TIDMLXI

RNS Number : 5465G

LXI REIT PLC

26 November 2020

26 November 2020

LXi REIT plc

(the "Company" or the "Group")

ACQUISITIONS TOTALLING GBP61 MILLION AND PORTFOLIO UPDATE

The Board of LXi REIT plc (ticker: LXI), th e specialist

inflation-protected very long income REIT, is pleased to report the

acquisition of 11 foodstores and two discount stores from five

different vendors/developers for a total cost of GBP61 million

("the Acquisitions").

The Acquisitions have been acquired at an attractive average net

initial yield of 5.7% (net of acquisition costs) and with a strong

and diversified tenant base in the form of Aldi, Lidl, Waitrose,

Co-op, Iceland, B&M and The Range.

The Acquisitions deploy the disposal proceeds of the Group's

recently sold BCA facility in Corby ("the BCA Facility") at a yield

which is materially higher than both the 4.45% exit yield on the

BCA Facility and the Group's latest portfolio valuation yield of

5.1%.

The Acquisitions reflect the Company's yield-disciplined focus

on smaller sized foodstores which are currently the primary focus

for our grocery tenants being right-sized for their preferred

product range, but also offering online fulfilment through either

or both of home delivery and click & collect.

The Acquisitions are let or pre-let on long, index-linked or

fixed uplift leases with low current rents (averaging GBP14 per sq

ft) and low capital value pricing (averaging GBP230 per sq ft).

The Group's whole portfolio now has a long WAULT to first break

of 22 years, with 96% index-linked or fixed uplift rent reviews and

is well diversified across the following robust sub-sectors:

Industrial (21%), Budget Hotels (21%), Foodstores and Essentials

(20%), Healthcare (13%), Car Parks (8%), Pubs (5%), Drive-thru

Coffee (4%) and Other (8%).

Aldi foodstore forward funding, Northumberland

The Company has exchanged contracts on the pre-let forward

funding of an Aldi-anchored scheme in Berwick-upon-Tweed,

Northumberland.

The foodstore, which will extend to 19,000 sq ft, has been fully

pre-let to Aldi Stores Limited (the principal UK trading company of

the Aldi group) on an unbroken 20-year lease commencing on

completion of the building works, with five-yearly RPI

inflation-linked reviews. The starting rent is a low GBP16 per sq

ft.

The adjoining 10,000 sq ft unit has been fully pre-let to

Iceland Foods Limited, trading as Food Warehouse (the principal

trading company of the Iceland Foods group) on an unbroken 10-year

lease, with upwards only rent reviews and a low starting rent of

GBP16.40 per sq ft.

Lidl foodstore, Hampshire

The Company has acquired a 26,800 sq ft foodstore in Portsmouth,

Hampshire. The property, which was purpose built for the tenant in

2017 and trades strongly, is fully let to Lidl UK GMBH (the

principal UK trading company of the Lidl group), with 22 years

until expiry and 17 years until first break.

The rent is reviewed on a five-yearly basis at a fixed growth

rate of 2% per annum compounded. At the next rent review, which

will take place in two years' time, the rent will still be at a

very low rate of GBP12 per sq ft.

Waitrose foodstore, Cheshire

The Company has acquired a 25,000 sq ft foodstore in Poynton,

Cheshire. The property, which was purpose built for the tenant in

2010 and trades strongly, is fully let to Waitrose Limited (the

principal trading company of the Waitrose group), with 15 years

unexpired until first break.

The rent is reviewed on a five-yearly basis at a fixed growth

rate of 2.5% per annum compounded.

The store is the dominant foodstore in its locality, which draws

on an affluent catchment population, and benefits from a material

online delivery capability.

Co-Op portfolio

The Company has acquired a portfolio of seven Co-Op foodstores

in Blackpool, Glasgow, Pontypridd, Sandbach, Southport, Wallasey

and Wrexham, from a mortgagee.

Each property is let to the Co-Operative Group Limited (the

principal company of the Co-op group) with over 16 years unexpired

to first break and with annual rental uplifts fixed at 2.25% per

annum.

The portfolio benefits from a low average rent of GBP15.80 per

sq ft and a liquid average lot size of 12,000 sq ft. The properties

also have the advantage of a high number of parking spaces,

averaging 51 per store, which help ensure a good customer

experience with quick and easy access to the store as well as

assisting the tenant in their provision of additional services and

sales channels such as click & collect.

B&M and The Range, Yorkshire

The Company has acquired two discount stores, comprising 72,000

sq ft in Bradford, Yorkshire, which were purpose built for the

tenants in 2019.

The first unit is fully let to The Range (through its principal

UK trading company, CDS (Superstores International) Limited), with

19 years until first break and fixed rental uplifts of 2.5% per

annum compounded.

The second unit is fully let to B&M Retail Limited (the

principal trading company of the FTSE 100 listed B&M group),

with 14 years until first break and fixed rental uplifts of 2% per

annum compounded.

The current average rent on the two units is an exceptionally

low GBP7 per sq ft.

FOR FURTHER INFORMATION, PLEASE CONTACT:

LXI REIT Advisors Limited Via Maitland/AMO

Simon Lee (Partner, Fund Manager)

John White (Partner, Fund Manager)

Peel Hunt LLP Tel: 020 7418 8900

Luke Simpson/Liz Yong

----------------------------------------

J efferies International Tel: 020 7029 8000

Ed Matthews/Tom Yeadon

----------------------------------------

Maitland/AMO (Communications Adviser) Tel: 020 7379 5151

James Benjamin Email: lxireit-maitland@maitland.co.uk

----------------------------------------

The Company's LEI is: 2138008YZGXOKAXQVI45

NOTES:

LXI REIT plc invests in UK commercial property assets let, or

pre-let, on very long (typically 20 to 30 years to expiry or first

break), inflation-linked leases to a wide range of strong tenant

covenants across a diverse range of robust property sectors.

The Company may invest in fixed-price forward funded

developments, provided they are pre-let to an acceptable tenant and

full planning permission is in place. The Company will not

undertake any direct development activity nor assume direct

development risk.

The Company is targeting a quarterly dividend of 1.44 pence per

ordinary share for the quarter that commenced on 1 October

2020.*

The Company, a real estate investment trust ( " REIT " )

incorporated in England and Wales, is listed on the premium listing

segment of the Official List of the UK Listing Authority and was

admitted to trading on the main market for listed securities of the

London Stock Exchange in February 2017.

The Company is a constituent of the FTSE 250, EPRA/NAREIT and

MSCI indices.

Further information on the Company is available at

www.lxireit.com

* These are guidance levels or targets only and not a profit

forecast and there can be no assurance that they will be met.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQBABBTMTATTMM

(END) Dow Jones Newswires

November 26, 2020 02:00 ET (07:00 GMT)

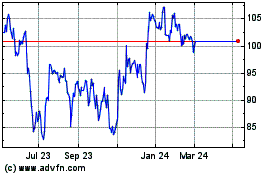

Lxi Reit (LSE:LXI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lxi Reit (LSE:LXI)

Historical Stock Chart

From Apr 2023 to Apr 2024