in the context of the new

Euroclear system.

Important notes

Unless the context otherwise required, defined terms used in this

announcement have the meanings given to them in Part 9 of the EGM

Circular.

For further information, please contact:

Kenmare Resources plc

Jeremy Dibb

Investor Relations

https://www.globenewswire.com/Tracker?data=7ukLHe3lC-pe-vr0sKdQIqKsivLlDulGE6DD_7ETODjjELXMfScvHiaBV-L_wZYWDOkE_l5kKFKLZt7Yy-N_FpckOHfIn-hpOAKYwg853FY=

ir@kenmareresources.com

Tel: +353 1 671 0411

Mob: + 353 87 943 0367

Murray (PR advisor)

Joe Heron

Tel: +353 1 498 0300

Mob: +353 87 690 9735

About Kenmare Resources

Kenmare Resources plc is one of the world's largest producers of mineral

sands products. Listed on the London Stock Exchange and the Euronext

Dublin, Kenmare operates the Moma Titanium Minerals Mine in Mozambique.

Moma's production accounts for approximately 7% of global titanium

feedstocks and the Company supplies to customers operating in more than

15 countries. Kenmare produces raw materials that are ultimately

consumed in everyday "quality-of life" items such as paints, plastics

and ceramic tiles.

Forward Looking Statements

This announcement contains some forward-looking statements that

represent Kenmare's expectations for its business, based on current

expectations about future events, which by their nature involve risks

and uncertainties. Kenmare believes that its expectations and

assumptions with respect to these forward-looking statements are

reasonable. However, because they involve risk and uncertainty, which

are in some cases beyond Kenmare's control. Actual results or

performance may differ materially from those expressed or implied by

such forward-looking information.

(END) Dow Jones Newswires

March 11, 2021 02:00 ET (07:00 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

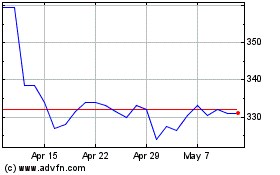

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

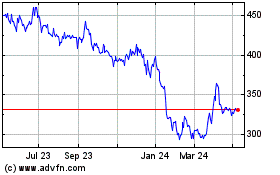

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Apr 2023 to Apr 2024