TIDMKMR

Standard Form TR-1

Standard form for notification of major holdings

NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer and

to the Central Bank of Ireland)(i)

--------------------------------------------------------------------------------------------------------

1. Identity of the issuer or the underlying issuer of

existing shares to which voting rights are

attachedii:

Kenmare Resources plc

--------------------------------------------------------------------------------------------------------

2. Reason for the notification (please tick the appropriate box or boxes):

[x ] An acquisition or disposal of voting rights

[ ] An acquisition or disposal of financial instruments

[ ] An event changing the breakdown of voting rights

[ ] Other (please specify)(iii) :

--------------------------------------------------------------------------------------------------------

3. Details of person subject to the notification obligation(iv) :

Name: City and country of registered office (if applicable):

PREMIER MITON GROUP PLC LONDON, ENGLAND

------------------------- -----------------------------------------------------------------------------

4. Full name of shareholder(s) (if different from 3.)(v) :

--------------------------------------------------------------------------------------------------------

5. Date on which the threshold was crossed or reached(vi) :

03/09/2021

--------------------------------------------------------------------------------------------------------

6. Date on which issuer notified:

06/09/2021

--------------------------------------------------------------------------------------------------------

7. Threshold(s) that is/are crossed or reached:

7%

--------------------------------------------------------------------------------------------------------

8. Total positions of person(s) subject to the notification obligation:

--------------------------------------------------------------------------------------------------------

% of voting rights

through financial

% of voting rights instruments Total number

attached to shares (total of 9.B.1 Total of both of voting rights

(total of 9.A) + 9.B.2) in % (9.A + 9.B) of issuer(vii)

------------------------- ------------------- ------------------ ----------------- -----------------

Resulting situation

on the date on

which threshold

was crossed or

reached 6.99% 6.99% 109,736,382

------------------------- ------------------- ------------------ ----------------- -----------------

Position of previous

notification (if

applicable) 7.49% 7.49%

------------------------- ------------------- ------------------ ----------------- -----------------

9. Notified details of the resulting situation on the date on which the

threshold was crossed or reached(viii) :

--------------------------------------------------------------------------------------------------------------------------------------------

A: Voting rights attached to shares

--------------------------------------------------------------------------------------------------------------------------------------------

Class/type of

shares

ISIN code (if

possible) Number of voting rights(ix) % of voting rights

------------------

Direct Indirect Direct Indirect

------------------ ---------- ---------------------- ----------------------------------- -----------------------------------------------

IE00BDC5DG00 7,672,068 6.99%

------------------ ---------- ---------------------- ----------------------------------- -----------------------------------------------

SUBTOTAL A 7,672,068 6.99%

------------------ ---------- ---------------------- ----------------------------------- -----------------------------------------------

B 1: Financial Instruments according to Regulation 17(1)(a) of the Regulations

--------------------------------------------------------------------------------------------------------------------------------------------

Type of financial Expiration Exercise/ Number of voting % of voting rights

instrument date(x) Conversion Period(xi) rights that may

be acquired if the

instrument is exercised/converted.

------------------ ---------- ---------------------- ----------------------------------- -----------------------------------------------

SUBTOTAL B.1

---------------------- ----------------------------------- -----------------------------------------------

B 2: Financial Instruments with similar economic effect according to Regulation

17(1)(b) of the Regulations

--------------------------------------------------------------------------------------------------------------------------------------------

Type of financial Expiration Exercise/ Physical or cash Number of % of voting rights

instrument date(x) Conversion settlement(xii) voting rights

Period (x)

(i)

------------------ ---------- ---------------------- ----------------------------------- -------------- -------------------------------

SUBTOTAL B.2

----------------------------------- -------------- -------------------------------

10. Information in relation to the person subject to the notification

obligation (please tick the applicable box):

[ ] Person subject to the notification obligation is not controlled by

any natural person or legal entity and does not control any other undertaking(s)

holding directly or indirectly an interest in the (underlying) issuer.(xiii)

[x ] Full chain of controlled undertakings through which the voting rights

and/or the

financial instruments are effectively held starting with the ultimate

controlling natural person or legal entity(xiv) :

-----------------------------------------------------------------------------------------------------

% of voting rights

through financial

% of voting rights instruments if it Total of both if

if it equals or is equals or is higher it equals or is higher

higher than the notifiable than the notifiable than the notifiable

Name(xv) threshold threshold threshold

------------------------- --------------------------- -------------------- -----------------------

Premier Miton Group

Plc

------------------------- --------------------------- -------------------- -----------------------

Premier Asset Management

Midco Ltd

------------------------- --------------------------- -------------------- -----------------------

Premier Asset Management

Holdings Ltd

------------------------- --------------------------- -------------------- -----------------------

Premier Asset Management

Limited

------------------------- --------------------------- -------------------- -----------------------

Premier Investment

Group Ltd

------------------------- --------------------------- -------------------- -----------------------

Premier Fund Managers

Ltd 6.99% 6.99%

------------------------- --------------------------- -------------------- -----------------------

11. In case of proxy voting: [name of the proxy holder] will cease to

hold [% and number] voting rights as of [date]

-----------------------------------------------------------------------------------------------------

12. Additional information(xvi) :

In reference to section 9, the shares detailed are managed by Premier

Fund Managers Ltd within multiple portfolios on behalf of underlying clients,

based on investment management agreements whereby the client has delegated

the exercise of the voting power to the referenced investment manager.

-----------------------------------------------------------------------------------------------------

Done at PREMIER MITON GROUP PLC, GUILDFORD, UK on 06/09/2021

Annex: Notification of major holdings (only to be filed with the Central

Bank of Ireland and not with the relevant issuer)

------------------------------------------------------------------------------

A: Identity of the person subject to the notification obligation

------------------------------------------------------------------------------

Full name (including legal form for legal entities)

PREMIER MITON GROUP PLC

------------------------------------------------------------------------------

Contact address (registered office for legal entities)

EASTGATE COURT, HIGHSTREET, GUILDFORD, SURREY, GU1 3DE

------------------------------------------------------------------------------

E-Mail

gregor.craig@premiermiton.com

------------------------------------------------------------------------------

Phone number / Fax number

01483 400493

------------------------------------------------------------------------------

Other useful information (at least legal a contact person for legal persons)

------------------------------------------------------------------------------

B: Identity of the notifier, if applicable

------------------------------------------------------------------------------

Full name Gregor Craig

------------------------------------------------------------------------------

Contact address EASTGATE COURT, HIGHSTREET, GUILDFORD, SURREY, GU1 3DE

------------------------------------------------------------------------------

E-Mail gregor.craig@premiermiton.com

------------------------------------------------------------------------------

Phone number / Fax number 01483 400493

------------------------------------------------------------------------------

Other useful information (e.g. functional relationship with the person

or legal entity subject to the notification obligation)

------------------------------------------------------------------------------

C: Additional information:

------------------------------------------------------------------------------

The Central Bank of Ireland ("Central Bank") may process

personal data provided by you in order to fulfil its statutory

functions or to facilitate its business operations. Any personal

data will be processed in accordance with the requirements of data

protection legislation. Any queries concerning the processing of

personal data by the Central Bank may be directed to

https://www.globenewswire.com/Tracker?data=YVHvyJ5luy2CZqgxIW47HfxN4WA_y6XvkGLRRJDwKgWeNdyPv_GoRFzfaCKLkp2JCf5moAyWY_pN6NvjsOkD2J8aN9BkC0ZK_Yv0uJUxvpWU09h9mOm5fZ-6YtHf07zk

dataprotection@centralbank.ie. A copy of the Central Bank's Data

Protection Notice is available at

https://www.globenewswire.com/Tracker?data=XTz8rRPQqpkejXlWL6KgPkpyhBRN_WnbZ7deHHjnQphF6gXpURWwwzkPPg4hOYA6jDped3FgjstmpfJuwlLdXTvmECZSYnY_x8S0ckVH6CcFd4xAJCB4O_QerWnMaBrvUI61y_AefuboEYUhdvvNyA==

www.centralbank.ie/fns/privacy-statement.

Notes

(i) . Persons completing this form should have regard to the

requirements of the Transparency (Directive 2004/109/EC)

Regulations 2007 as amended (the "Regulations"), the Central Bank

of Ireland's Transparency Rules (the "Transparency Rules") and

Commission Delegated Regulation (EU) 2015/761 of 17 December

2014.

(ii) Full name of the legal entity and other identifying

specification of the issuer or underlying issuer, provided it is

reliable and accurate (e.g. address, LEI, domestic number

identity).

(iii) Other reason for the notification could be voluntary

notifications, changes of attribution of the nature of the holding

(e.g. expiring of financial instruments) or acting in concert.

(iv) This should be the full name of (a) the shareholder; (b)

the natural person or legal entity acquiring, disposing of or

exercising voting rights in the cases provided for in Regulation

15(b) to (h) of the Regulations (Article 10 (b) to (h) of Directive

2004/109/EC); or (c) the holder of financial instruments referred

to in Regulation 17(1) of the Regulations (Article 13(1) of

Directive 2004/109/EC).

As the disclosure of cases of acting in concert may vary due to

the specific circumstances (e.g. same or different total positions

of the parties, entering or exiting of acting in concert by a

single party) the standard form does not provide for a specific

method how to notify cases of acting in concert.

In relation to the transactions referred to in points (b) to (h)

of Regulation 15 of the Regulations (Article 10 of Directive

2004/109/EC), the following list is provided as an indication of

the persons who should be mentioned:

- in the circumstances foreseen in letter (b) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC), the natural person or legal entity that acquires the voting rights and is entitled to exercise them under the agreement and the natural person or legal entity who is transferring temporarily for consideration the voting rights;

- in the circumstances foreseen in letter (c) of the Regulation

15 of the Regulations (Article 10 of Directive 2004/109/EC), the

natural person or legal entity holding the collateral, provided the

person or entity controls the voting rights and declares its

intention of exercising them, and natural person or legal entity

lodging the collateral under these conditions;

- in the circumstances foreseen in letter (d) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC), the natural person or legal entity who has a life interest in shares if that person or entity is entitled to exercise the voting rights attached to the shares and the natural person or legal entity who is disposing of the voting rights when the life interest is created;

- in the circumstances foreseen in letter (e) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC), the controlling natural person or legal entity and, provided it has a notification duty at an individual level under Regulation 14 of the Regulations (Article 9 of Directive 2004/109/EC), under letters (a) to (d) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC) or under a combination of any of those situations, the controlled undertaking;

- in the circumstances foreseen in letter (f) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC), the deposit taker of the shares, if he can exercise the voting rights attached to the shares deposited with him at his discretion, and the depositor of the shares allowing the deposit taker to exercise the voting rights at his discretion;

- in the circumstances foreseen in letter (g) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC), the natural person or legal entity that controls the voting rights;

- in the circumstances foreseen in letter (h) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC), the proxy holder, if he can exercise the voting rights at his discretion, and the shareholder who has given his proxy to the proxy holder allowing the latter to exercise the voting rights at his discretion (e.g. management companies).

(v) Applicable in the cases provided for in Regulation 15(b) to

(h) of the Regulations (Article 10 (b) to (h) of Directive

2004/109/EC). This should be the full name of the shareholder who

is the counterparty to the natural person or legal entity referred

to in Regulation 15 of the Regulations (Article 10 Directive

2004/109/EC) unless the percentage of voting rights held by the

shareholder is lower than the lowest notifiable threshold for the

disclosure of voting rights holdings in accordance with the

requirements of the Regulations and the Transparency Rules.

(vi) The date on which threshold is crossed or reached should be

the date on which the acquisition or disposal took place or the

other reason triggered the notification obligation. For passive

crossings, the date when the corporate event took effect.

(vii) The total number of voting rights shall be composed of all

the shares, including depository receipts representing shares, to

which voting rights are attached even if the exercise thereof is

suspended.

(viii) If the holding has fallen below the lowest applicable

threshold in accordance with the Regulations and the Transparency

Rules the holder is not obliged to disclose the extent of the

holding only that the holding is "below 3%" or "below 5%" as

appropriate.

(ix) In case of combined holdings of shares with voting rights

attached "direct holding" and voting rights "indirect holding",

please split the voting rights number and percentage into the

direct and indirect columns -- if there is no combined holdings,

please leave the relevant box blank.

(x) Date of maturity/expiration of the financial instrument i.e.

the date when right to acquire shares ends.

(xi) If the financial instrument has such a period -- please

specify this period -- for example once every 3 months starting

from [date].

(xii) In case of cash settled instruments the number and

percentages of voting rights is to be presented on a delta-adjusted

basis (Regulation 17(4) of the Regulations/Article 13(1a) of

Directive 2004/109/EC).

(xiii) If the person subject to the notification obligation is

either controlled and/or does control another undertaking then the

second option applies.

(xiv) The full chain of controlled undertakings, starting with

the ultimate controlling natural person or legal entity, has to be

presented also in cases in which only on subsidiary level a

threshold is crossed or reached and the subsidiary undertaking

discloses the notification, as only thus will the markets get a

full picture of the group holdings. In the case of multiple chains

through which the voting rights and/or financial instruments are

effectively held, the chains have to be presented chain by chain

leaving a row free between different chains (e.g.: A, B, C, free

row, A, B, D, free row, A, E, F etc.).

(xv) The names of controlled undertakings through which the

voting rights and/or financial instruments are effectively held

have to be presented irrespective of whether the controlled

undertakings cross or reach the lowest applicable threshold

themselves.

(xvi) Example: Correction of a previous notification.

(END) Dow Jones Newswires

September 07, 2021 04:00 ET (08:00 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

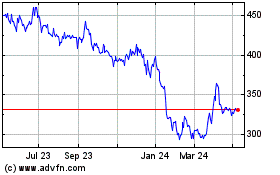

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

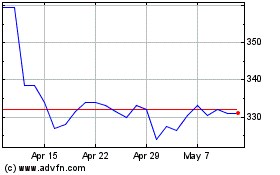

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Apr 2023 to Apr 2024