TIDMKRPZ

RNS Number : 4272Q

Kropz PLC

26 February 2021

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014 which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

26 February 2021

Kropz Plc

("Kropz" or the "Company")

New Convertible Facility Agreement

Kropz Plc (AIM: KRPZ), an emerging African phosphate explorer

and developer, announces it has entered into a new conditional

convertible equity facility of up to US$ 5 million ("New Equity

Facility"), with ARC Fund ("ARC"), the Company's major shareholder,

in order to fund the ongoing work at the Company's Hinda phosphate

project ("Hinda"), located in the Republic of the Congo

("RoC").

The US$ 5 million facility is in addition to the US$ 40 million

facility which ARC and the Company entered into in May 2020

("Existing Equity Facility").

New Equity Facility Highlights

-- The New Equity Facility commitment of up to US$ 5 million

provided by ARC, which can be drawn down at the discretion of

Kropz;

-- This further financing is within the authorisation limits

given at the last AGM in August 2020 and has received the relevant

consent from the South African Reserve Bank ("SARB");

-- Repayment of the New Equity Facility and any interest thereon

will be in the form of conversion into ordinary shares in the

Company and issued to ARC, at a conversion price of 4.202 pence per

Ordinary Share ("Equity Facility Shares") each quarter, and any US$

amount will be converted to GBP at an agreed rate of US$ 1=GBP

0.73; and,

-- First draw-down expected on 10 March 2021 for US$ 2 million

with conversion into Equity Facility Shares expected to take place

immediately, and every quarter thereafter.

Further details on the New Equity Facility

ARC has committed to providing the unconditional Equity Facility

of up to US$ 5 million (conversion rate is subject to a fixed rate

of US$ 1= 0.73 GBP) to the Company. The Equity Facility will be

drawn down on a quarterly basis at the discretion of Kropz (this

transaction is within the authorisation limits given at the last

AGM in August 2020). The first quarterly drawn down is expected to

take place on 10 March 2020 and quarterly thereafter.

The Equity Facility is convertible following a drawdown into

newly issued ordinary shares of 0.1 pence each ("Ordinary Shares")

in the capital of the Company ("Equity Shares") at a fixed price of

4.202 pence per Ordinary Share (the "Conversion Price") and a fixed

exchange rate of US$ 1= GBP 0.73 at each quarterly draw-down.

Following a conversion, the Company will apply for the Equity

Shares to be admitted to trading on AIM.

The Equity Facility will bear interest at the aggregate of 6.5

per cent. and one-month LIBOR ("Interest") in the event that a

conversion does not occur. In certain events of default by the

Company or the Company not having sufficient share authorities in

place to permit the issue of Ordinary Shares on a conversion, ARC

may elect to accelerate repayment of any sums drawn under the New

Equity Facility together with accrued interest and a further

default rate of interest of 4 per cent., such that such sums are

immediately due and payable. It is the Company's intention to have

drawdown and conversion occur together on the quarterly schedule

thereafter.

Hinda

As the Company announced on 4 February 2021, Kropz appointed

Hatch Africa (Pty) Ltd ("Hatch"), a leading global engineering and

construction firm, to complete the updated feasibility study

("Updated FS") on Hinda. The Updated FS will target a phased

approach in line with the terms of the mining investment agreement,

with initial production of one million tonnes per annum ("Mtpa") of

phosphate rock being exported from the existing port facility at

Pointe-Noire, which is 50 km from Hinda. A second phase production

ramp-up of two Mtpa will also be evaluated with export from a new

port site, located north of Pointe-Noire.

Related Party Transaction

The New Equity Facility is a related party transaction

("Transaction") pursuant to Rule 13 of the AIM Rules. Machiel

Reyneke is a director of the Company and the representative of ARC.

Further, as noted below, ARC and Kropz International are treated as

acting in concert for the purposes of the City Code on Takeovers

and Mergers (the "Code") and have individual and aggregate

interests in the Ordinary Shares as set out above. Mike Nunn, a

director of the Company, is the beneficial owner of Kropz

International. Accordingly, Mr Reyneke and Mr Nunn have not been

involved in the approval of the Transaction by the Company's

board.

The directors of the Company who are considered independent for

the purposes of the Transaction (being the directors excluding Mr

Reyneke and Mr Nunn), having consulted with the Company's nominated

adviser, consider the terms of the Transaction to be fair and

reasonable insofar as the Company's shareholders are concerned.

Draw Down

As noted above, the Company will be making the first draw down

request under the New Equity Facility on or around 10 March 2021.

Further details of this draw down, as well as the fourth quarterly

draw down request under the Existing Equity Facility, will be made

in a separate announcement in due course.

The subsequent draw downs under the Existing and New Equity

Facilities are expected to be made on or about 10 June 2021 and

quarterly thereafter, in line with the terms of the Equity

Facilities.

Concert Parties and Impact on Shareholdings

As noted in the Company's AIM admission document, ARC and Kropz

International are treated as acting in concert for the purposes of

the Code and have individual and aggregate interests in the

Ordinary Shares as set out in the table below. It is noted that,

both before and after the closing of the Existing and the New

Equity Facilities, on an aggregate basis, ARC and Kropz

International hold and will continue to hold more than 50 per cent.

of the Ordinary Shares and voting rights in the Company. On a

standalone basis ARC, through its option with Kropz International,

currently has a fully diluted interest of 86.5 per cent. of the

Company (see footnote 3 below).]

Maximum Interests in Ordinary Shares (1)

Maximum no.

of further

shares to be

issued pursuant Maximum shareholdings

to Original following Original

Existing and New Equity and New Equity

ordinary Facilities Facilities

shares (1) (1)

No. % No. No. %

--------------------- ------------ ---- ----------------- ---------------------- ----

ARC (2) 409,948,665 73.4 354,418,954 764,367,619 83.7

Kropz International

S.a.r.l (2)(3) 54,933,474 9.8 0 54,933,474 6.0

Concert Party 464,882,139 83.2 354,418,954 819,301,093 89.7

(1) Assumes for illustrative purposes that the Existing and New

Equity Facility is fully drawn.

(2) ARC and Kropz International are deemed to be acting in

concert as defined in the Code.

(3) Kropz International and ARC have entered into an arrangement

pursuant to which Kropz International has granted to ARC a call

option over 50 per cent. of its shareholding. The call option over

Kropz International's Ordinary Shares can be exercised by ARC if

the value of ARC's shareholding on the third anniversary of

Admission is 20 per cent. lower than its value on IPO on 30

November 2018. The call option has an alternative settlement of

cash or assets, if the transfer of the Ordinary Shares would

require the transferee to make a Rule 9 offer for the Company

pursuant to the City Code.

(4) Mike Nunn, a director of Kropz, holds his beneficial

interest in Kropz through Kropz International.

(5) Exchange rates used are fixed at US$ 1= GBP 0.73 for the New

Equity Facility and US$ 1= GBP 0.86 for the Existing Equity

Facility.

For further information visit www.kropz.com or contact:

Kropz Plc

Mark Summers (CEO) +27 (0)79 744 8708

Grant Thornton UK LLP Nominated Adviser

Samantha Harrison

Harrison Clarke

George Grainger +44 (0) 20 7383 5100

Hannam & Partners Broker

Andrew Chubb

Ernest Bell +44 (0)20 7907 8500

Tavistock Financial PR & IR (UK)

Emily Moss +44 (0) 207 920 3150

Jos Simson kropz@tavistock.co.uk

Oliver Lamb

R&A Strategic Communications PR (South Africa)

James Duncan +27 (0)11 880 3924

james@rasc.co.za

About Kropz Plc

Kropz is an emerging African phosphate explorer and developer,

with an advanced stage phosphate mining project in South Africa and

a phosphate project in the Republic of Congo. The vision of the

Group is to become a leading independent phosphate rock producer

and to develop into an integrated, mine-to-market plant nutrient

company focusing on sub-Saharan Africa.

-S-

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSEDFUIEFSELE

(END) Dow Jones Newswires

February 26, 2021 02:00 ET (07:00 GMT)

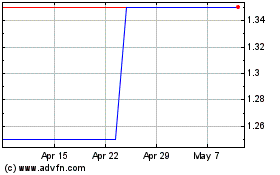

Kropz (LSE:KRPZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

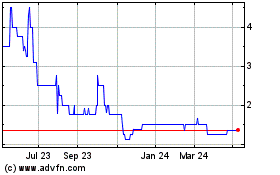

Kropz (LSE:KRPZ)

Historical Stock Chart

From Apr 2023 to Apr 2024