TIDMKMR

Kenmare Resources plc

("Kenmare" or "the Company" or "the Group")

14 October 2021

Q3 2021 Production Report

Kenmare Resources plc (LSE:KMR, ISE:KMR), one of the leading

global producers of titanium minerals and zircon, which operates

the Moma Titanium Minerals Mine (the "Mine" or "Moma") in northern

Mozambique, is pleased to provide a trading update for the quarter

ending 30 September 2021 ("Q3 2021").

Statement from Michael Carvill, Managing Director:

"Q3 2021 represents the first quarter of ilmenite production at

nameplate capacity of 1.2 million tonnes per annum, an 87% increase

on the production achieved in Q3 2020. Despite expected lower

grades in Q4, we remain confident in the outlook for 2021 annual

production and re-iterate our guidance of 1.1-1.2 million tonnes of

ilmenite.

Whilst we continue to remain vigilant against the threats posed

by COVID-19, I am pleased to report that over 90% of our employees

have now received two doses of vaccine. I'm also delighted to

report that this quarter's record production was achieved with no

Lost Time Injuries (LTIs) and, in the past few days, we've achieved

a new company record of 5 million man hours worked without an

LTI.

Market conditions for all products remained strong in Q3 2021

with pricing strengthening quarter on quarter, a robust order book

in place and positive outlook across markets."

Q3 2021 overview

-- Improved Lost time injury frequency rate ("LTIFR") of 0.08 per 200,000

hours worked to 30 September 2021 (30 September 2020: 0.29), zero lost

time injuries recorded during the quarter

-- More than 90% of Mine employees have now received two doses of COVID-19

vaccine

-- Heavy Mineral Concentrate ("HMC") production of 413,400 tonnes in Q3

2021, a 60% increase compared to Q3 2020, in line with expectations

-- Ilmenite production of 314,400 tonnes in Q3 2021, an 87% increase

compared to Q3 2020, the first full quarter's production at nameplate

capacity of 1.2 million tonnes per annum of ilmenite, setting a new

record

-- Primary zircon production of 15,700 tonnes, representing a 44% increase

compared to Q3 2020, benefitting from increased HMC production

-- Total shipments of finished products of 322,600 tonnes, a 173% increase

compared to Q3 2020

-- Guidance for 2021 reiterated at 1.1-1.2 million tonnes of ilmenite, plus

associated by-prodcuts

-- Demand for Kenmare's products remained robust in Q3 2021, supporting

strong sales volumes and further price increases

Operations update

Operational results for the Moma Mine in Q3 2021 were as

follows:

Q3 2021 Q3 2020 Q2 2021

----------------- ---------- --------- ---------- ---------- ----------

tonnes tonnes % variance tonnes % variance

----------------- ---------- --------- ---------- ---------- ----------

Excavated ore(1) 10,084,000 8,333,000 21% 10,938,000 -8%

----------------- ---------- --------- ---------- ---------- ----------

Grade(1) 4.83% 3.58% 35% 4.70% 3%

----------------- ---------- --------- ---------- ---------- ----------

Production

----------------- ---------- --------- ---------- ---------- ----------

HMC production 413,400 258,000 60% 436,600 -5%

----------------- ---------- --------- ---------- ---------- ----------

HMC consumption 426,800 260,400 64% 423,200 1%

----------------- ---------- --------- ---------- ---------- ----------

Ilmenite 314,400 167,900 87% 283,900 11%

----------------- ---------- --------- ---------- ---------- ----------

Primary zircon 15,700 10,900 44% 14,900 5%

----------------- ---------- --------- ---------- ---------- ----------

Rutile 2,700 1,600 69% 2,200 23%

----------------- ---------- --------- ---------- ---------- ----------

Concentrates(2) 11,900 9,000 32% 11,800 1%

----------------- ---------- --------- ---------- ---------- ----------

Shipments 322,600 118,000 173% 249,600 29%

----------------- ---------- --------- ---------- ---------- ----------

1. Excavated ore and grade prior to any floor losses.

2. Concentrates include secondary zircon and mineral sands concentrate.

Kenmare's rolling 12 month lost time injury frequency rate

(LTIFR) for the 12 months to 30 September 2021 was 0.08 per 200,000

man-hours worked (30 September 2020: 0.29), with no LTIs recorded

in Q3 2021. 4.9 million LTI free hours worked completed by the end

of Q3 2021.

HMC production was 413,400 tonnes in Q3 2021, a 60% increase

compared to Q3 2020 (258,000 tonnes) due primarily to a combination

of higher tonnes of ore excavated due to a full period of WCP B

mining in this period and higher grades. Ore grades in Q3 2021 were

4.83%, up 35% on Q3 2020 (3.58%) as a result of WCP B mining in the

Pilivili zone. As previously announced, grades are expected to fall

to 3.8% in Q4 2021, before normalising at around 4.1% for 2022.

Production of all finished products increased substantially in

Q3 2021 compared to Q3 2020. This was due to a 64% increase in HMC

consumption, benefitting from higher HMC availability. Ilmenite

production was 314,400 tonnes, representing an 87% increase

compared to Q3 2020 (167,900 tonnes), higher than the increase in

HMC consumption, benefitting from increased ilmenite content in the

HMC and improved recoveries relative to Q3 2020.

Primary zircon production was 15,700 tonnes, representing a 44%

increase compared to Q3 2020 (10,900 tonnes), lower than the

increased HMC consumption, due to lower zircon contained in the HMC

(particularly at WCP B) and a temporary increase in intermediate

stockpiles. Rutile production was 2,700 tonnes, a 69% increase (Q3

2020: 1,600 tonnes) as the recovery improvement programme delivered

positive results. Concentrates production was 11,900 tonnes, a 32%

increase compared to Q3 2020 (9,000 tonnes), reflecting a temporary

increase in secondary zircon intermediate stock.

Kenmare shipped 322,600 tonnes of finished products during the

quarter, which represents a 173% increase compared to Q3 2020

(118,000 tonnes), as steady shipments were made through the period.

This comprised 283,400 tonnes of ilmenite, 18,800 tonnes of primary

zircon, 3,600 tonnes of rutile and 16,800 tonnes of

concentrates.

Closing stock of HMC at the end of Q3 2021 was 21,000 tonnes,

compared with 34,300 tonnes at the end of Q2 2021. Closing stock of

finished products at the end of Q3 2021 was 186,300 tonnes,

compared to 164,100 tonnes at the end of Q2 2021.

Capital projects update

The ramp up of the HMC pumping system from Pilivili has

continued to progress. Less road haulage was required in the

quarter and is now being wound down. The overall forecast capital

cost for the WCP B project remains in line with prior guidance of

US$127 million.

The Rotary Uninteruptible Power Supply (RUPS) project has moved

into the execution phase with civil engineering and building

construction underway. Fabrication of the RUPS units is complete

and transportation to site is underway. The project is expected to

be completed in Q1 2022.

Work on the Nataka Prefeasibility Study (PFS) continues.

Detailed orebody investigations are progressing well with a view to

optimally mining with WCP A at Nataka from 2025. It is expected

that the PFS will be finalised in 2022.

Market update

Demand for Kenmare's products remained robust in Q3 2021,

supporting strong sales volumes and further price increases.

The recovery in the downstream titanium markets continued,

supporting high utilisations at pigment plants globally and strong

demand from titanium metal producers. In 2021, despite an increase

in the supply of ilmenite from mines in China and concentrate

products from Mozambique, the market has continued to be tight.

Positive momentum continued in Q3 2021, as demand for ilmenite

product to upgrade into high-grade feedstocks continued to grow

strongly in China.

The outlook for Q4 2021 remains positive, with a strong order

book in place. The Company continues to monitor the impact of power

disruption to downstream industries in China, and the potential

effect on demand related to the uncertainty in the Chinese real

estate market. However, demand remains strong from our customers in

China, and elsewhere, into Q4 and global feedstock inventories

remain at low levels.

Demand for zircon improved in Q3 2021, as major economies

continued the recovery from COVID-19 restrictions being lifted.

Demand from the ceramics and foundry industries has recovered

particularly quickly. In China, Kenmare's zircon concentrate

benefited from a tight spot market. Coupled with supply

disruptions, the strong demand has resulted in an undersupplied

market and prices for zircon are expected to increase again in Q4

following increases in Q2 and Q3.

For further information, please contact:

Kenmare Resources plc

Jeremy Dibb

Investor Relations

ir@kenmareresources.com

https://www.globenewswire.com/Tracker?data=lmt0uaGz8H77a6qS6d9dds42fwMqK4sPvQ6c9cUeeusckHvO2SG0KP9uEQzM2DqBI5bGt27XYY4TEwR-c8Q6-s9ozFvUqj2VQLhOKo96TGM=

Tel: +353 1 671 0411

Mob: + 353 87 943 0367 / + 353 87 663 0875

Murray (PR advisor)

Joe Heron

Tel: +353 1 498 0300

Mob: +353 87 690 9735

About Kenmare Resources

Kenmare Resources plc is one of the world's largest producers of

mineral sands products. Listed on the London Stock Exchange and the

Euronext Dublin, Kenmare operates the Moma Titanium Minerals Mine

in Mozambique. Moma's production accounts for approximately 5% of

global titanium feedstocks and the Company supplies to customers

operating in more than 15 countries. Kenmare produces raw materials

that are ultimately consumed in everyday "quality-of life" items

such as paints, plastics and ceramic tiles.

Forward Looking Statements

This announcement contains some forward-looking statements that

represent Kenmare's expectations for its business, based on current

expectations about future events, which by their nature involve

risks and uncertainties. Kenmare believes that its expectations and

assumptions with respect to these forward-looking statements are

reasonable. However, because they involve risk and uncertainty,

which are in some cases beyond Kenmare's control, actual results or

performance may differ materially from those expressed or implied

by such forward-looking information.

(END) Dow Jones Newswires

October 14, 2021 02:00 ET (06:00 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

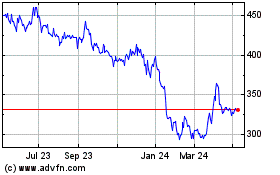

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

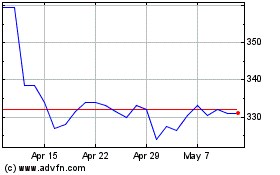

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Apr 2023 to Apr 2024