TIDMLOOP

RNS Number : 2948O

LoopUp Group PLC

29 May 2020

29 May 2020

LOOPUP GROUP PLC

("LoopUp Group" or the "Group")

Grant of Options and Director and PDMR Dealings

LoopUp Group plc (LSE AIM: LOOP), the premium remote meetings

company, announces that the Group's Remuneration Committee and the

Board have approved the grant of 1,195,700 options ("New Options")

over ordinary shares of 0.5 pence each ("Ordinary Shares") to 107

employees, including Executive Directors and PDMRs, pursuant to the

Group's share option scheme.

All New Options were granted with an exercise price of 110.5

pence each, being the closing middle market price on 28 May 2020.

The New Options will vest over four years, one quarter at the end

of year one and then three quarters on a monthly basis over years

two to four.

The grant of 1,195,700 New Options equates to 2.16% of the

Group's current issued share capital. In total, 5,583,012 options

now remain outstanding, which equates to 10.08% of the Group's

current issued share capital. The Group's current total number of

Ordinary Shares in issue is 55,367,349.

The Board of the Group considers annual grants of share options

to be an effective and important mechanism to incentivise and

retain key employees of the Group and to align them with

shareholder interests.

New Options granted to Director / PDMRs

The following PDMRs of the Group were granted share options,

which are included in the totals above:

Options Shares

----------- ---------------------- ----------------------------------------- ----------------------------

Total number Options

New of options as % of

Options held post issued Number % of issued

Name Title granted grant share capital of shares share capital

----------- ---------------------- --------- ------------- --------------- ----------- ---------------

Steve

Flavell co-CEO, Director 199,000 199,000 0.36% 2,625,875 4.74%

Michael

Hughes co-CEO, Director 199,000 1,079,000 1.95% 2,616,899 4.73%

Simon

Healey CFO, Director 27,500 179,500 0.32% 64,500 0.12%

Marcus

Greensit COO, PDMR 43,000 499,000 0.90% 156,243 0.28%

Robert

Jardine CMO, PDMR 30,750 123,750 0.22% 22,500 0.04%

Alex

Breen CPO, PDMR 30,750 233,968 0.42% 452,207 0.82%

Benjamin VP Group Commercial,

Fried PDMR 27,500 109,500 0.20% 3,381 0.01%

VP Network

David Operations,

Carroll PDMR 27,500 109,500 0.20% - -

Koorosh VP Engineering,

Nouri PDMR 21,000 73,000 0.13% - -

Edward General Counsel,

Cooper PDMR 21,000 73,000 0.13% 3,514 0.01%

The FCA notification, made in accordance with the requirements

of the EU Market Abuse Regulation is appended below.

For further information, please contact:

LoopUp Group plc via FTI

Steve Flavell, co-CEO

+44 (0) 20 7886

Panmure Gordon (UK) Limited 2500

Dominic Morley / Alina Vaskina (Corporate

Finance)

Erik Anderson (Corporate Broking)

+44 (0) 20 7260

Numis Securities Limited 1000

Simon Willis / Jonny Abbott (Corporate Finance)

+44 (0) 20 3727

FTI Consulting, LLP 1000

Matt Dixon / Emma Hall / Jamille Smith / Shamma

Kelly

About LoopUp Group plc:

LoopUp (LSE AIM: LOOP) is a premium remote meetings solution.

The solution provides a reliable, secure and incredibly simple

experience that is optimised for external guests on

business-critical meetings, such as professional services firms'

communications with their clients. Over 5,000 organisations

worldwide trust LoopUp's award-wining SaaS solution with their

remote meetings, including more than 20 of both the world's top-100

law firms and top-100 private equity firms, as well as enterprises

such as Travelex, Kia Motors, Planet Hollywood and National

Geographic. The Group is headquartered in London, with offices in

San Francisco, New York, Boston, Chicago, Dallas, Los Angeles,

Denver, Cardiff, Milton Keynes, Madrid, Berlin, Malmo, Hong Kong,

Sydney and Barbados, and is listed on the AIM market of the London

Stock Exchange (LOOP). For further information, please visit:

www.loopup.com .

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them.

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Names 1. Steve Flavell, co-CEO, Director

2. Michael Hughes, co-CEO, Director

3. Simon Healey, CFO, Director

4. Marcus Greensit, COO, PDMR

5. Robert Jardine, CMO, PDMR

6. Alex Breen, CPO, PDMR

7. Benjamin Fried, VP Group Commercial,

PDMR

8. David Carroll, VP Network Operations,

PDMR

9. Koorosh Nouri, VP Engineering, PDMR

10. Edward Cooper, General Counsel, PDMR

-------------------------- ------------------------------------------

2 Reason for the notification

----------------------------------------------------------------------

a) Position/status Classified as PDMRs of the Company

-------------------------- ------------------------------------------

b) Initial notification Initial Notification

/Amendment

-------------------------- ------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------

a) Name LoopUp Group plc

-------------------------- ------------------------------------------

b) LEI 21380063DQ4WXDQLYB80

-------------------------- ------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

----------------------------------------------------------------------

a) Description of the Options over Ordinary Shares of 0.5p

financial instrument, each

type of instrument

-------------------------- ------------------------------------------

b) Identification code GB00BYQP6S60

-------------------------- ------------------------------------------

c) Nature of the transaction Grant of New Options

-------------------------- ------------------------------------------

d) Price(s) and volume(s) Price(s) Volume(s)

1. 110.5p 199,000

------- ----------

2. 110.5p 199,000

------- ----------

3. 110.5p 27,500

------- ----------

4. 110.5p 43,000

------- ----------

5. 110.5p 30,750

------- ----------

6. 110.5p 30,750

------- ----------

7. 110.5p 27,500

------- ----------

8. 110.5p 27,500

------- ----------

9. 110.5p 21,000

------- ----------

10. 110.5p 21,000

------- ----------

-------------------------- ------------------------------------------

d) Aggregated information 627,000 options at 110.5p each

- Aggregated volume

- Price

-------------------------- ------------------------------------------

e) Date of the transaction 28 May 2020

-------------------------- ------------------------------------------

f) Place of the transaction London Stock Exchange

-------------------------- ------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DSHSEFEFAESSEII

(END) Dow Jones Newswires

May 29, 2020 02:00 ET (06:00 GMT)

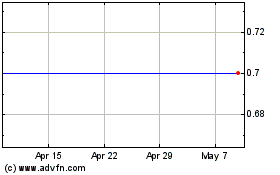

Loopup (LSE:LOOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

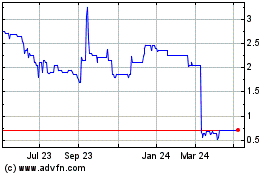

Loopup (LSE:LOOP)

Historical Stock Chart

From Apr 2023 to Apr 2024