TIDMLME

30 October 2020

LIMITLESS EARTH PLC

("Limitless" or the "Company")

UNAUDITED HALF-YEARLY RESULTS FOR

THE SIX MONTHSED 31 JULY 2020

The Company is pleased to announce its half-yearly result for the six months to

31 July 2020.

CHIEF EXECUTIVE'S STATEMENT

Limitless is a proactive investing company that focuses on making investments

in and assisting companies that show the potential to generate returns through

capital appreciation. The directors look to make investments into small

companies which have clear routes to value appreciation, and which operate in

sectors with long term growth prospects that are driven by demographic change.

Examples of such sectors include Cleantech, Life Sciences and Technology. The

Company has four investments, and reports on them below.

It is the Board's intention to have its investments revalued in the next few

months.

Saxa Gres S.p.A ("Saxa") is a turn-around circular economy company which

specialises in an innovative porcelain and ceramic stone tile production

process using recycled urban waste. It has been extremely successful in

expanding its operations by competitor acquisitions and this has enabled it to

satisfy the increasing demands for its products while attracting valuable

funding from relevant institutional investors.

Saxa's main product is Grestone, which it describes as a 'ceramic stone', is a

patented conglomerate composed of 70% porcelain stoneware and 30% waste from

industrial incinerators which can cope with high stress and is targeted for use

in urban surfacing and street design.

Limitless' investment rational was driven by the changing behavioural trends of

consumers and the attitudes of businesses and governments towards products with

greater social impact compared to traditional manufacturing. As Saxa has

established a proven production process using waste incinerator ash amalgamated

into high quality tiles, it has established its strong ESG credentials. The

Company further hopes that Green Public Procurement, a voluntary European

instrument which provides guidelines and criteria aimed at Europe's public

authorities for sustainable production and consumption, will help drive

European demand for Saxa's products through increased requirements to recognise

environmental credentials early in tender processes. Saxa has seen significant

growth in international demand for its products with the Italian domestic

market now only representing 5-10% of its orders.

Since our initial investment, Saxa has expanded its production capacity and

continued to innovate products. More recently, Saxa has launched a cobblestone

product for pedestrian crossings whereby the colour is incorporated into the

cobblestone such that it will not discolour and fade with age. The products

are targeted at local authorities and it is expected that, in addition to

product's environmental credentials, it should provide long term cost savings

through reduced maintenance.

To date, Limitless has made three investments in Saxa and, as a result, holds

EUR 617,000 of 10 per cent. listed loan notes and EUR 75,000 of 10 per cent.

unlisted loan notes with an option to acquire approximately 2.38 per cent. of

the equity share capital of Saxa Gres at an exercise price of EUR1EUR per share.

The Board of LME is pleased with the commercial progress that Saxa Gres has

made and is hopeful of being able to positively revalue its investment in the

near-term as financial information and performance data becomes available.

V-Nova Ltd. ("V-Nova") is a London-headquartered technology company providing

next-generation data compression solutions that address the ever-growing media

processing and delivery challenges. V-Nova is an IP Software company which has

developed an innovative video and imaging compression technology with broad

application from developed, data-rich economies to emerging markets. V-Nova

provides solutions spanning the entire media delivery chain, including content

production, contribution, storage and distribution to end-users.

V-Nova's management is targeting the company's technology at becoming an

integrated world standard, evidence of which is supported by the Moving Picture

Experts Group (MPEG) having selected V-Nova's technology to become a new

standard (MPEG5-Part2). This is expected to yield V-Nova a recurring revenue

stream for a long period. In addition, V-Nova recently announced that the MPEG

coding standard, LCEVC standard specification, is final.

Limitless is hopeful for further news of corporate development and contracts

following what it believes may be milestone events for V-Nova which should

allow V-Nova to expand into further vertical sales channels.

The Company's investment rational for V-Nova was from its desire to invest into

technology related to the provision and consumption of data. This is a field

in which Limitless considers there will be considerable growth for the

foreseeable future as consumption trends seem to increase faster than telecoms

companies are able to build infrastructure driving the need for better data

compression and processing.

Limitless invested GBP500,000 in V-Nova on 18 December 2015 in a convertible loan

note, which was subsequently converted in April 2017 into Series B1

participating shares at a valuation of V-Nova of c. GBP80 million.

We have been advised that V-Nova is currently fundraising and, following the

completion of this round, we are hopeful that it will be possible to positively

revalue our investment to match these new terms.

Chronix Biomedical, inc. ("Chronix"), is a privately-owned biotech company

founded in 1997 which specialises in simple blood tests (liquid biopsies) for

real-time monitoring of the effectiveness of cancer drugs, including

immunotherapies, and rejection of transplanted organs. Chronix's cancer test is

based on patented technology whereby it can identify gains and losses in cell

free DNA that allow them to determine if a cancer therapy is working.

Similarly, its transplant test allows it to determine if an organ that is

transplanted is being accepted or rejected by the recipient. This helps inform

the physician so as to alter the immunosuppressive drug regime given to the

patient.

In June 2018, Chronix signed its first commercial agreement with a large

EU-based lab group, which already processes more than 150,000 laboratory

samples daily, providing an exclusive licence for Germany, Austria, Switzerland

and Belgium. The contract is for 15 years and, as previously advised,

independent research analysts estimated the net present value of the licensing

payments to Chronix over the life of the agreement to be approximately $92

million, subject to a minimum number of tests being performed each year.

Chronix recently announced a further licensing agreement with a Nasdaq listed

company for its CNI monitoring technology used in Chronix's liquid biopsy tests

which detects tumour-derived cell-free DNA in blood samples of patients.

Limitless' investment rational for its investment in Chronix was driven by the

Company's view of significant growth opportunities in the medical screening

sector as developments in drugs and medical understanding require more advanced

and immediate clinical diagnostics tools.

To date, Limitless has invested US$600,000 in Chronix, which includes a

follow-on investment of US$100,000, by way of convertible preference stock and

a 6 per cent. convertible loan note.

The Board of LME values and recognises the considerable achievements of

Chronix's management and understands that additional funding and partnership

agreements are needed to continue to develop the company's operations as it

moves from concept towards commercialisation, to exploit its potential and,

ultimately, drive company valuation. Chronix's management team continues to

actively raise funds to support its objectives and to support the company to

financial breakeven.

Exogenesis Corporation is a Boston-based nanotech firm which specialises in

modifying and controlling the surface of objects at a nanoscale level, through

accelerated particle beam processing, to avoid needing to apply coatings.

Application of the company's technology can improve the safety and efficacy of

implantable medical devices and improve the performance of optics, glass and a

variety of substrates used in the laser, memory and semiconductor industries.

Exogenesis Corporation is a pre-revenue business.

Exogenesis Corporation Received 510(k) Clearance for the Exogenesis Hernia

Mesh, First Soft Tissue Repair Device with Nano-Modified Surface in October

2019, albeit news flow since then has been limited as to further developments.

More recently, in October 2020, Exogenesis Corporation announced that early

trials of its Exogenesis Surgical Mask, a protective nose and mouth covering

for healthcare workers and patients, achieved its primary endpoints of trapping

and deactivating COVID-19 viral particles in simulated real-world exposures.

The Company used its Accelerated Neutral Atom Beam technology to increase the

surface area of fibres allowing for more colloidal copper to be applied to the

mask, increasing the protective barrier. The company hopes to progress to

premarket regulatory filings soon for this product.

The Board of LME recognises Exogenesis' technological achievements and, as it

has still to prove its revenue streams, awaits news of its first commercial

deals which are expected to be linked to selling into its existing vertical

sectors.

The Board of Limitless consider that Exogenesis' last announcement provides

renewed optimism for the company's business model and, in turn, this

investment.

Limitless invested US$300,000 in May 2016 in Exogenesis Corporation by way of 8

per cent. convertible senior notes.

During the reporting period, the Company looked at new potential investments

and opened a series of due diligence on potential new investments some of which

are ongoing. The Board continues to actively source new investments.

This announcement contains inside information for the purposes of Article 7 of

EU Regulation 596/2014.

For further information, please contact:

Limitless Earth plc

www.limitlessearthplc.com

Guido Contesso - CEO +44 7780 700

091

Cairn Financial Advisers LLP +44 20 7213 0880

Nominated Adviser

www.cairnfin.com

Jo Turner/Sandy Jamieson

Peterhouse Corporate Finance Limited +44 20 7469

0930

Joint Broker

www.pcorpfin.com

Peter Greensmith

UNAUDITED INCOME STATEMENT AND

STATEMENT OF COMPREHENSIVE INCOME

6 MONTHS ENDED 31 JULY 2020

Notes Unaudited Unaudited Audited

31/07/2020 31/07/2019 31/01/2020

Continuing operations GBP GBP GBP

Investment Income 13,430 14,379 37,797

Total Income 13,430 14,379 37,797

Administration expenses (80,022) (74,511) (186,384)

Foreign currency exchange gain/ 46,013 (29,948)

loss

Operating loss and loss before (20,579) (60,132) (178,535)

taxation

Taxation - - -

Loss for the period (20,579) (60,132) (178,535)

Total Comprehensive loss for the period (20,579) (60,132) (178,535)

Earnings per share:

Basic and diluted loss per share 3 (0.0003p) (0.09p) (0.0027p)

There are no items of other comprehesive income.

UNAUDITED STATEMENT OF

FINANCIAL POSITION

AS AT 31 JULY 2020

Unaudited Unaudited Audited

31/07/2020 31/07/2019 31/01/2020

GBP GBP GBP

Current assets

Investments held for 1,809,398 1,711,809 1,763,386

trading

Trade and Other receivables 86,238 53,123 77,158

Cash 151,936 419,007 262,845

2,047,572 2,183,939 2,103,389

Total Assets 2,047,572 2,183,939 2,103,389

Current Liabilities

Trade and other payables (38,215) (35,600) (73,453)

Net Assets 2,009,357 2,148,339 2,029,936

Equity

Issued Share Capital 654,000 654,000 654,000

Share Premium 2,350,630 2,364,725 2,350,630

Share Warrant Reserve - - -

Retained Earnings (995,273) (870,386) (974,694)

Total Equity 2,009,357 2,148,339 2,029,936

Unaudited Statement of

Changes in Shareholders'

Equity

for the period ended 31 July

2020

Share Share Share Retained Total

capital premium warrant earnings

reserve

GBP GBP GBP GBP GBP

Audited Changes in Equity for 654,000 2,350,630 14,095 (781,716) 2,237,009

the period ended 31 January

2018

Comprehensive loss for the - - - (28,538) (28,538)

period

Audited Changes in Equity for 654,000 2,350,630 14,095 (810,254) 2,208,471

the period ended 31 January

2019

Comprehensive loss for the (178,535) (178,535)

period

Warrants expired during the - - (14,095) 14,095 -

period

Audited Changes in Equity for 654,000 2,350,630 - (974,694) 2,029,936

the period ended 31 January

2019

Comprehensive loss for the - - - (20,579) (20,579)

period

Warrant cancellation - -

Unaudited Changes in Equity 654,000 2,350,630 - (995,273) 2,009,357

for the period ended 31 July

2020

UNAUDITED CASH FLOW STATEMENT FOR THE

6 MONTHS ENDED 31 JULY 2020

Unaudited Unaudited Audited

31/07/2020 31/07/2019 31/01/2020

2020 2019 2020

GBP GBP GBP

Cash flows from operating activities

(Loss) for the year before tax (20,579) (60,132) (178,535)

Investment income (13,430) (14,379) (37,797)

Foreign Currency exchange gain/ loss (46,013) - 29,947

Decrease/ (increase) in receivables (9,079) (19,833) (43,869)

(Decrease)/ increase in payables (35,237) (31,890) 5,964

Net cash outflow from operating activities (124,338) (126,234) (224,290)

Cash flows from investing activities

Finance income received net 13,430 14,379 37,797

Purchase of investments - - (81,526)

Net cash outflow from investing activities 13,430 14,379 (43,729)

Net decrease in cash and cash equivalents (110,908) (111,855) (268,019)

during the year

Cash at the beginning of year 262,844 530,862 530,863

Cash and cash equivalents at the end of 151,936 419,007 262,844

the year

UNAUDITED CASH FLOW STATEMENT FOR THE

6 MONTHS ENDED 31 JULY 2020

NOTES TO THE FINANCIAL STATEMENTS

1. General Information

Limitless Earth plc is a company incorporated and domiciled in England and

Wales. The Company's ordinary shares are traded on the AIM market of the London

Stock Exchange. The address of the registered office is Suite 2, Northside

House, Mount Pleasant, Barnet, Hertfordshire, England, EN4 9EB

The principal activity of the Company is that of an investing company pursuing

a strategy

2. Accounting policies

The principal accounting policies have all been applied consistently throughout

the period covered and have not changed since being reported on in the

financial statements for the year ended 31 January 2020.

Basis of preparation

The interim financial information set out above does not constitute statutory

accounts within the meaning of the Companies Act 2006. It has been prepared on

a going concern basis in accordance with the recognition and measurement

criteria of International Financial Reporting Standards (IFRS) as adopted by

the European Union.

The financial statements have been prepared under the historical cost

convention.

The interim financial information for the six months ended 31 July 2020 has not

been reviewed or audited. The interim financial report has been approved by the

Board on 29 October 2020.

3. Loss per share

The basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average number of

ordinary shares outstanding during the period. Diluted earnings per share is

computed using the same weighted average number of shares during the period

adjusted for the dilutive effect of share warrants and convertible loans

outstanding during the period.

Unaudited Unaudited Audited

31/07/2020 31/07/2019 31/01/2020

Loss from continuing operations (20,579) (60,132) (178,535)

attributable to equity holders of the

company

Weighted average number of ordinary 65,400,000 65,400,000 65,400,000

shares in issue

Pence Pence Pence

Basic and fully diluted loss per (0.0003) (0.0009) (0.0027)

share from continuing operations

(Pence)

4. Copies of Interim Accounts

Copies of the interim results are available at the Group´s website at:

www.limitlessearthplc.com.

END

(END) Dow Jones Newswires

October 30, 2020 03:00 ET (07:00 GMT)

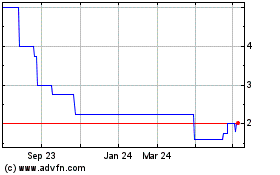

Limitless Earth (LSE:LME)

Historical Stock Chart

From Mar 2024 to Apr 2024

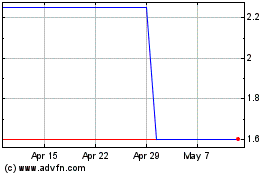

Limitless Earth (LSE:LME)

Historical Stock Chart

From Apr 2023 to Apr 2024