TIDMLBOW

RNS Number : 7742I

ICG-Longbow Snr Sec UK Prop DebtInv

16 December 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM, THE UNITED STATES,

AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION.

16 December 2020

ICG-Longbow Senior Secured UK Property Debt Investments

Limited

Publication of Circular and Notice of Extraordinary General

Meeting

The Board of ICG-Longbow Senior Secured UK Property Debt

Investments Limited (the "Company") is pleased to announce the

details of the proposed orderly realisation of the Company and

associated adoption of the New Investment Objective and Investment

Policy (together, the "Proposal"). The Proposal is subject to

Shareholder approval as required by the Law and the Listing

Rules.

A circular in connection with the Proposal (the "Circular") is

expected to be posted to Shareholders later today containing,

amongst other things, a letter from the Chairman of the Company, an

expected timetable of principal events, a notice of the

Extraordinary General Meeting and details of the action to be taken

by Shareholders, together with the Form of Proxy for the

Extraordinary General Meeting.

The Circular will shortly be available on the Company's website

at www.lbow.co.uk. The contents of such website are not

incorporated into, and do not form part of, this announcement (the

"Announcement"). A copy of the Circular will also be submitted to

the National Storage Mechanism and will be available for inspection

at https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

Capitalised terms used in this Announcement, unless otherwise

defined, have the same meanings as set out in the Circular.

Background to the Proposal

As announced by the Company on 3 November 2020, the Board has

decided to recommend the orderly realisation and return of capital

to Shareholders following a review of the Company's strategy and in

line with the recommendation of its Investment Adviser. [i]

The underlying performance of the Company's portfolio has proved

resilient and defensive through the Covid-19 pandemic, with no

impairments, which enabled the Company to deliver a fully covered

dividend to Shareholders in September 2020. The Board's focus is,

however, on continuing to maximise shareholder value and it

therefore believes that given the current economic backdrop and

re--rating of the sector, an orderly realisation is the most

prudent option.

In reaching this decision, the Board took account of a number of

factors including the prevailing discount to Net Asset Value of the

Ordinary Shares, the market capitalisation of the Company and the

lack of liquidity of the Ordinary Shares, the consequent difficulty

in growing the Company's issued share base to permit greater

diversification and liquidity for Shareholders, feedback received

from Shareholders and the expected maturity profile of the Group's

portfolio.

The Board has not made this decision because of a lack of

potential reinvestment opportunities or because of any performance

issues with any of the existing loans, all of which are expected to

be repaid in full, along with all contractual interest and exit

fees. However, the Board believes that an orderly realisation of

the Group's assets will return better value to Shareholders than

any other option, including proposing to put the Company into

formal winding up.

In order to do this, the Company is seeking Shareholder approval

to replace the Current Investment Objective and Investment Policy

with the New Investment Objective and Investment Policy. If

approved by Shareholders at the Extraordinary General Meeting, the

new strategy would be implemented in such a manner as will

endeavour to realise all the Group's investments in a manner that

achieves a balance between maximising the net value received from

those investments and making timely returns to Shareholders. The

orderly realisation strategy would not result in the liquidation of

the Company in the immediate future or require the Group to dispose

of assets within a defined or accelerated timeframe.

The Board will continue to have an important role in

representing Shareholders' interests and ensuring the best value is

obtained during the realisation of the portfolio of assets. The

number of Board members will reduce as the workload diminishes over

time, while still retaining the mix of skills required to discharge

their duties and statutory responsibilities.

Should the adoption of the New Investment Objective and

Investment Policy be approved by Shareholders, the Board will seek

to continue the payments of dividends out of earnings for as long

as it is prudent and economic to do so. However, it is likely that

at some point prior to the Company being placed into liquidation

these will cease as the asset value and diversification of the

Company's portfolio shrinks.

Summary of the Proposal

Adoption of the New Investment Objective and Investment

Policy

The Board is proposing to adopt the New Investment Objective and

Investment Policy to facilitate an orderly realisation strategy and

to cease making any new investments except in very limited

circumstances as detailed in the Circular.

The adoption of the New Investment Objective and Investment

Policy is a material change for the purposes of the Listing Rules,

which accordingly requires both the consent of the Financial

Conduct Authority and Shareholders. The Company has received

written approval from the Financial Conduct Authority to adopt the

New Investment Objective and Investment Policy and, accordingly, is

now seeking Shareholder approval to adopt the New Investment

Objective and Investment Policy at the Extraordinary General

Meeting in accordance with the Listing Rules.

The Board will endeavour to realise all the Group's investments

in a manner that achieves a balance between maximising the net

value received from those investments and making timely returns to

Shareholders. The Group's investments continue to perform

satisfactorily and in the view of the Directors, being prescriptive

as regards the timeframe for realising the Group's investments

could prove detrimental to the value achieved on realisation.

Therefore, it is the Board's view that the strategy for the

realisation of the Group's investments will need to be flexible and

may need to be altered to reflect changes in the circumstances of a

particular investment or in the prevailing market conditions. In so

doing, the Board will take account of the continued costs of

operating the Group. The Company's listing and the capacity to

trade in its Ordinary Shares will be maintained for as long as the

Directors believe it to be practicable and cost-effective during

the orderly realisation, subject to being able to meet the

requirements of the Listing Rules. Accordingly, once a significant

proportion of the Company's assets have been realised and

distributed to Shareholders, the Board will then consider, in light

of the then prevailing market conditions and Shareholders' views,

whether it would be appropriate to propose a resolution for

delisting the Ordinary Shares, which would require additional

Shareholder approval at that time.

Irrespective of whether or not the Board seeks to delist the

Ordinary Shares, once all, or substantially all, of the Group's

investments have been realised, the Company will, at an appropriate

time, seek Shareholders' approval for it to be placed into

voluntary winding up.

Mechanics for returning cash to Shareholders

The Board has carefully considered the potential mechanics for

returning capital to Shareholders as part of the orderly

realisation and return of capital to Shareholders. The Articles

already include a B Share Mechanism for returning capital to

Shareholders and the Board currently believes it is in the best

interests of Shareholders as a whole to utilise the B Share

Mechanism to return capital to Shareholders at the appropriate

time, as set out in further detail in the Circular.

The Board considers that administering the B Share Mechanism

would be relatively simple and therefore cost-effective. However,

the Company reserves the right to use an alternative mechanism to

return capital to Shareholders from time to time if the Board

believes any such alternative mechanism to be in the best interests

of Shareholders.

Benefits of the Proposal

The Directors believe, having taken into account the views of a

range of Shareholders, the Investment Adviser and the AIFM(i) ,

that the Proposal is in the best interests of the Company and its

Shareholders as a whole, and should yield the following principal

benefits:

-- implementing an orderly realisation of investments is

expected to achieve a balance between maximising the net value

received from those investments and making timely returns to

Shareholders;

-- the Company will be able to return cash to Shareholders in a

cost-effective and timely manner through the proposed B Share

Mechanism (or by way of such other mechanisms which the Directors

consider, in their discretion, are in the best interests of

Shareholders from time to time); and

-- it is intended that the Company's admission to listing on the

premium segment of the Official List and to trading on the premium

segment of the Main Market would be maintained during the orderly

realisation and the capacity to trade in the Ordinary Shares will

be maintained for as long as the Board believes it to be

practicable, subject to ongoing adherence to the relevant Listing

Rules (including the requirement that sufficient shares be held in

public hands) and all other applicable law and regulation.

The Extraordinary General Meeting

The Extraordinary General Meeting is to be held at Floor 2,

Trafalgar Court, Les Banques, St Peter Port, Guernsey GY1 4LY at

10.30 a.m. on Thursday, 14 January 2021.

At the Extraordinary General Meeting, an ordinary resolution

will be proposed to adopt the New Investment Objective and

Investment Policy. The ordinary resolution to adopt the New

Investment Objective and Investment Policy requires a majority of

those Shareholders voting to vote in favour in order to be passed.

The vote on the Resolution contained in the Notice of Extraordinary

General Meeting will be held by poll, which the Board considers to

be the fairest approach in the light of the restrictions in

relation to Covid-19 set out below.

The Guernsey government guidance on reducing social interactions

between people (social distancing) to reduce the transmission of

Covid-19, and specifically the avoidance of large gatherings and

non-essential travel, has been eased. Currently, the Guernsey

government have implemented a mandatory isolation period for people

travelling to the island, which might make in-person attendance at

the Extraordinary General Meeting impracticable for Shareholders,

corporate representatives or proxies who would need to travel to

Guernsey to attend in person. Shareholders should carefully

consider whether or not it is appropriate to attend the

Extraordinary General Meeting if the guidance continues to be the

same or becomes even more restrictive.

The situation in respect of Covid-19 is developing rapidly and

Shareholders should note that further changes may need to be put in

place at short notice in relation to the Extraordinary General

Meeting.

Updates on any changes to the proceedings of the Extraordinary

General Meeting will be published on the Company's website

www.lbow.co.uk and notified by the Company through a Regulatory

Information Service announcement.

Shareholders should carefully read the Circular in its entirety

before making a decision with respect to the Proposal.

Expected Timetable

The current expected timetable of principal events for the

implementation of the Proposal is set out below and in the

Circular. If any of the key dates set out in the expected timetable

change, an announcement will be made through a Regulatory

Information Service. All times shown in this Announcement are

London times, unless otherwise stated.

Publication of Circular 16 December 2020

Latest time and date for receipt 10.30 a.m. on 12 January 2021

of Form of Proxy or CREST Proxy

Instruction

Time and date of the Extraordinary 10.30 a.m. on 14 January 2021

General Meeting

For further information, please contact: Ocorian Administration (Guernsey) Limited:

Rosemary Osborne-Burns +44 (0)14 8174 2742

Cenkos Securities plc:

Will Rogers +44 (0)20 7397 1920

Rob Naylor +44 (0)20 7397 1922

Will Talkington +44 (0)20 7397 1910

Maitland/AMO Limited: icg-maitland@maitland.co.uk

Sam Turvey +44 (0) 7827 836 246

Finlay Donaldson +44 (0) 7341 788 066

ICG Real Estate :

Olivia Montgomery + 44 (0)20 3545 1543

[i] Shareholders should note that, as announced by the Company

on 25 November 2020, the Company terminated the appointment of the

Investment Adviser, Intermediate Capital Managers Limited, pursuant

to the Investment Advisory Agreement and appointed the AIFM, ICG

Alternative Investment Limited, an affiliate of the Investment

Adviser, as its alternative investment fund manager pursuant to the

AIFM Agreement.

Cautionary statements

This Announcement may contain and the Company may make

statements containing "forward-looking statements" with respect to

certain of the Company's plans and its current goals and

expectations relating to its future financial condition,

performance, strategic initiatives, objectives and results.

Forward-looking statements sometimes use words such as "aim",

"anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "seek", "may", "could", "outlook" or other words

of similar meaning. By their nature, all forward-looking statements

involve risk and uncertainty because they relate to future events

and circumstances which are beyond the control of the Company.

As a result, the actual future financial condition, performance

and results of the Company may differ materially from the plans,

goals and expectations set forth in any forward-looking statements.

Any forward-looking statements made in this Announcement by or on

behalf of the Company speak only as of the date they are made. The

information contained in this Announcement is subject to change

without notice and except as required by applicable law or

regulation, the Company expressly disclaims any obligation or

undertaking to publish any updates or revisions to any

forward-looking statements contained in this Announcement to

reflect any changes in the Company's expectations with regard

thereto or any changes in events, conditions or circumstances on

which any such statements are based.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGGPGQPPUPUGBA

(END) Dow Jones Newswires

December 16, 2020 02:00 ET (07:00 GMT)

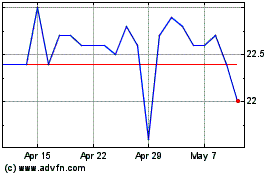

Icg-longbow Senior Secur... (LSE:LBOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Icg-longbow Senior Secur... (LSE:LBOW)

Historical Stock Chart

From Apr 2023 to Apr 2024