TIDMKRS

RNS Number : 8509B

Keras Resources PLC

13 October 2020

Keras Resources plc / Index: AIM / Epic: KRS / Sector:

Mining

13 October 2020

Keras Resources plc ('Keras' or the 'Company')

Project & Corporate Update

Keras Resources plc, the AIM listed mineral resource company, is

pleased to announce an update on progress at the Diamond Creek

high-grade direct shipping ore ('DSO'), organic phosphate mine in

Utah, USA ('Diamond Creek') and the Nayéga Manganese mine in Togo,

West Africa ('Nayéga').

OVERVIEW

Diamond Creek

-- Completed 2020 mining campaign - 7,620 run-of-mine ('ROM')

tons extracted including the bulk sample; this is over 50% more

than initially planned for the first year of production

-- Sold 1,012 tons of product at an average price of US$260 per ton

-- Focused on bringing new owner-operated plant into production

with the capacity to process the five-year 48,000-ton production

target

o Fabrication of the plant is on time and expected to be shipped

from Shanghai, China in November 2020

o Agreed new plant location to increase logistics flexibility

and provide better access to the US west-coast - plant

commissioning expected Q1 2021

Nay é ga

-- Successful management trip to Togo in September 2020 with

another planned in early November 2020 - positive meetings with

high level government officials and various service providers

-- Underpinned Nayéga's production-ready status following site

visit to dry-test 6,500 tonne per month bulk sample processing

plant and associated water reticulation system

-- Completed 25 of the planned 50 pits of the Ogaro pitting

programme; on track to complete pitting phase by the end of October

2020 with channel samples to be submitted thereafter to determine

grade and particle size distribution per geological horizon

Corporate

-- Increased interest in Falcon Isle Holdings LLC ('Falcon

Isle'), the 100% owner of the Diamond Creek, to 40% having loaned

Tranches 2a and 2b totalling USD1,200,000 to Falcon Isle

Keras Resources CEO, Russell Lamming said: "We are very

encouraged to have completed the 2020 mining campaign at Diamond

Creek, extracting a total of 7,620 tons, which is over 50% more

than initially planned for the first year of production.

Furthermore, we have also achieved 20% of our Year 1 sales forecast

in only two months, having sold a total of 1,012 tons at an average

price of US$260/t in August and September, highlighting the

significant demand for our high quality product.

"Our attention now turns to bringing our owner operated plant

into production so that we can increase both our processing

flexibility and our product range and subsequently widen our

marketing universe.

Excitingly, we secured a new site 150kms south-west of Spanish

Fork, which facilitates increased flexibility and better access to

the US west coast without increasing our logistics cost from the

mine to the new processing facility. Although this has pushed the

commissioning into early 2021, the long-term benefits far outweigh

this slight delay.

"With regards to Nayéga, Graham Stacey and I spent three weeks

in September meeting key government officials, government advisors

and various contractors and service providers to ensure that as we

progress towards the conclusion of the project permitting process

we are production ready. The Nayéga site visit undertaken during

the trip, where both the processing plant and ancillary services

were successfully dry-tested, is testament to the quality and drive

of our in-country team, which has achieved this despite the severe

restrictions necessitated by the COVID-19 pandemic.

"Our recent trip to Togo was extremely valuable from both an

operational and corporate perspective and we look forward to

advancing the appropriate discussions with the new Togolese

Government following the recent appointment of Victoire Tomegah

Dogbé as the new Prime Minister and Mila Aziable as the new

Minister of Energy and Mines. We look forward to updating

shareholders on both our Diamond Creek Mine and Nayéga Manganese

Project in due course."

FURTHER INFORMATION

Diamond Creek Phosphate Project

Diamond Creek is a fully permitted, high grade DSO, low capex

organic phosphate mine. The mine achieved first commercial

production in late July 2020 and the first beneficiated -10 mesh

organic product, part of a 770-ton order, was dispatched in early

September.

The 2020 mining campaign has now been completed with a total of

7,620 ROM tons now extracted from the Diamond Creek mine. As of 09

October, 2,487 tons of ROM have been toll-processed with total

sales to date of 1,012 tons averaging $260/t. This represents 20%

of the forecast sales for Year 1, which the Board believe to be

highly encouraging based on the first two months of production.

As previously reported, the Company decided to increase Year 1

of the phased ROM production by 50% from 5,000 tons to 7,500 tons

to ensure sufficient material over the winter while maintaining the

Year 5 target of 48,000 tons of commercial production. The increase

in planned production does not change the terms of the agreement

announced on 30 July 2020.

Current beneficiation is being undertaken through a

toll-treating agreement at a plant located in Fillmore, Utah,

approximately 150kms south west of Spanish Fork. A new plant, to be

owned and operated by Falcon Isle, which has the capacity to

process the five-year 48,000-ton production target, is anticipated

to be shipped from Shanghai in November 2020. This is expected to

be commissioned in Q1 2021 and will increase both the available

capacity and flexibility to produce different sized beneficiated

material.

Nayéga Manganese Project

The Company continues to make progress at the Nayéga manganese

project in northern Togo, West Africa. During September 2020,

management had a successful trip to Togo where they met high level

government officials and various service providers; another trip is

planned in early November 2020. Additionally, they visited the

Nayéga site to dry-test the 6,500 tonne per month bulk sample

processing plant and associated water reticulation system, which

underpinned the project's production-ready status.

Additionally, the Company recommenced activities on 7 September

2020 at Nayéga, focussing on exploration at the Ogaro prospect,

which is located 5km east-southeast of the main Nayéga deposit and

4km south of the previously explored T27 deposit. 25 of the planned

50 pits are complete with the remaining 25 pits on track to be

completed by the end of October 2020; channel samples will be

submitted thereafter to Intertek Laboratory in Accra, Ghana, to

determine grade and particle size distribution per geological

horizon. Previous test-pitting in the area to test the core area of

mineralisation have returned positive results, with best intercepts

including 1.76m @ 18.6% Mn from 0m, 2.05m @ 15.8% Mn from 0m and

2.00m @ 16.2% Mn from 0m.

Corporate

Further to the announcement dated 30 July 2020, the Company has

loaned Tranches 2a and 2b totalling USD1,200,000 to Falcon Isle

Holdings LLC ('Falcon Isle'), the 100% owner of Diamond Creek,

increasing the Company's current interest in Falcon Isle to

40%.

**ENDS**

For further information please visit www.kerasplc.com , follow

us on Twitter @kerasplc or contact the following:

Russell Lamming Keras Resources plc info@kerasplc.com

Nominated Adviser &

Joint Broker

Ewan Leggat / Charlie SP Angel Corporate

Bouverat Finance LLP

Joint Broker Shard Capital Partners +44 (0) 20 3470 0470

Damon Heath / Erik Woolgar LLP +44 (0) 20 7186 9900

Financial PR

Susie Geliher / Cosima St Brides Partners

Akerman Ltd +44 (0) 20 7236 1177

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDVLLFFBBLFFBE

(END) Dow Jones Newswires

October 13, 2020 02:00 ET (06:00 GMT)

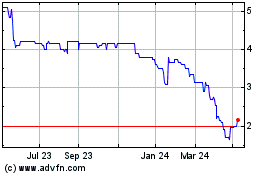

Keras Resources (LSE:KRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

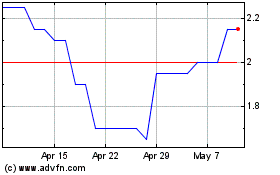

Keras Resources (LSE:KRS)

Historical Stock Chart

From Apr 2023 to Apr 2024