TIDMLBE

RNS Number : 1121T

Longboat Energy PLC

23 March 2021

Longboat Energy PLC

("Longboat Energy", the "Company" or "Longboat")

Audited Full Year Results to 31 December 2020

London, 23 March 2021 - Longboat Energy, established by the

former management team of Faroe Petroleum plc to build a

significant North Sea-focused E&P business, announces its

full-year results for the period ended 31 December 2020.

Highlights

Financial Summary

-- Cash reserves of GBP7.0 million as at 31 December 2020, no

debt and a tax receivable of GBP0.7 million (31 Dec 2019: GBP9.2

million) which allows the Company ample headroom to continue to

pursue its business development activities.

-- GBP0.7 million receivable resulting from a tax rebate for 78%

of our Norwegian E&P spend, of which the first instalment of

one third has been paid since the year end.

-- Low fixed running costs of GBP125k per month with additional variable due diligence costs.

Business Summary

-- In 2020 we experienced unprecedented changes to all aspects

of society and the global economy, with the energy sector

particularly hard hit by an unprecedented fall in demand. This

resulted in the global upstream M&A deal count reaching a

20-year low.

-- Recently introduced Norwegian tax changes have lowered

breakeven oil prices and increased Internal Rate of Return (IRR)

for non-sanctioned projects, which will accelerate new project

developments and drilling plans. The impact of these changes allows

Longboat to now consider modest exposure to Norwegian development

assets in combination with a production acquisition.

Outlook

-- Longboat is currently participating in a number of potential

acquisition processes where we have unique knowledge and can take

advantage of the continuing market dislocation.

-- The Company's core strategy remains unchanged and there are

exciting opportunities ahead as the backlog of transactions begins

to unwind.

-- This year has seen oil prices stabilizing at a much higher

level and with vaccination programmes being rolled out the

transaction market is already looking more positive.

-- Several processes have been launched recently and we expect

more assets to come to market as vendors seek to take advantage of

the uptick in commodity prices.

-- Exploration drilling results in Norway have remained very

strong and we have included the acquisition of exploration assets

as an integral part of our investment strategy

-- Longboat is well positioned to pursue the expected

forthcoming transactional opportunities, guided by a management

team with a strong track record of delivering value through

M&A.

Helge Hammer, Chief Executive Officer of Longboat Energy

commented:

"Longboat remains well-placed to transact. We have an

experienced team with excellent relationships across the industry

and we have the ability to absorb personnel as part of a

transaction, if required. With a backlog of deals under way where

sellers are under increasing pressure to exit assets, we believe

there will be many value accretive opportunities for Longboat. We

are also encouraged by good progress with the processes currently

underway, a number of which we are participating in."

This announcement does not contain

inside information

Enquiries:

Longboat Energy via FTI

Helge Hammer, Chief Executive Officer

Jon Cooper, Chief Financial Officer

Stifel (Nomad) Tel: +44 20 7710 7600

Callum Stewart

Jason Grossman

Simon Mensley

Ashton Clanfield

FTI Consulting (PR adviser) Tel: +44 20 3727 1000

Ben Brewerton

Sara Powell

Ntobeko Chidavaenzi longboatenergy@fticonsulting.com

Results

For the period to 31 December 2020, the Group's loss after

taxation was GBP1,626,179

Dividends

It is the Board's policy that the Company should seek to

generate capital growth for its shareholders but may recommend

distributions at some future date when the investment portfolio

matures, and production revenues are established and when it

becomes commercially prudent to do so

Statement of going concern

The financial statements of Longboat Energy plc have been

prepared on a going concern basis. In accordance with the AIM Rules

for Companies, if the Company has not made an acquisition or has

not substantially implemented its Investment Policy within 18

months of admission to the AIM market, which will occur on 28th May

2021, the Company is required to seek shareholder approval for its

Investment Policy at the next Annual General Meeting of the Company

and at each subsequent Annual General Meeting until such time as

there has been an acquisition or the Investment Policy has been

substantially implemented (such a resolution being referred to

hereafter as a 'Continuation Vote'). The reliance on future

shareholder approval constitutes a material uncertainty that may

cast significant doubt on the Company's ability to continue as a

going concern. The financial statements do not include any

adjustments that would result from the basis of preparation being

inappropriate.

Outlook

The initial focus of the Directors is to identify, secure and

finance a first acquisition that will deliver asset(s) that are

able to meet the Company's investment criteria (including near term

cashflow) as well as provide an appropriate basis to build on the

Company's investment objectives. In parallel, the Board will

continue to focus on seeking additional opportunities for

generating shareholder returns in the medium and long-term beyond

the first acquisition.

Consolidated Statement of profit or loss

for the Period to 31 December 2020

Year Period

ended ended

31 December 31 December

2020 2019

audited unaudited

Notes GBP GBP

GROUP

Revenue - -

Administrative expenses (2,399,204) (198,051)

Operating loss 6 (2,399,204) (198,051)

Finance income 5 18,736 1,750

Loss before taxation (2,380,468) (196,301)

Income tax credit 8 754,289 -

Loss after tax (1,626,179) (196,301)

Other comprehensive income

Currency translation differences 524 25

Loss and total comprehensive

income for the period (1,625,655) (196,276)

Loss per share 9

Basic (16.26) (9.52)

Diluted (16.26) (9.52)

The income statement has been prepared on the basis that all operations

are continuing operations.

Statement of financial position

As at 31 December 2020

2020 2019

GBP GBP

GROUP Notes audited unaudited

Non-current assets

Property, plant and equipment 10 11,798 2,245

Current assets

Trade and other receivables 11 75,807 83,104

Current tax recoverable 18 777,823 -

Cash and cash equivalents 7,021,105 9,204,257

7,874,735 9,287,361

Total assets 7,886,533 9,289,606

Current liabilities

Trade and other payables 16 351,610 227,222

351,610 227,222

Net current assets 7,534,923 9,060,139

Non-current liabilities

Deferred tax liabilities 17 431 -

Total liabilities 352,041 227,222

Net assets 7,534,492 9,062,384

Equity

Called up share capital 12 1,000,000 1,000,000

Share premium account 13 7,808,660 7,808,660

Other reserves 450,000 450,000

Share based payment reserve 14 97,763 -

Currency translation reserve 15 549 25

Retained earnings (1,822,480) (196,301)

Total equity 7,534,492 9,062,384

The financial statements were approved by the board of directors

and authorized for issue on 22 March 2021 and are signed on its

behalf by:

Helge Hammer (Chief Executive Officer) Director

22 March 2021

Statement of changes in equity

for the Period 31 December 2020

Share Share Share based Currency Other Retained Total

capital premium payment translation reserves earnings

account reserve reserve

Notes GBP GBP GBP GBP GBP GBP GBP

GROUP

Balance at 28 May 2019 - - - - - - -

Period ended 31 December 2019:

Loss and total comprehensive expense for

the period - - - 25 - (196,301) (196,276)

Issue of share capital 230,000 270,000 - - - - 500,000

Share buy-back and cancellation of share

premium (180,000) (270,000) - - 450,000 - -

Initial Public Offering 950,000 8,550,000 - - - - 9,500,000

Costs of share issue - (741,340) - - - - (741,340)

Balances at 31 December 2019 1,000,000 7,808,660 - 25 450,000 (196,301) 9,062,384

Period ended 31 December 2020:

Loss and total comprehensive expense for

the period - - - 524 - (1,626,179) (1,625,655)

Credit to equity for equity settled share-based

payments - - 97,763 - - - 97,763

Balances at 31 December 2020 1,000,000 7,808,660 97,763 549 450,000 (1,822,480) 7,535,016

Consolidated statement of cash flows

for the Period to 31 December 2020

2020 2019

Notes GBP GBP GBP GBP

GROUP

Cash flows from operating activities

Cash absorbed by operations 25 (2,164,648) (60,711)

Tax paid (23,533) -

Net cash outflow from operating

activities (2,188,181) (60,711)

Investing activities

Purchase of property, plant and

equipment (12,359) (2,245)

Interest received 18,736 1,750

Net cash generated from/(used

in) investing activities 6,377 (495)

Financing activities

Proceeds from issue of shares - 9,258,660

Net cash generated from financing

activities - 9,258,660

Net (decrease)/increase in cash

and cash equivalents (2,181,804) 9,197,454

Cash and cash equivalents at beginning

of year 9,197,479 -

Effect of foreign exchange

rates 524 25

Cash and cash equivalents

at end of year 7,016,199 9,197,479

Relating to:

Bank balances and short-term

deposits 7,021,105 9,204,257

Bank overdrafts (4,906) (6,778)

Notes to the financial statements

for the Period to 31 December 2020

1. Statutory information

Longboat Energy plc is a public limited company, limited by

shares, registered in England and Wales. The Company's registered

number is 12020297 and registered office address 5(th) Floor, One

New Change, London, England, EC4M 9AF

2. Accounting policies

Basis of preparation

The financial information set out herein does not constitute the

Company's statutory financial statements for the year ended 31

December 2020, but is derived from the Company's audited financial

statements. The auditors have reported on the 2020 financial

statements and their reports were unqualified and did not contain

statements under s498(2) or (3) Companies Act 2006 but did contain

a material uncertainty in relation to going concern.

The 2020 Annual Report was approved by the Board of Directors on

22(nd) March 2021. The financial information in this statement is

audited but does not have the status of statutory accounts within

the meaning of Section 434 of the Companies Act 2006.

In 2019 the Company did not prepare consolidated financial

statements as the subsidiary activity was immaterial and the

Company therefore took advantage of the exemption under the

Companies Act 2006 s405. Accordingly, BDO LLP's audit was in

respect of the Parent Company financial statements only. As such

the 2019 Group comparatives are unaudited.

The financial statements of Longboat Energy plc and the Company

have been prepared in accordance with International Financial

Reporting Standards (IFRS) in conformity with the requirements of

the Companies Act 2006.

The financial statements have been prepared on the historical

cost basis.

Going concern

The Directors, having made due and careful enquiry and preparing

forecasts, are of the opinion that the Company has adequate working

capital to continue in operation over the next 12 months. The

directors, therefore, have made an informed judgement, at the time

of approving the financial statements, that there is a reasonable

expectation that the Company has adequate resources to continue in

operational existence for the foreseeable future. As a result, the

directors have continued to adopt the going concern basis of

accounting in preparing the annual financial statements.

In accordance with the AIM Rules for Companies, if the Company

has not made an acquisition or has not substantially implemented

its Investment Policy within 18 months of admission to the AIM

market,

which will occur on 28(th) May 2021, the Company is required to

seek shareholder approval for its Investment Policy at the next

Annual General Meeting of the Company and at each subsequent Annual

General Meeting until such time as there has been an acquisition or

the Investment Policy has been substantially implemented (such a

resolution being referred to hereafter as a 'Continuation Vote').

The reliance on shareholder approval, which is not guaranteed,

constitutes a material uncertainty that may cast significant doubt

on the Company's ability to continue as a going concern. The

financial statements do not include any adjustments that would

result from the basis of preparation being inappropriate.

Notes to the financial statements

for the Period to 31 December 2020

3. Critical accounting estimates

In the application of the company's accounting policies, the

directors are required to make judgements, estimates and

assumptions about the carrying amount of assets and liabilities

that are not readily apparent from other sources. The estimates and

associated assumptions are based on historical experience and other

factors that are considered to be relevant. Actual results may

differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised, if the revision

affects only that period, or in the period of the revision and

future periods if the revision affects both current and future

periods.

Share-based payments (note 14)

Estimation was required in determining inputs to the share-based

payment calculations including share price volatility as detailed

in note 14.

Judgment was required in determining the point at which the

Group and recipients had a shared mutual understanding of the terms

of the awards made under the FIP. Whilst the awards were legally

granted in July 2020, the Board consider that IPO Admission

Document provided such a shared mutual understanding given the

detailed disclosure of the terms of the scheme. Accordingly, the

estimated fair value of the FIP award has been spread over the

vesting period which commenced at IPO. A charge of GBP96,396 (2019:

nil) has been recorded which includes the one-month period relevant

to the period ended 31 December 2019 as the charge of GBP7,973 was

immaterial to that period.

4. Employees and directors

GROUP

The average monthly number of persons (including directors)

employed by the group during the year was:

2020 2019

Number Number

Executive Directors 2 2

Non-Executive Directors 4 4

Staff 2 1

Total 8 7

Their aggregate remuneration comprised:

2020 2019

GBP GBP

Wages and salaries 646,485 52,163

Share based payment charge 97,763 -

Social security costs 82,826 6,504

Pension costs 41,782 3,447

868,856 62,114

Notes to the financial statements

for the Period to 31 December 2020

5. Net finance income

GROUP 2020 2019

GBP GBP

Interest income

Bank deposits 18,736 1,750

Total interest income for financial assets that are not held at

fair value through profit or loss is GBP18,736 (2019:

GBP1,750).

6. Operating Loss

The loss before income tax is stated after charging:

GROUP 2020 2019

GBP GBP

Operating loss for the period is stated after charging/(crediting):

Exchange losses/(gains) 28,037 (86,792)

Depreciation of property, plant and equipment 2,807 -

Group auditor remuneration 16,000 8,000

Other assurance services 16,000 -

Subsidiary audit fees 4,170 -

Share-based payments 97,763 -

Executive Director's remuneration 226,024 22,635

Non-Executive Director remuneration 230,541 21,145

Wages and salaries 150,719 8,383

Pensions and payroll taxes 124,608 9,951

Operating leases 96,519 9,500

7. Auditors' remuneration

GROUP 2020 2019

Fees payable to the group's auditor GBP GBP

and associates:

For audit services

Audit of the financial statements of

the group 36,170 8,000

During the prior year the auditor provided non-audit services of

GBP15,000 in their role as Reporting Accountant in relation to the

Company's Admission to AIM. No such services were provided in the

current year.

Notes to the financial statements

for the Period to 31 December 2020

8. Income tax

2020 2019

GBP GBP

Current tax

UK corporation tax on profits for the current - -

period

Foreign taxes and reliefs (754,289) -

(754,289) -

The charge for the year can be reconciled to the loss per the

income statement as follows:

2020 2019

GBP GBP

Loss before taxation (2,380,468) (196,301)

Expected tax credit based on a corporation tax

rate of 19.00% (2019: 19.00%) (452,284) (37,297)

Effect of expenses not deductible in determining

taxable profit 29,421 8,321

Effect of overseas tax rates (16,696) -

Adjust closing mainstream unrecognised deferred

tax to average rate of 19.00% - 363

Adjust closing ring fence unrecognised deferred

tax to average rate of 19.00% - (28,217)

Deferred tax not recognised 439,559 56,830

Foreign taxes and reliefs (754,289) -

Taxation credit for the period (754,289) -

Unused tax losses on which no deferred tax asset has been

recognised as at 31 December 2020 was GBP1,288,521 (2019:

GBP299,105) and the potential tax benefit was GBP439,559 (2019:

GBP56,830). Deferred tax assets, including those arising from

temporary differences, are recognised only when it is considered

more likely than not that they will be recovered, which is

dependent on the generation of future assessable income of a nature

and of an amount sufficient to enable the benefits to be

utilised.

Notes to the financial statements

for the Period to 31 December 2020

9. Loss per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

Diluted earnings per share is calculated using the weighted

average number of shares adjusted to assume the conversion of all

dilutive potential ordinary shares. These are not included because

they are anti-dilutive.

2020 2019

GBP GBP

Number of shares

Weighted average number of ordinary shares

for basic earnings per share 10,000,000 2,062,213

Earnings

Earnings for basic and diluted earnings per

share being net profit attributable to equity

shareholders of the group for continued operations (1,625,655) (196,301)

Basic and diluted earnings per share

From continuing operations (16.26) (9.52)

10. Property, plant and equipment

Computers

GROUP GBP

Cost

Additions 2,245

At 31 December 2019 2,245

Additions 12,360

At 31 December 2020 14,605

Accumulated depreciation and impairment

At 31 December 2019 -

Charge for the year 2,807

At 31 December 2020 2,807

Carrying amount

At 31 December 2020 11,798

At 31 December 2019 2,245

Notes to the financial statements

for the Period to 31 December 2020

11. Trade and other receivables

2020 2019

GROUP GBP GBP

Taxes recoverable 22,161 45,060

Prepayments and other debtors 53,646 38,044

75,807 83,104

The directors consider that the carrying amount of trade and

other receivables approximates to their fair value.

12. Called up share capital

Allotted and issued ordinary shares of ten pence each ('Ordinary

Shares'):

Number Class Nominal value GBP

-------------- ------------ --------------- -------------

10,000,000 Ordinary GBP0.10 1,000,000

Share capital history over the period:

- On incorporation on 28 May 2019, one subscriber share with a

nominal value of GBP1.00 was issued

- On 3 September 2019 the subscriber share of GBP1.00 was

subdivided into 10 Ordinary Shares and a further 999,990 Ordinary

Shares were issued at par

- On 23 October 2019 1,000,000 Ordinary Shares were issued at

par

- On 25 November 2019 300,000 Ordinary Shares were issued at a

premium of 90p per Ordinary Share and from the total Ordinary

Shares in issue (2,300,000 Ordinary Shares), 1,800,000 Ordinary

Shares were repurchased, cancelled and transferred to other

reserves leaving 500,000 Ordinary Shares in issue with total

subscription monies of GBP500,000 (which was carried out in order

to ensure that the founders' subscription price for Ordinary Shares

was equal to the price paid by the new subscribers in the initial

public offering i.e. GBP1.00 per share)

- On 25 November 2019 a capital reduction was undertaken to

convert GBP270,000 of share premium to other reserves

- On 28 November 2019 9,500,000 Ordinary Shares were allotted to

the new subscribers at a premium of 90p per Ordinary Share

13. Share Premium Account

2020 2019

GBP GBP

At the beginning of the year 7,808,660 -

Issue of new shares - 7,808,660

At the end of the year 7,808,660 7,808,660

Notes to the financial statements

for the Period to 31 December 2020

14. Share-based payment reserve

The Group operates two share-based payment schemes. It operates

a Founder Incentive Plan (FIP) under which awards are legally

granted in the form of performance units to the participants which

was detailed in the IPO Prospectus. Subject to the achievement of

performance conditions, the FIP award may be converted into nil

cost options over a number of shares on three measurement dates

during the life of the FIP. The life of the FIP is five years from

the date of the initial IPO, which was November 2019. There are two

executive directors, one non-executive director, one non-employee,

and one staff member who are members of the plan. The Group also

operates a Long-Term Incentive Plan (LTIP) under which awards are

legally granted in the form of performance units to the

participants which was detailed in the IPO Prospectus. Subject to

the achievement of performance conditions, the LTIP award may be

converted into nil cost options over a number of shares on three

measurement dates during the life of the LTIP. The life of the FIP

is three years from the date of the aware being granted, which was

September 2020.

2020 2019

GBP GBP

At the beginning of the year - -

Credit to equity for equity-settled share-based 97,763 -

payments

At the end of the year 97,763 -

Founder Incentive Plan

The Founder Incentive Plan has a five-year term, with awards

granted on 3 July 2020. Under the FIP, awards are granted in the

form of performance units to the participants. Subject to the

achievement of performance conditions, the FIP award may be

converted into nil cost options over a number of shares on three

Measurement Dates during the life of the FIP. The value of the

award is dependent on the extent to which the Measurement Total

Shareholder Return (Measurement TSR) exceeds the Threshold Total

Shareholder Return (Threshold TSR) at each Measurement Date.

Measurement Dates will be on the third, fourth and fifth

anniversaries of the IPO date.

The IFRS 2 'Share-based Payments' fair value of each performance

share granted under the FIP is estimated as of the grant date using

a Monte Carlo simulation model with weighted average assumptions as

follows:

2020 2019

GBP GBP

Weighted average share price at grant date 0.78 -

TSR performance - -

Expected volatility 50.44% -

Risk free rate (0.08)% -

Dividends yield 0.00% -

The expected share price volatility is based upon the share

price volatility from the IPO to the Date of Grant.

Notes to the financial statements

for the Period to 31 December 2020

14. Share-based payment reserve (continued)

Long Term Incentive Plan

The LTIP has a three-year term with the first award granted on

24 September 2020. Under the LTIP, awards are granted in the form

of performance units to the participants. Subject to the

achievement of performance conditions, the LTIP award may be

converted into nil cost options over a number of shares on the

vesting date. The value of the award is dependent on the extent of

the growth of the TSR per annum at the Measurement Date.

The IFRS 2 'Share-based Payments' fair value of each performance

share granted under the LTIP is estimated as of the grant date

using a Monte Carlo simulation model with weighted average

assumptions as follows:

2020 2019

GBP GBP

Weighted average share price at grant date 0.885 -

TSR performance - -

Expected volatility 58.00% -

Risk free rate (0.10)% -

Dividends yield 0.00% -

The expected share price volatility is based upon the share

price volatility from the IPO to the Date of Grant.

15. Currency translation reserve

2020 2019

GBP GBP

At the beginning of the year 25 -

Currency translation differences 524 25

At the end of the year 549 25

The currency translation reserve relates to the movement in

translating operations denominated in currencies other than

sterling into the presentation currency.

Notes to the financial statements

for the Period to 31 December 2020

16. Trade and other payables

2020 2019

GROUP GBP GBP

Trade payables 129,713 94,452

Accruals 115,309 63,877

Social security and other taxation 94,850 6,504

Other payables 11,738 62,389

351,610 227,222

17. Deferred Tax

The following are the major deferred tax liabilities and assets

recognised by the company and movements thereon during the current

and prior reporting period.

GBP

Deferred tax liability at 1 January 2019 and 1 January -

2020

Deferred tax movements in current year

Differences in tax basis for depreciation in Norway 431

Deferred tax liability at 31 December 2020 431

Deferred tax assets and liabilities are offset in the financial

statements only where the company has a legally enforceable right

to do so.

18. Current Tax Receivable

2020 2019

GROUP GBP GBP

Current tax receivable 777,823 -

Current tax receivable relates to a balance which is due to be

refunded to the Group under the negative tax instalment regime

which applies to oil and gas companies which are operating in

Norway. This relates to expenses incurred in 2020 and is

recoverable in 2021.

19. Retirement benefit schemes

Defined contribution schemes

The Group operates a defined contribution pension scheme for all

qualifying employees. The assets of the scheme are held separately

from those of the company in an independently administered

fund.

The total costs charged to income in respect of defined

contribution plans is GBP41,782 (2019: GBP3,447).

Notes to the financial statements

for the Period to 31 December 2020

20. Related party transactions

Members of the Board of Directors are deemed to be key

management personnel. Key management personnel compensation for the

financial period is the same as the Director remuneration set out

in note 6 to the accounts.

Directors' and the Company Secretary's interests in the shares

of the Company, including family interests, were as follows:

Ordinary shares

Helge Hammer 300,000

Jonathan Cooper 125,000

Graham Stewart 150,000

Jorunn Saetre 25,000

Julian Riddick 100,000

In addition, the following conditional awards have been made to

the Executive Directors and Company Secretary under the FIP which

are expressed as a percentage of the total maximum potential award,

being 10% of the Company's issued share capital:

Maximum percentage

Percentage entitlement entitlement Maximum percentage

of Initial Award of growth in of issued share

Founder pool value from IPO capital

% % %

Helge Hammer 23.5000% 3.525% 2.3500%

Graham Stewart 19.7500% 2.963% 1.9750%

Jonathan Cooper 19.1250% 2.869% 1.9125%

Julian Riddick 18.5000% 2.775% 1.8500%

------------------ --------------------- --------------------

The Company also recharged costs onto its subsidiary which

totalled GBP436,141 during the year. At the year end, GBP10,253 was

outstanding.

The Group does not have one controlling party.

Notes to the financial statements

for the Period to 31 December 2020

21. Cash absorbed by operations

2020 2019

GROUP GBP GBP

Loss for the year after tax (1,626,179) (196,301)

Adjustments for:

Deferred tax 431 -

Corporation tax (754,289)

Investment income (18,736) (1,750)

Depreciation and impairment of property, plant 2,807 -

and equipment

Equity settled share-based payment expense 97,763 -

Movements in working capital:

Decrease/(increase) in trade and other receivables 7,192 (83,104)

Increase in trade and other payables 126,363 220,444

Cash absorbed by operations (2,164,648) (60,711)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DKBBNNBKBANB

(END) Dow Jones Newswires

March 23, 2021 03:00 ET (07:00 GMT)

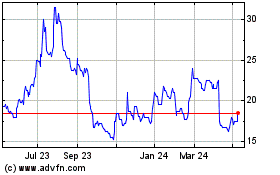

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Mar 2024 to Apr 2024

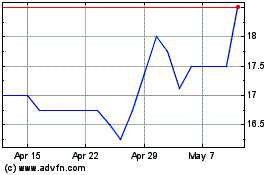

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Apr 2023 to Apr 2024