TIDMLMS

RNS Number : 5386X

LMS Capital PLC

21 December 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

21 December 2023

LMS Capital plc

LMS Capital plc (the "Company") acquires Castle View Retirement

Village, Windsor as first step in establishing a retirement living

investment platform

Summary

The Board of LMS Capital PLC ("LMS"), the listed investment

company, is pleased to announce the acquisition of Castle View

Retirement Village, Windsor (" Castle View ").

-- The acquisition price is GBP11.9 million, of which GBP6.0

million is being provided by LMS equity and the remaining GBP5.9

million by a loan from the existing lenders to the scheme.

-- Castle View is a purpose built retirement village, completed

in 2018 and comprising 64 individual 1 and 2 bedroom apartments, of

which 15 remain to be sold.

-- As set out in our 2022 Annual Report and again at the June

2023 half year, one of our objectives, as part of our real estate

investment activity, has been to deploy capital in the retirement

living sector which we believe offers the prospect of strong growth

in the coming years.

-- The investment in Castle View provides a foundation for our activity in the sector.

Integrated Retirement Communities

Underlying demand for retirement housing options in the UK is

driven by the ageing population. The number of households of 75+

years is expected to increase by 77% in the 25 years to 2043.

This older population owns in excess of 40% of all residential

housing equity, which can be used to finance retirement options and

release equity, in addition to releasing family housing stock to

the wider housing market.

The retirement living market is currently undersupplied, with

relatively few developers of scale and an increasing interest from

institutional capital.

The sector covers a wide spectrum of different housing options

for older people, ranging from full provision care homes at one end

to traditional housebuilding aimed at older people, but without any

facilities, at the other end.

Integrated Retirement Communities ("IRCs"), of which Castle View

is one, along with other established schemes around the country,

sit broadly in the middle of this range. Residents have their own

property and live independently in their own self-contained home,

with access to communal facilities and amenities and the

availability of optional support and care services, if needed,

arranged between the resident and the providers.

Castle View

Castle View has been acquired from the two entrepreneurs, Robin

Hughes and James Sarmecanic, who developed the site, and from their

funding partner which provided equity funding for the

development.

Castle View comprises a purpose-built retirement village,

completed in 2018 including 64 individual 1 and 2 bedroom

apartments. The communal facilities include 24-hour reception,

library, private dining room, landscaped gardens, bars, lounges and

a roof terrace.

Residents acquire individual apartments on 250-year leases and

pay an annual service charge and a deferred fee. The deferred fee

is payable only when an apartment is resold and is linked to a

percentage of the resale price.

To date 49 apartments have been sold to residents on 250-year

leases, leaving 15 apartments remaining to be sold. LMS has

acquired the companies that employ the team responsible for running

the village, as well as the entity that owns the freehold interest

in both the sold and unsold apartments and which carries the right

to receive the deferred fee.

Acq u isition Terms

-- The companies that own Castle View are being acquired for a

price of GBP11.9 million on a debt-free and cash free basis.

-- The acquisition is being part financed by a loan of GBP5.9

million from the existing lenders to the scheme, plus a GBP6.0

million equity investment from LMS.

-- The acquisition includes:

o the freehold interest in all 64 units, entitling the

freeholder to the annual service charges and deferred fees;

o the leasehold interests on the 15 unsold units which have an

estimated sale value of GBP8.3 million;

-- LMS will in addition provide GBP400,000 of working capital for the business;

-- The loan is secured on the freehold interest and is for a

term of 3 years. The loan is required to be paid down from the

proceeds of apartment sales.

Returns

Sale of 15 unsold apartments

Construction was completed at the end of October 2018 and in the

year from November 2018 to November 2019, 19 apartments were sold.

The pandemic and lockdowns in 2020 and 2021 impacted the rate of

sales, but rates have increased again in 2022 and 2023.

Sale rates for new developments in the retirement living sector

are recognised to be slower than rates for regular market new build

apartments and houses. We have taken a conservative view of sale

rates for the remaining apartments in evaluating the acquisition

but expect to maintain or improve upon the historic rates.

Deferred fees on resale of apartments

The deferred fees are payable to Castle View, by the vendor, out

of the proceeds of resale as and when an apartment is resold. The

level of deferred fee depends on length of ownership starting at 4%

and increasing to a maximum of 20% from the beginning of the 5th

year of ownership. The deferred fee covers the capital costs of

constructing the communal facilities, the costs of updating the

facilities over the lifetime of the asset and provides a return on

the capital invested.

The timing and amount of the investment return from the deferred

fees will depend on the actual timing and value of resales and will

inevitably be uneven year to year. The average period of ownership

within IRC's is 8 years, and on this basis on average approximately

12.5% of units would expect to be resold each year, once village

occupancy has matured, meaning all units are sold and the pattern

of occupancy established. Allowing for the time for the village to

achieve maturity, our conservative base case appraisal model shows

overall income returns in excess of 11%.

The annual service charge is designed to recover the regular

costs of running the village, but not to give an operating surplus

that would provide a return on capital.

Future Plans

The investment in Castle View is intended to be a cornerstone in

the development of a retirement living investment platform.

LMS has established a subsidiary company, LMS Retirement Living

("LMSRL") as the acquisition vehicle for Castle View, to identify

further investments in the sector and to identify additional equity

and debt partners to coinvest alongside LMS.

The LMSRL Board will comprise individuals, all of whom LMS has

been working with for the last 12-18 months as it has built

knowledge and been evaluating opportunities to enter the

sector.

The Board will be chaired by Roger Davies. Roger is a senior

industry figure having been Chief Executive of MHA and

Non-Executive Chair and Director of several sector businesses and

has worked with LMS since early 2022. Other members of the team

include:

-- Karl Hallows - Karl has over twenty years experience in the

retirement living sector, in senior and non-executive director

roles and will join the LMSRL Board as an executive. Karl, in

conjunction with the rest of the team, will have responsibility for

the development of the investment platform.

-- Chris Dancer - Chris is part of LMS' real estate team and has

been instrumental during the last 2 years in establishing LMS'

knowledge and presence in the retirement living sector and has been

closely involved in evaluating potential investment

opportunities.

-- Caroline Howard - Caroline is part of LMS' finance team and will provide finance support.

Nick Friedlos, Managing Director of LMS, will oversee LMSRL on

behalf of the LMS Board and will provide support to the team.

Commenting on the Acquisition:

Robbie Rayne, Chairman of the Board of LMS, said:

"Over the last 2 years, LMS has been evaluating opportunities to

deploy capital in the retirement living sector as an extension to

its property background.

The goal, having now acquired Castle View, is to develop an

investment platform in the sector and deliver attractive returns to

our shareholders. The sector is currently fragmented with multiple

different business models and offers to residents. It offers the

prospects of strong growth and attractive investment returns,

underpinned by favourable demographics. I am confident in our team

and the long-term prospects for the sector."

The person responsible for arranging the release of this

announcement on behalf of the Company is IQ EQ Corporate Services

(UK) Limited, the Company Secretary.

Enquiries

LMS Capital PLC - Nick Friedlos, Managing Director

nfriedlos@lmscapital.com

0207 935 3555

Shore Capital - Robert Finlay/Rose Ramsden

0207 408 4050

Vico Partners - John Sunnucks

jsunnucks@vicopartners.com

07919 615222

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUNKKBQNBDBABB

(END) Dow Jones Newswires

December 21, 2023 02:00 ET (07:00 GMT)

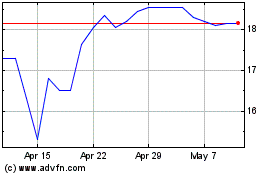

Lms Capital (LSE:LMS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Lms Capital (LSE:LMS)

Historical Stock Chart

From Nov 2023 to Nov 2024