TIDMKMR

Kenmare Resources plc ("Kenmare" or "the Company")

14 July 2021

Q2 and H1 2021 Production Report

Kenmare Resources plc (LSE:KMR, ISE:KMR), one of the leading

global producers of titanium minerals and zircon, which operates

the Moma Titanium Minerals Mine (the "Mine" or "Moma") in northern

Mozambique, is pleased to provide a trading update for the quarter

and half year ending 30 June 2021 ("Q2 2021" and "H1 2021").

Statement from Michael Carvill, Managing Director:

"Kenmare's capital investment over the last three years

continues to deliver as Q2 saw a record quarter of production for

ilmenite, improving on the record set in Q1 2021. WCP B continues

to perform well in Pilivili, supporting higher volumes of ore mined

and final product output. We remain confident in the outlook for

annual production and re-iterate our guidance of 1.1-1.2 million

tonnes of ilmenite in 2021.

We are concerned by the rise in delta variant COVID-19 cases in

Southern Africa. Therefore I'm particularly pleased that we expect

to offer COVID-19 vaccinations to all Mine employees and

contractors, as well as local communities, later this month.

Market conditions for ilmenite, and titanium feedstocks in

general, remained strong in Q2 2021 with pricing strengthening

quarter on quarter. The outlook for zircon has also continued to

improve, with price increases during the quarter and continuing to

date."

Q2 2021 overview

-- Improved Lost Time Injury Frequency Rate ("LTIFR") of 0.14 per 200,000

man-hours worked for the 12 months to 30 June 2021 (30 June 2020: 0.32),

zero lost time injuries recorded during the quarter

-- COVID-19 vaccinations of the Mine workforce and local communities are

expected to start later this month

-- Heavy Mineral Concentrate ("HMC") production of 436,600 tonnes in Q2

2021, representing a 41% increase compared to Q2 2020 (310,300 tonnes),

benefitting from higher grade and excavated ore volumes

-- Record ilmenite production of 283,900 tonnes in Q2 2021, representing a

35% increase compared to Q2 2020 (209,900 tonnes), benefitting from

increased HMC production

-- Primary zircon production of 14,900 tonnes, representing a 28% increase

compared to Q2 2020 (11,600 tonnes), also benefitting from increased HMC

production

-- Total shipments of finished products of 249,600 tonnes, representing a

14% increase compared to Q2 2020 (219,100 tonnes)

-- Kenmare expects production of all products to be within 2021 guidance

-- Strong ilmenite market conditions continued in Q2 2021 and this is

expected to continue in Q3 2021, with higher prices agreed and a strong

order book in place

-- The positive outlook for the zircon market has continued to strengthen,

with received prices rising in Q2 2021

-- At the end of H1 2021, net debt was US$76.1 million (31 December 2020:

US$64.0 million net debt), as a result of higher prices and sales being

offset by the timing of capital expenditure and a reduction in the use of

invoice factoring

Production

Production from the Moma Mine in Q2 and H1 2021 was as

follows:

Q2 2021 Q2 2020 Q1 2021 H1 2021 H1 2020

----------------- ---------- ---------- ---------- ---------- ----------

tonnes % variance % variance tonnes % variance

----------------- ---------- ---------- ---------- ---------- ----------

Excavated ore(1) 10,938,000 6% 22% 19,893,000 8%

----------------- ---------- ---------- ---------- ---------- ----------

Grade(1) 4.70% 43% 1% 4.67% 40%

----------------- ---------- ---------- ---------- ---------- ----------

Production

----------------- ---------- ---------- ---------- ---------- ----------

HMC production 436,600 41% 21% 798,500 43%

----------------- ---------- ---------- ---------- ---------- ----------

HMC consumption 423,200 36% 8% 814,400 46%

----------------- ---------- ---------- ---------- ---------- ----------

Ilmenite 283,900 35% 3% 559,000 52%

----------------- ---------- ---------- ---------- ---------- ----------

Primary zircon 14,900 28% 12% 28,200 33%

----------------- ---------- ---------- ---------- ---------- ----------

Rutile 2,200 47% 16% 4,200 45%

----------------- ---------- ---------- ---------- ---------- ----------

Concentrates(2) 11,800 31% 33% 20,700 18%

----------------- ---------- ---------- ---------- ---------- ----------

Shipments 249,600 14% -28% 594,100 44%

----------------- ---------- ---------- ---------- ---------- ----------

1. Excavated ore and grade prior to any floor losses.

2. Concentrates include secondary zircon and mineral sands concentrate.

In Q2 2021 Kenmare's rolling 12-month LTIFR was 0.14 per 200,000

man-hours worked (Q2 2020: 0.32), with zero lost time injuries

recorded during the quarter.

HMC production was 436,600 tonnes in Q2 2021, representing a 41%

increase compared to Q2 2020 (310,300 tonnes). This was a result of

a 43% increase in ore grades (to 4.7%) and a 6% increase in

excavated ore volumes (to 10.9 million tonnes), setting a new

quarterly record of HMC production. Excavated ore volumes also

increased by 22% when compared to Q1 2021, benefitting from higher

mining rates from all plants. As previously announced, grades are

expected to be maintained between 4.5-5.0% Total Heavy Mineral

until Q4 2021 (when grades are anticipated to drop to 3.7%), before

normalising at around 4.3% in 2022.

Ilmenite production rose broadly in line with increased HMC

production to 283,900 tonnes, representing a 35% increase compared

to Q2 2020 (209,900 tonnes). Despite ilmenite recoveries being

slightly lower than expected in Q2 2021, production set a new

quarterly record and recoveries have now returned to expected

levels.

Primary zircon production increased by 28% to 14,900 tonnes in

Q2 2021 (Q2 2020: 11,600 tonnes) benefitting from increased HMC

consumption. Rutile production was 2,200 tonnes, up 47% (Q2 2020:

1,500 tonnes) due to increased feed and improved circuit

recoveries. Concentrates production was 11,800 tonnes, up 31% (Q2

2020: 9,000 tonnes) also due to increased HMC consumption.

Full year guidance, as published on the 13(th) January 2021, is

maintained for all products.

Total shipments in Q2 2021 increased by 14% compared to Q2 2020

and H1 2021 shipments were up 44% on H1 2020. Kenmare shipped

249,600 tonnes of finished products during the period (Q2 2020:

219,100 tonnes), which was comprised of 235,400 tonnes of ilmenite,

10,000 tonnes of primary zircon and 4,300 tonnes of

concentrates.

Closing stock of HMC at the end of Q2 2021 was 34,300 tonnes,

compared with 20,900 tonnes at the end of Q1 2021. Closing stock of

finished products at the end of Q2 2021 was 164,100 tonnes,

compared to 101,000 tonnes at the end of Q1 2021 (Q2 2020: 156,700

tonnes).

COVID-19 update

COVID-19 cases at Moma steadily decreased through Q2 2021, with

41 people in isolation on 13 April 2021 and continued to fall to

zero by late May. However, Southern Africa has recently been

experiencing a third wave of cases, which has also led to a small

increase at site, with 15 people currently in isolation.

Protecting our people and the communities in which we operate

has always been Kenmare's highest priority. In addition to the

various physical distancing and hygiene protocols, and testing

procedures, Kenmare has been working with industry partners and the

Government of Mozambique to acquire, distribute and administer

vaccines. The vaccines are now on the way to site and vaccinations

of the mine workforce and local communities are expected to start

later this month.

Capital projects update

The capital project to move WCP B to Pilivili, including

associated infrastructure, is now substantially complete. The final

parts of the HMC pumping pipeline for WCP B operations at Pilivili

have been installed and are undergoing ramp up. Heavy mineral

product is being transported via the pipeline and a reduced

trucking operation. It is expected that the pipeline will be

operating at capacity in the coming months. The total capital cost

of the WCP B move is estimated at US$127 million, as outlined in

the Preliminary Results for 2020.

Market update

Positive market conditions prevailed for mineral sands in Q2

2021 with market prices for ilmenite, zircon and rutile all

increasing.

Ilmenite prices continued to rise through the quarter,

benefitting from strong demand. Pigment plants are operating at

high production rates, whilst the titanium metal and welding

sectors are also experiencing a strong recovery. In addition, as a

result of increased production, ilmenite sales volumes increased

52% in H1 2021 (vs H1 2020).

Despite some disruptions to major titanium feedstock producers

in Q2 2021, overall global supply has increased. This has primarily

come from China and Vietnam, in addition to ilmenite in the form of

concentrates.

The recovery in demand for zircon accelerated in Q2 2021 and

price increases were achieved for Kenmare's zircon products. The

zircon market is tight and further exacerbated by production

disruptions from zircon suppliers. Demand for Kenmare's zircon

products is currently exceeding its ability to supply.

Due to strong global demand for commodities, the freight market

has been exceptionally tight in Q2, leading to a rapid increase in

rates. These conditions are expected to persist in H2 2021.

Positive market conditions for all Kenmare's products are

expected to continue in Q3 2021, despite an expected strong freight

market having the potential to dampen received prices. We have a

strong order book for our ilmenite products and we expect to a

supportive market for rutile and zircon in H2 2021.

Finance update

On 19 May 2021, Kenmare paid its 2020 final dividend of USc7.69

per share. This was the balancing payment of a 2020 full year

dividend of USc10.00 per share, up 22% from 2019. As previously

stated, Kenmare is targeting a 25% Profit After Tax dividend

payment for 2021.

Kenmare drew down in full its US$40.0 million Revolving Credit

Facility in early April 2020, as previously announced, to provide

maximum liquidity and flexibility in an unprecedented period. The

Company repaid US$20.0 million of this facility in June 2021.

Consequently, at 30 June 2021, cash and cash equivalents were

US$56.6 million (31 December 2020: US$81.1 million) and gross bank

loans, including accrued interest, were US$132.7 million (31

December 2020: US$151.3 million). Accordingly, as at 30 June 2021,

Kenmare had net debt of US$76.1 million, compared to US$64.0

million net debt at 31 December 2020, which is mainly due to the

timing of capital expenditure payments and a reduction in the use

of invoice factoring.

Kenmare will announce its results for the six months ended 30

June 2020 on 18 August 2021.

For further information, please contact:

Kenmare Resources plc

Jeremy Dibb

Investor Relations

Tel: +353 1 671 0411

Mob: + 353 87 943 0367

Murray (PR advisor)

Joe Heron

Tel: +353 1 498 0300

Mob: +353 87 690 9735

About Kenmare Resources

Kenmare Resources plc is one of the world's largest producers of

mineral sands products. Listed on the London Stock Exchange and the

Euronext Dublin, Kenmare operates the Moma Titanium Minerals Mine

in Mozambique. Moma's production accounts for approximately 5% of

global titanium feedstocks and the Company supplies to customers

operating in more than 15 countries. Kenmare produces raw materials

that are ultimately consumed in everyday "quality-of life" items

such as paints, plastics and ceramic tiles.

Forward Looking Statements

This announcement contains some forward-looking statements that

represent Kenmare's expectations for its business, based on current

expectations about future events, which by their nature involve

risks and uncertainties. Kenmare believes that its expectations and

assumptions with respect to these forward-looking statements are

reasonable. However, because they involve risk and uncertainty,

which are in some cases beyond Kenmare's control, actual results or

performance may differ materially from those expressed or implied

by such forward-looking information.

(END) Dow Jones Newswires

July 14, 2021 02:00 ET (06:00 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

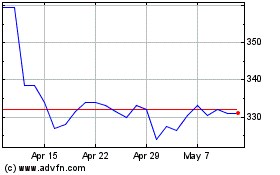

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

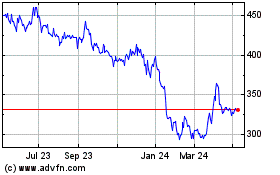

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Apr 2023 to Apr 2024