LondonMetric Property PLC LONDONMETRIC ACQUIRES LONG LET SERVICE STATIONS (6275N)

February 02 2021 - 1:00AM

UK Regulatory

TIDMLMP

RNS Number : 6275N

LondonMetric Property PLC

02 February 2021

2 February 2021

LONDONMETRIC PROPERTY PLC

LONDONMETRIC ACQUIRES GBP22 MILLION OF LONG LET CONVENIENCE

SERVICE STATIONS AND SELLS GBP4 MILLION OF KWIK FIT AND CAR WASH

ASSETS

LondonMetric Property Plc ("LondonMetric") announces that it has

acquired GBP21.9 million of convenience service stations across

three separate transactions reflecting a blended NIY of 5.1%. The

seven assets have a WAULT of 18 years and all benefit from

contractual rental uplifts.

The transactions comprise:

-- Four modern Co-op convenience service stations in

Basingstoke, Dagenham and South Wales acquired for GBP12.5 million.

The assets are let on a WAULT of 16 years, benefit from fixed

rental uplifts and are 20% reversionary;

-- Two London convenience service stations in Stamford Hill and

Plumstead acquired for GBP5.4 million through a sale and leaseback

arrangement with TG Convenience Stores. The properties are let for

20 years and benefit from inflation linked rent reviews; and

-- A new Shell and Budgens service station in Worcester acquired

for GBP4.0 million. The property is let to Motor Fuel Group for a

further 23 years and benefits from inflation linked rent

reviews.

Separately, LondonMetric has sold GBP4.2 million of Kwik Fit

service stations and IMO car washes at a NIY of 4.7%. These assets

were originally acquired through larger portfolio transactions.

Andrew Jones, Chief Executive of LondonMetric, commented:

"These long income acquisitions offer attractive triple net

income and are let on long leases to strong covenants with

certainty of income growth. Given their strong locations, they are

also underwritten by vacant possession value."

For further information, please contact:

LondonMetric Property Plc

Andrew Jones / Martin McGann / Gareth Price

Tel: +44 (0) 20 7484 9000

FTI Consulting

Dido Laurimore / Richard Gotla / Andrew Davis

Tel: +44 (0) 20 3727 1000

About LondonMetric Property Plc

LondonMetric is a FTSE 250 REIT that owns one of the UK's

leading listed logistics platforms alongside a diversified long

income portfolio, with 16 million sq ft under management. It owns

and manages desirable real estate that meets occupiers' demands,

delivers reliable, repetitive and growing income-led returns and

outperforms over the long term.

Further information is available at www.londonmetric.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQUARWRAOUURAR

(END) Dow Jones Newswires

February 02, 2021 02:00 ET (07:00 GMT)

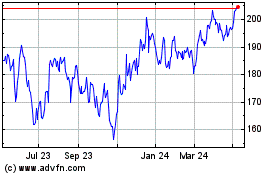

Londonmetric Property (LSE:LMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Londonmetric Property (LSE:LMP)

Historical Stock Chart

From Apr 2023 to Apr 2024