Kenmare Resources Q1 2021 Production Report

April 15 2021 - 1:00AM

UK Regulatory

TIDMKMR

Kenmare Resources plc ("Kenmare" or "the Company")

15 April 2021

Q1 2021 Production Report

Kenmare Resources plc (LSE:KMR, ISE:KMR), one of the leading global

producers of titanium minerals and zircon, which operates the Moma

Titanium Minerals Mine (the "Mine" or "Moma") in northern Mozambique, is

pleased to provide a trading update for the quarter ending 31 March 2021

("Q1 2021").

Statement from Michael Carvill, Managing Director:

"I am pleased to report that the number of people in isolation for

COVID-19 at Moma has fallen from 177 in mid-March to 41 currently.

Whilst operations continued throughout, there have been minor

interruptions as a result.

It's very pleasing to see the uplift in production as WCP B settles into

normal operation in Pilivili. We remain confident in the outlook for

production and re-iterate our guidance of 1.1-1.2 million tonnes per

annum of ilmenite in 2021.

Our rising production volumes are also well supported by strong demand

for our products. Market conditions for ilmenite remain strong and the

backdrop for zircon has also been improving and we expect prices to

begin rising in the coming quarters."

Overview

-- The number of people in isolation due to COVID-19 at Moma was 41 on the

13 April, having seen steady reduction from 177 reported on 10 March

-- Lost time injury frequency rate ("LTIFR") of 0.24 per 200,000 man-hours

worked on a 12-month rolling basis, an improvement from 0.25 in Q4 2020

-- Heavy Mineral Concentrate ("HMC") production increased 46% to 361,900

tonnes (Q1 2020: 248,100 tonnes), benefitting from a 37% increase in

grade and a 10% increase in tonnes excavated

-- Ilmenite production increased 73% to 275,100 tonnes (Q1 2020: 159,100)

-- Primary zircon production increased 39% to 13,300 tonnes (Q1 2020: 9,600)

-- Rutile production increased 36% to 1,900 tonnes (Q1 2020: 1,400)

-- Total shipments of finished products up 77% to 344,400 tonnes (Q1 2020:

194,600 tonnes), benefitting from increased production volumes and

upgraded transhipment capacity

-- The ilmenite market has remained strong, with further price increases

received in Q1 2021

-- The outlook for the zircon market has improved as increased global demand

and low inventories have led to price increases in early Q2 2021

COVID-19 update

COVID-19 cases at site have been steadily decreasing, with 41 people in

isolation on 13 April 2021, down from 177 on the 10 March 2021.

Protecting our people has always been Kenmare's highest priority. In

addition to the pre-existing physical distancing and hygiene protocols,

Kenmare has been conducting weekly testing of the complete workforce on

the site. This has helped identify and isolate positive cases more

quickly and limit the spread of the virus.

However, the larger number of cases limited the availability of

personnel, including senior management, in Q1 2021. While the business

has been managed to mitigate the impact and production has continued,

some impacts on production were experienced during the quarter but are

difficult to quantify.

Production

Production from the Moma Mine in Q1 2021 was as follows:

Q1 2021 Q1 2020 Variance Q4 2020 Variance

----------------- ---------------- --------- -------- ---------- --------

tonnes tonnes % tonnes %

----------------- ---------------- --------- -------- ---------- --------

Excavated ore(1) 8,955,000 8,153,000 10% 7,554,000 19%

----------------- ---------------- --------- -------- ---------- --------

Grade(1) 4.64% 3.39% 37% 5.64% -18%

----------------- ---------------- --------- -------- ---------- --------

Production

----------------- ---------------- --------- -------- ---------- --------

HMC production 361,900 248,100 46% 384,700 -6%

----------------- ---------------- --------- -------- ---------- --------

HMC consumption 391,200 246,700 59% 338,900 15%

----------------- ---------------- --------- -------- ---------- --------

Ilmenite 275,100 159,100 73% 219,100 26%

----------------- ---------------- --------- -------- ---------- --------

Primary zircon 13,300 9,600 39% 11,200 19%

----------------- ---------------- --------- -------- ---------- --------

Rutile 1,900 1,400 36% 1,400 36%

----------------- ---------------- --------- -------- ---------- --------

Concentrates(2) 8,900 8,600 3% 8,600 3%

----------------- ---------------- --------- -------- ---------- --------

Shipments 344,400 194,600 77% 321,300 7%

----------------- ---------------- --------- -------- ---------- --------

1. Excavated ore and grade prior to any floor losses.

2. Concentrates include secondary zircon and mineral sands concentrate.

During Q1 2021 Kenmare further improved its safety performance, with a

rolling 12-month LTIFR of 0.24 per 200,000 man-hours worked (Q4 2020:

0.25) due to new risk assessment processes becoming embedded in

operations.

HMC production was 361,900 tonnes in Q1 2021, representing a 46%

increase compared to Q1 2020 (248,100 tonnes), mainly due to the 37%

increase in ore grade as WCP B is now mining in the higher grade

Pilivili deposit. A 10% increase in excavated ore was also a significant

factor, due to a higher contribution from WCP C, which began operating

in February 2020, as well as slightly increased volumes at WCP A and WCP

B.

Mining utilisations are expected to rise for the remainder of the year,

supporting higher excavated ore volumes. This is a principal area of

management focus. Grades are expected to be maintained between 4.5-5%

Total Heavy Mineral until Q4 (when grades are anticipated to drop to

3.7%), before normalising at around 4.3% in 2022.

Production of all finished products from the Mineral Separation Plant

increased during Q1 2021 as a result of increased HMC production from

the mine. Ilmenite production was 275,100 tonnes, up 73% (Q1 2020:

159,100 tonnes); primary zircon production was 13,300 tonnes, up 39% (Q1

2020: 9,600 tonnes); rutile production was 1,900 tonnes, up 36% (Q1

2020: 1,400 tonnes); and concentrates production was 8,900 tonnes, up 3%

(Q1 2020: 8,600 tonnes). Concentrate production increased less than

primary zircon due to an intermediate stock build of 3,600 tonnes during

the quarter, which is expected to reverse.

Total shipments in Q1 2021 increased 77% compared to Q1 2020 (Q1 2020:

194,600 tonnes), reflecting strong product market conditions and aided

by the increased capacity of the transhipment vessels, following

previously announced upgrade works. Kenmare shipped 344,400 tonnes of

finished products during the period. Shipments comprised of 326,700

tonnes of ilmenite, 8,500 tonnes of primary zircon, and 9,300 tonnes of

concentrates. No rutile was shipped during the quarter.

Closing stock of HMC at the end of Q1 2021 was 20,900 tonnes, compared

with 50,200 tonnes at the start of the year. Closing stock of finished

products at the end of Q1 2021 was 101,000 tonnes (Q4 2020: 145,500

tonnes).

Capital projects update

The final parts of the HMC pumping pipeline for WCP B operations at

Pilivili have been installed, with commissioning now underway. The total

capital cost of the WCP B move is estimated at US$127 million, as

outlined in the 2020 Preliminary Results.

Market update

The ilmenite market continued to perform strongly into 2021 and Kenmare

achieved price increases for ilmenite in Q1 2021.

Following on from the strong recovery in H2 2020, demand for titanium

pigment remained buoyant in Q1 2021, as downstream markets saw a strong

uplift from the ongoing global economic recovery. Pigment producers are

operating at high utilisation rates to meet demand and due to low

inventory levels, this is flowing directly through to demand for

titanium feedstocks. The titanium metal market is also starting to

recover in key regions such as Asia, which has further bolstered

ilmenite demand.

Ilmenite supply continues to be constrained in India, while recent mine

closures in Australia have also reduced supply. This has been more than

offset by increased ilmenite supply from Vietnam in recent months and

higher ilmenite production in China. Despite higher supply from these

sources, ilmenite demand has exceeded Kenmare's ability to supply in Q1

2021 even after drawing on finished product inventories.

The outlook remains positive as demand for Kenmare's products is strong

across all major geographical regions, with many recovering faster than

anticipated. We have secured the majority of sales for Q2 2021 and

expect ilmenite demand to remain robust as pigment inventories remain

low through the supply chain.

Market dynamics for zircon improved in Q1 2021, benefitting from higher

global demand and low inventories. As a result, prices have shown

increases in early Q2 2021.

For further information, please contact:

Kenmare Resources plc

Jeremy Dibb

Investor Relations

ir@kenmareresources.com

https://www.globenewswire.com/Tracker?data=W5MNckJl9lbTEHz3AI-EQyPgFbmYKImiNVKZ2ZJThn2e8GvUc_UNeh41OVqcJ5YENl4IlmELbWMygkQxKsc_8oxMB_gylCXvWyEd46x-xd0=

Tel: +353 1 671 0411

Mob: + 353 87 943 0367

Murray (PR advisor)

Joe Heron

Tel: +353 1 498 0300

Mob: +353 87 690 9735

About Kenmare Resources

Kenmare Resources plc is one of the world's largest producers of mineral

sands products. Listed on the London Stock Exchange and the Euronext

Dublin, Kenmare operates the Moma Titanium Minerals Mine in Mozambique.

Moma's production accounts for approximately 5% of global titanium

feedstocks and the Company supplies to customers operating in more than

15 countries. Kenmare produces raw materials that are ultimately

consumed in everyday "quality-of life" items such as paints, plastics

and ceramic tiles.

Forward Looking Statements

This announcement contains some forward-looking statements that

represent Kenmare's expectations for its business, based on current

expectations about future events, which by their nature involve risks

and uncertainties. Kenmare believes that its expectations and

assumptions with respect to these forward-looking statements are

reasonable. However, because they involve risk and uncertainty, which

are in some cases beyond Kenmare's control. Actual results or

performance may differ materially from those expressed or implied by

such forward-looking information.

(END) Dow Jones Newswires

April 15, 2021 02:00 ET (06:00 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

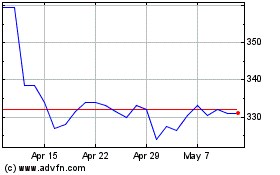

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

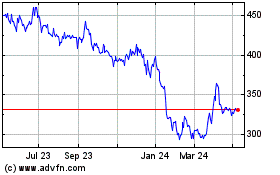

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Apr 2023 to Apr 2024